The canaries are singing. I sold my Omnicom stock to put some money in the war chest.

Sahm I Am

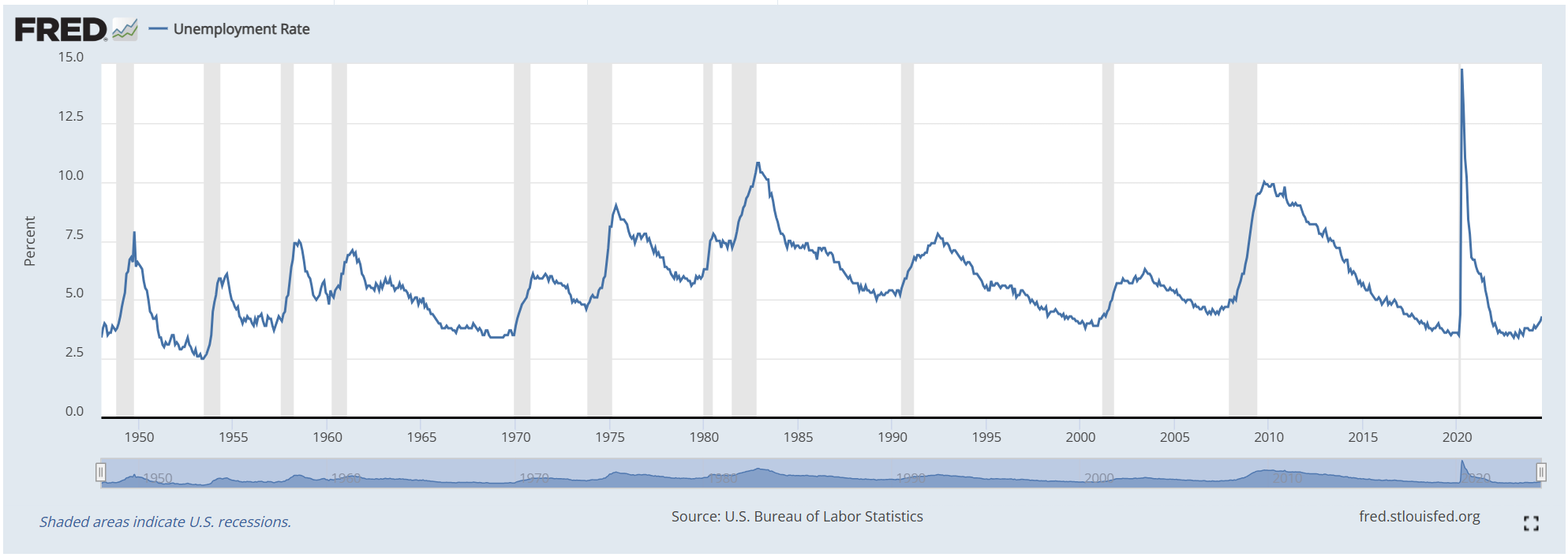

The graph above, courtesy of the Federal Reserve, shows the unemployment rate graphed against every recession of the past 75 years. There is a pretty clear correlation there. Unemployment rates go up during recessions as companies lay off workers and then slide back down during the subsequent business expansion as companies gradually hire them back. Every time the unemployment rate has hit bottom and then started to move back up, a recession has quickly followed. There have been no exceptions. The unemployment report that came out a couple of weeks ago and sent the market into a tailspin made it pretty clear that we are in that ominous part of the cycle where the unemployment rate has troughed and is moving back up. The econometric gods have spoken. Consider yourself warned.

The natural inclination here is to sell everything and hide in cash until the storm blows over. That’s a very seductive narrative. Frustratingly, it’s not that easy. Even if we knew with 100% certainty that there was, indeed, going to be a recession (and despite the compelling picture painted by the graph above, there is always the possibility that this time will be different) we still don’t know the exact timing of the recession. We don’t know exactly when it will start or when it will end. We don’t know how long it will last. We don’t know how severe it will be. Will it be a mild recession like the one we had in 2001 or a more painful episode like the Great Financial Crisis? How will the market react? Will stocks cruise through the recession largely unscathed or plummet like a stone? If the market does drop, how low will it go? And to add even more uncertainty, how will the individual stocks in our portfolio perform relative to the market? Some stocks may drop more, some less. Some will hit bottom months before everything else, others may lag the recovery by a year or two. Some may even buck the trend and gain ground during a recession.

So the signal that the unemployment rate is sending is somewhat less useful than it appears at first.

