A surprisingly good year rounds out the first 5 years of mispriced markets.

5 Year Anniversary

This month marks the five year anniversary of this blog. I launched mispriced markets in January of 2018 in an impulsive frenzy of article writing and google searches for how to use WordPress. At the time, I didn’t have a very clear vision for what I wanted the site to be. And to be honest, I still don’t. I thought I’d just put some stuff out there and see what happened. It’s been a chaotic journey. I’ve learned a few new tricks, made a few mistakes and adjusted course along the way. It’s been more difficult and taken more time than I thought it would. But it’s also been more enjoyable and far more rewarding than I was expecting.

I was nervous when I launched this site in the winter of 2018 that the markets were worryingly high. Stock prices were expensive and valuations were stretched. I wondered if I should wait to launch the blog until after the market had cooled off. But the market had already been high for years and there was no telling how long I might have to wait for a better entry point. I wasn’t getting any younger. What’s more, I reasoned that new investors could probably use whatever guidance I had to give even more in a bear market than they could in a more benign market environment.

So I rushed headlong into the fray, trying to temper any advice I gave with a healthy dose of doom and gloom to keep expectations low. In retrospect, the caution was warranted. Stocks have struggled to make any headway over the last 5 years. In fact, once adjusted for inflation, and even factoring in dividends, the Russell 2000 stock market index has gone exactly nowhere over those 5 years. The index has risen by 21% in nominal terms but the consumer price index has risen by the same amount, leaving investors with a frustrating 5 year trip to nowhere. Heaven help those investors hoping to generate an income from their stock market investments.

What’s more, those intervening 5 years have taken us all on a truly wild ride. Even matching the disappointing stock market performance has been a massive challenge as the market has acted like a bucking bronco attempting to throw investors off on multiple occasions. JP Morgan reports that the average investor has trailed the meagre performance of the Russell 2000 by 4% a year. Not only has the market been going nowhere, the average investor has been underperforming even that low benchmark.

It is easy to see why. The market dropped by 25% in late 2018, recovered and then plunged again in the early days of the pandemic, dropping 40% in a month. At the time, it was an open question as to whether we were headed for financial armageddon or not and it would have taken a strong constitution to stay the course. Amazingly, the market did not fall to pieces. Instead, it turned on a dime and went on to stage one of the most impressive bull market runs we’ve ever seen. The combination of government stimulus and investor euphoria drove stock market valuations to all-time highs. Once again, investors would have had to fight hard against their emotions to avoid getting swept up in the excitement.

And now, we’re dealing with the aftermath of that speculative binge. Stocks are down again this year. Many of the most overpriced stocks are down by 70% or more. It is not hard to fathom why the average investor has struggled to keep their head above water in the face of this kind of turbulence.

Throughout the turmoil, I have followed the same unexciting, value-oriented approach that I have always followed. Buying overlooked companies at reasonable prices. And I am very, very pleased to report that my initial justification for launching this blog even in the face of high prices and stretched valuations has proven valid. It turns out I did have something worthwhile to share with new value investors looking for guidance. Perhaps doubly so given the difficult market conditions we’ve faced.

How To Double Your Money in 5 Years

My mispriced markets portfolio has doubled in value over the last 5 years, gaining 97% from Jan 1, 2018 to Jan 1, 2023. In inflation adjusted terms, I’ve gained 76% vs. a market that has gone nowhere. That works out to an annual outperformance of 11% per year.

I’ve posted all the stock trades I’ve made over those 5 years on this website. But to emulate that performance and track those buys and sells, move for move, would have taken an awful lot of intestinal fortitude. I don’t make it easy on people. I maintain a nearly perma-bear level of pessimism in the face of chronically high stock prices. I tend to never give an unqualified thumbs up to any stock I buy, always trying to point out any potential pitfalls I see. I gravitate towards unpopular sectors and never own any of the well-known market darlings. I don’t use impressive-sounding market jargon. I hem and haw and change my mind.

On the surface, it looks like only an idiot would slavishly follow my market movements. Even I have trouble committing completely to my own stock finds and have frequently held more money aside in cash over these last 5 years than has been good for me. However, any idiot that had thrown caution to the wind and had committed 100% to the stocks that I have unearthed would have done very well indeed.

For all the idiots out there then, I plan to continue searching for off-the-wall ideas and will blog about them on this website. And I’ll continue to make it uncomfortable for people to actually follow my advice.

A Change In Focus

When I started this website, I still had one foot in the micro-cap camp. These penny stocks have been good to me over the years and I’ve been reluctant to let them go. My starting portfolio, in January of 2018, was about half micro-caps and half small, mid and large-caps. As well, it was almost entirely invested in the Canadian market. But I am partly a victim of my own success and over the last 5 years I have transitioned away from the micro-cap arena to focus on the small, mid and large-cap segments. As I’ve moved away from the more thinly traded segments of the market I have found fewer and fewer companies in Canada that meet my investing criteria. As a result, I’ve been forced to find a new home in the US markets. With these two changes of focus, I’ve been worried that I might not be able to match my previous performance record. So far, that doesn’t seem to be the case.

