I cast a critical eye on my recent performance and uncover some interesting stats from a pile of old brokerage statements.

Performance Update

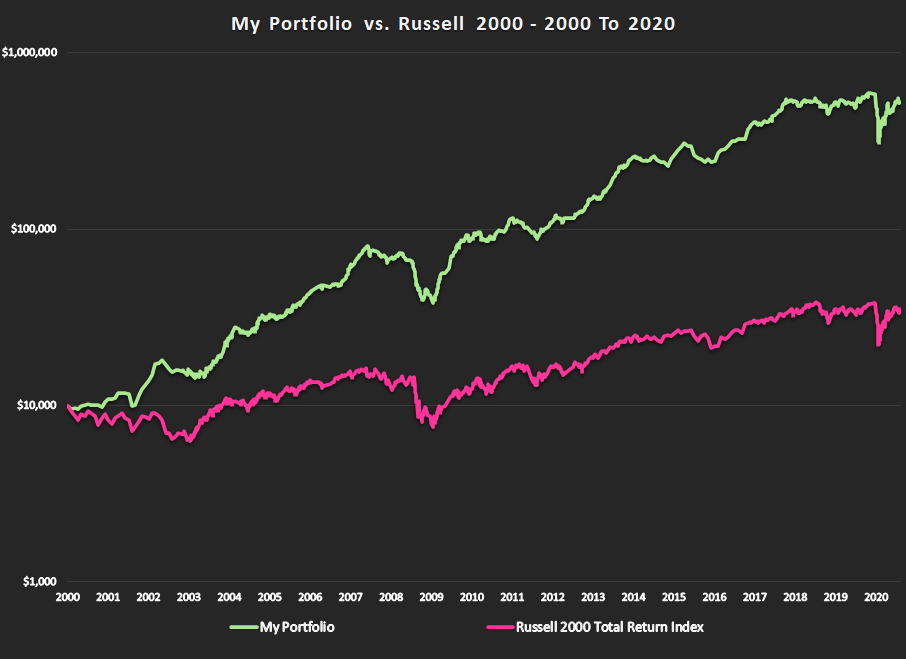

I launched this blog back in January of 2018. I had just come off of a very good year, with my portfolio finishing 2017 up an ego-boosting 45% vs a 16% gain for the Russell 2000. Looking back over the past two decades I had reason to feel good about my track record. With a 38% annualised return, it would put most Wall Street professionals to shame. While those returns had been goosed by a number of big successes during the late nineties and had been moderating as my portfolio matured (or perhaps as the character of the market shifted or perhaps as I became older and a little less reckless), I nonetheless could proudly point to a still very healthy 10 year annualised return of 22.5% which beat the benchmark Russell 2000 index by a wide margin (13.7% per year to be exact).

Why not share this kind of success with the world? I had friends who were curious about what I did and I kept running into people who at least professed a passing interest in stock picking. Maybe I could do my small part to educate a new generation on the ins and outs of value investing and add my 2 cents’ worth to the collective human knowledge bank.

I’ve enjoyed writing this blog. I’ve had an opportunity to connect with readers from around the world and through it have also made some new friends in my own backyard. The feedback has always been positive and people seem to appreciate the time I’ve taken to share my experiences. But I’m acutely aware of the public nature of my posts. People might actually be out there listening to and maybe even acting on what I have to say. I want to be sure they know what they’re getting into.

When I first wrote out the “Track Record” section of this blog a couple of years ago, I finished up with the boilerplate caution that “past performance may not be indicative of future returns.” Unfortunately, that has proved to be annoyingly prophetic.

