Looking across the valley to the other side of this crisis, I plan for an eventual recovery and add 5 new stocks to the portfolio: Teck Resources, Magellan Aerospace, Foot Locker, Adcore Inc and PHX Energy Services.

Keeping The Faith

Is value investing dead? It’s a worthwhile question. Investing fads come and go. Value investing has a long and storied history behind it but as an investing philosophy, maybe it has run its course. Is it time to move on to greener pastures? The annual pilgrimage to Omaha and the media frenzy that usually surrounds it was a subdued affair this year. Articles are openly questioning whether the Oracle has lost his touch after a decade of lackluster performance. Have ETF’s, hedge funds, high frequency trading, artificial intelligence, free trading commissions and massive, instantaneous access to data made the lone stock picker a sad relic of the past?

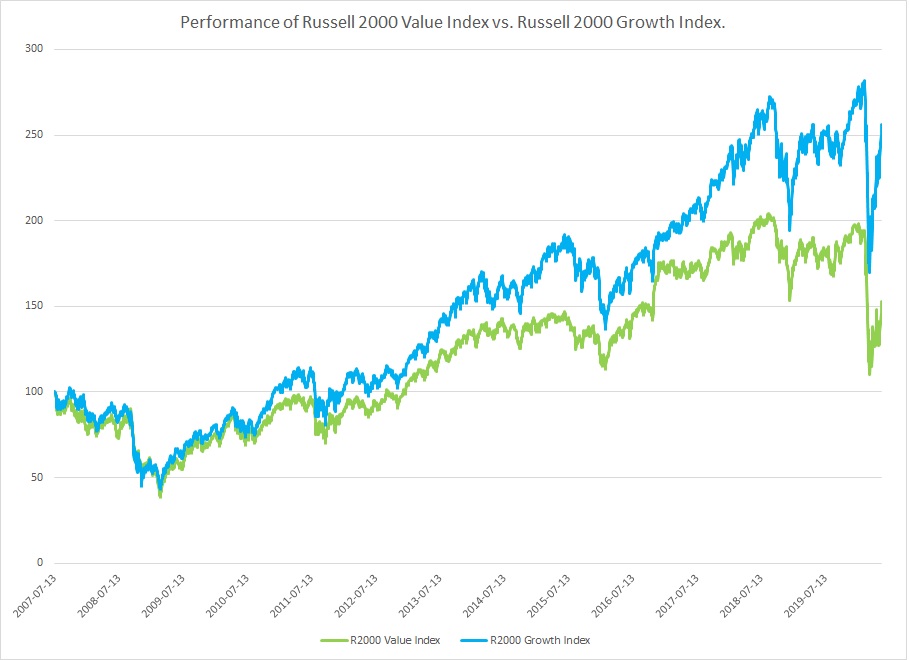

I strongly doubt it. But it is true that the past 10 years have not been kind to value investors. Below is a graph of the Russell 2000 Value Index vs. the Growth Index. It’s easy to see who’s been coming out on top lately.

Over the past 13 years, since the last market peak in July of 2007, the value index is up 50%, while the growth index is up 150%. With results like that, it’s easy to see why investors are losing faith in value investing.

Fortunately, I’ve managed to put both indexes to shame. My own portfolio is up 600% over the same time period. Take that, ETF’s. Nonetheless, every percentage point of those gains has felt hard-fought. And lately, the fight has seemed particularly fierce as value stocks have taken an absolute drubbing in the covid meltdown while the growth end of the spectrum powers its way back up to new highs.

Far from getting discouraged, this dynamic is filling me with a new-found sense of optimism. Misery loves company so they say and there are plenty of value investors getting slaughtered out there right now. I think the weak returns from value over the past decade and more especially over the past several years could be setting us up for a long period of outperformance.

At times like this, it’s worth taking a step back and looking at the historical record. Kenneth French, one of the pioneers of factor-based investing (the investing equivalent of paint by numbers), has very generously put together a fantastic website of historic market data. https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

