Lessons learned from a year of crisis and an optimistic look at the road ahead.

Annual Report

Every year around this time, companies release their annual year-end reports. They talk up their accomplishments and report on the challenges they faced in the year just ended. They also unveil their plans for the future. These reports are always a treasure trove of information. Given the crazy year we’ve just had, I was keen to see what companies had to say about it all. Wading through the results of hundreds of companies over the last few weeks has given me some perspective on where we’ve been, although where we’re headed remains more of a mystery.

In the end, I did not come up with any new investments. I have added a few new names to my watchlist, though. There are always interesting things going on out there in the business world and if the stock prices were just a bit cheaper or the company results were just a bit better, they might make for a promising investment. I’ve got my eye on a company in the aerospace industry, another in the semiconductor field, a financial services company, a couple of furniture manufacturers, some retailers, a company that builds trailer homes and another that makes kitchen appliances. There’s a company I’m eyeing that has exposure to the booming lumber industry. Another offers an unexpected backdoor play on the electric vehicle phenomenon. Yet another seems like it might offer an attractive entry point into the newly legalized marijuana sector in sunny Arizona. But after slicing and dicing the markets and collating all the results, in the end I did not find anything that offers me a significantly better value than what I already own.

While it’s always nice to uncover something new, it’s also comforting to know that out of thousands of alternate possibilities, the 11 stocks currently sitting in my portfolio still represent what I think is the cream of the crop from a value perspective.

As we hopefully emerge in the coming months from a frightening global pandemic, this seems an opportune time for introspection and maybe some long-term strategic planning. Reflecting on the roller coaster ride of the last year, I’ve come up with 3 lessons that I think I’ve learned from the market meltdown and subsequent recovery.

Lessons Learned

The first lesson is that when it comes to value investing, you don’t have to be in a hurry. In the heat of the moment, as the headlines scream their way across your computer screen and stock prices alternately flash green and then red, you can get lulled into a false sense of urgency. Things are happening fast and you’ve got to react now! That may well be true for the day trading crowd but for the value investors out there, they’d often be just as well served by taking a deep breath, shutting off their computers and going for a nice, calming walk in the woods.

During the pandemic, I bought and sold a number of stocks. The churn in the portfolio was a bit more frenetic than usual. It all seemed terribly important at the time. I was taking profits where I could and snapping up the bargains that seemed to be appearing. I was trying to juggle the risk of a great depression-style meltdown with the promise of a stimulus fueled melt-up. I had this sense that this could be a once in a lifetime opportunity to really take advantage of a market gone haywire. If there were ever going to be big market mispricings, surely this would be that time. Through shrewd market moves maybe I could capitalize on over two decades of investing experience and really prove my mettle.

It didn’t quite work out that way. Companies that I thought would be hurt the most from lockdowns went on to flourish. Companies whose share prices I thought offered the potential for mouth-watering returns ended up disappointing. And many companies I wouldn’t touch with a ten foot pole went on to become the market’s star performers. Overall, the stocks I bought at the height of the panic, as a group, did do quite well. When the dust settled, I had managed to stick handle the portfolio to a perfectly respectable performance. If I clock my portfolio’s returns from the start of 2020, when the first few reports of a strange new flu-like illness began to appear, to now, my portfolio was up 61.2%. By comparison, the Russell 2000 was up 39.2%. Take that, Russell 2000. A strong showing to be sure, but not particularly out of line with the returns I’ve enjoyed in the past, in far less apocalyptic circumstances. It wasn’t the once in a lifetime opportunity I imagined it to be.

And here’s the kicker: If I had simply held on to the stocks I owned at the beginning of 2020, shut off the computer and spent the year on a beach somewhere in the Caribbean, unplugged from the daily gyrations of the markets, I would have fared just as well. In fact, that portfolio would have been up 61.6%. In this alternate reality I would have made an extra 0.4% through a rigorous policy of benign neglect. Not that I had anything better to do during the lockdown, but it is both humbling and perhaps reassuring to know that I gained nothing from the hours spent in front of my spreadsheets last year. Evidently, my portfolio will sail on, for a time at least, with or without me at the helm.

