As the covid bull market winds down, everyone is waiting for the other shoe to drop. What better way to pass the time then, than by loading up on yet another shoe company?

If The Shoe Fits

It seems I have a thing for shoes. I did quite well with Genesco early on in the pandemic. Hibbett also did well. Foot Locker was more of a wash. Way back in the day I owned a company called Sterling Shoes. They went bankrupt and I rode the stock all the way down to zero. We don’t have to talk about that one.

Well, I’m at it again. This time with a company called Designer Brands Inc. (DBI.NYSE). This is a company that owns and operates a chain of big box shoe stores across the US and Canada under the name “DSW – Designer Shoe Warehouse”. They have 642 stores in total. That puts them in the sweet spot, in my opinion. Big enough to have been around for awhile and proven their mettle but small enough that there could still be years of growth ahead of them if they play their cards right.

It’s been a while since I added a new stock to the portfolio, so I was fairly excited when this one made it through my vetting process. When I told my wife I had found a new stock to buy she asked me what it was. “Designer Shoe Warehouse”, I proudly told her. “Oh, I don’t like those stores. I don’t think their shoes are very good quality.” And then, because she’s lived with me for 30 years, she paused and said, “But I guess it’s cheap, right?”

Right you are, baby! It is cheap. Very cheap. It first flashed up on my screens with a p:e of 4 (to trailing earnings), so I assumed there must be something drastically wrong with the company. Especially considering that the average small cap stock these days trades for more than 5 times that level. But after doing my due diligence and putting this stock through it’s paces, I failed to come up with anything that would seriously dissuade me from buying into this footwear retailer.

Everything Must Go!

To be sure, the retail industry is in a state of disarray right now and the whole sector is selling at a discount. Companies have been whipsawed around by covid and now find themselves badly overstocked. They are desperate to clear out inventory and this is going to lead to a few quarters, maybe even a year or two, of aggressive promotions and clearance sales. This is not a constructive environment to be in. DSW says the big 3 footwear companies (Nike, Skechers and Adidas) are running with about 50% more inventory than they would like to have. Clearing out all that inventory is going to be a painful process.

DSW itself is not doing too badly in this regard. They do have moderately more inventory on hand than they are happy with, but they have done a better job than most of keeping a lid on things. As well, they have a well-defined clearance procedure in place and to some degree they actually welcome the return of clearance inventory because it has brought the clearance sale shoppers back into their stores. Nevertheless, the next few quarters are not likely to be pretty.

What’s more, if you believe we’re headed for a severe recession this year (I’m still not quite convinced), retail is generally not where you want to be. If you’re focused on the short term, this is not an investment for the faint of heart.

On December 1, the company released its third quarter earnings, which were solid, but they reduced their outlook for the holiday quarter, forecasting essentially break even results. This went over like a lead balloon. The market did not like this forecast at all and sent the price plummeting from $15 to $11 overnight, and it has continued to drift down from there. Which is, of course, exactly why it flashed up on my radar screen.

I don’t mind putting up with a little pain if the reward is great enough. It is possible that the next year or two could be uncomfortable for shareholders and it may take time for this story to mature, but if I look out a few years, after the dust has settled, I quite like what I see.

Components of Value

To my mind, the value of a company is based on 3 main things: its baseline earnings, the variability of those earnings (principally how badly the company does during recessions) and how fast I expect those earnings to grow. Personally, I also put a lot weight on the balance sheet strength of the company; how much debt it is carrying. The rest of the market doesn’t seem to care nearly as much about debt levels as I do. But for me, too much debt is always a deal killer.

So let me start with that: the balance sheet looks good. In November they received a $140 million cheque from the government for covid rebates and used this money to pay down debt. This should leave them with debt comfortably under two times annual earnings. So I’ve got no complaints there.

