After an extensive review of the investment landscape following the first quarter earnings season, I decide to jettison Preformed Line Products from the portfolio, take profits on PHX Energy Services and add a new name, Bird Construction to the stable.

Performance

The first 6 months of the year caught me by surprise. After ending 2018 on a decidedly sour note, the market did an abrupt about face and powered back up to reach new record highs in April. In the face of central bank largesse, surging stock prices, and some signs that suggested maybe the economy wasn’t ready to head off the edge of a cliff just yet, I lost faith in my put option strategy and sold these off at a rather painful loss.

The often-repeated wisdom on Wall Street is that you can’t time the market. Never one to take conventional wisdom at face value, I have set out twice to prove this truism wrong. Both times I have fallen flat on my face.

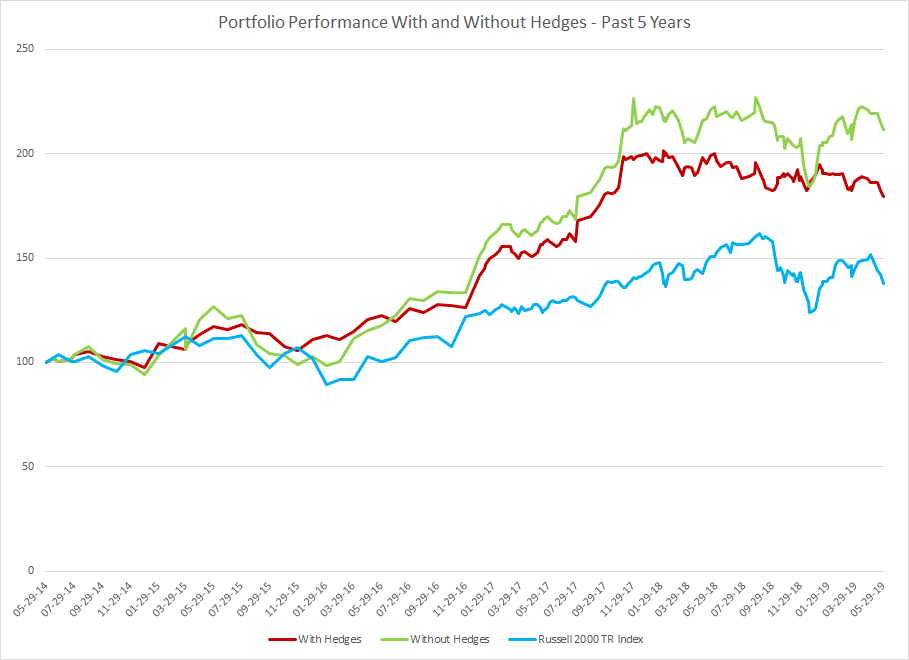

Below is a graph of my overall portfolio performance over the past 5 years both with and without my hedges. I first started hedging my portfolio against a market drop back in the summer of 2014. I removed them again at the end of 2016 when it appeared that the economy had moved through its soft patch and was back in growth mode. As the market was soaring to new highs in late 2017, I put my hedges back in place and finally abandoned them once again 2 months ago. As you can see from the graph, I would have been significantly better off if I had just stuck to my knitting and focused on owning a selection of undervalued companies. My attempts to protect the portfolio against a major market drop proved to be an expensive drag on performance when no such drop materialized.

The same held true in spades over the first 5 months of this year. My portfolio of stocks, without the drag from the put options, ended the first 5 months of the year up 11% vs. a 9.2% gain for the Russell 2000 Total Return index. But my actual portfolio, because of the losses I took on those put options, lost 5.4%. Ouch! It’s going to take me awhile to make back that lost ground.

I wish I had some brilliant insight to share with you from all of this. I have spent the better part of the last 5 years fussing about with various hedging strategies. I have spent countless hours looking at economic indicators. Durable goods orders, inventory to sales ratios, initial jobless claims, South Korean exports, the Baltic Dry index, purchasing managers surveys and so on and so on. I’ve pored over historical option price data, put together elaborate spreadsheets modelling various bear market scenarios and spent way too much time trying to come up with the perfect hedging strategy. In the end, I think I have to very reluctantly agree with the conventional wisdom here. You can’t time the market. Or at least I can’t. And Lord knows, I’ve tried.

