The mystery is revealed: A roll-up play in the construction industry catches my eye.

Atlas Engineered Products

AEP.TSXV

Share Price: $0.50

This is the “mystery company” that I referred to in my post on the Planet MicroCap conference which I attended recently in Las Vegas. Atlas was one of the presenting companies at that conference and I got a good chance to talk to the CEO who reaffirmed my investment thesis. Along with the other 9 micro caps I’ve talked about recently, it rounds out my “Tiny Ten”. I’ll be following this group over the coming year to see how their fortunes play out.

There is a classic stock market play referred to as the “roll-up” or “consolidation strategy” whereby you identify a fragmented industry that has many smaller, private players in it and you then start buying up these small “mom and pop” type operations, rolling them into your own growing empire and wringing out efficiencies of scale as you go. Private companies, especially smaller ones, often can be bought for significantly less than what a comparable company might sell for on the public markets. The roll-up strategy takes advantage of this discrepancy by issuing stock in the public markets at a p:e of, say 12 (or even better, a higher growth multiple of 20 or more) and then using that money to buy private companies at a p:e of 6 or 8. The private company’s earnings then get added to the public company’s earnings and there is an immediate boost from the gain in the earnings multiple, which raises the stock price and provides fodder for yet more acquisitions.

This strategy has been used very effectively by two of Canada’s current big stock market successes: Alimentation Couche Tard, which has rolled up the convenience store sector and MTY Food Group, which has done the same for food court franchises.

Atlas is aiming to do the same thing for the building truss market. (Building trusses are the big triangles made out of 2 by 6’s that you see packed onto transport trucks whipping by you on the highway. They form the skeleton of a building’s roof and are typically built off-site.) Apparently, there are about 300 of these roof truss manufacturers spread out across Canada. Each manufacturer will typically have about $3-$5 million in annual sales and many of them are run by baby boomers who are now looking for an exit so they can enjoy a well-deserved retirement. Roof trusses are big and bulky and it is impractical to ship them long distances. Because of the shipping costs, you have a slew of small, regional players who are protected from competition by the logistical limits of transporting these trusses. Since there is not much competition, these regional players can get away with being run somewhat inefficiently. This creates an opportunity to buy them and tighten up their operations.

Atlas started off by developing and fine tuning their business model with a larger truss manufacturer located on Vancouver Island near Nanaimo. They whipped this company into top shape with the idea that they would use the best practices developed at this company and apply it to all their subsequent acquisitions across Canada. With the initial Nanaimo company, they went public on the Venture exchange in November and raised a few million dollars of seed money which they quickly turned around and used to make a string of 3 additional acquisitions in the building truss sector.

The terms that they negotiated for these initial 3 acquisitions appear to be quite attractive. They are buying these private companies for half of what you’d expect to pay in the public markets and so can hopefully make effective use of this public/private valuation discrepancy. They are often not paying the full acquisition cost in cash but instead are using a combination of some cash, some stock in their company and some debt that they can apply against the acquired assets. (In one case, they bought a company for less than its tangible book value and funded a good part of the acquisition with a mortgage taken out on the acquired company’s buildings.) If done right, there is the opportunity here for some very clever financial engineering. (in a good way!)

As they become known in the industry, they are getting a flurry of interested inquiries. In addition to their initial 3 acquisitions, they have another 9 targets waiting in the wings. Annual sales will be running at around the $20 million mark once the first slate of acquisitions have been fully absorbed and they are projecting this to grow to $50 million by next year and then as much as $150 million a few years after that.

While growth through acquisition is likely the meat of the story here, they also see opportunities to grow organically. Because the companies they are acquiring have been run by owners who have had an eye to retiring sooner rather than later, they often haven’t been pursuing basic expansion opportunities. In one case, it was simply a matter of buying an additional saw to unlock $800,000 in additional orders. As well, there is a growing trend in the industry to increase the number of off-site prefab components in new residential construction and Atlas intends to add prefab floor and wall panel capability to all its new acquisitions.

With a market cap of around $18 million, you don’t seem to be paying too much for the anticipated growth. (For an early stage, start-up company without much in the way of an earnings history to base a valuation on, I sometimes fall back on the rough rule of thumb that a price of 1 times sales could offer a good entry point as long as the rest of the story seems compelling.) The initial Nanaimo company had sales of close to $10 million a year and was solidly profitable. The first three acquisitions that have already been announced should double this figure. With the increased costs of management (to help run all of these acquired companies) and the legal and accounting fees involved in making the acquisitions happen, profits could be under pressure until they can get the scale they would need to cover these additional expenses. In the most recent quarter just ended, the company did indeed slip back into the red. However, once the company has grown in size, these overhead costs should be absorbed and then hopefully, we will see some significant profits that would let us come up with a more precise valuation.