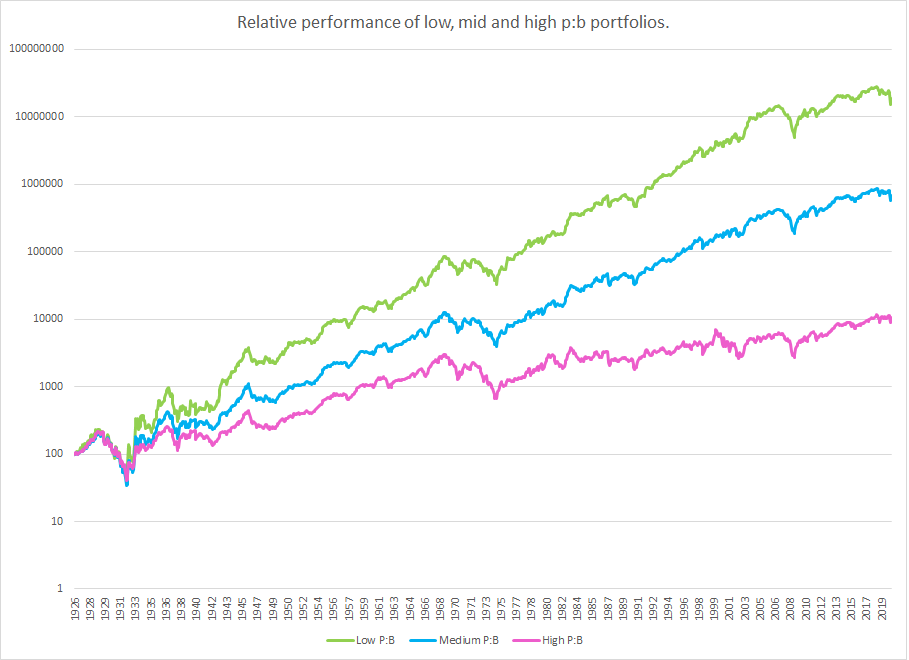

I used this data to help get some clarity on the value vs growth debate. I divided the market into three different portfolios, a growth portfolio, a value portfolio and a middle-of-the-road portfolio. The value portfolio comprises the 30% of stocks on the NYSE with the lowest price to book ratios. The growth portfolio is made up of the 30% of stocks with the highest p:b ratios and the middle of the road portfolio tracks the stocks in between those two extremes. (Using other valuation yardsticks like price to earnings, price to cash flow or price to sales gives very similar results.)

Below is a graph of these three portfolios. Over the last 100 years, it certainly looks like value has been the hand’s down winner, consistently pulling away from the rest of the pack. The high-priced growth stocks, in contrast have been absolute dogs over the years. In fact, the difference in the annual rate of return of the low-priced stocks vs. the high-priced group is an incredible 9% per year!

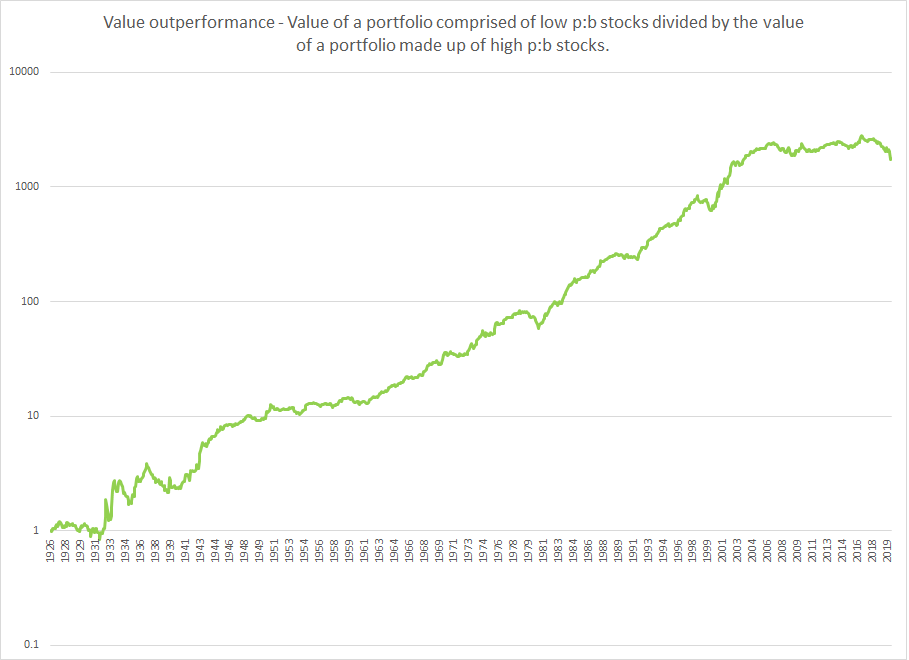

But what this graph doesn’t show very well is that there have been a few times over the years when value has lagged and we’re in one of those times right now. You can see this better when you graph only the relative outperformance of value stocks compared to growth. If you create two portfolios, one made up of cheap stocks and one made up of expensive stocks and start them both out at $1 in 1926, over time the value portfolio has grown far more than the more expensive, growth portfolio. If you divide the value of the value portfolio by the value of the growth portfolio you get a ratio that you can graph. This ratio gives you a great visual representation of the degree to which value is outperforming growth year by year. If the line on the graph is moving up and the ratio is expanding, then the value portfolio is pulling away from the growth portfolio. If it moves down, value is underperforming and if the line moves sideways it means that neither portfolio is outperforming the other. Here’s what that graph looks like…

Clearly, over time, you’d have wanted your money in the cheap stocks. The value portfolio has grown to over 1000 times the size of its growth counterpart over the past 94 years. That’s the magic of compounding an extra 9% in annual returns over almost 100 years. But notably, there have been two occasions when cheap stocks failed to produce that extra punch. The first was in the immediate aftermath of the second world war from 1948 to 1961. And the second occasion was, of course, now, from the peak of the market in 2007 to the present day.