If I accept that I can’t time the market, then I would have to come up with an effective hedging strategy that is cheap enough that I can just leave it in place year after year and forget about it. So far, I haven’t been able to do that. Whether it be as simple as cash in the bank or as complex as some multi-faceted put option strategy, there’s always a high price to pay for the downside protection you’re buying. (Even if it’s only the opportunity cost of the money that you haven’t invested.) Of course, your peace of mind may be well worth the price of the downside protection. This is a debate that I continue to have with myself. For many years I followed the mantra of “all in, all the time, baby!”. I think I’m starting to move back towards that philosophy. The last remaining vestige of my attempt at hedging is a large cash cushion that has accumulated in my portfolio. Until I find a home for this cash, it remains as a half-hearted hedge of sorts.

However, this does not mean that I have thrown off my permabear mantle. My long-term outlook is still depressingly pessimistic. Whenever stock valuations (ie the price of companies relative to their underlying earnings and asset values) have been this high before, the market has ultimately gone nowhere for the next 10 or 15 or even 20 years, often with pretty gut-wrenching declines in the interim. I see no reason to expect anything different this time around.

Try as I might, though, I see no easy way to profit from that insight. The past 5 years have been a terrible period for value investors with many practitioners of the art lagging the market. And yet, despite this, the unhedged part of my portfolio has still managed to beat its benchmark by almost 10% a year. I am not completely confidant that I can maintain this level of outperformance in the face of a long, grinding bear market, but if I can, then it makes sense for me to stay fully invested, even if the market does end up spinning its wheels for years to come. Cognitive dissonance be damned.

In other words, the best defense may just be a good offense. So enough belly-aching. Time to roll up the sleeves and get to work! In order to prosper over the coming decades, I’m going to have to squeeze every last drop of value from the market that I can.

First Quarter Review

I just closed the books on my first quarter review. There are about 400 stocks in the Canadian market that I follow. I went through each of these in turn, calculating what I thought was a fair price to pay for each one based on its current and past earnings profile, it’s future growth prospects, the strength of its balance sheet and any other miscellaneous factors that seemed relevant. I did the same thing for a similar number of U.S. stocks. I then sorted these lists by the degree to which the current share price was above or below my fair value estimate. The stocks that made it to the top of this short list were the most theoretically undervalued of the group.

After this initial review, I had about 100 names that seemed to offer potentially promising discounts. I went through this short list of undervalued opportunities with a fine-toothed comb. As usual, under closer scrutiny many of them started dropping by the wayside. Perhaps there was a whack of preferred shares or options which diluted the numbers and made the stock look less attractive. Perhaps there was a minority interest that I had missed in the first go-around that reduced the profits attributable to common shareholders. Perhaps there was some recent guidance that was predicting dramatically weaker results in the coming quarters.

I wanted to find 5 or 6 new stocks to buy. I really did. Between the sale of my put options, the recent takeovers of 2 of my portfolio companies and the sale of my Questor Technology, I had a fair pile of cash building up.

But I couldn’t do it. Out of those 800 stocks, I came up with only 1 new addition to the portfolio. To make matters, worse, I decided to sell my Preformed Line Products after a disappointing first quarter report and also sold off PHX Energy Services to cash in on some price appreciation in the latter. When the dust settled, I still ended up having a third of my portfolio sitting in cash.

This is probably telling me something. My bearish put option strategy may not have been wrong. Just way too early and way too bloody expensive. But if, try as I might, I just can’t find anything much to buy, then keeping a decent cushion of cash off to one side may be the next best option. Hopefully, the market will give me an opportunity to redeploy this cash sooner rather than later and it will be off to the races once again.

Portfolio Changes

Preformed Line Products enjoyed a very brief sojourn in the portfolio. I bought this company less than 3 months ago on the back of a strong showing in 2018. They make connectors and other miscellaneous accessories used in electrical distribution and telecom networks. I thought their business looked fairly recession-proof and they offered a nice geographic diversification with worldwide operations. All this at what looked like a reasonable price. Then the Q1 results came in and not to put too fine a point on it: they sucked. Sales were flattish while their expenses climbed significantly. Rising raw material costs, rising wage costs, extra professional fees. It all added up. First quarter adjusted EPS dropped from $1.17 all the way down to 30 c. I had to think about this one for a couple of weeks before finally deciding to bail. I still like the company, but I don’t like the fact that expenses are climbing. A single quarter of soft revenues is no big deal, but if costs are running out of control, this is a bigger problem in my books. The weak first quarter could be a one-off. Perhaps EPS will come back strong again next quarter. Perhaps those elevated costs were due to one-time items that won’t repeat in Q2. Perhaps they will raise prices in the coming quarters to offset their rising costs. But the share price did not fall much after the disappointing quarterly results were reported, meaning I could exit without too much pain and so I’m not sticking around to find out. Maybe I’ll have the opportunity to buy back in again if my fears prove to be unfounded.

