To commemorate the 25th anniversary of my initial foray into the markets, I look back at my experiences over the past two and a half decades and dive into a little more detail on my historical returns, hoping for some insight into what the future might bring.

Reminiscences of a Value Investor

It was 25 years ago this spring that I started my investment journey. When you’re young, you don’t really know who you are or what you want out of life. I had wound up in a career that I didn’t feel particularly passionate about. I was looking down the long stretch of years that lay between me and an eventual retirement and searching for an alternate route through life. It found me almost by accident.

My plan, such as it was, was to keep a tight rein on my spending so that I could save up an initial nest egg that could then start growing and multiplying itself. With that out of the way, I’d cut back to part time work and try to find a work/life balance that made sense to me. (Heavy on the life, light on the work.) I’d get my saving out of the way early and then wait patiently for that money to compound to the point where I could maybe even take an early retirement.

This was long before the FIRE movement (financial independence, retire early) became a thing. Back then it was called Voluntary Simplicity. I still prefer to use that term and my wife rolls her eyes whenever I do because, as it turns out, we didn’t exactly end up living the life of extreme frugality that I had at first envisioned.

I was a regular visitor to the finance section of my local library. (This was pre-internet) My debate at the time was between starting my investment journey on the real estate side or the stock market side. Both seemed to offer the opportunity for healthy returns with a bit of added hard work and ingenuity. In the end, I chose the stock market route. The bookish, numbers analysis side of stock investing appealed to me more than the angry calls from tenants side of the real estate game. As well, I have a gut aversion to debt and it is hard to play the real estate game without embracing the judicious use of debt.

So stocks it was. The book that really tipped the balance for me and set me on my way was Peter Lynch’s “One Up On Wall Street”. This was an approach to investing that made absolute sense to me. He made it sound easy. Buy stocks in decent looking companies with a low p:e ratio and low debt (I liked the low debt part). Ideally, you’d like to see some opportunities for future growth. Focus on smaller companies because these are more often overlooked by the big players on Wall Street. Boring companies are good because it means no one is paying any attention to them. Companies that do something mildly distasteful are even better.

These principles seem so out of step with the market zeitgeist of today, but I think they still have a timeless quality to them and they immediately resonated with me. Off I went to the library to start researching potential investment candidates. Pretty soon a steady stream of annual reports started appearing in my mailbox as I hunted for those elusive bargains.

Two other books had a big effect on me early in my career. One was the classic “Wealthy Barber” by David Chilton. Another easy, breezy read. David lays out the case for the magic of compounding interest. If you could find some way to grow your money at a decent rate, say 10% per year, then time has a snowballing effect on your net worth. Starting as early as possible can make an enormous difference to your final tally. If I could somehow manage to scrape together $30,000 by the time I was 30 (I did) and if I could grow that at 10% a year, then that would balloon to $1 million by the time I was ready to collect my gold watch and hit the links.

The one and done aspect of this approach really appealed to me. I could save that money now, when I was in my 20’s and I was still used to living like a starving university student and then I’d never have to save another penny. I could just let that initial nest egg compound for the next 35 years. This would save me from the onus of saving any more money down the road which would help a great deal in my ultimate goal of working as little as possible.

Tick, Tick, Boom!

The other book that really intrigued me and my wife and prompted us to attend a talk put on by the author, was one called “Boom, Bust And Echo” by David Foot. The author explains the dramatic demographic anomaly of the baby boom generation born after WWII and how this massive bulge of babies had affected society and the economy over the decades that followed, as they grew from children into teenagers then young adults and then started having families of their own. You could use the inexorable march of time to forecast how this demographic bulge would keep altering and affecting society in the decades to come as they moved through the natural stages of life. Most importantly, he laid out a convincing argument for why we were about to see an unprecedented economic and stock market boom the likes of which had never been seen before as these baby boomers moved into their peak spending and saving years.

So again, this reinforced my desire to get in early. As part of Generation X that followed in the footsteps of the baby boom, there was a feeling of picking over the meagre scraps left behind by this demographic force of nature. But if I could somehow jump the queue and get myself in front of the demographic freight train then maybe I might be able to tip the scales in my favour.