On the graph, you can also see how the last 2 ½ years, accelerating into the recent market meltdown have been especially nasty for the value crowd.

Which brings us back to the original question. Is value investing dead? It is possible that market dynamics have indeed taken a permanent detour. Boring things like earnings and book values may be relics of a bygone era and it’s all about platforms and network effects now. Maybe traditional accounting and investing approaches simply can’t capture the true potential of the new economy and disruptive companies like Shopify. I’m willing to concede that possibility, but I don’t really believe it.

Instead, I see a lot more parallels to the market environment that I saw back during the internet boom of the late nineties. If you look at the value outperformance chart above you can see that the value/growth ratio took a similar dip back then, only to abruptly reverse course when the internet bubble popped. I think we could be setting up for a similar set of events now. 6 or 7 technology mega stocks have been powering the markets higher. Without this handful of stocks, the S&P 500 would have been flat for the past 5 years.

But it goes deeper than that. The market is very divided right now. On the one hand, you’ve got many companies that are moderately cyclical (that is, their earnings tend to decline during recessions and recover more strongly following them) that have been beaten down lately because of fears about the coronavirus and the possibility of a nasty, lingering recession afterwards. Single digit p:e ratios are common in this group. On the other hand, you’ve got stocks that are more defensive and some that are even benefitting from the distorting effects of the shut-ins. Many technology stocks fall into this latter group. These stocks still enjoy very high valuations and p:e’s of 20 or above are common. The differences in the prices that the market is putting on these two groups of stocks is unusually wide right now. That, I believe, is creating a lot of opportunity.

Value has had its ups and downs over the years but overall, there have been far more ups than downs. Looking at only the recent past could lead investors to ignore this incredibly lucrative investing strategy. 13 years is a long time to be waiting for a strategy to pay off and many former value investors may have thrown in the towel. The last decade has been particularly trying, but for any new investors out there, I would not discount the value philosophy just yet. True, it hasn’t worked as well as it has in the past, but even so, I’ve managed to personally do quite well over this time period by following a focused value-oriented approach. And if the past is any indication, this stretch of relative weakness in the value space could be setting us up for a whopping great run of outperformance. Value investing may be in a deep state of hibernation but I think it is far from dead.

Taking Stock

Surveying the investing landscape after the recent release of the first quarter numbers, I like what I see. But stocks still aren’t cheap. After the blistering rebound off the bottom in March, many stocks seem dangerously overpriced. Going through the list of Canadian stocks this week, I saw that Shopify now has a market cap of $126 billion. At first, I thought there was something wrong with the numbers on my spreadsheet. The number of shares was probably off which was throwing off the market cap calculation. But I checked the company’s financial statements and found that, no, this is actually what some investors are willing to pay for this company. This for a company that has never made money and seems to progressively lose more money the more popular it gets. It takes an awfully optimistic outlook to make that price make sense.

But way back in the cheap seats, there is a lot of interesting stuff to look at. The value spread, or the difference between the most expensive stocks in the market and the least expensive has widened to levels last seen in the internet mania of the late nineties. If you’re prepared to get your hands dirty and buy into companies that are struggling right now with the coronavirus pandemic, you can find some surprisingly good values.

As always, cheap can always get cheaper. If this is just a bear market rally and we head lower into the fall as the full extent of the economic damage becomes apparent, then all stocks are likely headed lower and cheap stocks may be leading the pack on the way down. But my assumption is that this too shall pass. Perhaps we’ll have a nasty recession to contend with first. Perhaps the virus will come back in waves, causing repeated and sporadic shutdowns. I’m skeptical that they’ll actually be able to come up with an effective vaccine. No doubt the tsunami of government stimulus will have unintended consequences. But humans are pretty darn resilient. I’ve been looking at how companies have performed over the last full business cycle, from 2007 to the present and I’ve been extrapolating that to the next business cycle. Yes, there will be bad years in there, but I’m sure there will be good years as well and right now you can pick up some pretty decent bargains if you’re willing to look beyond the valley of the current recession to the eventual recovery beyond.

New Blood

During this quarter’s review, I managed to find a relative bounty of 5 new stocks that I felt good about adding to the portfolio at current prices. Most of the things I’ve been looking at and many of the stocks in my portfolio at the moment are in sectors that have been directly affected by the coronavirus. And not in a good way. Energy, retailing, auto parts, advertising, finance, aviation, real estate, mining. Once again, my assumption is that all of the present turbulence will pass. The trick is to find the companies with the balance sheet strength to make it through to the other side that are trading at a low enough price to make the journey worthwhile.