The Bigger They Are, The Harder They Fall

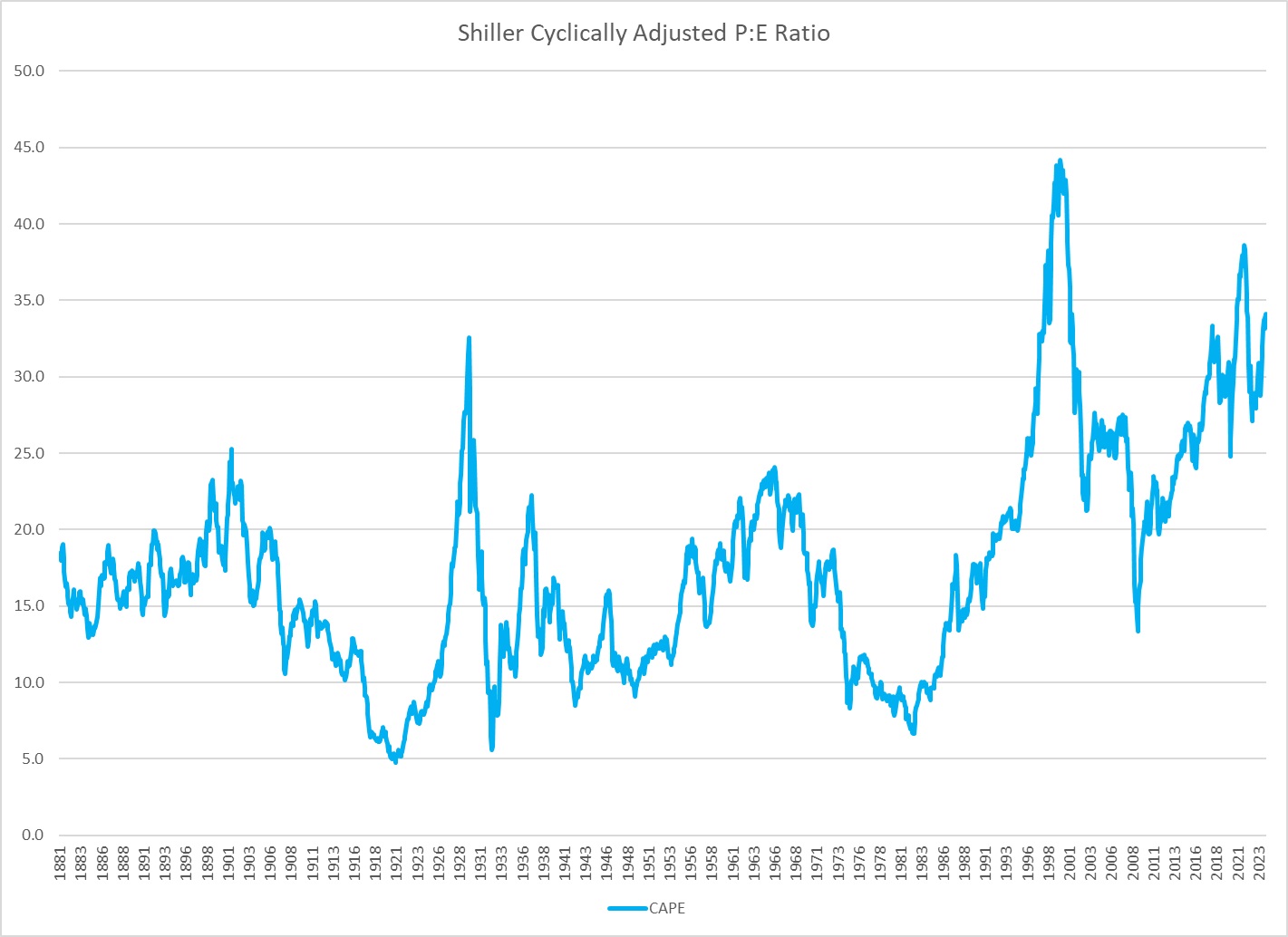

Nonetheless, It seems reasonably likely that we are headed for another recession in the not too distant future. It also seems reasonably likely, given the general state of extreme overvaluation of the market, that such a recession could result in a significant drop in the overall level of the market.

The p:e of the market right now is around 34 (using average earnings over the last 10 years). It got as low as 7 back in the 1970’s and plumbed even lower depths in the more distant past. Do the math. If earnings stayed constant, prices would have to fall by 80% to reach their lows of the 1970’s. Worth keeping in mind.