I’ve noticed this phenomenon before. Every so often I wonder idly if I should take a year’s sabbatical and unplug from the market just to clear my head and reset my priorities. But in the end, I’m having too much fun. I’d get bored.

The benign neglect thing doesn’t last forever. The portfolio is like a garden that needs to be tended. You can let it go for awhile and it will continue to grow and flower but if you ignore it too long it starts to get choked by weeds. Going forward for the next 12 months, I’d far rather have the portfolio I do now, after the adjustments I’ve made over the past year, than the portfolio I would have had in my lazy alternate reality. So yes, periodic renewal is important, but it doesn’t have to happen on a rigid timeline.

Lesson #1: Value investing is not formula 1 racing. You don’t need to keep your eye on the road and your hands on the wheel at all times. Relax. Put on the cruise control. Listen to a podcast. Stop at Tim Horton’s and grab a coffee. You’ll still get where you’re going in the end.

Lesson #2: Time in the market is more important than timing the market. I shouldn’t need to learn this lesson. Everyone knows you can’t time the market. But I rarely trust what everyone knows. Often it seems, everyone is wrong. But if I wanted proof positive that the universe is an inscrutable place, boy the last 12 months provided that in spades. Hours spent doom scrolling through the latest Zerohedge headlines or trying to make sense of a mass of conflicting economic indicators ultimately served no purpose. I think the takeaway here is to turn off the talking heads and take up a more productive hobby like cheese making.

Lesson #3: My investing approach has a dark side. The trade-off for the superior long-term returns that I’ve been able to generate (so far) is painful under-performance whenever the economy weakens. My value portfolio tends to do best during times like the present when the economy is recovering from a downturn, but it can lag the market when the economy is slowing down. I’ve seen this pattern in the last 3 recessions and to a lesser extent in the slowdowns in 2011 and 2015. If I had a magic crystal ball that could warn me of impending trouble ahead and then give me the all-clear when the trouble was about to end, I could profit enormously from this insight. So far, I haven’t found that crystal ball (see lesson #2) so I am stuck with the rather unsatisfying strategy of simply taking the good with the bad and hoping that the eventual outperformance on the other side of a slowdown more than makes up for the underperformance heading in. After being put through the wringer a number of times now I can report that this process never gets any easier.

Back To Basics

Putting this all together leaves me with a Zen-like back to basics approach to portfolio management. But to reach this state of cool detachment, I think it is vitally important to decide how much money you’re willing to risk in the markets before all hell breaks loose, not after. Now, for instance, would be an excellent time. In the midst of a crisis, you don’t always think rationally. Trying to gauge how much money you should have in or out of the markets while the world is going crazy around you is a huge distraction and the decisions you make in the heat of the moment are unlikely to be perfectly thought out. Far, far better to determine ahead of time how much you’re prepared to commit to the investing game, understanding the substantial risks and rewards involved, than to try to figure this out on the fly. It’s too late to cash out after the horse has left the barn. In my younger days, I was prepared to commit 100% of my funds to the market. That figure is no longer 100%. But after putting some serious thought over the last few months into what that allocation should be, I’ve made my decision and the money that I am committing to the markets is now committed. It’s staying in the markets come hell or high water. What I want to do is avoid the nasty temptation to try to time the market; moving money in and out and in and out of the market as my outlook shifts first one way then the other. For the funds that I have committed to the market (which is still the majority of them) I am back to the “all in, all the time” philosophy that I have followed for most of my investment career.

One big advantage of this set it and forget it philosophy is that it lets you step away from the action. I’ve always been pretty good about not obsessing over my portfolio. It needs to have space to breath; to grow and evolve. Checking stock prices multiple times a day serves no purpose. I update the stock prices in my spreadsheet once a week. I stay on top of any news releases for the stocks in my portfolio by having them emailed to me. Apart from that, I try to keep myself busy with more productive pursuits. By far the most useful thing I do is to sit down a few times a year and go through my target universe of 1000 or so stocks looking for any new opportunities that may have developed in the several months since the last time I looked. This is where I get 90% of my ideas. Everything else is just noise.

