This wealth management company has weathered previous market storms well and seems to offer compelling value as we sail into rougher waters ahead.

Gluskin Sheff Associates Inc. – GS.TSX

Nov 24, 2018

Share price: $10.62

Number of shares: 31 234 000

Market Cap: $332 million

The Backstory

Gluskin Sheff is an independent Canadian wealth management company founded in 1984 by Ira Gluskin and Gerald Sheff. The company went public in 2006 and has been providing its shareholders with a lucrative stream of dividends ever since.

Their clients are mostly high net worth individuals. These clients entrust Gluskin Sheff with their money and rely on them to deliver superior long-term returns with a focus on capital preservation.

“Gluskin Sheff is committed to meeting the needs of our clients by preserving their capital, managing risk and delivering exceptional service and strong long-term investment returns through various economic and market cycles.”

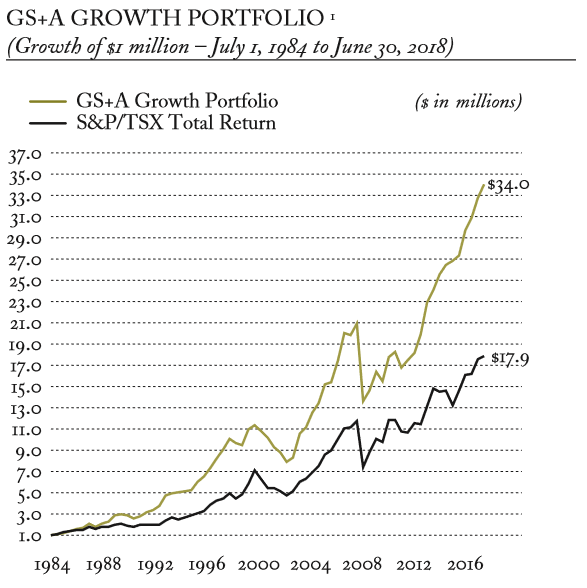

It’s a tall order, but the company has proven that it is up to the task with an enviable long-term track record. This graph of the performance of one of their flagship funds, speaks volumes as to the effectiveness of their approach…

Their chief economist, David Rosenberg is often being quoted in the financial media and I find myself agreeing with his straight-shooting take on the economy and the markets much more frequently than not. The firm’s investment philosophy seems deeply ingrained in the company culture and immediately appeals to a value investor such as myself. This is how they describe it…

“Our investment decisions are based on bottom-up research that looks for companies with a history of long-term growth and stability, a proven track record, shareholder-minded management and a share price below our estimate of intrinsic value.”

The Numbers

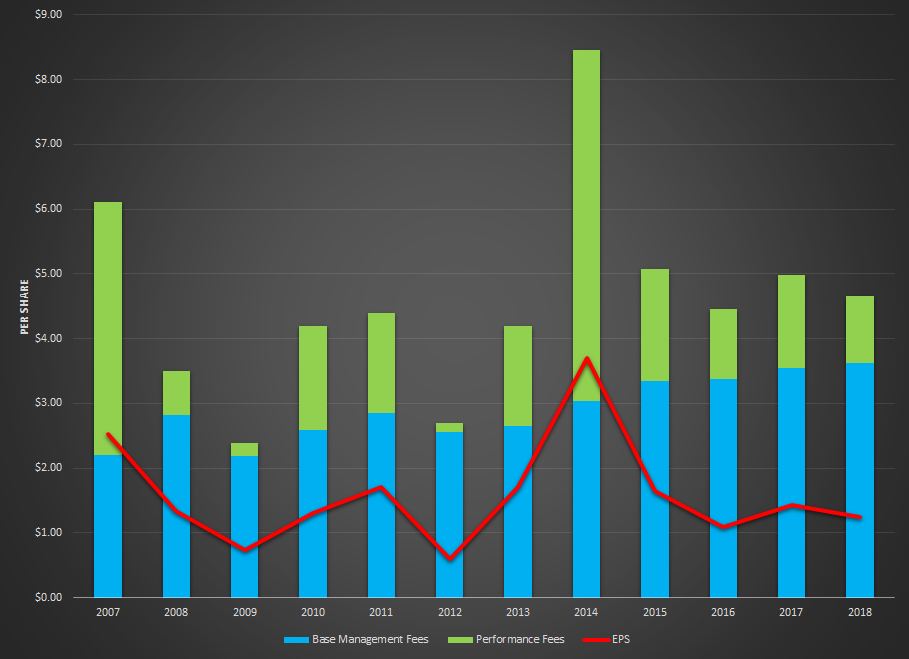

Gluskin Sheff makes its money by collecting management fees on the assets that it manages for its clients. These management fees come in two flavours: regular base fees which are based on the total value of assets under management and more sporadic performance fees which are earned when the client portfolios exceed pre-set performance thresholds. From this revenue, they subtract variable compensation expenses for their employees and miscellaneous other overhead expenses to arrive at their final yearly profit. The table and graph below show the breakdown between the base management fees and performance fees over the past 12 years along with the ensuing earnings and dividends per share.