Bargain Hunting

All of which is to say, after coming back from a fantastic European vacation with the family and after reviewing the state of the markets and the second quarter results of my various portfolio companies, I was looking to see if there might be something I could sell. This would be as much an offensive move as a defensive one. Yes, graphs like the Shiller PE Ratio graph above give me the willies, but after 28 years as a permabear, I’ve sort of become numb to the constant fear of the massive market wipeout that this graph suggests will knock us all on our asses at some point.

Instead, I’m thinking more short term and more opportunistically. Generally speaking, value investors perversely enjoy big market sell-offs. These tend to create opportunities. Good companies go on sale and bad companies are sometimes given away for free (Graham’s net-nets). To take full advantage of these clearance sales, it’s nice to have a bit of excess cash on hand. It makes the bargain hunting that much more fun.

Thinning The Herd

In the end, I decided to harvest my gains in Omnicom and move on. I also sold a bit of my Kronos stock.

This raises a little pot of money that I can stash off to the side. I try to stay fully invested most of the time but given the current state of the union, I’m in no great rush to redeploy this money. If I see something compelling, I’ll buy back in. If not, I’ll wait. If I’m lucky, the market will crash in the interim.

Why did I pick on Omnicom? Well, objectively, it was the least undervalued of my holdings. Under my baseline earnings and growth rate assumptions, there wasn’t a whole lot of room left for stock price appreciation. Some, but not a lot. Not so much that I felt like holding on through a whole recession and subsequent recovery cycle. In the final accounting, I did reasonably well with my Omnicom stock. I bought in at $47 and sold at $96. A 2 bagger in a little under 4 years. On an annualized basis, my return from Omnicom beat the market (the Russell 2000) by about 12% per year, exactly in line with my average rate of portfolio outperformance. But that success comes with an asterisk.

I bought into Omnicom (a large marketing agency) with high hopes, expecting at the very least a continuation of its previous record of moderate growth and at the best, an acceleration in growth as they finished up a mutli-year restructuring and reorganization. But instead, sales have flatlined. Sales are no higher now, on an inflation adjusted basis, than they were 3 years ago. As a result, I’ve lowered my future growth expectations and therefore reduced my fair value target. That, plus the simultaneous share price appreciation, brought this stock within spitting distance of what I thought it was worth. So out the door it went. In the end, despite failing to meet my expectations on the growth front, the investment was still a winner simply because I bought it cheap and sold it less cheap.