There Is No Alternative

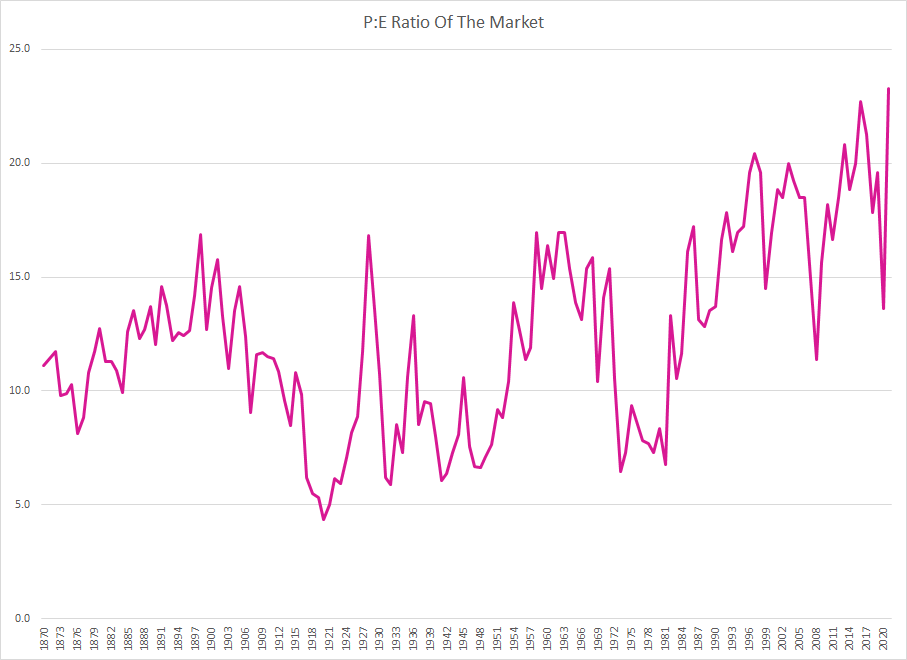

Part of this Zen attitude towards the markets is an acceptance of the things I cannot change. This is a graph that I put together by mashing together two different data series. It shows the p:e ratio (using price to peak earnings) of the S&P 500 and various predecessor indices prior to 1950. In 1950 it switches over to showing the median p:e ratio of the NYSE. Interestingly, being a median and not an average, this number was largely unaffected by the internet bubble of the late nineties, which mostly affected a relatively small group of outrageously priced technology stocks. It also makes the current speculative mania look a little less extreme than it would if you were tracking the average p:e of the S&P 500.

What this graph does show very clearly is a market that has been steadily moving further and further away from its historic anchor. As a value investor, I am a firm believer in reversion to the mean. What goes up must come down and what goes down will eventually recover. For years, I was looking at this graph of p:e ratios and loudly warning anyone who would listen of the impending market crash that was about to occur. Fortunately, I largely ignored my own prophecies of doom and have ridden this bizarre freight train of a market all the way up, with only a few relatively minor detours along the way.

The latest covid fueled market dislocation and the stunning recovery on the other side has me finally abandoning my long-held belief that a day of reckoning is imminent. They say that when the last bear throws in the towel, the market will have finally reached its peak. So perhaps I am ringing the bell at the top here. I am not suggesting that there are not a lot of sectors of the market that look very overheated at the moment (there are) or that after the torrid rally of the last 12 months, we’re not overdue for some sort of pullback or consolidation (or crash) but I am also willing to leave the door open to the possibility that the high asset price environment of the last 20 years could continue for an unknowable period of time. There are larger forces at work here (a rapidly aging society, central banks hell bent on printing their way to salvation, the dramatic rise in value agnostic, passive investing) that perhaps mean that mean reversion may be taking an extended vacation. Or perhaps even that the mean we’re destined to revert to has shifted permanently (gasp) higher.

This brings me back to my “all in, all the time” philosophy. If I don’t know when or even if a big market drop is going to come, then my only alternative is to stay fully invested with the money I am prepared to put at risk and ride out the turbulence. If there was an alternative, I would take it. But I don’t believe there is. I’ve looked at bonds. I’ve looked at real estate deals. I’ve looked at foreign markets. I’ve looked at the slowly declining purchasing power of my cash. Yes, it’s true, at these prices, stocks may not offer the kinds of returns that investors have enjoyed in the past. But neither does anything else. At least with stocks I may have some sort of an edge that might let me squeeze out a few extra percentage points of profit. I think that’s my best shot and I’m taking it.