I’m still a big believer in reading the demographic tea leaves. I think it was David Foot who said that demographics explains 2/3 of everything. It doesn’t explain it all, but it explains a lot. And I think today, as the baby boomers storm headlong into their retirement years, this phenomenon still goes a long way towards explaining some of the extreme market and economic distortions that we are witnessing right now.

As Mr. Foot predicted, the baby boom generation did indeed re-shape the investing landscape. Starting in the late nineties, as they moved through their forties and then progressing through the next 25 years, their coordinated focus on saving money for retirement, I believe, is largely what is behind the stunning series of asset bubbles we have witnessed over the last two and a half decades. And as they all finally reach retirement age together, I think we are witnessing the culmination of that tidal shift of money into every conceivable corner of the investment universe. Demographically, we’re probably getting near the end of this paradigm shift. The baby boom had pretty much petered out by 1964. Those stragglers are now 57 years old, so we’ve got another 7 years to go before all the boomers have finally reached retirement age. Meanwhile, the vanguard of the movement, those born in 1946, are 75 now. As the final boomers reach retirement age, the leading edge of the cohort will be shuffling off this mortal coil. How this plays out for the market remains to be seen. Importantly, research shows that old people tend not to spend down their nest eggs in retirement, or at least they often do so only slowly. It’s not like you hit age 65 and you immediately sell all your assets. But the pendulum does definitely shift from accumulation to gradual depletion. From saving to gradual dis-saving. This is likely to have an effect on the markets. The next 20 years are likely to look very different from the last 20. The demographic tailwind is going to turn into a headwind. Dealing with that as investors and as a society is going to be a monumental challenge.

I got lucky. I was in the right place, at the right time, with the right investing approach. My confidence in the demographic forces at play and in the value investing style as laid out by Peter Lynch kept me (mostly) fully invested throughout the major booms and busts along the way. A few early successes stoked my passion for the craft and prompted me to devote much of my free time to learning about the markets and seeking out overlooked opportunities. I struck a home run early on with an investment in a small, unappreciated peddlar of exercise equipment on late night TV called Bowflex. Peter Lynch’s principles helped me to avoid the hype and mania surrounding the onset of the internet and helped me neatly sidestep the ensuing crash. Another lucky strike in the fall of 1999 led me to a tiny company that I initially started following because of their business providing corrosion control for pipelines. The company pivoted into the business of installing fiber optic cable and a big, sweetheart deal with the city of Winnipeg prompted me to invest early before Wall Street caught wind of what was going on. Within months the stock had shot up 13 fold and I had turned a $7500 investment into $100,000.

These early successes helped give me the platform I needed to pursue this new passion of mine as a career in and of itself. My wife, bless her heart, has been in there, almost from the very beginning, right alongside me. She has always had an unshaken confidence in my abilities and has never second guessed or doubted my investing decisions. Her confidence was definitely the source of much needed support during some of the more difficult market episodes. She pooled her savings with mine early on and in 2003, when my son was 2 years old, we made the difficult decision together and decided to quit our jobs and see if we could somehow manage to build a life together in a very unconventional manner.

New Beginnings

My son just turned 20 and after a false start last year and a winter spent trapped in our basement doing online learning, he is off to continue his studies in Montreal this fall. His passion is music, not the stock market, but he warmed the cockles of my heart a couple of months ago when he approached me to ask my advice about opening up a brokerage account and investing some money he had saved. I got him to read my blog and after some deliberation he decided to split his money two ways, dividing it equally between Foot Locker and Cervus Equipment.

I am excited that he is starting his investment journey even earlier than I did, but also apprehensive on his behalf. As I said, I believe the demographic forces that have shaped the markets over the last 20 years are going to be a headwind over the next 20, not a tailwind, as baby boomers start to slowly spend down their accumulated savings. I think young people today are going to have a much more difficult time building wealth, at least initially, than their parents did. But it is not all doom and gloom. He has time on his side. The pig will pass through the python (another good baby boomer book from the 90’s). By the time he hits his 30’s, some of the recent market excesses may have worked themselves out and he’ll be able to embark in earnest on his own wealth building journey.