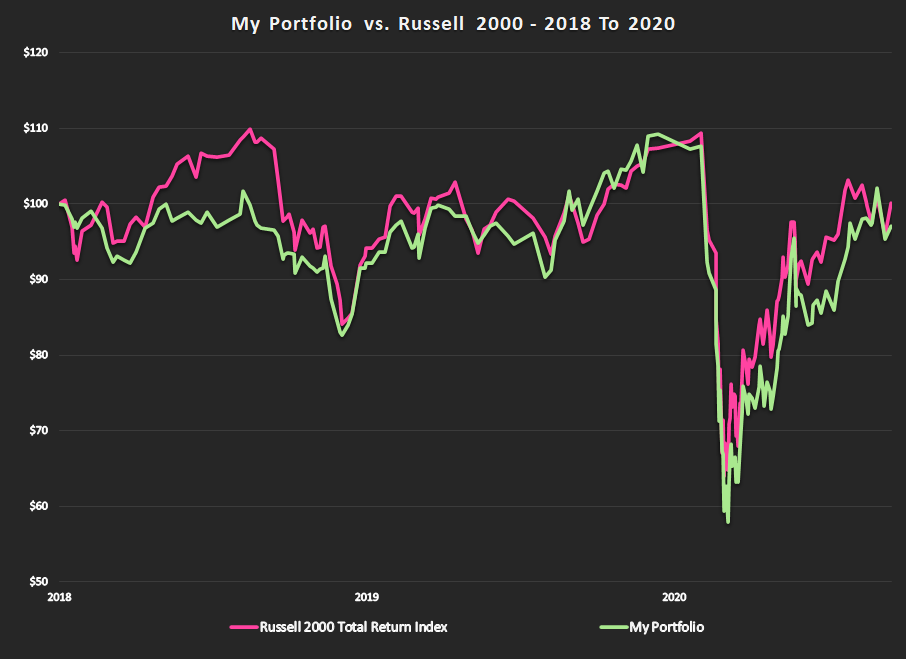

Since launching this blog on Jan 19, 2018, my portfolio has gone exactly nowhere. I have had some scattered successes and a few frustrating losses but overall, an investor would have been just as well served by putting their money into a Russell 2000 index fund or ETF as they would have been by mirroring my various stock selections.

Below is a graph of my portfolio vs. the Russell 2000 Total Return index since Jan 19, 2018.

And to put that into some longer term context…

The last few years have now officially been the longest stretch of zero outperformance I have experienced so far in my investing career and I have to admit, it is starting to make me sweat just a little bit. There have been other lulls. The closest comparable time period is the stretch from the start of 2010 to the middle of 2012, a 2 ½ year period that also saw my portfolio just treading water against the Russell 2000. This period ended with some fireworks in 2013 as my portfolio leaped 68% that year. Maybe this more recent period of uninspiring performance will end the same way. One can hope.

It is a sobering reminder, though, that the stock market can be capricious. It does not offer up a steady payout that you can take to the bank. It often seems like a frenetic casino and nothing serves to highlight that point better than the incredible roller-coaster ride the market has taken us on over the last few months.

Investing Scorecard

During the height of the coronavirus lockdowns I was looking for a project to keep myself occupied and I dug out all my old brokerage statements right back to the beginning of time in the spring of 1996. I’ve updated the Portfolio Archive section of this website with all the gory details, including a complete list of the stocks I have owned over the years, how long I owned them for and how much money I made or lost on each one. (I also updated the Track Record section to include a summary table at the end, listing my annual returns.)