Portfolio Review

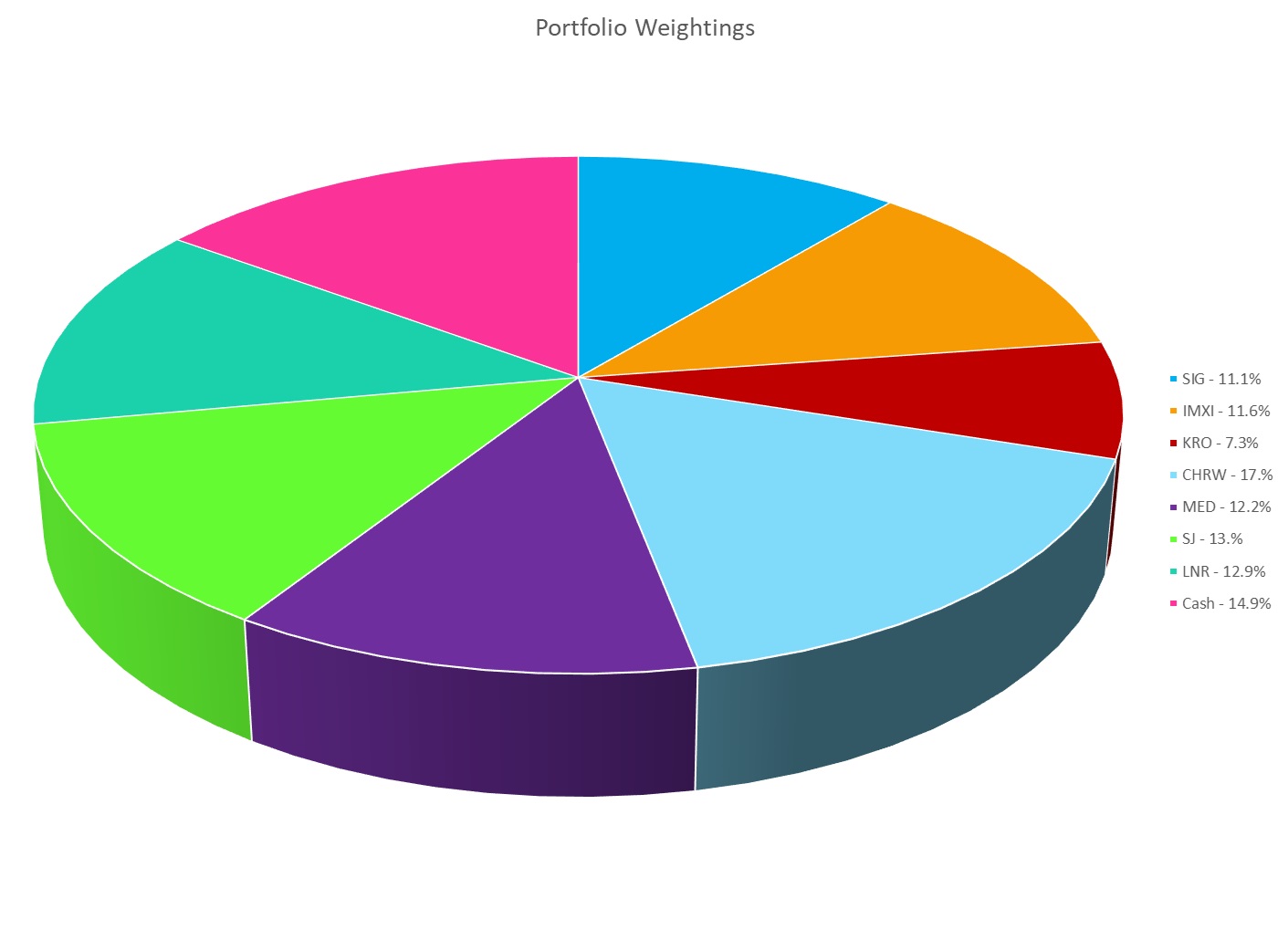

Which leaves me with only 7 stocks left to shore up the portfolio. Fewer than I would like to own to be sure but if we are indeed in the final innings of the current market expansion, it is not too surprising that I am struggling to find value. Here’s where I stand with my remaining holdings…

Kronos Worldwide: It’s been a harrowing ride, but I have made at least some money on my investment to date. I bought this highly cyclical titanium dioxide manufacturer on the down part of its cycle as earnings dropped and investors bailed. It was a classic example of catching a falling knife, something I do fairly frequently. I bought in at $9 and had to watch it drop to $6 over the next 6 months as losses continued to mount. The down cycle this time around was a particularly nasty one and in the end, the company capitulated this summer and slashed its usually very reliable dividend to conserve cash and pay down its mounting debt.

By the time they axed their dividend, however, the tide had already begun to turn. The company is back to making money again and last quarter’s profits were quite respectable. If we weren’t staring another recession in the face, I’d be happy to hold on to a full position in this one and see just how high profits might rise in the next up cycle.

But the possibility of a looming recession gives me pause. This has been a very cyclical company in the past. A new recession hard on the heels of Kronos’ recent difficulties could send the stock reeling again. Historically, the timing of the titanium dioxide cycle has not correlated exactly with the overall business cycle and so there is a chance that profits could continue to swell even in the face of a deteriorating economy. I’m uncomfortable betting too heavily on that, though.

As well, the company has taken on more debt than I like to see during this downturn. And they have had to renegotiate the interest rate on this debt substantially higher, which will eat into future profits. That lowers my baseline earnings expectations and therefore my fair value target somewhat. As a result, I’ve trimmed my position. Enough so that I feel comfortable hanging on to this one through yet another slow patch if it turns out that that is what is in the cards. I’m not thrilled with how the risk/reward picture looks for this company at the moment but I am reluctant to just give it away at too cheap a price. I’ll be monitoring this one closely and if we have a burst of exuberance that takes the stock unexpectedly higher this fall, I may sell my remaining position.

Signet Jewelers: During a recession, an expensive diamond ring may not be at the top of most people’s priority spending list. The company could lose money. But the real question is, how will it perform during the next up cycle? Trailing earnings are around $10 right now. Can it get back to that level? I’d say that’s reasonably likely. Would a p:e of 15 on those earnings be reasonable? I’d say so. That gives me a share price of $150 to shoot for, about double the current level. That’s enough incentive to keep me invested.