History Repeats

The market, as always, is inscrutable and wildly unpredictable. Everyone can have their own theories about why the market is destined to do this or that, but in the end, there are so many competing forces and influences at work that timing or trying to predict anything is really just a mug’s game.

Having said that, this market reminds me very, very much of the internet bubble of the late 90’s. That episode resolved itself quite benignly from my vantage point. The high flying, money-losing, speculative story stocks had their comeuppance and the boring, old economy, value stocks eventually won out in the end. In today’s market, the over-pricing is definitely more pervasive. There are fewer places to hide this time around. But the same basic dynamic is there. Story stocks, growth stocks, money-losing stocks, speculative stocks have all been on fire. Until recently, value stocks have been dragging their feet. It is possible that as this latest bubble bursts, a Peter Lynch style portfolio may hold its value better than expected. So I didn’t discourage my son from making the investments he did and I remain mostly invested myself.

At the same time, the median stock has gotten progressively more expensive over the last 20 years. If this bull market which started way back in 1982 were to fully unwind, there is huge downside potential. A drop of 75-80% in the major indexes is not out of the question. It’s a sword of Damocles which has hung over my head almost from day one.

It’s very important to me that I convey to the readers of this blog that I don’t harbour any illusions that I can sidestep that kind of collapse if it were to happen. My full intention is to ride this market all the way to the bottom (or to the top, whichever it may be). During the crisis of the last year, I did move some money off to the side. I’m not 28 anymore and I do have a bit more risk aversion than I did when I was younger. But the prospect of a market that drops 80% is both terrifying and incredibly exciting. Back in the 1970’s, at the bottom of the last great bear market, the average p:e ratio of the S&P 500 dropped to 7. I’ve gone back and looked at stock tables from that era. While the average p:e was 7, you had many companies trading at p:e ratios of 2 or 3. Imagine that! It makes a value investor’s mouth water, just thinking about it. In an environment like that, it’s quite possible that you could construct a portfolio of promising companies that all traded at 2 times earnings or less. Sure, the move down to get there (from the current average p:e ratio of over 30) would be incredibly painful, but man, the bottom would be something to behold.

A p:e of 2 means an earnings yield of 50%. Imagine a world where you could potentially grow your money by 50% per year. For my son and his generation, a major market crash like this could be the gift of a lifetime. I’d be crying in my beer, of course, but if I kept my wits about me, maybe I’d have a few pennies left to rub together to join in the fun.

Active vs. Passive Investing

I do have one big trick up my sleeve. Without it, I wouldn’t still be playing this game. I would take a diversified, basket approach to investing. I’d own some low-cost ETFs in a variety of sectors. Make sure I had some exposure to emerging markets, some exposure to small cap stocks, preferably with a value tilt. I’d want to own some real estate. Something where I could add value; a fixer upper or a property I could re-zone or re-purpose. I might own some precious metals. Maybe even some cryptocurrency (no, that’s going too far.) I’d be sure to have a healthy emergency reserve of cash stored safely somewhere. I might also try to work on a side hustle to provide a backup source of income.

But (apart from the cash and I suppose, the side hustle, if you were to count this blog) I don’t own any of those things. Instead, I’ve got all my eggs in one basket. Value-priced stocks. The reason why is that I think I can continue to outperform the market. I don’t know that I can, of course, but I think I can. I’ve been doing it for 25 years now and I am hopeful that perhaps I can pull off this alchemist’s trick for another 25 years as well.

The Alpha And The Beta

Every investor’s returns are a combination of two things: the alpha and the beta. The beta is the return that a purely passive approach to stock selection provides. This is what those legions of passive, ETF investors are relying on. For 39 years now, from the bottom of the last great bear market in 1982 to the present day, this market beta has rewarded investors handsomely. The S&P 500, in inflation adjusted terms, has grown by 9% per year. Simply buying a piece of this index in 1982 would have given you a handsome return of 9% annually over the ensuing four decades.