The timing of the performance fees is quite unpredictable and results in a very lumpy set of annual earnings. Wall Street doesn’t like unpredictability and I believe this is one of the reasons why it is presenting us with this value-priced opportunity. The last blockbuster payday was back in 2014 and the sugar rush of that windfall has largely worn off. Looking back over the last 12 years, EPS have averaged $1.59 per share. But twice during this time period, annual earnings spiked above the $2.50 mark, the most recent occasion being in 2014 when earnings reached $3.69 per share. There have been weaker years as well, notably in fiscal 2009 which encompassed the big market drop of 2008. (Their fiscal year ends in June.) Over time, though, the periodic windfall years have more than compensated for the lean years. Notably, the base management fees that the company collects help to smooth out the turbulence and provide a nice floor under the level of earnings, even during extremely challenging market conditions like the company experienced in 2008/2009. Gluskin Sheff uses a variable rate compensation scheme for its employees which ties bonuses to the level of performance fees collected. In this way, overhead costs tend to drop along with revenues when markets are struggling, providing the company with a nice buffer. Given where we are in the current market cycle, I find it reassuring that the company remained solidly profitable throughout the last recession.

Since its debut on the public markets in late 2006, the company has paid out nearly 100% of its annual earnings to shareholders in the form of regular dividends along with periodic “special” dividends that it hands out when it has a particularly good year. Over the past 12 years, these dividend payments have averaged an annual $1.47 per share.

However, the past may not necessarily be prologue. With such a volatile earnings history it is difficult to get a read on precisely what to expect average earnings to be like going forward. On the one hand, the company has been facing intensifying competition from the big banks who are trying to muscle in on this company’s traditional wealth management turf. As well, the exploding popularity of ultra low-cost ETFs has put downward pressure on fees and profit margins across the industry. On the other hand, the company has been successful at growing its assets under management through acquisition, on-boarding new clients and simply growing the wealth of its existing client base and so far, this has largely offset the industry headwinds. Lately, the company has maintained a conservative, defensive posture in its client’s portfolios and this has likely been a drag on their performance as well. Looking forward, my crystal ball is as cloudy as ever. However, taking everything into consideration, using either 2018 EPS of $1.24 or the even better long-term average EPS of $1.59 as the basis for our valuation calculations seems eminently reasonable. There will be lean years ahead, especially if we are in the very early stages of a looming bear market but there will also be windfall years when outperformance fees give investors an unexpected bonus. Long term, I expect these two forces to roughly cancel each other out.

Valuation

Since the company has been dividending out all of its earnings, we can value this on the basis of its earnings or its dividend yield. The two should be basically the same thing. As well, since earnings are not being retained to reinvest in the company, we shouldn’t expect any significant future growth. Gluskin Sheff is simply a cash generating machine and we should treat it as such.

Using 2018 earnings which seem like a reasonable marker for the expected future middle-of-the-road performance of this company, we get a p:e ratio of 8.6 at a $10.62 share price. This compares very favourably to the typical Canadian small cap company which is sporting a p:e ratio closer to 20 on full- cycle, average earnings. Since the company is paying out all of its earnings as dividends, this annual $1.24 figure should generate an average dividend yield of around 11%. Again, that is a very attractive yield if it can be maintained.

A quick look at the balance sheet confirms that the company has no net debt so hasn’t been borrowing from the bank to pay a dividend it can’t really afford. As well, the share count has been very stable over the past 12 years. With their variable cost structure and long-term track record, I am hopeful that the dividend can indeed be maintained.

Final Verdict

I believe there will always be a place for active, full service management of investor’s money, especially in the high net worth end of the market where personal relationships and capital preservation become much more important. Gluskin Sheff recently did a survey of its clients and found very high levels of overall satisfaction with the service they received. They offer ancillary services and specialized strategies that low cost, passive management can’t provide. The large baby boomer cohort is going to need personalized investment management services for decades to come.

At its root, this investment rests on a relatively simple premise. With the average Canadian small cap stock trading at a p:e of around 20 to average, full-cycle earnings, Gluskin Sheff’s trailing p:e ratio of 8.6 offers a compelling value. Results held up better than those of many smaller companies during the last major market downturn and the company looks well prepared to meet the next market drop head-on. In these uncertain times, a strong dividend can be a comforting thing and this company offers one in spades with a dividend yield of somewhere between 9 and 13% depending on how generous you are in assuming that the company will continue to be able to earn its periodic outperformance fees. While industry headwinds are not to be discounted, this company has a long, very successful track record and has adapted and evolved with the industry. They are not merely resting on their laurels at this point, but continue to broaden the scope of the services they offer their clientele. While value investing has been out of favour over the last few years, Gluskin’s brand of conservative, bottom-up fundamentals based investing will enjoy its time in the sun again and when it does, I’d like to be there to enjoy the ride.

Full disclosure: I own shares in this company.