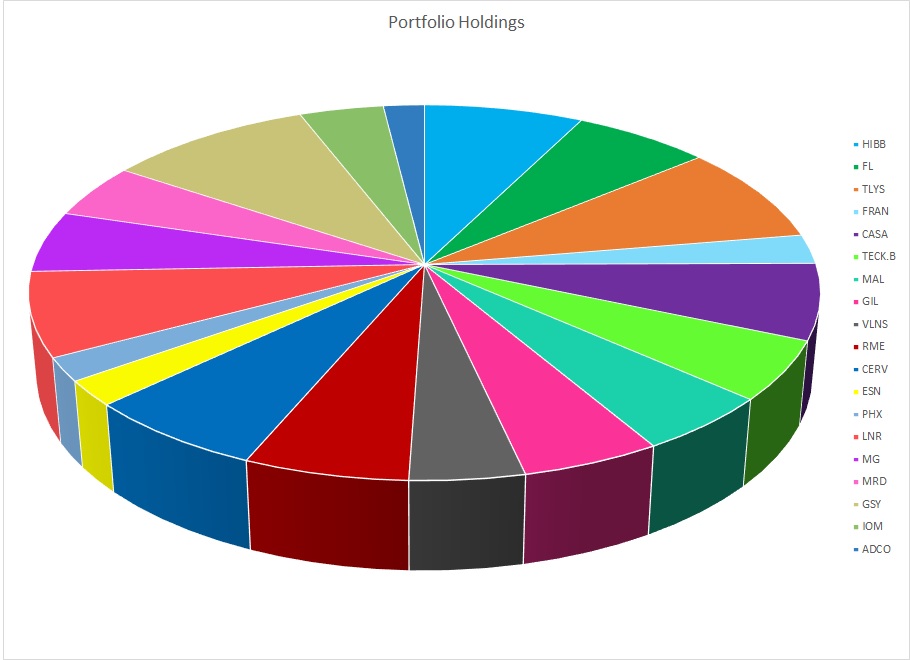

The 5 new stocks I bought, in no particular order, are: Magellan Aerospace (MAL), Teck Resources (TECK.B), Foot Locker (FL), Adcore Inc (ADCO) and PHX Energy Services (PHX). Adcore and PHX are both smaller, more speculative positions. Magellan, Teck and Foot Locker are full sized positions. I raised the money to buy these new holdings by selling off bits and pieces of my existing holdings. It is even more difficult than usual to predict which of my stocks might be the ultimate winners and which will be the losers as the magnitude of this coronavirus shutdown are so unprecedented. I’ve got a handful of smaller, more speculative positions (Francesca’s, Assure Holdings, Essential Energy Services, PHX Energy Services and Adcore) which I’ve devoted relatively less money to, but the rest of my portfolio is roughly evenly split between my other holdings. Here is a pie chart of my various positions at the moment…

Portfolio Review

I’m afraid I’m too lazy to pen a full write-up for each of the five new stocks I’ve bought, so I’ll just have to cram all my comments into this omnibus portfolio review.

Broken down by industry sector, here is a rundown of all my current holdings…

Retail

I love the retail sector. It’s easy to understand. You get to feel like a big shot doing “market research” by visiting the stores and wandering around aimlessly. The industry has been mercilessly beaten down over the last few years, first by Amazon and then by this nasty virus. I’ve been very consciously holding myself back from buying even more retail names. As it is, I’ve got about 30% of the portfolio exposed to retail. That’s probably about as far as I should push it. After all, I suppose it’s possible no one will actually return to the stores once they reopen. But I’m assuming that’s not the case. Apart from Francesca’s, all my retail stocks (Hibbett, Tilly’s, Foot Locker and Gildan) have rock-solid balance sheets. The first three entered this shutdown with piles of extra cash on their books, enough to see them through a prolonged slump in the industry. Even Francesca’s had a significant amount of cash on hand, although it came into this in a weaker position, profit-wise and its survival is not at all assured. I’ve been on the fence about ditching this one, but at the moment I continue to hold on stubbornly. The upside could be very large if they maneuver their way through this.

Hibbett reported a great first quarter. eCommerce sales were up a whopping 110% from last year and 40% of their online customers were new visitors to the site, which they hope will help them grab increased market share. Same store sales were only down 20% even though many of their stores were closed for a good part of the quarter. Inventory levels were down and their cash position remained strong. By the middle of May they had reopened most of their stores and they said they were actually seeing positive same store traffic compared to the same time last year in the stores that had reopened. Many of their stores are in strip malls with exterior access. All told, a great result and I’m very happy to hang on to this one at a mere 8 times last year’s earnings.

My new acquisition this quarter, in the retail space, was Foot Locker. This company has been on my radar for quite a while. It often shows up as slightly cheaper than Hibbett, but I felt that Hibbett might offer more potential for growth as Foot Locker is a more mature company with a global footprint. However, the recent price was too good to pass up and so I added Foot Locker to my holdings at a share price just under $27. At this price, the stock has a p:e of 5 to last year’s earnings. They have enough cash on their balance sheet to see them through a prolonged shutdown. Their earnings have held up better than most retailers over the last few years and they have a track record of above average growth over the last full business cycle. They run a global network of mostly mall-based athletic shoe stores with over 3000 stores spread across multiple banners in 27 countries worldwide. ¾ of their sales are in North America with most of the remainder coming from Europe although they are trying to expand in Asia.