But the market moves in cycles. Driven by the baby boomers, this cycle has been pushed out of all proportion and it has been one hell of a ride. Going forward, though, I strongly believe this market beta is in danger of disappearing altogether. Twenty years down the road, in the aftermath of this epic bull market run, I think that passive investors in the market (or in any other passive asset class) could be no better off than they are today. Of course, I don’t know what will transpire and I may be way off base here, but in my own personal projections, I am penciling in a big fat zero for my estimate of market returns (the market beta) over the next 20 years. (And short term, as I alluded to above, things could get even uglier.)

Which only leaves the alpha. That is the degree to which an investor can outperform the market averages. For an ETF investor, the alpha is obviously zero unless they can presciently jump in and out of various sectoral ETFs at just the right time. In fact, for most investors, even professional money managers, their alpha is often zero (or worse). Combine that with the potential for zero or negative beta and you have a pretty bleak overall forecast. Hence the basket-driven approach. Maybe if you’re lucky, something will end up working!

But I have a somewhat unique outlook. I actually have been able to produce consistent alpha. Quite a lot of it in fact. How much of it exactly, has been a bit of a moving target, but it’s definitely been more than zero.

The Value of Value

Value investing has had a long and storied run. A simple, mechanical approach of just buying the stocks with the lowest price to earnings ratios would have beaten the market by a few percentage points a year. Compound that over decades and you’re talking real money. You get similar results regardless of what valuation metric you use. Price to book, price to sales, price to cash flow, they all provide the same free ride. James O’Shaughnessy goes into great detail on this quantitative approach to stock picking in his fascinating book, “What Works On Wall Street”. Conversely, if an investor consistently buys the most expensive stocks in the market, those with the highest p:e ratios, p:b ratios or what have you, their performance suffers horribly and they end up underperforming the market by a wide margin.

History has a lesson to teach us here. Buying the sexy, expensive stocks, the glamour stocks, the stocks that everyone else is buying and that are fun and exciting to own is dangerous for your bank account. Buying the cheap, boring, unloved and overlooked stocks is much more beneficial to your financial well-being. Or at least it was.

The economist, Kenneth French has a treasure trove of quantitative data on his website that is fun to play around with. I used this data to put some concrete numbers to these concepts.