A Tight Ship

Looking ahead, my goal is to run a tight ship. After the blistering market rally of the last 12 months, there are a relative dearth of opportunities out there. I would much rather own 10 rock solid, compellingly undervalued companies than 20 more mediocre or less undervalued ones. As long as the 10 I own are diversified across various sectors and styles, I am perfectly comfortable running a concentrated portfolio. Especially when I hold the kind of higher quality names that I do now.

While my overall portfolio has definitely been cheaper in the past (had a lower average p:e ratio), the current batch is no slouch in this regard. By my estimates, the average p:e of my current collection of undervalued names is around 10. That implies an earnings yield of 10% if I were able to buy these companies in their entirety and run them for my own personal gain. If my estimates are roughly correct, that is a far better rate of return (even if it is a mostly theoretical construct) than anything else I could put my money into. And on a relative basis, that average p:e of 10, compared to the rest of the market, looks like an absolute steal.

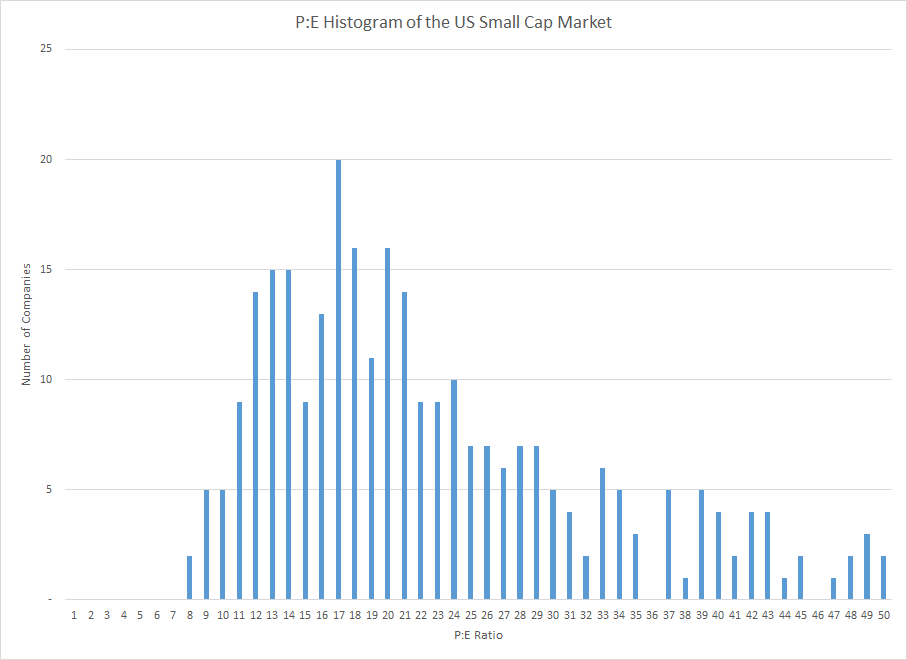

Below is a histogram I put together of the p:e ratio composition of the US small cap market. I used the results from my recent stock review, looking at the companies in my target universe (no resource companies, no financials, no real estate, no utilities) with a market cap less than $2 billion, a relatively low ratio of debt to earnings and using my own estimates of their representative earnings (typically using either 2019 earnings or trailing earnings, if not too distorted by covid effects, or peak earnings if the company is a turnaround situation.)

There is a lot of junk trailing off to the right-hand side of this graph. These are companies with very high p:e ratios. Ratios of 30, 40, even 50 or more are not uncommon in today’s market. Surprisingly, while some of these are legitimately great companies, many of them are not. As I went through the list, I was struck by how many very mediocre companies with spotty earnings or quite underwhelming growth profiles were being accorded these nosebleed level p:e ratios. Oh well, not my problem. What interests me is that bulge to the left. This is where the real meat of the market is. Real companies, doing real things, selling for real prices. And the peak of that bulge, the mode if you will, is 17. (FYI, the median is 24 and the average is 42) So most of the stocks that I would tend to want to buy are trading at around 17 times my estimated earnings right now. The stocks I own are all trading for closer to 10 times earnings. Therein, I hope, lies the potential for future reward.

