A deteriorating near-term outlook has me switching lanes.

Pick a Lane

The world’s economy is caught in a massive traffic jam. The heavy demand for goods of all kinds that we’ve seen during covid is like rush hour on the 401. (Or the Los Angeles freeway, for those not familiar with the delights of Canada’s largest motorway). The multiple covid disruptions and shutdowns are the fender benders that are slowing traffic even more.

The latest pile-up is being caused by China’s bizarre pursuit of a zero covid policy. For Qorvo and Skyworks Solutions, two key players in the 5G connectivity space, this roadblock is looming straight ahead and the cars up ahead are slamming on their brakes.

Qorvo and Skyworks (SWKS.NASDAQ) are freakishly similar companies. I took a close look at both of them when I was reviewing Qorvo last fall and decided to place my bets on Qorvo. At the time, Qorvo looked a little cheaper to me, but now, Qorvo’s lane is slowing and Skyworks’ seems to be moving faster. After results came out for both of these companies this week, I made the impulse decision to switch lanes. I put in a market order to sell my Qorvo and 60 seconds later, bought the identical number of shares of Skyworks. The round trip cost me around $14 in commissions.

We all know how well switching lanes works in a traffic jam. Sometimes you come out ahead. Sometimes you don’t. It probably doesn’t make that much difference in the end. But in the near term, at least, I think I’m moving a little faster now.

Like Qorvo, Skyworks is involved in the design and engineering of advanced radio frequency chips and antennas for smartphones and an increasing multitude of other connected devices. Also, like Qorvo, Apple is their biggest customer, with around half of their total sales being with this one company. That’s a big risk for sure and is one of the things that tilted the balance slightly in favour of Qorvo when I first bought in (Qorvo has somewhat fewer of its eggs in this one basket). But that customer profile is also what is skewing the picture in favour of Skyworks right now. Qorvo deals a lot more with the second-tier Chinese manufacturers of smartphones and these are the companies that are suffering the most right now from the Chinese lockdowns. Skyworks concentrates on the higher end of the smartphone market (Apple, Samsung and Google) and so is more insulated from this latest disruption.

Both companies are predicting sales and profits to slump next quarter as the draconian Chinese lockdowns limit both production and demand in China. But Qorvo’s near term outlook is decidedly worse. Based on what management is saying, I think profits could fall as much as 50% in the upcoming quarter and they expect the headwinds to continue into the quarter after that as well. By contrast, being less exposed to the Chinese market, and focusing more on the high end, Skyworks sees a more moderate slowdown next quarter and a faster recovery with strong growth resuming in the second half of this year.

After we get through this traffic jam and things start moving again, the longer-term outlook for both these companies still looks bright. In NA and Europe, we are still in the early stages of 5G smartphone adoption. And the trend towards growing connectivity (the internet of things) is an exciting one and could power superior growth for years to come.