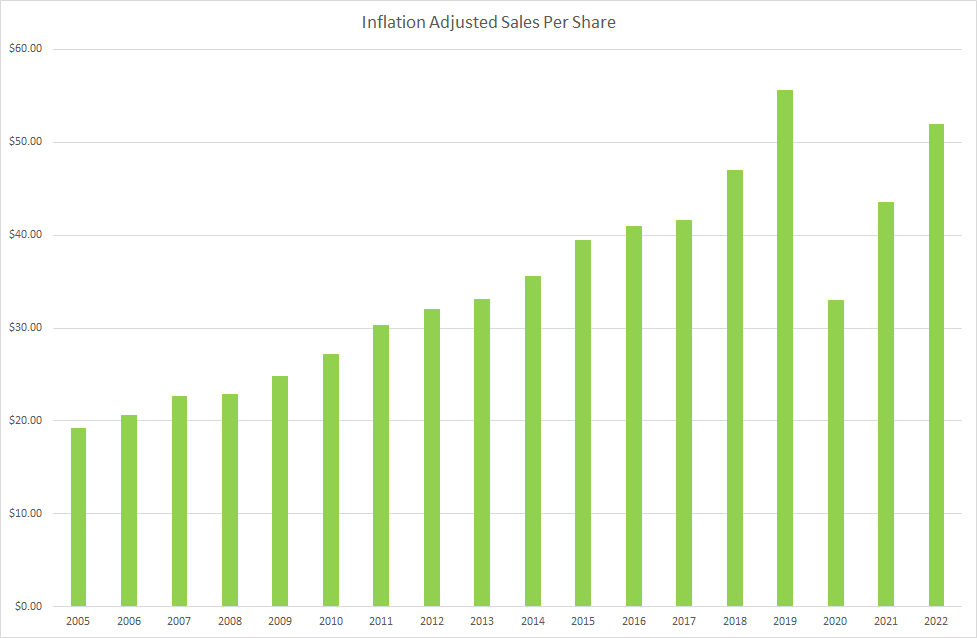

Next let me tackle the growth question. Here is a graph of their inflation adjusted, annual sales over the last 15 years.

Between 2008 and 2018, sales grew at a steady rate of around 4% a year over inflation. Throw in a healthy dividend on top of that and you have a company that has grown at more or less the market average. They’ve got a retail concept that seems to work reasonably well and they’ve just been executing on that year after year. After the wild distortions of covid, my hope is that they will resume their pattern of slow and steady sales growth.

Squinting at this graph, I’ve made the not terribly scientific assessment that current 12 month sales levels are approximately on trend with the pre covid pattern and so I’ve just been using that sales level as my baseline assumption for sustainable sales going forward. Sales in the most recent 12 month period were a shade over $50 per share.

The company has a few avenues open to it for growth that should keep the ball rolling. They are small enough that they can continue to expand their store footprint, if the market demand is there. They recently opened a new concept store in Texas called “Warehouse Reimagined” which has been getting high marks from customers and has been producing strong financial results, so if they choose to pursue this, that’s another source of potential growth. But their main growth focus over the next few years is going to be on expanding sales of their own in-house shoe brands. These owned brands come with nice, fat profit margins and early results from this program have been very encouraging.

Next up, we have earnings variability. I spend a lot of time looking at historical net profit margins when I look at stocks, especially lately, with covid throwing everything into disarray. First I come up with an estimate of what I expect sales to look like after all the covid effects wind down. Sales tend to be more stable and consistent than earnings, which is why I sometimes start with those. Then I figure out what sort of profit margin the company was historically able to generate when the world wasn’t busy going bananas. I throw these two things together and voila! I’ve got my earnings estimate.