As I did my latest review, I found that “10” number to be the sweet spot for a potentially undervalued opportunity. If I came across a company that was trading at close to 10 times my earnings estimate I would sit up and take notice. Do a little more digging. See what it looked like under the hood. If you can combine a solid balance sheet with a price earnings ratio close to 10 (anything under 12 really), a track record to give credence to your earnings estimates and ideally a few avenues for possible future growth, then you could have a real winner on your hands.

While I did come up with a few new possibilities, in the end, I didn’t like any of them better than what I already owned. After the culling and fine tuning that I’ve done to my portfolio over the last 12 months, I like what I already own quite a lot.

A side note: I’ve been casually throwing around the term “earnings estimates”. That’s because now, to a much larger extent than usual, my earnings numbers are just that: estimates. One could less charitably call them guesses. Covid has created large distortions in the economy and in the markets. There are companies that have seen their profits soar during covid as consumers dramatically shift their buying habits. The price of lumber has gone from $300 per 1000 board feet to $1000. Sporting goods retailers can’t replenish their inventory fast enough. Boating and RV manufacturers are raking in record profits. Home builders are swamped with demand. A skin care company that sells hand sanitizer might look like a bargain at 5 times trailing earnings but 12 months ago this company was losing money. What happens when we all stop obsessively spraying Purell on our hands every 10 minutes? On the other side of the coin, great swathes of the economy have been sidelined and mothballed by covid. As long as they have the balance sheet strength to persevere, you’ve got to pencil in at least a partial recovery in profits there. The whole thing is enough to make your head spin. In many cases, I’ve fallen back on simply using 2019 pre-covid earnings as a baseline and then fine tuning a bit up or down depending on how quickly and to what degree I expect things to return to normal. On the plus side, those 2019 earnings may be under-estimating the potential for future earnings if people really let loose on the other side of this pandemic. If so, that’s great. But I always like to use more conservative estimates in my calculations, so I’ve mostly been sticking with the 2019 numbers.

The Mispriced Markets Portfolio

Getting back to my portfolio, there weren’t any nasty surprises in this latest earnings season. It was mostly steady as she goes. Companies already seem to be well on their way to shaking off the effects of covid and as we move through 2021, hopefully this will continue. Fourth quarter earnings came in strong for most of my portfolio companies.

All of my portfolio companies are in good shape from a balance sheet perspective as well. Foot Locker and Genesco both have a net cash position. Even Essential Energy, despite looking like a basket case from an earnings perspective, has $6 million in cash sitting in the bank. Linamar has done a great job of whittling down the debt it took on a few years ago to fund a big acquisition in the farming equipment sector. Debt is now sitting at around one times earnings and clears the way for another potential acquisition down the road. Cervus equipment has also made good strides in paying down its debt. Apart from its floor plan financing, it now enjoys a net cash position. Again, this bodes well for potential future acquisition activity.

While the global supply chain is in a complete shambles at this point, and this is likely to impact results in the first and second quarters of this year, one positive spin on this is that it means many companies are running with unusually lean inventories. Once the supply chain issues get sorted out this should mean less promotional activity and fatter profit margins for all involved. Foot Locker warned of supply chain disruptions in its latest conference call and Linamar seems likely to be affected by semiconductor shortages that are shutting down car production around the world. I would imagine that Hammond Power might be affected by parts shortages as well. For the most part, I’m not overly concerned by all of this. My assumption is that this is all temporary and will get sorted out as the economy normalizes. I’m valuing my companies based on the next 10 years of cash flow not the next 3 months. For the moment, the market seems to agree with this assessment. Hopefully, it doesn’t freak out if Q1 results come in on the thin side as a result of these disruptions.

The Business Cycle

We seem to be emerging now from an economic slowdown that really started back in 2018 and then culminated in the brutish but mercifully brief recession last spring and summer. The ISM Purchasing Managers Index gives a good pictorial representation of what’s been going on.