Unsurprisingly, they lost money in their first quarter ended May 2 as they bore the full brunt of the shutdown. I would expect results to improve going forward as stores reopen. This is one of the cheapest retailers out there right now and for a large, iconic brand like this, I think the coronavirus is giving us a chance to get in on a high-quality company at an excellent price.

I’m awaiting results from Tilly’s but their large cash hoard heading into this thing leaves me feeling fairly sanguine. I don’t know how much traffic these mall-based retailers are going to see in the immediate aftermath of the coronavirus but if they’ve got the balance sheet to wait out the worst of the storm, then I’m comfortable waiting to see what transpires. On the upside, this enforced day of reckoning for many of the weaker retailers out there could be just what the industry needs to clean house and leave more room for the remaining players. Mall rents could come down and less cut-throat competition could mean higher profit margins for everyone. Also, many retailers are saying that their ecommerce plans have suddenly been dramatically accelerated and this could help the sector in its fight against the Amazon goliath.

Gildan Activewear doesn’t have any net cash lying around (they do have cash to play with, but it is more than offset by debt) but they are a large company with plenty of access to financing. Their projections for cash burn at the end of March weren’t too scary. They had to shut down their factories, but they kept their distribution center open and have been serving their customers from existing inventory. I’m quite happy with this purchase, although I didn’t fully realise the extent to which they were dependent on printwear for the bulk of their revenues. I was thinking of this as a more defensive play in the sector and, given their size and history, I still think this is a fair assessment, but in the shorter term, many of their customers in the printed T-shirt industry are in the sectors hardest hit by the coronavirus: conferences, sporting events, tourism, etc. So I might have to be a little more patient with this one. Still, with a p:e of 8 or so to last year’s earnings I see plenty of upside potential once the virus passes.

Francesca’s is my last retailer. They had $10 million in cash heading into this thing, they’ve applied for another $10 million in tax rebates and they’ve borrowed a further $5 million. Will all this be enough to see them through until customers return to stores? They’re not sure. They said in their last report that the coronavirus raises concerns about their ability to continue as a going concern. But I continue to hang on. There is a new CEO at the helm and he sounds like he is on the ball. Absent this shutdown, the company was flirting with profitability. Three years ago, the company was making $15 per share. That gives the stock a price to peak earnings ratio of way less than 1. Nothing permanent has changed at this company since then. They haven’t shut down that many stores, they haven’t gone into debt (although that may be changing now) and they haven’t issued new shares. If they could get their mojo back, the sky is the limit here. They have an interesting and unique business model in the sector with very small store sizes and limited inventory levels that give them the ability to be flexible and responsive to changing trends. At least theoretically. But they need to execute and time may have run out. I’d only put money into this stock I was prepared to lose.

Energy

The same could be said for Essential Energy Services. Pity the poor Canadian oil and gas companies. They were already in dire straits before the coronavirus sent oil prices plunging below zero. Now, the outlook for the sector in western Canada is very much in question. However, all is not lost. There is an LNG plant being built in British Columbia that may one day revive natural gas drilling in the region. Activity still continues, albeit at a much reduced rate. There is a saying that the best cure for low oil prices is low oil prices. The frackers south of the border have finally been beaten into submission (at least temporarily) and this is taking supply out of the market. If the virus proves to be a short, sharp shock, economic activity could recover more quickly than expected and drive demand for oil back up. Investment in the sector has been weak since 2014 and there is always the potential for a surprise oil price shock to the upside as increasing demand meets unexpectedly curtailed supply. Essential is trading at a tenth of the value of its drilling rigs. It was solidly cash flow positive with minimal debt heading into this downturn. They continue to sideline rigs and crews and are seeing at least some revenue coming in from what activity remains in the sector. At 15 c a share, I’m holding on to this puppy. You just never know.

In a very similar vein, I actually doubled down on this philosophy and took a new position in another oil and gas service company called PHX Energy Services. Again, this is a smaller, speculative holding. The energy sector is not for the faint of heart right now. But PHX has a sparkling fleet of new rigs, kitted out with their own proprietary technology that has been in high demand from drillers looking for every edge. They started out as a Canadian company but since the downturn in 2014, have been expanding in the US and now have 70% of their operations south of the border. I’ve owned this company before and have done well with it but, like Essential and many other drill rig service companies, they have struggled to turn a consistent profit since the price of oil collapsed a few years ago. Just before the coronavirus hit, it looked like things might finally be taking a turn for the better. In Q1 of this year, they recorded their best quarter since 2014. They actually turned a profit with earnings coming in at around 7 c. Together with substantial non-cash depreciation expenses, that gives them pretty solid cash flow. Or at least it would in any normal sort of environment. They have slashed capex this year in response to the plummeting price of oil and are coming at this with a strong balance sheet with a modest amount of debt. This is obviously a contrarian play which might or might not work out. I initially went looking for an oil producer to play the possibility of a recovery in the oil price but couldn’t find one I felt comfortable with. At least with Essential and PHX, I’ve got my foot in the door if it turns out we actually need more oil and gas than we think.