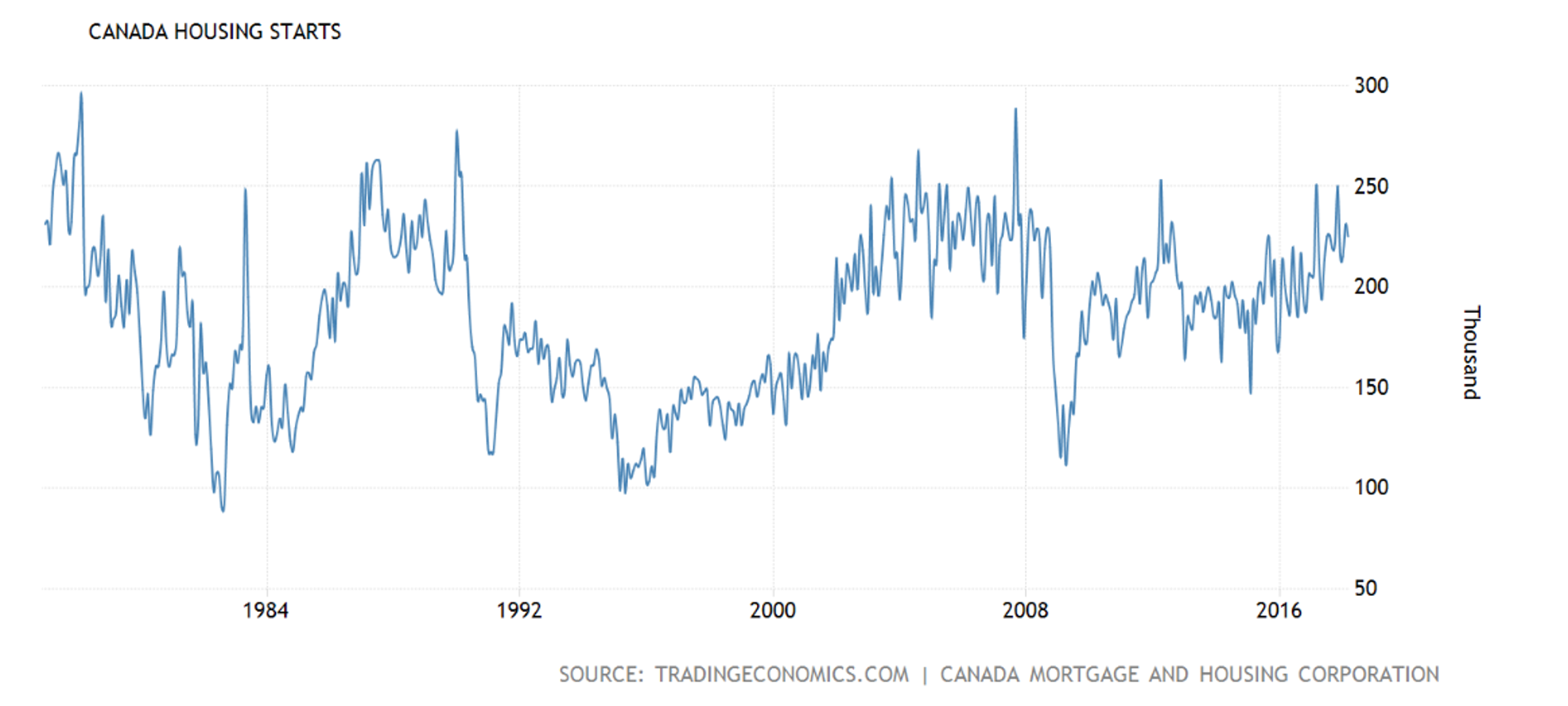

This is a small, early stage company and is thinly traded. It is hard to buy shares in significant quantity. As well, a lot could go wrong. Housing starts in Canada are near their highs and a major housing bust could wreak havoc on the industry. There is significant execution risk here. Management is largely untested and the success of their roll-up strategy has yet to be proven. The business idea seems compelling, but this is still a very speculative play. I have invested some money into the idea, but it is a small amount. If the story evolves and the company grows as it hopes to, then there may be an opportunity to add more to this position down the road.

Full disclosure: I own shares in this company.