Here is a table of my calculated net profit margins (I’ve excluded large, non-recurring items from the earnings part of these calculations) over the past 18 years. (Profit margins are earnings as a percent of sales. ie earnings / sales.)

| Calendar Year | Profit Margin |

| 2005 | 3.2% |

| 2006 | 5.1% |

| 2007 | 3.8% |

| 2008 | 1.8% |

| 2009 | 3.7% |

| 2010 | 1.7% |

| 2011 | 5.6% |

| 2012 | 6.6% |

| 2013 | 6.4% |

| 2014 | 6.0% |

| 2015 | 5.2% |

| 2016 | 4.1% |

| 2017 | 3.4% |

| 2018 | 2.9% |

| 2019 | 2.9% |

| 2020 | -15.3% |

| 2021 | 4.1% |

| TTM | 4.3% |

There’s a fair bit of variability there, so any earnings estimate I come up with is going to only be a rough approximation. Profit margins have fluctuated between 1.7% at the recessionary lows in 2008 and 2010 and 6% in the strongest years of the last business expansion. Prior to covid, during the “retail apocalypse” years when Amazon started kicking sand in everyone’s face, profit margins slumped back down to 3%.

For the trailing 12 month period, profit margins are sitting at 4.3%. This could well have been goosed higher by covid effects, so a return to the pre-covid 3% range once the dust settles looks like a more conservative assumption and that’s the number I’ve chosen to use for now. I’m moderately hopeful that I’ll be able to raise this number as future events unfold.

Connecting The Dots

Putting all this together, this is what I come up with: my baseline assumption is that profit margins will return to the 3% range during all but the worst recessionary years. With current sales of $50 per share, that means EPS of $1.50 (3% of $50) and a p:e of 6 at the recent $9.50 share price. I am expecting sales to keep growing at their historical rate of around 4% over inflation. The company is re-instituting its dividend, after suspending it during covid, and also buying back shares. This all leads me to conclude that, at some point, it is not so unreasonable to hope for a market average multiple on this stock. Right now the average p:e ratio of US small cap stocks is around 22. That’s a very generous leg up from the p:e of 6 that I’m calculating for DSW and implies that the stock price would have to more than triple for the stock to catch up to its market peers. If I’m patient enough, I could could conceivably get a 3 bagger or more from this stock. Even struggling, no-growth companies are trading at p:e ratios in the mid to high teens right now so if growth at DSW were to stall out, the stock price would still look significantly undervalued.

Could I be wrong in my earnings estimate? Absolutely. As you can see, I really just picked it out of a hat. I looked at the long-term table of profit margins and picked a level that I thought seemed justifiable. I could have just as easily picked the trailing 12 month figure of 4.3% or, if I was being really pessimistic, the recessionary low of 1.7%. But even that pessimistic take doesn’t completely derail the investment thesis. A profit margin of only 1.7% gives EPS of $0.85 and a p:e of 11 which is still quite low compared to the majority of stocks out there. And this assumes that earnings will stay at that depressed level forever, which seems highly unlikely.

In fact, in order for the current ultra-low stock price to make sense, this company has to start losing money, not just because of some inventory clearance or a nasty recession, but on a permanent, ongoing basis. The big shoe makers are being aggressive about moving to direct to consumer sales and cutting out the retail middle men like DSW. Perhaps this is where the pessimism surrounding this stock comes from. I was burned by this with Foot Locker and perhaps I will be burned yet again with DSW. But whereas Foot Locker was heavily exposed to a single supplier (Nike), DSW has spread its bets more evenly, and crucially, they are focused on building up their own suite of proprietary, in-house brands that will hopefully offset this trend. If I end up losing money on this stock, though, perhaps this is where the story will go off the rails.

Rational Exuberance

This setup is the kind of risk/reward relationship I like to see. Using what I think are some pretty conservative baseline assumptions, I get a stock that looks deeply undervalued at current prices. Even when I pencil in a permanent drop in earnings to prior recessionary lows or a stalling out of growth in the future, I’m still looking at a stock that is moderately underpriced. Only a terminal decline in the company’s fortunes from here would upset the apple cart.