Aviation

Restaurants, hotels, airlines, cruise ships: some of the first sectors I looked at in my hunt for coronabargains. I mostly came up empty handed. Given the scope of the problems facing these sectors and the relatively high debt loads that most companies in these sectors carry, I couldn’t find any companies that I thought were cheap enough. Close on a number of occassions, but no cigar. However, one stock I did find that gives me the exposure to the aviation sector I was looking for is a Canadian company called Magellan Aerospace. Magellan makes parts for planes as well as doing some repair and maintenance work. Their revenues are roughly equally split between Canada, the US and Europe. Boeing and Airbus are their two biggest customers and commercial aviation makes up 2/3 of their overall sales. Military contracts round out the other third. They had a rough time of it in the 2000’s but started to turn things around going into the last recession and have been riding a wave of strong industry demand for new planes for the past 10 years. Profits peaked this cycle at around $1.50 per share but have been drifting down recently due to weakening demand as the economy cools and several programs which got suspended or curtailed at Boeing and Airbus, including the Boeing 737 Max.

Last year the company earned around $1.20 a share, giving the stock an attractive p:e of around 4 or 5 depending on whether you want to use last year’s lowered earnings or their peak cycle earnings of $1.50. No doubt, business will be tough for the next few years. It may be awhile before we see another sustained spurt of growth, but until this virus hit, industry players were talking about an aviation supercycle that they thought would last another 10 years as plane travel in Asia and the developing world continued to expand. Sure, maybe this is off the table now. But with a modest debt load, a history of robust sales through the last recession and some military contracts to soften the blow, I think there is enough potential that the current p:e of 4 or 5 could look like a real steal a few years down the road.

Mining

Another new addition to the portfolio this quarter was Teck Resources. Teck is one of the heavyweights in the mining sector with a market cap of $11 billion. 60% of their business comes from mining metallurgical coal from their mines in British Columbia. This is the type of coal used to fire the blast furnaces that make steel. (As opposed to thermal coal which is just used for heating and energy production.) Another 20% of profits come from their copper mining operations in Canada and Chile and the remaining 20% from their large zinc mine in Alaska and a smaller one in Peru.

Their coal mines are very long-lived assets with over 30 years of reserves. Their copper mining operations have a similarly long projected mine life thanks to a large new copper mine they are developing in Chile called Quebrada Blanca. This mine is currently under construction and when completed in a couple of years will double the company’s production of copper and establish it as one of the top 20 copper producers in the world. Longer term, additional expansion of this mega resource they say could vault them into position as one of the world’s top 5 producers.

It’s this potential future exposure to copper that really piqued my interest. The renewable energy vision for the future is going to need a lot of copper. The average electric car requires 4 times as much copper as an internal combustion engine vehicle. Solar and wind farms need plenty of copper as well (not to mention steel). Industry analysts say that the amount of extra copper needed to meet even the low end of our climate change goals would need the equivalent of 3 new Quebrada Blanca projects every year for the next 11 years. But those projects don’t exist. We likely don’t have as much copper as we need and that could end up pushing the price of the copper we do have far higher than current prices suggest. By buying into a world-class, long lived copper resource with future expansion possibilities, you’re buying an option on the potential for this copper-hungry future.

And you’re doing it at a pretty cheap price. Teck Resources has averaged EPS of $3 per share over the past 10 years. Last year they made around $3.40 and the two years before that they brought home earnings of $4.50 per share. Earnings seem likely to take a hit this year as steel foundries get shut down and economic growth slows, but longer term, I am targeting a return to EPS of $4 or more, giving the stock a p:e of 3.3 at the $13.30 I paid for most of my shares.

A price like that for a large, well known company like this means there must be some warts I haven’t mentioned. Commodity markets are volatile. Earnings dipped as low as 40 c back in 2015 and they could well go negative this year. I don’t expect the company to make $4 each and every year. As well, there are some dead trout in the Elk River Valley where they do most of their coal mining that need explaining. If it turns out they are killing the fish with the run-off from their mining operations, this could put a serious crimp on their operations. Their big new copper mine in Chile could face delays and cost overruns. Their debt is a tad higher than I usually like to see. Recently, they wrote off their stake in a large oilsands operation that they decided not to proceed with. That was several billion dollars down the drain.

But the current price, I think is a good one, and I like having some exposure to the resource sector, especially if it ends up that all the trillions of dollars the Fed has been printing into existence actually ends up affecting the price you have to pay for your new steel refrigerator or Tesla model S.