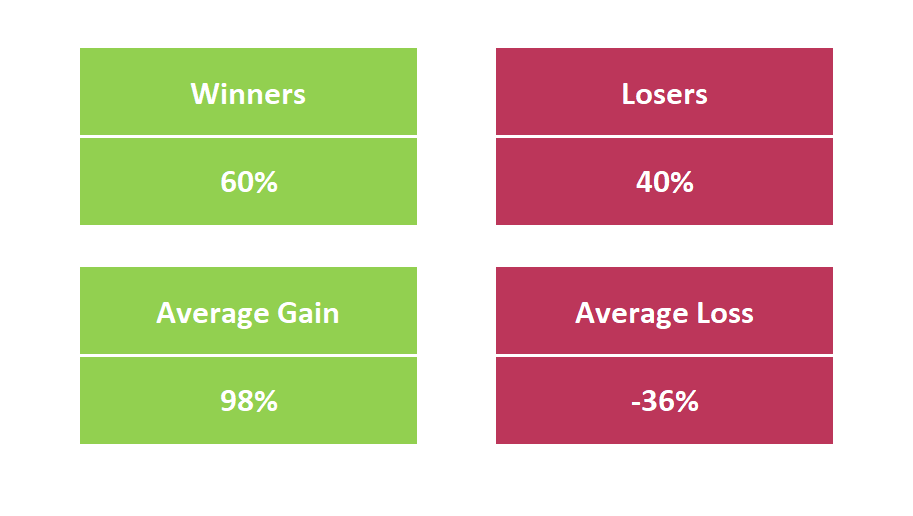

In total, I have bought and sold 200 different stocks over this 24 year stretch. Focusing on the years since 2000 (which appropriately excludes a few massive gains in the late nineties), I calculated my win/loss ratio. It turns out, I’ve made money on 60% of the stocks I’ve bought over the years and lost money on the other 40%. Of the ones that have made money, my average profit has been 98%. The average loss for the losers was 36%. (For those math nerds out there, the median gain was 61% and the median loss was 31%) The average holding period was 1.4 years.

Clearly, I am not about to put the Oracle of Delphi out of business. I only manage to pick winners a relatively slim majority of the time. 4 out of every 10 stocks I buy turn out to be duds. And on average, I lose about a third of the money I’ve put into those piece of crap ideas. Overall, though, I do win somewhat more than I lose and when I do win, I’ve often won big.

In the end, investing is very much a game of probabilities. The stock market is intensely unpredictable. The last 6 months shows us that. Some of the stocks I sold during the coronavirus meltdown have done surprisingly well (surprising to me at least). Some of the ones I bought have done frustratingly poorly. But despite the somewhat lackluster returns of the last 2 ½ years, I remain a strong believer that value will win out in the end. By always placing your bets on what look to be the most undervalued securities, I believe you are stacking the odds in your favour. It’s like you’re placing bets on a roulette wheel that you know has a 60% chance of landing on black. Any individual spin may come up red and you could have a long run of bad luck with a whole string of red spins, one after the other, but if you stick with it and continue betting on black, the odds are likely to swing in your favour eventually.

Thus, I remain undaunted in my pursuit of value. Right now, it’s a scary time to be a value investor. As a group, the odds seem to have been against us for the last few years. Value indexes have been getting trounced by their sexier, “growthier” peers. The coronavirus crisis has only accentuated this effect. I’ve been reviewing Q2 results in both the Canadian and US markets, always on the look-out for better bargains, but I have not found any that I like more than my existing collection of offbeat names. Right now, good stocks seem more expensive than usual. You’ll pay through the nose for a good company in a growing sector with good prospects that is benefitting from the whole coronavirus stay-at-home phenomenon. Companies that don’t follow this feel-good storyline are being trashed. Unsurprisingly, that trash heap is where I’m finding most of my portfolio companies at the moment.

If the coronavirus had been limited to a single wave and we had shaken off the trauma and gotten back to business as usual, this blog post might have had a very different tone. But instead, the coronavirus and our unprecedented response to the coronavirus, shows little sign of abating. I worry that the psychological impacts of this contagion and the economic side effects will be felt long after the actual contagion has cleared. Which does give me some pause when I cast my eye over my collection of beaten down companies, many of which are losing money at the moment, and whose future prospects remain a question mark. I will not be surprised if, true to form, 40% of them turn out to be duds.

Betting On The 60%

It is the other 60% that I am pinning my hopes on. There are some very good companies in the portfolio. Teck Resources has one of the largest steel-making coal deposits in the world and is in the process of developing one of the world’s largest copper mines. (a metal that is sure to be in high demand for the upcoming wave of electric cars about to hit the roads) It has been profitable every year for the past 16 and trades at a modest price to its previous average earnings. If central banks ever succeed in producing the inflation they seem to so desperately crave, big piles of rocks like this are going to look very attractive.

Linamar is another company with a long history of profitability, losing money only once in the past 20 years. Their order book was looking very healthy before the covid pandemic took its toll. With everyone moving out to the suburbs, demand for automobiles could be surprisingly strong. But Linamar doesn’t just make auto parts. It also manufactures industrial scissor lifts, farm machinery and medical equipment. Trading at a very low price relative to its pre-covid earnings and just a shade over tangible book value, you’re not paying very much to own this manufacturing powerhouse.

Enerflex has operations in countries around the world, helping to build the natural gas power plants and infrastructure that will support a renewable energy future. While the exact role that natural gas will ultimately play in the greener energy future remains unclear, this company too has a solid track record with 10 straight years of profit behind it. Trading at a p:e of only 4 times its average earnings and half of its tangible book value, the price seems worth the gamble that gas will remain an important part of the future energy equation.