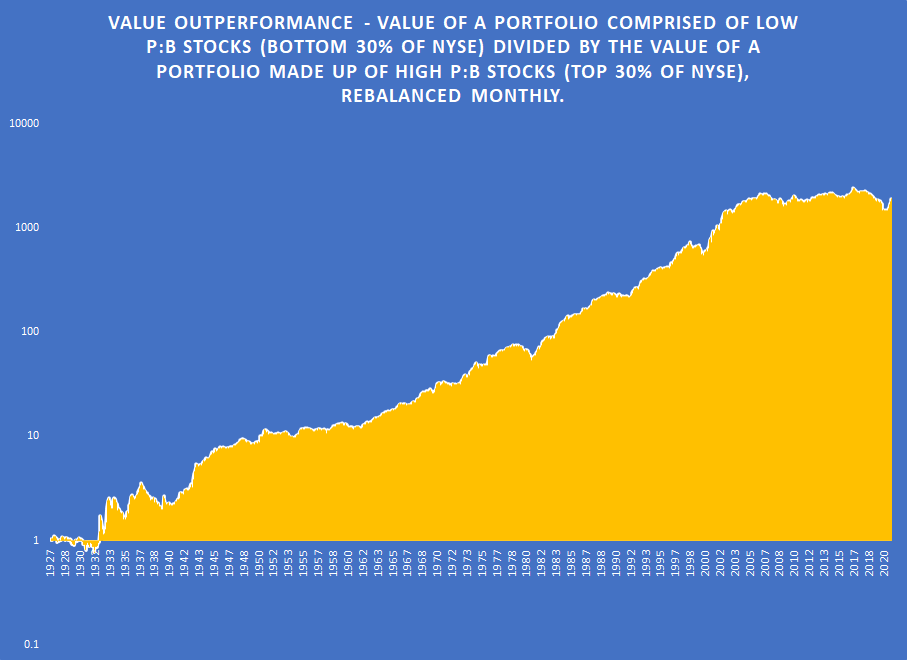

If you had been able to travel back in time and put $1 into a portfolio of low p:b stocks way back in 1927 and if you had rebalanced this portfolio regularly to ensure that you always owned the cheapest stocks in the market, today your portfolio would be worth $357,000 (and that’s adjusted for inflation, no less). Conversely, if you had invested the same dollar in a portfolio of high p:b glamour stocks, your money would have still grown, but only to $186. There are no zeroes missing on that number. The value investor could have bought himself a brand new sports car with the proceeds from his unusually long career. The investor chasing the high-priced, glamour stocks of the day would have barely been able to afford a new set of tire chains.

If we graph this relationship, we can see how value stocks have performed relative to their “high growth” peers. The graph below shows the value of the low p:b portfolio divided by the value of the high p:b portfolio. The relationship starts out at 1:1 but the value portfolio rapidly gains the upper hand, rising to 2 times the value of the portfolio of more glamorous stocks, then 4 times, 8 times and so on. By the end of the series, the value portfolio is worth more than 1000 times what the “growth” portfolio is worth.

On the graph below, an upward line indicates that value is beating growth while a sideways line means neither is outperforming the other. A downward sloping line means value is actually lagging. The line usually goes up.

While value has staged an impressive performance over the long haul there have been a few periods where it struggled to gain ground on the more expensive, high-priced portfolio. The first time was in the years surrounding the Great Depression. The next big period of weakness was in the 10 years from 1953 to 1963. And finally, the last and longest stretch of relative weakness for the value investing crowd has been in the most recent period from the start of the Great Financial Crisis in 2007 to today.

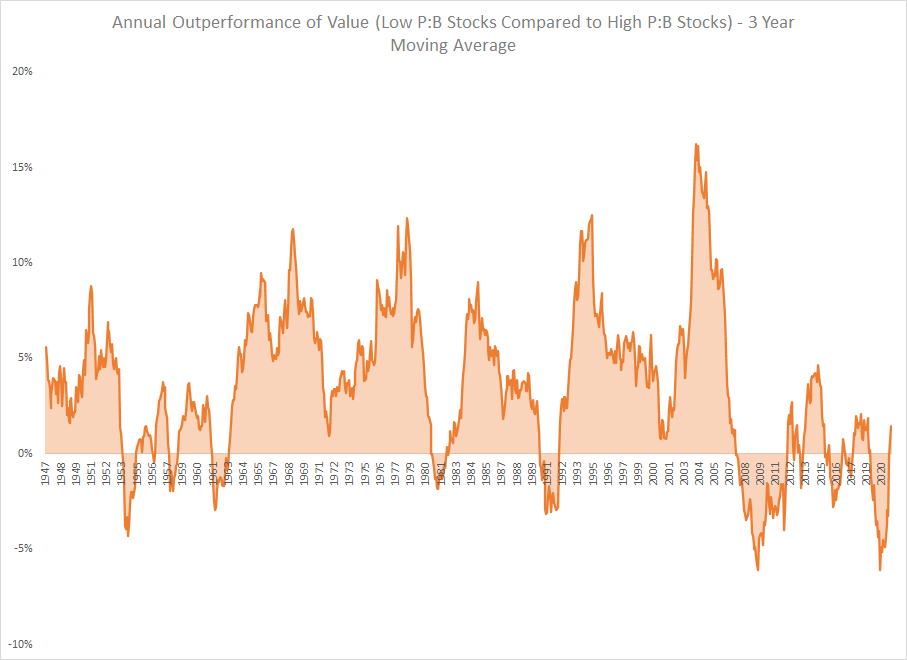

Here is the same information, presented in a slightly different way. I’ve zoomed in on the period after 1947 and I’ve graphed the annual level of outperformance of the value portfolio vs. the expensive, high p:b portfolio. Most of the time cheap wins out, but again, those periods from 1953 to 1963 and the current sorry state of affairs stand out as exceptions to the rule.

