With a global footprint, record sales and earnings and a shiny, new acquisition in the works, this automotive and industrial manufacturing company is firing on all cylinders.

Linamar – LNR

March 16, 2018

Share price: $73.06

Number of shares: 65 357 000

Market Cap: $4.8 billion

The Backstory

Linamar is a diversified manufacturer of automotive, industrial and agricultural products with an expanding global footprint. It has grown steadily over the years both in terms of its product line and its geographic reach. The company has 25,700 employees spread across 59 manufacturing facilities, 6 R&D centers and 21 sales offices in 17 countries around the world. Linamar divides its operations into two main segments: powertrain/driveline, which manufactures parts primarily for the automotive industry and industrial, which manufactures aerial platforms (scissor lifts), telehandlers and booms. Additionally, in the first quarter of 2018 they made a sizable acquisition of MacDon, a Winnipeg based manufacturer of heavy agricultural equipment. MacDon has been in business for 67 years and also has a global footprint with sales in over 40 countries worldwide.

Their powertrain/driveline division makes up the bulk of their business, accounting for 83% of sales and 77% of operating earnings in 2017. The industrial, “skyjack” division which manufactures and sells scissor lifts, used in a wide variety of applications, offers a nice diversification and accounted for the rest of 2017 sales and earnings. The new agricultural acquisition promises to diversify the company even further and is expected to be immediately accretive to earnings.

Their website offers a full accounting of their various products. I have to admit, not being a gearhead, I only have a vague conception of what all the gear casings, cylinder blocks, axle rods, camshafts and bearing housings are used for but it looks like they cover a wide spectrum of auto parts. However, many, though not all, of the parts Linamar makes are for use in the internal combustion engine. This could turn out to be one of the main headwinds that this company faces. An acceleration in the demand for electric cars does pose a real risk to Linamar’s operations, but the company is fully aware of this and has been making a concerted effort to expand its offerings into hybrid, electric and fuel cell powered vehicles. The CEO has said she sees many opportunities in this new and growing field. To this end, they recently announced their second major win of an e-axle manufacturing contract. As well, their recent agricultural equipment acquisition is likely a conscious effort to diversify away from a reliance on the internal combustion engine. While a smaller part of their operations, they also provide components to the renewable energy industry (solar and wind) and to the construction, off road vehicle and marine industries.

In their core automotive division, 58%, 32% and 10% of sales are to North America, Europe and Asia respectively. They therefore enjoy some nice diversification geographically as well as by product line. With their content per vehicle sitting at $159, $69 and $10 in North America, Europe and Asia, they clearly have further room to expand. In the fourth quarter of 2017 they were pleased to announce double digit content per vehicle growth in every region globally despite an overall flat market.

Looking forward, they entered 2018 with a strong launch book, a large, new acquisition which could provide an immediate boost to earnings and some interesting new contract wins, including an agreement with an innovative Israeli company which has developed a line of in-wheel suspensions.

The Numbers

NOTE: All my earnings numbers are adjusted as I see fit to reflect what I hope is an accurate picture of ongoing, day to day operations (evening out tax rates, excluding one-time write offs, adjusting for exchange rate fluctuations, etc.). As well, debt levels, book value and other numbers frequently involve some interpretation on my part. I cannot vouch for the accuracy of these numbers. It is easy to enter a plus instead of a minus on my calculator or mistakenly reference the wrong line on a balance sheet. So please use these numbers as illustrative only and do your own due diligence.

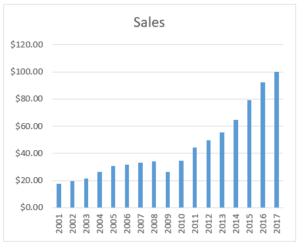

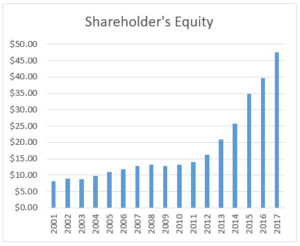

Linamar ended 2017 on a strong note with record sales and earnings. My estimate of adjusted EPS comes in at $7.79, giving this stock a trailing p:e ratio of 9.4. Growth has been very solid over the past 10 years with growth in sales, earnings and shareholder’s equity of 11.7%, 15.1% and 14.1% per annum. While earnings have shot ahead in the past few years on the back of improving profit margins, these three metrics are all roughly in agreement and paint the picture of a company that has grown at a rate well above average. Especially for a company with the size and scale of Linamar this is a laudatory accomplishment.

