Reminiscences of a value operator.

Letters From The Trenches

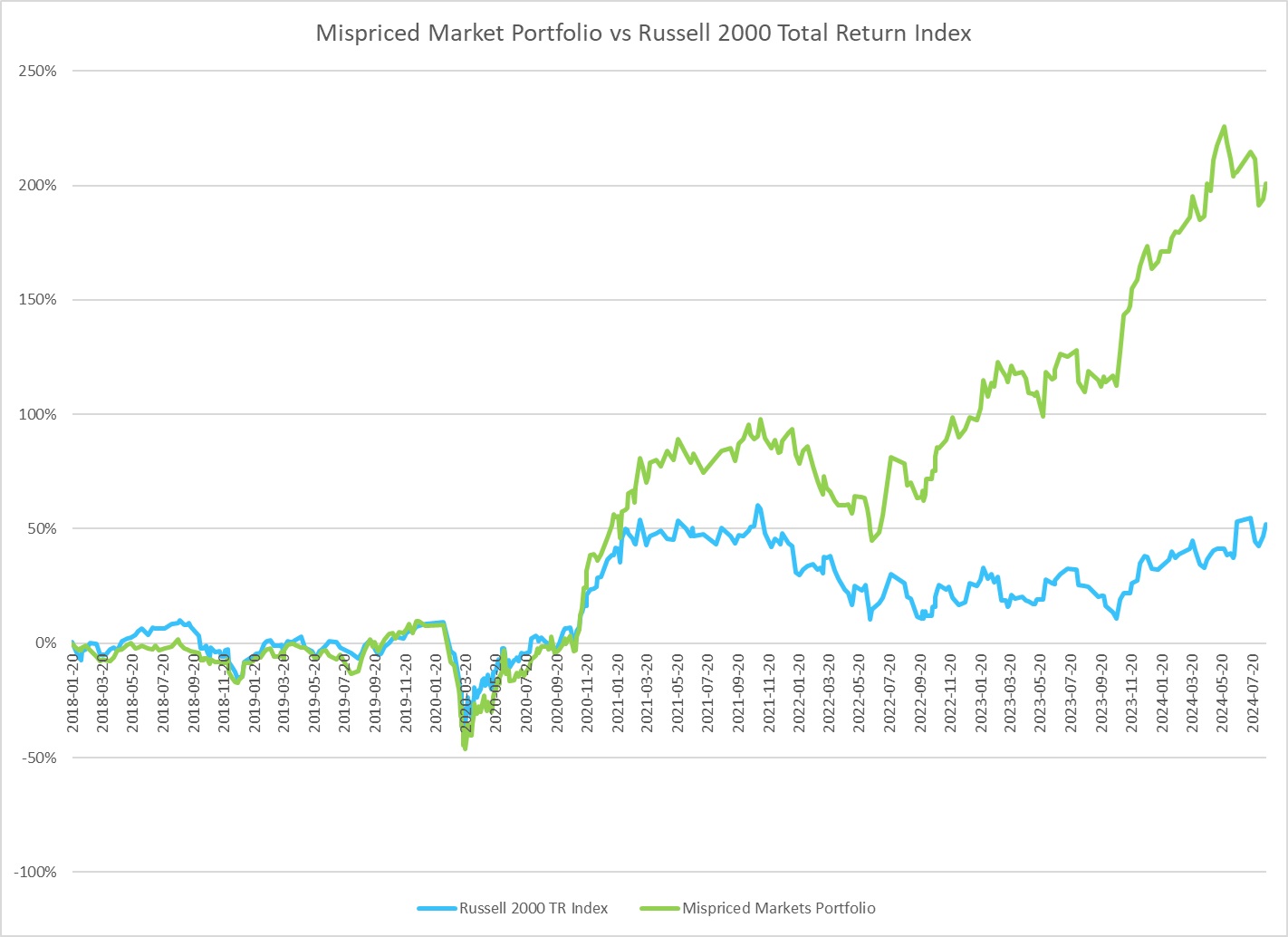

For 6 years, from the spring of 2018 to the fall of 2024, I blogged in real-time about every move I made in my own personal portfolio. This was a somewhat harrowing experience. It is not easy putting all your investment decisions out there in the open for everyone to see and critique. I had my share of missteps but fortunately, once the dust had settled, I enjoyed far more successes than I did failures. In the final accounting, my portfolio had tripled in size and I had outperformed the benchmark Russell 2000 index by 12% annually.

As is obvious from the graph above, it was not a smooth ride. For the first 3 years of this blog’s life, my portfolio failed to make any progress against the benchmark index. Any readers from that era would have been forgiven for dismissing my musings as the outdated ramblings of an investment has-been. But then the economy and the market hit bottom in the summer of 2020 and started to rip higher. As has often been the case, the beaten down stocks I packed my portfolio with ripped even higher.

This has been a common theme in my investing. When the economy is slowing down, my collection of beaten down value stocks simply track the market lower. No one pays attention to these ugly ducklings when market conditions are deteriorating. But if I am patient, and keep accumulating these diamonds in the rough whenever I find them, eventually the market turns and these ignored, overlooked value stocks start to shine.

If there was one lesson I could take away from these past 6 years, it would be to stay the course. Ignore the chaos and the noise and stick to your core, value investing principles. At some point we will have another period of soft economic performance. A recession. Maybe even a stock market crash.

If so, I will use any period of weakness to restock the cupboard with a new set of deeply undervalued situations. Warren Buffett advises investors to “buy when others are fearful”. Good advice to remember although very difficult to put into practice. It takes discipline and patience but if you can pull it off, you’ll be well rewarded in the end.

In retrospect, I couldn’t have picked a better time to showcase all the real-world tribulations and triumphs that come from being a dedicated value investor. I hope that these posts will stand the test of time and will give new investors some valuable insights into how one person successfully stick-handled a stock portfolio through the chaotic mess that is the real world.