Technology

Broadly speaking, there are two ways an investor could play the sudden and unexpected dislocation caused by the coronavirus. Clearly, I’ve largely taken the somewhat less comfortable route of bottom fishing in the most beaten down sectors. The more obvious approach is to look for companies that might actually benefit from the world’s population being stuck indoors and at home for months at a time. Technology stocks in general have obviously been big beneficiaries of this lockdown. But I haven’t seen many opportunities in this sector. It was already ridiculously overpriced to begin with and has just gotten more so. I’ve already commented on the nosebleed valuation of Spotify which now makes up something like 7% of the entire Canadian stock exchange. You’re unlikely to find many bargains in this corner of the market.

However, I did come across one little niche play that I thought looked interesting and I added it to the portfolio as a smaller, speculative sized investment. The company is called Adcore Inc and while listed on the Canadian venture exchange is actually an Israeli company. They’ve come up with a suite of software that empowers advertising agencies to harness the full power of data analytics to drive their online advertising spend. Using artificial intelligence algorithms and data analytics they can improve online advertising bid prices and results, offer insights and drive efficiencies. The company was founded in 2006 by its current CEO and went public just last year. Sales grew last year by 30% over the year before and they recorded a profit in each of their four quarters. Their solution is used by over 500 different marketing agencies. The outlook was bright at the start of the year and even despite the disruption caused by the coronavirus they remain upbeat. In the first quarter, ended March 2020, sales were down, as advertising spending, particularly in the travel and leisure sectors, dropped. They nonetheless managed to eke out a small profit and have $5 million in cash that should last them through a few quarters of depressed revenue. Coming out the other side of this, they think the surge in ecommerce activity could play right into their hands and they look forward to making some exciting new announcements in the coming months.

Based on last year’s strong showing, I’m pegging my EPS expectations at 7 c once business returns to normal. At the current share price, that gives the stock a p:e of 10. For a company in the technology sector and the ecommerce sector in particular, with a possible runway for rapid growth in front of it, that seems like a worthwhile speculation to make, despite the near term uncertainty caused by the coronavirus.

My other technology stock is Casa Systems. Again, a more speculative play given that the company is currently losing money and has stated up front that it doesn’t see conditions improving materially this year. Still, they are in a good position, being in the business of helping telecom companies expand their network capacity cheaply and efficiently. With everyone trying to stream the latest reality cooking show at the same time, there is a lot of bandwidth being used. They are actively working on new 5G applications as well and this will hopefully provide the foundation for their next stage of growth. Thanks to their serendipitous exposure to a suddenly hot sector, the stock price has held up better than any of my other stocks. I continue to hold on to it hoping that their R+D efforts will bear fruit in the future. At the moment, though, the company is more or less breaking even and remains a show-me story.

Automotive

I’ve owned Linamar and Magna for a long time now. I bought in pretty much at the peak of the cycle because they were the cheapest stocks I could find in a very expensive market. Classic value trap. The stock prices have only drifted lower as activity in the sector started to cool and investors began to look nervously ahead to the next recession. Auto stocks are notoriously cyclical and pretty much every company I look at in the sector sports a single digit p:e ratio. I’ve looked at other players in the industry to see if I should perhaps switch horses but Linamar and Magna remain my two favourites. Linamar came out with a very upbeat presentation early on in the covid meltdown that has me optimistically counting my pennies on the other side of this. Their long-term outlook was bright and at recent lows, the stock traded for a while at a mere 3 times peak earnings. For a strong company with a great long-term track record, that really seems like an outstanding price.

Magna is not quite as cheap but has size on its side and perhaps less exposure than Linamar to the messy internal combustion engine. I think both companies still offer compelling value at current prices. I’m prepared to be patient. The auto industry could be in for a rough ride over the next couple of years. On the other side, will there be as much business if electric cars take over the roads? Will people be working at home more and commuting less? Will we all just be too poor to buy a new car? All legitimate concerns. But until the market is willing to pay me what I think these companies are worth, I’m going to hang on and find out.

Agriculture

The court finally decided. Huawei’s CFO is going to be extradited to the US. The Chinese immediately came out with some apocalyptic pronouncement concerning Canadian-Chinese relations. I’m not sure they’re going to be buying much of our canola anytime soon. Rocky Mountain Dealerships and Cervus Equipment are two more stocks that seem like they have been in the portfolio for an eternity. Cervus actually had a pretty good quarter in the first quarter of this year. But a good part of that was a rush to buy before the surging US dollar lifted prices of farm equipment as well as some backlogged demand for transport truck orders placed last year. Going forward, farmers need to find something to plant and someone to buy it. I have no insight into the farming sector and don’t really have a good sense for when or even how likely it is that farmers can get back to business as usual. Between the two of them, Rocky Mountain and Cervus have a lock on the western market. If there is going to continue to be a farming sector in western Canada, these two will eventually benefit. Both companies have stock prices that are way down from where they were a couple of years ago and p:e ratios of 4 to what earnings looked like before China went nuclear on Canadian canola farmers.