I also sold PHX Energy Services. I first bought this stock back in September of 2015 in the wake of the oil price collapse at $3.15 per share. I sold it again a year and a half later, in March of 2017 at around $3.70. The stock price promptly collapsed again after I sold it, giving me the opportunity to get back on for a second ride. I started accumulating it again in November of the same year at $2.15. I rode the stock back up to the $3 mark and sold my last share of it recently at $2.97. A fair amount of effort, for a relatively modest set of gains, but I’ll put this one in the win column, nonetheless.

At the current price of around $3.00, I feel this stock is trading at roughly fair value. If the oil and gas sector takes flight again then the stock would have more room to run, but if the sector continues to struggle, then the stock may have difficulty hanging on to its recent gains, as it did a couple of years ago. At this point it is virtually impossible to predict with any sort of accuracy what future earnings might be like for PHX or for any of the other money-losing oil and gas service stocks. Instead, I have tended to focus in on the tangible book value of these companies. As the stock price of PHX has risen, so too has its p:b ratio and now, at 1.4, the company is sitting in the mid-range of the Canadian oil and gas service stocks I track. At this price, I’m not sure there’s enough potential upside to compensate for the downside risk if we move to a more electrified future.

Bird Construction is a new name that I have added to the portfolio this earnings season. Bird is a construction company based out of western Canada. When the resource sector was booming, Bird was booming as well. Sales were climbing, profits were robust and the dividends flowed like wine. But then the bloom came off the rose and Bird fell on hard times. They were making $1 per share or more during the resource boom but these earnings have dried up over the last few years. They lost money in 2018 and lost money again in the first quarter of 2019. However, they have been actively diversifying their client base, looking for business to replace the lost oil and gas and mining business. They have secured a contract to build 9 new Ontario Provincial Police detachments and 20 new light rail transit stations in Ottawa. Meanwhile, the resource industry still offers up the occasional goody like their recent contract to build workforce accommodation for the new LNG plant in Kitimat. They had some problems with the execution of a major contract last year and at the beginning of this year which took a big bite out of their profits but they think that their results will improve as the year progresses and they are targeting a return to “normalised” EPS of around 59 c by next year. This company has always struck me as quite well run. Their balance sheet is rock solid with no net debt and they have a history of paying out virtually all of their excess earnings in dividends. My belief is that they have a future with or without a return of the resource sector and at the current share price of $5.74, I can buy in to this story for 10 times their projected earnings. If they manage to hit those projections, I think this will be a good buy.