The past couple of years, when I really committed to larger stocks and to the US market, have been quite good. But it is early days still and I won’t really be breathing a sigh of relief for a few more years yet. (Who am I kidding? When it comes to investing, I’ll never truly breath a sigh of relief.)

2022 In Review

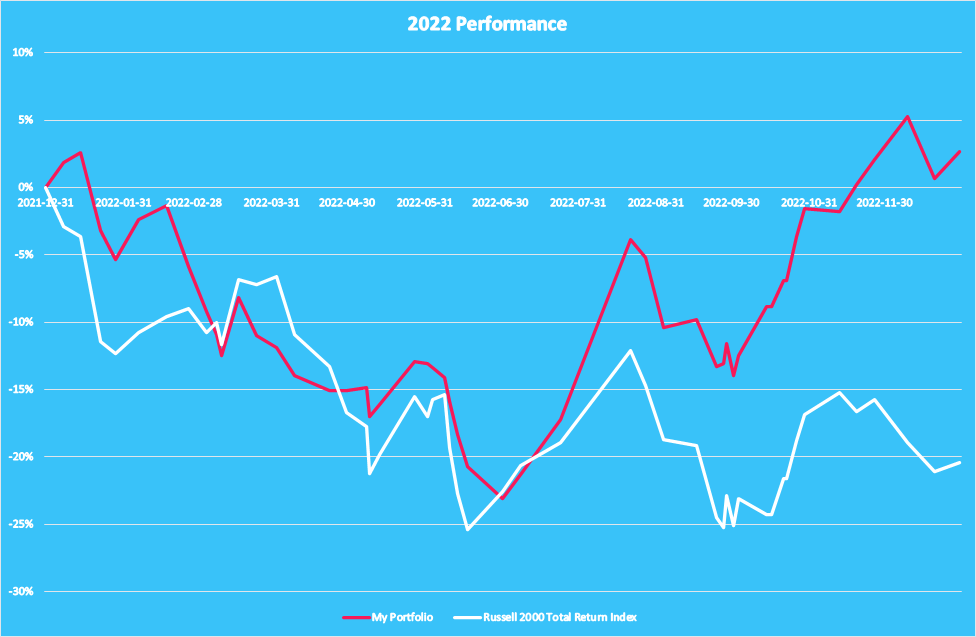

2022 was a very good year for the mispriced markets portfolio. My portfolio ended the year up 3%. This, in a rough year for the markets, with the Russell 2000 index down by 20%. I tend to look at everything though the lens of relative performance. I feel much happier with a 3% gain when the market is down by 20% than I do with a 10% gain when the market is up by 5%. So 2022 was a much appreciated and frankly, unexpected win.

I did a full review of the markets in November and December and did not find anything new to add to the cupboard. I am always on the lookout for fresh ideas, but until I find something significantly better than what I already own, I will stay the course with what I have. I am comfortable holding on to the stocks I currently own as we move into 2023. They are a diversified lot and look reasonably priced compared to what else is out there.

What Will Be In 2023

As we move through 2023, the distortions of the covid era will continue to abate. Whether we settle back down gently to an equilibrium level or whether the pendulum swings back the other way and gives us a nasty earnings recession to compensate for the previous over-exuberance remains to be seen. Certainly, all the macro economic indicators appear to be signaling a recession in 2023 but nothing in the stock market is ever certain. A full blown recession may or may not ensue and if it does, stock prices may or may not move lower in sympathy. I think I’ve finally had it beaten into me over the last 5 years. I concede defeat. You can’t time the market. So don’t even try.

Instead, I will aim to always stack the portfolio with the best, most undervalued companies I can find. Companies that I think can prosper during the good times and stay solvent during the bad times. I don’t know when those good and bad times will be, so that’s the best I can do.

There are often good opportunities to buy when there is blood in the streets. But for the most part, I’m not seeing much blood yet. Owners of some of the more egregiously overpriced tech stocks might disagree, but for the more general market, we haven’t seen the kind of bloodbath that would produce a spate of compelling turnaround opportunities. That bloodbath might be coming, or it might not. If it does, that’s a sector I’ll be looking at. Meanwhile, I’ll continue to hold on to the (hopefully) more stable companies I already own and will save the heroics for a future date.

Thanks To My Readers

It’s been a fun 5 years. Thank you to all the readers that have sent their e-mails of comments, questions and congratulations. It’s that kind of feedback that keeps me blogging away. I hope the next 5 years are as exciting, challenging and rewarding as the last 5 have been.

Let’s see what 2023 has in store for us…