Growth in adjusted earnings, sales and shareholder’s equity, on a per share basis.

Linamar has so far accomplished this impressive track record without taking on an undue amount of debt. Currently their net debt position works out to around $13.71 per share, just less than 2 times their annual earnings. However, the new agricultural equipment acquisition is likely to weaken their balance sheet significantly, at least until they can pay some of the debt down with their ongoing cash flow. At a purchase price of $1.2 billion and change, this is likely to more than double their total debt and bring their debt level up to a more uncomfortable 4 times earnings. While their desire to diversify away from the auto parts sector is understandable and could well be the right move to make, in the shorter term, this debt load could weigh on the stock. And if we are nearing the end of this very robust auto cycle, the timing of this balance sheet leveraging could prove to be unfortunate. On the other hand, if the auto sector does cool off, their decision to enter the farm equipment sector could end up looking like a very smart move. Given their past record of prudently managing their balance sheet, I am inclined to give management the benefit of the doubt here and see what they can do with this new acquisition.

Valuation

At the current share price, Linamar sports a trailing p:e ratio of 9.4. This seems like a very attractive price for what has been a strong performer in the past with a global footprint, a diversified product portfolio and a market cap of close to $5 billion. This market cap qualifies the company as a “whale” deserving of a large cap, premium valuation. With many large cap stocks trading at p:e ratios over 20, buying into this Canadian success story at a p:e of 9.4 looks like a very good deal.

Of course, there are a number of obvious reasons why the stock price is depressed at the moment. Right now, Canada is in a heated debate with the US over the fate of NAFTA. The average car manufactured in North America uses parts that have criss-crossed the border multiple times on their way to making it into the final assembly. Scrapping the NAFTA agreement could play havoc with this supply chain. The market hates uncertainty and the ultimate outcome of these trade negotiations is still very much up in the air.

Many companies in the auto industry are sporting low valuations right now. The last 4 years have been extremely good for the auto makers with robust sales and strong profit margins. Investors are legitimately concerned that these good times can not last. At some point, consumers may become tapped out. If interest rates were to rise or the economy were to sink into recession then the demand for new cars will fade.

On a more existential note, the industry could be facing enormous disruptive forces with the advent of the electric car and the driverless car. Over the next few years, all of the big auto makers are planning to introduce a slew of new electric vehicles. These vehicles are simpler to build and use fewer parts. This is a real threat to auto makers like Linamar. Despite their brave words, the company will likely struggle to replace all of its lost business if the electric car revolution takes the industry by storm. However, if the pace of adoption is more gradual, then hopefully there will be a sufficient number of new opportunities to outweigh the loss of business in their legacy internal combustion engine business.

Some visionaries are saying that the advent of true driverless vehicles will be an even more dramatic paradigm shift and will lead to the demise of the car industry as it currently exists, with everyone sharing driverless fleets of taxis. While these are both developments to watch closely, I believe that the reality of new technologies often does not quite live up to the hype and that Linamar still has a solid future helping to build the car of the future.

Final Verdict

While I do not discount the possible storm clouds on the horizon for Linamar and for the auto industry in general, I believe that there could be as much opportunity here as there is danger. With its recent move into the farming sector and the ongoing success of its skyjack division, Linamar is more than a one trick pony. Linamar is a well run, globally diversified company with a very strong track record and I can buy it now for less than half of what most other large cap stocks are trading at. To me that discount makes it worth dealing with the current uncertainty that hangs over the company and the auto industry in general.

I and members of my family own shares in this stock.