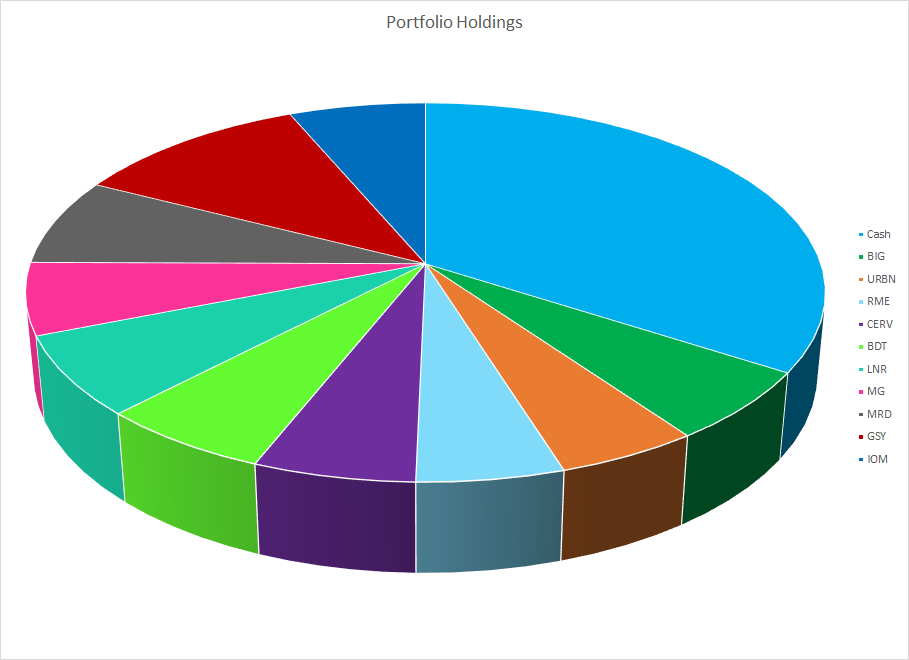

Portfolio Holdings

Currently I hold 10 stocks in my portfolio, 8 Canadian companies and 2 from the U.S. I also hold a healthy dollop of cash, totaling a third of the portfolio. The money I have in my stock holdings is fairly evenly split between all 10 names. I do have some favourites on the list and a few that I’m a little bit more nervous about but I’ve learned from past experience that my feelings towards any of my stocks bears little relation to their subsequent performance. As a result, I generally try to keep my bets fairly evenly spread out.

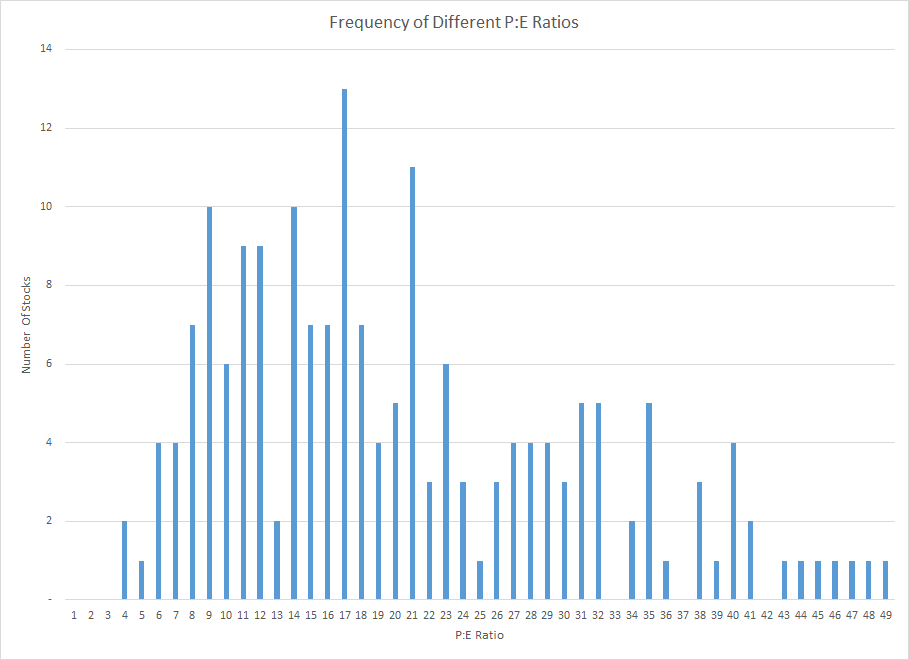

Below is a histogram showing the distribution of p:e ratios in the universe of Canadian stocks that I follow. This universe is made up of about 300 money making stocks and mostly excludes companies from the resource, financial and real estate sectors. It’s a mix of small, mid and large cap stocks.

As you can see, there is a cluster of cheap stocks with p:e’s of between 8 and 12 at the lower end of the spectrum. This is mostly where I’ve been hunting for value and is currently where most of my portfolio holdings are hanging out. Needless to say, my hope is that at least a few of these will migrate up to the next group of stocks that we see in the 14 to 24 p:e range. With strong balance sheets and what I think are pretty good long-term prospects, I see no reason why my class of misfits can’t graduate to the bigger leagues. If I’m lucky, a few of them might even make it up further to the right hand side of the chart where we see a surprising number of companies reporting p:e ratios in the 30’s or even 40’s. Mind you, I’ve usually exited a position long before it gets to this level.

Company Rundown

What follows is a quick and dirty overview of my various stock holdings. For a somewhat more detailed look at the recent Q1 developments for each company as well as links to current stock quotes and financial data and any in-depth analysis I’ve written on the companies in the past, please see my Portfolio Holdings page.

