A stunning stock market recovery caps a surreal year in the markets and offers me a golden opportunity to take a little risk off the table.

Tag: 2020

Unpleasant news from both these companies has me re-thinking my exposure to these speculative growth stories and selling out at a loss.

I get my hands dirty with a manufacturing company and use some recent share price strength to take profits on two of my existing holdings.

Sold on its merits, I add Omnicom to the fold.

I move to the sidelines as the company invests more heavily in its cannabis 2.0 future.

I cast a critical eye on my recent performance and uncover some interesting stats from a pile of old brokerage statements.

I take a comprehensive look at the retail sector in the United States. In the end, two new names enter the portfolio and four existing holdings get the boot.

A play on natural gas finds its way into the portfolio and I bid adieu to an old friend.

Looking across the valley to the other side of this crisis, I plan for an eventual recovery and add 5 new stocks to the portfolio: Teck Resources, Magellan Aerospace, Foot Locker, Adcore Inc and PHX Energy Services.

First quarter results that came in below my expectations have me rethinking my position in this company.

The combination of a quick return on my initial investment and a rapidly deteriorating industry outlook prompts me to beat a hasty retreat.

With the markets and the economy in disarray, the average p:e ratio of my portfolio has fallen to a level I haven’t seen since 2008.

In for a penny, in for a pound. I go all-in on the clothing sector with the purchase of G-III Apparel.

I make the difficult decision to sell Urban Outfitters as I try to adjust the portfolio to best take advantage of this new investment environment.

Showing up fashionably late to the pot party.

People are always going to want a clean pair of underwear. With that in mind, I took advantage of the recent market sell-off to add this global manufacturing powerhouse to my portfolio.

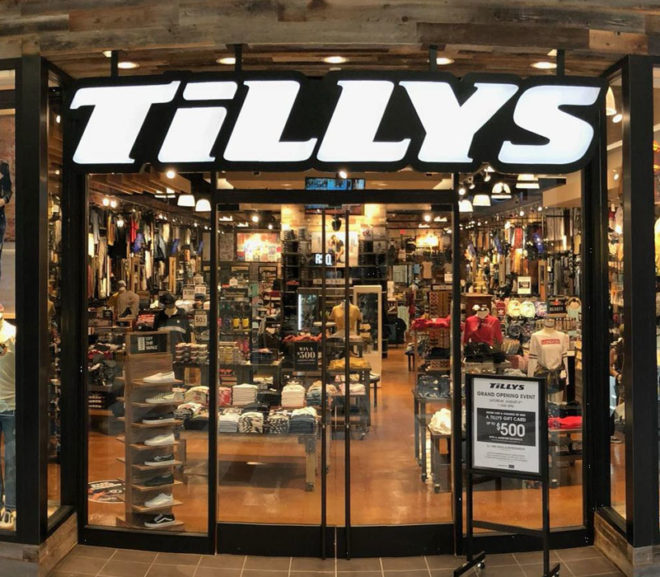

To make room in the portfolio for Tilly’s, I decided to sell off my position in Big Lots.

A balance sheet stuffed to the brim with cash encourages me to tempt fate and add yet another retailer to the portfolio even as we head into what is looking like a possible retail Armageddon.

Harsh customer reviews prompted me to take what profits I could on this evolving online marketing company.

By focusing more on the profits that I expect my portfolio companies to generate and less on their stock prices, big stock market drops become much less intimidating.