It’s not that value investing underperforms the market by a huge margin during these periods, it’s more just that it fails to make any headway. Investors in these eras are not being rewarded for going out on a limb and buying the ugly stuff that no one else wants. And conversely, investors are not being punished for buying the easy, glamorous, feelgood stocks that everyone else is buying.

This is exactly the situation we find ourselves in today. For 14 long years now, value investors have not been rewarded for their patience and the bright, shiny stocks in the market have continued to shine. Many famous value investors have fallen by the wayside. The ones that remain are largely ignored.

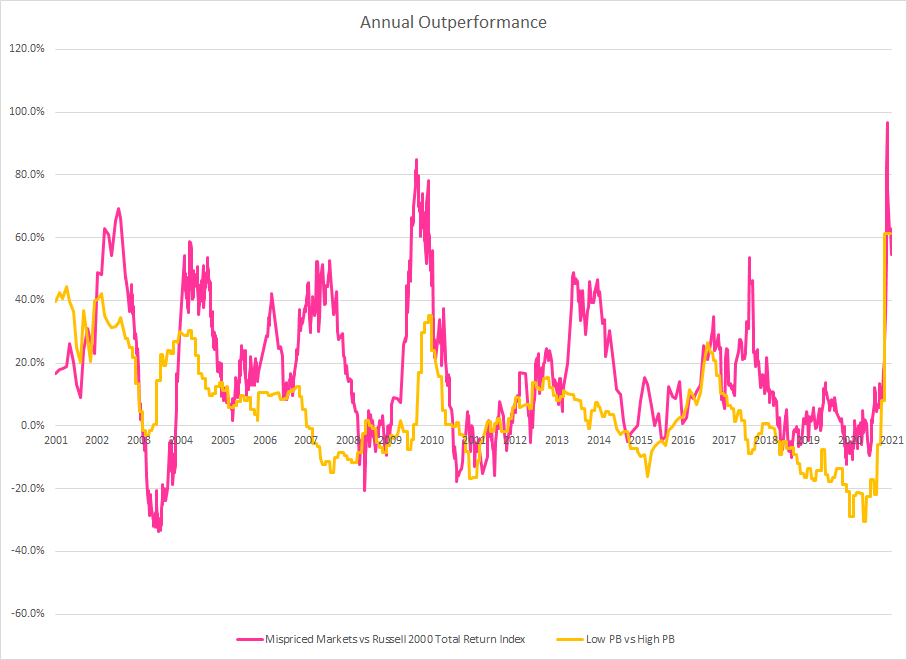

I have not been immune to this dynamic. Below is a graph of my own annual outperformance against the Russell 2000 Total Return Index. (The line in pink.) Superimposed on this is the annual outperformance of a low p:b portfolio relative to a high p:b portfolio. This line is in orange. You can see that my own level of under or over performance follows the fortunes of a more mechanical value investing strategy fairly closely. And you can also see that as value investments have lost their zing over the past 14 years, my level of outperformance has moderated somewhat as well.

Pump Up The Alpha

I find this graph both scary, and also reassuring. Scary because I don’t know how long this value drought will last. But also reassuring because I strongly believe that it will end eventually and that traditional, fundamentals-based value investing will once again reward its practitioners with superior long-term returns. When and if that happens, my past results suggest that I might be able to widen out my lead over the market indexes by an even greater amount. In other words, I might be able to pump up my alpha.

During the early 2000’s, when value investing was still going strong, I was beating the market by over 20% per year. Then the Great Financial Crisis hit and this long value drought began. In this environment, my level of outperformance dropped. Over the last 10 years, I’ve beaten the market by 12% per year. Still very respectable of course and I feel encouraged that I was able to produce these kinds of numbers following a value-oriented strategy in a market that was not at all conducive to this style of investing. Over the last 3 years, even with the recent recovery, my level of outperformance or alpha, has dropped to 6.9%. I admit, this is making me sweat a bit. But if I look at the performance of a mechanical value investing strategy, I see that this took a real grind lower over these last 3 years as well. If I compared myself not to the Russell 2000 but to this mechanical value strategy instead, I’d feel more optimistic about my returns.