The first quarter was not great for most of my companies. In fact, there were a few nasty surprises in there. My two agricultural equipment dealerships, Cervus and Rocky Mountain Dealerships both posted disappointing results, dragged down by weak demand for farm machinery. This boosted inventory to uncomfortable levels at both companies and it may take a few quarters of sub-par results to get this inventory whittled back down to normal levels again. To make matters worse, the ongoing scuffle with China over the detainment of Huawei’s CFO means that China has slammed the brakes on buying our canola and this may be another drag on performance as we move through the remainder of the year. At Cervus, the pain was somewhat offset by the strong performance of their Peterbilt truck dealerships, but indications are that after a torrid end to the year in 2018, this industry may slow down as well in the coming months. I thought long and hard about whether I should ditch these two companies in the face of a somewhat gloomy short-term outlook. But in the end, I decided to hang on for the ride. After all, I can’t sell everything! And longer term, these two stocks seem to offer compelling value. Both are trading at about 10 times their average earnings of the last 4 years; a period which has included both good times and bad. That’s a much better price than you’ll pay for most other companies in the market and longer term, I think there will be steady demand for agricultural equipment in western Canada, which should keep profits flowing.

In the US, my two remaining holdings are both dealing with the ongoing fallout from the retail apocalypse. While first quarter results were nothing to write home about for either company, they were both in-line with what I was expecting. In my review of the US market, there were many retailers that showed up on my low-priced screen. After sorting through the competition, I was satisfied that Big Lots and Urban Outfitters offer the best blend of cheapness, financial strength and future potential. They are both trading at around 10 times my fairly pessimistic estimate of ongoing EPS. And my estimates, I think, leave significant room for a surprise to the upside. Maybe Amazon will end up taking over the world. But I’m betting against it.

Moving on, we have Linamar and Magna, my two plays on the auto sector. Once again, I looked at the competition. Exco Technologies, Martinrea, Lear Corp and quite a few others. They all look cheap. Investors are assuming that the worldwide auto industry is headed for collapse and indeed, there are quite a few storm clouds out there. Chinese car sales have been nosediving. Inventory is piling up on dealer’s lots. Consumers have taken on a record amount of car loan debt. Then you throw in all this trade war, tariff business and the on-again, off-again NAFTA/USMCA negotiations and I admit, it looks pretty scary. Which is why we can now buy Linamar for 5 times peak earnings and Magna for 6.5 times peak earnings. These stocks are risky. But their low prices makes them less so. It will no doubt be an eventful ride but at these prices, I’m happy to stay onboard to see what happens.

Melcor Development is a real estate development company based out of Calgary. They are expanding operations into the US but remain primarily Alberta based. They are solidly profitable and you can buy the company for 0.4 times their book value, most of which is made up of undeveloped land and retained commercial property. To my simplistic way of viewing this stock, I can buy real estate in the depressed Calgary market for less than 50 cents on the dollar. I’ll take that deal.

GoEasy is one of the few bright lights in the portfolio. They have been posting great results, expanding their Easy Financial, sub-prime lending business. The stock is trading at a very reasonable p:e of around 10 to my 2019 projected EPS estimate. For a business that is growing by 20% or more year over year, that seems like a great price. Lending money to people who maybe can’t afford it. What could go wrong?

And finally Assure Holdings. Yes, their previous CEO was misusing corporate funds. Yes, the stock was suspended from trading for 5 months last year. Yes, they were egregiously overestimating the percent of their billings they were going to be able to ultimately collect on. And yet, this is my favourite stock right now. After coming clean at the end of last year, we now have a better read on what actual, collectible earnings might be and they look pretty good. I get estimated EPS of around 16 cents going forward. At a share price of $1.74, that gives us a p:e of around 10. This for a company that has all sorts of growth runway in front of it. They are rapidly expanding into new markets and if they can get a few clean quarters under their belt, the market could start warming up to this growth story.

Final Word

Investing is never easy. I almost always feel somewhat uncomfortable with the stocks I own. If I don’t, I ask myself what I’m missing. I have to say I feel more than a little quesy now when I look too closely at many of my current holdings. But in the crazy, upside-down world of value investing, that could be a good sign. Pass the gravol.

Full Disclosure: I own shares in Big Lots, Urban Outfitters, Rocky Mountain Dealerships, Cervus Equipment, Linamar, Magna International, Melcor Developments, GoEasy, Assure Holdings and Bird Construction. I do not own shares in PHX Energy Services or Preformed Line Products.