And if I allow myself a moment of sunny optimism, the potential upside from here is enough to get the heart racing. An intriguing possibility is that I am erring too much on the side of caution with my estimates. The retail sector has been through a lot in the past 5 years, first with the retail apocalypse, then with covid. If we throw in a looming recession on top of that, you get a pretty rough ride for retailers, one that may shake out some of the chaff and leave the survivors leaner and meaner. DSW says they have made structural changes to their business during covid that they think will permanently lift profit margins going forward. I haven’t factored this into my estimates, but it is certainly within the realm of possibility that a few years down the road, if we find ourselves in the middle of a healthy business expansion once again, profit margins will creep back up to or even surpass the 6% level we saw in the middle of the last decade. If you assume continued growth in sales between now and then, it’s not too hard to get yourself to an EPS figure of $4.00 a few years down the road. If you put a p:e of 20 on that, similar to the p:e ratio the company sported during the last business upturn, you’d get to a share price of $80 for a pulse pounding 8 bagger from current levels. It’s important to keep your expectations grounded, but it’s also fun to dream big sometimes.

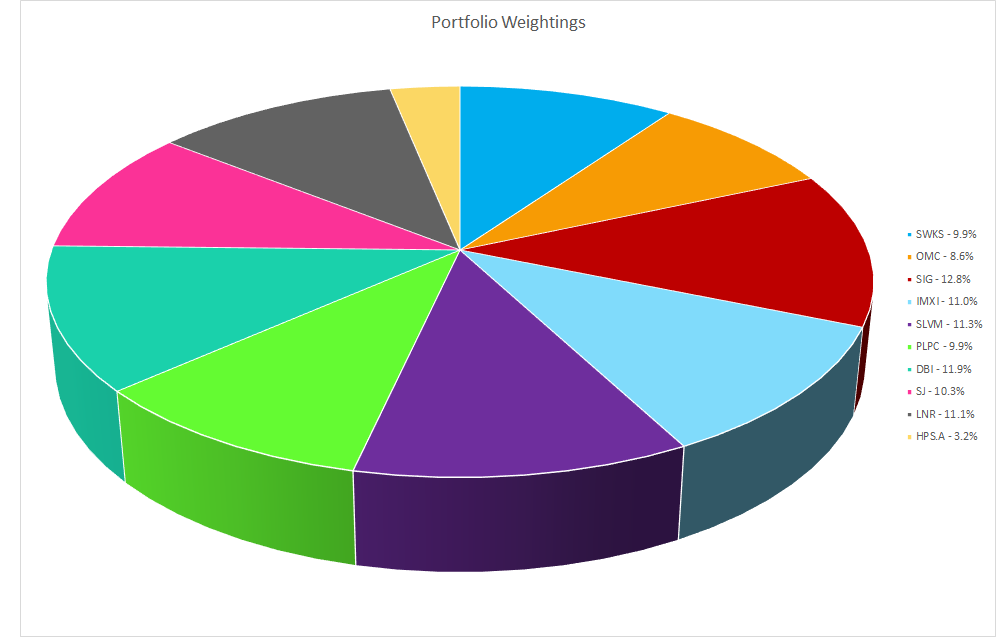

I bought into this stock over the course of the last week at a price of around $9.30 – $9.50. I used up the remainder of my cash to do it and had to raid the piggy bank by selling off some bits and pieces of some of my other stocks to bring this up to a fully sized position. I’ve got high hopes for this shoe seller, but I am also steeling myself to take some lumps if the economic road gets bumpy ahead, before hopefully scoring an eventual payoff.

Full Disclosure: I own shares in Designer Brands Inc. I do not own shares in Foot Locker, Genesco, Nike, Adidas or Skechers. According to my brokerage statement, I also own shares in Sterling Shoes even though the company hasn’t traded in years and the shares are worthless. Apparently, my broker is unable to remove these things from my account, so I have a nice, permanent reminder that things don’t always go according to plan.