While they were both sidelined last year by trade tensions with China, prior to that my two agricultural equipment dealership companies, Rocky Mountain and Cervus, both had rock solid track records as well, with many back to back years of profitability behind them. Both companies are trading for less than 5 times 2018 earnings and a healthy discount to book value. Both showed unexpected strength in their most recent Q2 earnings reports. It is too soon to say whether this was just a temporary response to the coronavirus (pent up demand from a weak Q1 combined with government subsidies) or whether these are early signs of a recovery in the Canadian agricultural sector. Either way, I see a lot to love in both these companies.

As I mentioned in my last blog post, I am also finding what looks to me to be compelling value in the US retail sector, notwithstanding, or more accurately, precisely because of, its recent covid troubles. I am betting that eventually these troubles will pass and that the stronger members of the retail sector will survive and, hopefully, prosper. At the prices I’m paying (4-6 times last year’s earnings) I’m willing to give that roulette wheel a spin.

Likewise, Magellan Aerospace with 11 years’ worth of consecutive profits in the bag and trading at half of book value, seems like it’s worth a spin as well, although I’ll be watching that ball bounce around with apprehension. Given the dire state of the airline industry, I do think it’s a crapshoot as to which colour this one ultimately lands on.

GoEasy is still busy shaking up the staid Canadian banking sector and so far they seem to be handling the stresses of the unfolding economic train wreck with relative ease. Not to be too ghoulish about it, but there is a chance that they might even prosper from tightening lending standards at the big banks.

Casa Systems is still losing money, but they have come out with a number of promising announcements recently, touting their various 5G initiatives. Adcore too sounds upbeat on its technology, even though the coronavirus is not doing any favours for its core travel and hospitality clientele.

The Valens Company is continuing to develop new, cannabis infused products, but the big pot growers that are their main customers are cautious in the face of industry-wide over capacity and a slow uptake by consumers. The company lost money in its most recent quarter and the stock price has been slumping. Not exactly what I hoped for when I bought the stock, but I remain a shareholder and am still hopeful that as things return to normal, the company could enjoy some new highs of its own.

In the hope springs eternal basket, I am still the less than proud owner of Assure Holdings. How many financial restatements does it take to make me pack my things and go? Quite a few, evidently.

PHX Energy Services has been a solid performer since I picked it up a few months ago. Trading at only 0.6 times book value, with a US-focused and technology driven fleet of modern drilling rigs, maybe they’ll be able to make a go of it in a sector that seems headed for the dustbin. Things look more tenuous over at Essential, but then the price is a third that of PHX, with a p:b ratio of only 0.2.

Also weighing in with a rock bottom p:b ratio of 0.2 is Melcor Development. Down south, millennials are flooding the housing market, desperate to move out of their parent’s basements, especially after being cooped up with the old codgers for the last 6 months. True, over at their commercial division, there are some lease payments that are past due, but if they can sort this out, why can’t Melcor get a piece of that housing boom action?

Sticking To My Knitting

After a very brief sojourn at moderately reasonable levels, stock market valuations have shot back up to their previous highs. Given how expensive everything has become (once again), many of my stocks look like real bargains, warts and all. With the average stock once again trading at a p:e ratio north of 20 and a p:b ratio of 2-3, the kinds of numbers I am seeing in my own portfolio offer me some comfort. Despite my recent performance or lack thereof, I am not about to abandon my value investing roots. As always, I will continue to buy what no one else wants.

This strategy has not worked out particularly well over the last 2 ½ years. I want to make that abundantly clear. It may not work out that well over the next 2 ½ years either. Who knows, it may never work again. Every investor has to decide what their investment philosophy is and what makes sense to them and then stay true to their beliefs.

I continue to bet on value.

Full Disclosure: I own shares in Foot Locker, Kohl’s, Genesco, Casa Systems, Teck Resources, Magellan Aerospace, The Valens Company, Rocky Mountain Dealerships, Cervus Equipment, Essential Energy Services, PHX Energy Services, Enerflex, Linamar, GoEasy, Assure Holdings, Adcore Inc and Melcor Development.