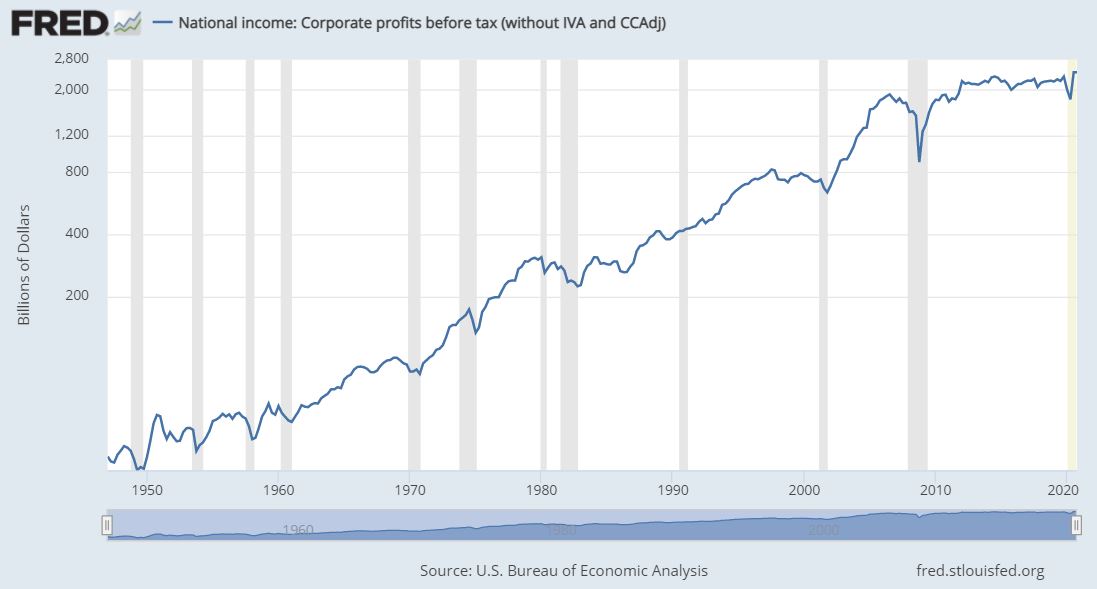

As we emerge from this downturn, I’ve shifted my focus from short term covid-related effects and distortions to the longer-term picture. How are companies going to perform not over the next 3-6 months but over the next business cycle? What do the next 5-10 years look like? Corporate profits have been treading water for a painfully long time, almost a decade now. As you can see from the graph below, that is very unusual from a historical perspective…

It seems like we are long overdue for a period of actual corporate profit growth. I almost forget what that looks like! If we do see some profit growth materialize, trying to pick the winners from the losers ahead of time is going to be a difficult task. They often say that the winners of one cycle are the laggards of the next. If this adage holds true, it suggests that technology will be the sector to avoid and out of favour sectors like resources, manufacturing and retail may be the surprise superstars of the next up cycle.

I may be jumping the gun here. We’re not out of the woods yet. A collapse of the current bubble in speculative stocks could spill over into the economy at large or the rest of the market. New viral variants could throw us a curveball. Surely someone, somewhere has to pay for all that stimulus we’ve been enjoying. But I’m tired of dwelling on the negatives. Time to break out the rose-coloured glasses and take a look past this crisis and into a brighter future.

Investing With An Eye To Growth

Looking out over the next 5 to 10 years it is impossible to predict with any sort of precision what company results will look like. What I like to do instead is look for potential. I like the retail sector. Physical retail has been through the wringer over the last few years. It’s been one body blow after another. But covid has pulled forward 5 years of e-commerce development into 6 months. Companies like Foot Locker and Genesco have been embracing e-commerce and honing their digital capabilities. They are shedding under-performing physical locations and as leases come up for renewal should be able to negotiate significantly lower rents. They’ve enjoyed a windfall of covid-fueled consumer spending and this has bolstered their balance sheets and put them on solid footing heading into the next cycle. Old inventory has been cleared out and they are now running lean and mean. Foot Locker is in a sweet spot right now with the popularity of sneaker culture. It’s got an impressive world-spanning footprint of stores to capitalize on people’s desire to get out and move after a year of being cooped up inside. Genesco and Foot Locker are not out of the woods yet and there are still challenges to face, but I like their prospects going forward. Trading at only 10-12 times last year’s earnings with fourth quarter earnings that were either close to or above last year’s levels, I see a lot to like at these two companies.