If you look at the 3 periods over the last hundred years when value investing struggled to make any headway, the common factor that perhaps unites them all is low interest rates. The period from 1953 to 1963 was notably the last time that interest rates were as low as they are now and it was an era when value investing lagged. I don’t think that is a coincidence.

Interest rates are the price of money and like most things in our free market economy, prices are set by the law of supply and demand. The baby boomers, as I mentioned, have all been saving furiously for their retirement for the past 20 years. They’ve built up a massive pool of savings and are all looking for something productive to do with those savings. So we have a massive supply of money which has pushed the price of that money (ie interest rates) down and asset prices up. In this environment there are a number of mechanisms that might plausibly favour growth over value. The low interest rate, low inflation environment promotes speculation. It boosts the value of future growth by lowering the discount rate used to value that growth. The pool of easy money encourages over capacity and zombie companies which tend to be in the more capital intensive, value sectors. It fuels massive and reckless leverage which in turn feeds into the hype and glamour stock arenas.

Which leads us elegantly back to square one. I believe it is the demographic distortion of the baby boom not only here in North America but in many developed nations around the world, which has pushed asset prices up to previously unheard of levels and it is also these same forces that are behind the long period of weak value performance we’ve been experiencing and the strong performance of the sexy, high growth, glamour stocks.

My Secret Weapon

Which brings me back to the alpha and the beta and what I view as my secret weapon in this fight, my alpha. A good alpha will make up for a bad beta. In other words, if the market is dropping by 5% per year and you’re beating the market by 10% per year, then you’re still doing alright, aren’t you?

I’m concerned about the future direction of the market. I think prices are far too high and that this is unsustainable. I think as the last baby boomers straggle into retirement, we will see the wave of saving and asset buying of the last 25 years turn into a steady trickle of dis-saving and asset selling which will lower the future market return, or beta, substantially.

But at the same time as this is happening, perhaps the forces that killed off value investing 14 years ago will also start to reverse. Perhaps the slow, steady selling off of assets will move money from the saving/asset side of the ledger back into the wages and spending side of the economy. Inflation and interest rates will start to trend up and this will benefit the kind of smokestack sectors traditionally favoured by value investors. The big, expensive glamour stocks will start to sell off and money will flow back into the cheap end of the market. The value strategy will resume its long upwards march and perhaps, just perhaps, my alpha will start to rise again. If I am incredibly lucky, perhaps a rise in my alpha might even offset the drop in the market beta. This possibility is what is keeping me in the market.

Ideally, I’d like to have my cake and eat it too and to a certain degree I already have. Even in one of the worst environments for value investing of the last 100 years, my own value investing strategy has still managed to produce healthy, market beating returns. Not just against a value index but against the Russell 2000 which contains many of the high flying, high growth stocks that have been giving me such stiff competition.

Perhaps the tide is turning even as I write this and after a long drought, value is on the verge of staging a dramatic comeback. The last few months have certainly been rewarding. In that scenario, I might hold out hope that my own excess returns might increase as well, although a return of value may well go hand in hand with lower overall market returns. Conversely, if the tail end of the baby boom keeps this party going and prices distorted for another 5 or 10 years, then value may continue to struggle. But in that case, a lower level of outperformance for my value-oriented activities would be offset by more attractive market-wide returns.

In this dance between the alpha and the beta, it is difficult to make any sort of meaningful forecast. There are forces here that are pulling in opposite directions. To throw yet another variable into the mix, as my portfolio has grown over the years, I’ve slowly been squeezed out of some of the smallest companies in the market and have been moving gradually up the market cap ladder. I don’t think this has greatly affected my performance so far, but it is something I am keeping an eye on.

Buckle In

In the final accounting, the last 25 years have been a wild and exciting ride. I’ve had wins and losses. I’ve had setbacks and glorious recoveries. I can trot out all the Greek letters I want to make myself sound smart but in the end, the future is about as clear as a gas station’s bathroom mirror. I don’t know what’s coming down the line but I’ve had a good run investing in overlooked, underappreciated, value-priced stocks and I see no reason to change my tune now. My investment journey has been full of twists and turns and I am sure there are more to come. I’m buckled in.