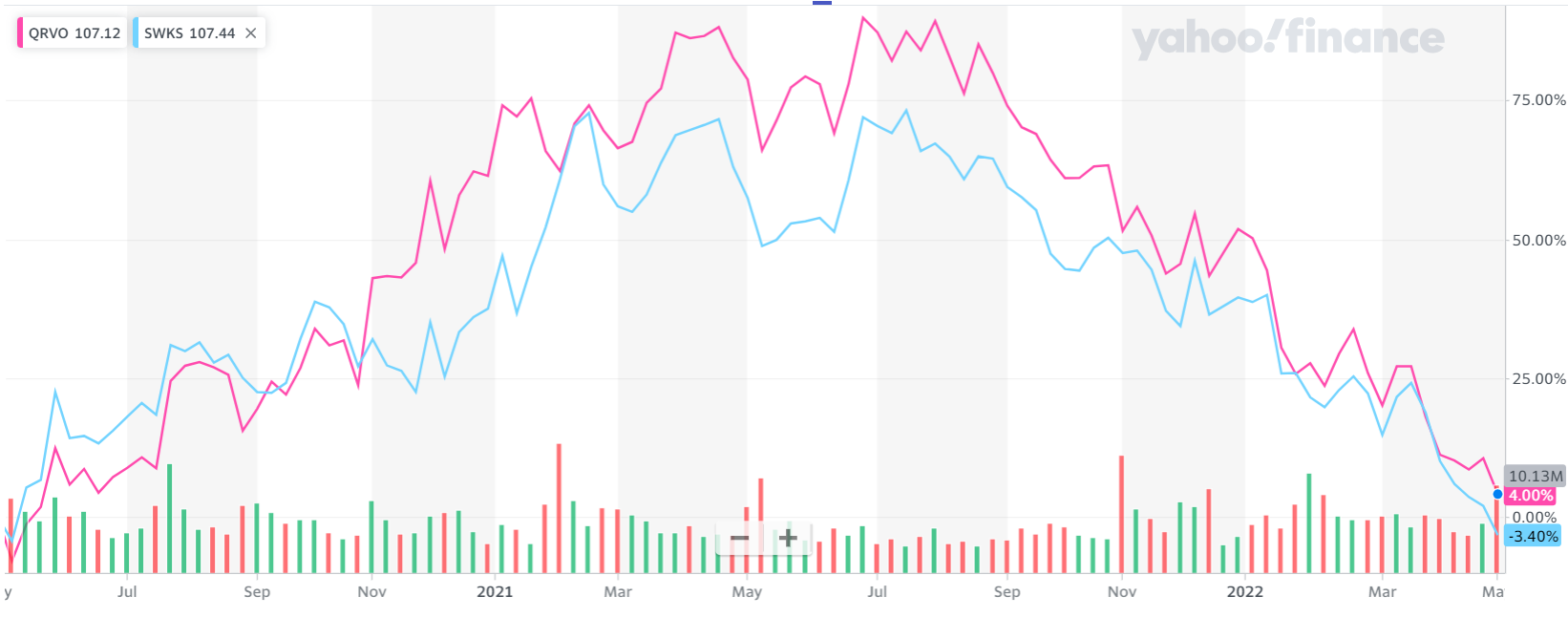

But before we get to the open road ahead, we have to get past this pile-up. As I said, Qorvo and Skyworks are very similar. They have nearly identical share prices, and these have been moving in lockstep over the past several years.

They both have similar earnings per share numbers. Analysts are pegging next year’s earnings estimates at around $10 per share for both of these companies. At their current share price, that would give both stocks a p:e of 10 (although those analyst estimates may ultimately prove to be on the high side). Profit margins have been similar recently as well. (Here, Skyworks has the slight edge.) They are roughly the same size in terms of market cap ($12 B for Qorvo, $18 B for Skyworks. Both shrinking fast). They both have been expanding purposefully into broader market applications for connected solutions (automotive, factory automation, aerospace and defense, etc.). Because of their specific customer make-up, Qorvo seems to be in for more of a rocky ride ahead than Skyworks, in the near term at least. As well, Skyworks has a much longer and more robust track record than Qorvo does. Qorvo sort of came out of nowhere in the last couple of years whereas Skyworks has a track record going back well over a decade. Both have strong balance sheets with minimal debt relative to their earnings.

With nearly identical p:e ratios, longer term, I think the stocks are likely to perform very similarly. But shorter term, I like Skyworks’ prospects better. And the more robust past track record gives me some added comfort if we are in for a rough patch ahead.

If the share price of Qorvo had dropped substantially more than Skyworks’ as a result of the cloudier near-term outlook, then I would have stayed with Qorvo because I suspect the ill-effects to be somewhat temporary. But it did not. The share prices have been moving in tandem, so it seems that the market is giving Qorvo no penalty for its more uncertain near-term outlook. Or, looked at another way, the market is giving Skyworks no premium for its more favourable short term outlook. Nor for its more robust longer-term track record.

Since the frictional costs of switching between the two are so low, I decided to make the leap. The technology exposure in my portfolio now lies in the hands of Skyworks and their crew.

Full disclosure: I own shares in Skyworks Solutions. I do not own shares in Qorvo Inc.