I am keeping the faith. By the time it is evident that the farm sector is on the mend, the stock prices at these two companies will have already moved back up. So I bide my time and wait.

Finance

Subprime lending. What could be better in the midst of a catastrophic economic collapse with unemployment levels surging to depression era levels? Investors dumped this stock, sending it down by 60% when things looked the bleakest. Since then, they’ve had a change of heart. Maybe things aren’t so bad after all. The company was ready for this or something somewhat like this. The majority of their customers have loan insurance which protects their loan payments in the event they can’t pay. The Canadian government was quick off the mark with support for the newly unemployed. It seems as if GoEasy can certainly withstand the immediate brunt of this. Longer term, as small businesses start to default and people find out that not everyone who was furloughed still has a job waiting for them on the other side, perhaps things will become more challenging. But is it possible that with banks tightening up lending standards and consumers and small businesses looking for lifelines that this company could not only survive but maybe even prosper? I owned a payday lending company (I know, makes me squeamish just writing about it) in 2008 and they actually did quite well in a similarly challenging environment. I’m wondering if GoEasy might benefit in the same way from the financial chaos now enfolding around us. This was my largest holding heading into the downturn and remains my largest holding. At least until I find something else I want to use the money for.

Real Estate

What a rogue’s gallery this list is. Next up on the list of beaten down names would be Melcor Development. What’s not to dislike? They develop housing subdivisions in Alberta which has just seen its primary income generating industry (oil) vanish into thin air. Canadian households were already over-extended with record high levels of mortgage debt. This shutdown won’t help matters any. Melcor earns a good chunk of its revenue from its office and retail real estate development efforts. Office and retail space are not exactly hot sectors right now. During the shutdown, many of their tenants just stopped paying. Why am I still holding on to this thing?? Mostly because of the book value. The company is trading at 1/5 of their tangible book value. If someone offered to sell me a small office building or retail space for 20% of its appraised value, I’d jump at the opportunity, regardless of how much we’d all like to spend the rest of our lives working at home in our pyjamas. So why wouldn’t I own Melcor at a similar discount? I would and I do.

Healthcare

Over at Assure Holdings, elective surgeries have been shut down for a couple of months now. Is there any sector that wasn’t affected by this thing?! That’s going to hurt their results over the next quarter or two. Maybe they can use this time to collect on some of those many unpaid bills that have dogged the stock from day 1. A few announcements from the company over the past couple of months confirm that it is still alive and ticking. Lots of promise here if they can get their billing systems in order.

(Addendum: Subsequent to writing this post and within minutes of posting it this morning, Assure came out with their year end results. I’m still digesting the results, but it looks like major problems with their billing and collections again this year. One of their major payors is refusing to pay. In somewhat more encouraging news, it sounds like the company is making headway with its project of bringing billing in-house. Hopefully they can get all this sorted out eventually. In the meantime, I would definitely classify this as a speculative stock and I’ll be taking a hard look at the financial filings to see if the share price is low enough to justify keeping it in my portfolio.)

And finally, there is The Valens Company. I’m going to toss this into the healthcare category. Certainly you could argue that they could be an important participant in our mental health as we seek out some pharmaceutical de-stressing. This is a new kid on the block and they were just getting going with their plan to corner the market in marijuana infused consumer products after this category got the stamp of approval from our government last fall. The virus has put a damper on operations until there are stores that are open and people that are in those stores to actually see all the wonderful new products they can partake in. But the company had cash in the bank heading into this and after hitting pause for a quarter or two I am hopeful they will get their buzz back.

Betting On The Future

Clearly I own too many stocks. This little opus just took me the better part of a day to write. But it’s cathartic. There are a lot of potential minefields out there to be worried about these days. It helps to take a step back and look at the portfolio as a whole. Longer term, I think there’s a lot to be optimistic about, mostly because of the prices that I’ve been able to get in many of the sectors more obviously affected by the coronavirus. It’s easy to feel reasonably good about things now, when most companies are still reporting profits. Three months from now, as second quarter losses start rolling in, it may be more difficult to maintain a sunny disposition. It is still a big question mark as to how long and how severe the effects of this shutdown are going to be. If this is a short, sharp shock that quickly resolves itself then the portfolio is very well positioned. If the virus and its effects drag on for months or years, then the portfolio is going to struggle. It’s an aggressive portfolio positioned for an eventual recovery. Hopefully that will be sooner rather than later, but if not, these are all promising companies, most of them with solid balance sheets, and I think they have what it takes to weather any further storms that may be coming our way.

Full Disclosure: I own shares in Hibbett Sports, Tilly’s, Foot Locker, Francesca’s, Casa Systems, Teck Resources, Magellan Aerospace, Gildan Activewear, The Valens Company, Rocky Mountain Dealerships, Cervus Equipment, Essential Energy Services, PHX Energy Services, Linamar, Magna, GoEasy, Assure Holdings, Adcore Inc and Melcor Development. I do not own shares in Shopify.