International Money Express: The market didn’t like this company’s latest set of quarterly results and lopped about 20% off the stock price. On the face of it, the earnings were fine. I think what might be spooking investors is a possible slowdown in the company’s previously high rate of growth. As well, the industry is clearly moving inexorably towards a more digital, online form of international money transfers and while this company is coming on strong with their own digital offering, they are still very much dependent on their old-school physical cash remittance services for the bulk of their profits. It’s going to be a delicate balancing act. How long can they milk their existing legacy physical remittance services for high profits? Can they grow their online offering fast enough and profitably enough to make a seamless transition to the digital age? Or will their legacy business drag them down? And will a possible recession make this even worse? There are risks here but the valuation is low enough that I’m willing to wait around for a while to find out how the story plays out. The trailing p:e ratio is 9. I could definitely paint a scenario where this stock is worth twice the current price a couple of years down the road. I could also paint a scenario where it’s worth half. I like the first picture better.

C.H. Robinson: Like Kronos, another example of trying to catch a falling knife. Except this time, I managed to catch it perfectly. That happens very rarely but boy is it gratifying when it does. This is a big trucking and logistics company that had been hit by the freight recession that followed in the wake of the shipping boom that occurred during covid. By sheer luck, I bought in at almost the exact bottom and the stock has risen smartly from where I purchased it back in April of this year. Profits are recovering and a new CEO is at the helm making all the right noises about cutting costs and streamlining operations. A full recovery to previous profit levels would still leave some room for this stock to move higher so I’m standing my ground. A recession might put a pause to the celebrations, but this is a large cap company and looking back at the recessions of 2008 and 2001, the company sailed through each of those just fine.

Medifast: Okay, I admit it, this is a crapshoot. Another falling knife. I’ve suffered a few cuts and knicks already. There may be worse to come. The company will likely lose money next quarter (and the quarter after that, and the quarter after that). But obviously my hope is that they turn the corner at some point. They have a large hoard of cash in the bank. This company is not going bankrupt tomorrow. Do they still have a viable business? Can they pivot from the traditional weight loss regimen of eating less and exercising more to taking a shot in the stomach once a week and bulking up on protein bars? Ummm. I think maybe. The company is not taking this lying down. They are charging headfirst into this new paradigm. They see enormous market opportunity if they can get this right. They have partnered with LifeMD to cover the drug side of the deal and are actively building out their adjuvant products and services. If they can pull this off, the upside could be dramatic. If not, well their cash should provide the opportunity to exit with at least some dignity left intact. In the past, they have not been particularly fazed by recessions, so at least they’ve got that going for them.

Stella Jones: In a somewhat oblique way this telephone pole company is a play on the overarching theme of electric grid expansion and hardening. It’s my backdoor play on the green transition. With a trailing p:e of 15, the stock is no longer as cheap as it was but nor is it egregiously expensive. It’s a relatively non-cyclical company and should be a reasonably sanguine place to hang out if we do tumble into a recession.

Linamar: What could possibly be left to say that I haven’t said a million times before? I bought Linamar way, way back in June of 2016 at $43 per share. At the time, the company had just come off a strong period of growth. Sales and earnings had doubled over the preceding 3 years. Profit margins were high and things were looking good. The stock looked very cheap at a p:e ratio of only 6.4 and had a strong balance sheet. Money in the bag.

Except it wasn’t. Over the 8 years I have held it, the stock has trailed the market by about 5% per year, rising by about 50% overall while the stock market doubled. Those high profit margins the company was enjoying when I first bought in were my downfall. Since then, the company has continued to grow, albeit not at the same rate as it had in the several years before I first bought in, but earnings have lagged far behind the sales and book value growth as the elevated profit margins settled back down to their more natural long-term average. Was this predictable? Sadly, no. Not infrequently, companies do manage to permanently grow their margins as they develop and expand their businesses. A steadily increasing profit margin can be a good sign. But other times, the boost in margins is just a temporary rush. We saw this a lot during covid. Usually the cure for this uncertainty is to buy in at a very low p:e. A low p:e can atone for a wide variety of sins, even a historically high profit margin.

But not in this case. Here we are 8 years later and on all counts, this stock looks fantastic. Those profit margins are now back down to hopefully sustainable levels. Sales and book value have both doubled in the past 8 years, which is a reasonably respectable showing. The company has diversified very successfully away from its reliance on auto parts for the internal combustion engine and now does a majority of its business in non-automotive sectors. Meanwhile, its auto parts division has a healthy footprint in the new generation of electric vehicle technologies.

But that p:e ratio continues to languish. It remains as low as it was 8 years ago and for the whole time I’ve owned it, it has rarely even breached the double digit mark, let alone the 15 or 20 mark that I think would be more justified.

Which is why I still own it. Someday I’ll sell it. But not today.

Full Dsiclosure: I own shares in Signet Jewelers, International Money Express, Kronos Worldwide, C.H. Robinson, Medifast, Stella-Jones and Linamar. I do not own shares in Omnicom Group.