Cervus Equipment is another company that I think has a lot of potential. 2019 was an unusually bad year for this company. They were blindsided by a canola embargo from China and had some bloated inventory issues to deal with. The company lost money in 2019 for the first time in 16 years. But they have emerged from that episode triumphant. Profits came back with a bang this year. They haven’t yet matched the peak they hit in 2018 but moving forward, I have every expectation that they will recover this lost ground and go on to make new highs in the next up cycle. They have got their equipment inventory well in hand and their balance sheet is looking pristine. They have a clear strategic direction to guide future growth. Currently their business mix is about 75% sales of equipment and 25% service revenue. They’d like to get this ratio down to 50/50 in the next 4 years. Service revenue is higher margin and less cyclical. It also helps to encourage loyalty and repeat customers if executed well. The company is also focused on growing slowly but steadily through periodic opportunistic acquisitions as independent dealership owners retire and look to pass on their legacy to a willing buyer. In their latest annual report, they highlighted their operations in the land down under. They now have 16 agricultural dealerships in Australia and New Zealand compared to the 38 they operate here in Canada. That is starting to give them significant scale in this region and is an important part of their growth strategy going forward. Australia and New Zealand help to serve the growing appetite of SE Asia as the consumer class there continues to grow and develop. Cervus still looks reasonably priced to me at 9 times peak earnings and I like having the exposure to the all-important agricultural sector.

Hammond Power was not a stellar performer during the last business cycle. While they like to tout the diversified nature of their client base, the mining sector nonetheless plays an important role in their customer line-up. Their fortunes sagged during the last business cycle along with the resource sector. They have made up for this by expanding in other areas, but a resurgence of activity in the mining sector should only enhance their results. After years of under-investment, the resource sector could be one of the surprise star performers of the next business cycle. An infrastructure spending boom could also give Hammond a welcome leg up over the next few years. Hammond was on a roll before covid hit and with their latest quarterly results they managed to edge past last year’s numbers. They underwhelmed the market during the last cycle but perhaps they might surprise to the upside during the next one. At a p:e of only 8 to last year’s earnings, the stock price could have a long way to run if investor expectations get reset.

Casa Systems is another company with the opportunity to reset expectations. They got left at the altar by the cable broadband sector after a flurry of network investment a few years ago came to an abrupt end. The company regrouped, made an important acquisition that broadened their skill set in the wireless field and has been diligently working on a new range of 5G products to take advantage of this next big wave in telecom infrastructure investment. They’ve started reporting modest profits again after a year of losses, but it remains to be seen if the customers trialing their products now go on to place big orders in the coming year or two. I have high hopes, but I’ll have to wait and see what unfolds.

While you have to squint pretty hard to see the potential in Essential Energy Services, I think it’s there. At the moment, with almost 2/3 of its total rig fleet sitting idle, the company is barely breaking even on a cash flow basis. It’s looking back at 6 long years of red ink with likely more to come. Truly only a stock a mother could love. But from a balance sheet perspective, they are in surprisingly good shape. Oil prices have recovered strongly over the last few months and once this feeds through to the exploration and production companies this should lead to a pick up in drilling activity. Essential operates one of the country’s largest fleets of coil tubing rigs, useful for getting at those hard to reach places. They also operate a downhole tools division which they think will benefit later this year from the mandated cleanup of orphaned wells. The LNG terminal in Kitimat that is slowly getting built offers a longer-term beacon of hope for the natural gas industry in western Canada and expanding pipeline capacity will help to free up the industry from the takeaway constraints that have plagued it the last few years. This stock has required the patience of Job to hang on to or perhaps the stubbornness of a mule but some day it may reward its believers.

In stark contrast to Essential, Omnicom is a rock-solid member of the portfolio. One of the largest ad agencies in the world, they could benefit from the shake-up in the advertising business and the move towards online and social media marketing. Customers may be looking for increased hand holding through this confusing transition. Profits doubled during the last business cycle and until proven otherwise, I would assume the same kind of performance this time around. Earnings have held up very well during the pandemic even as their travel, food service and leisure clients face major headwinds. Debt stands at around 1 times earnings and the stock trades at a relatively low 12 times 2019 EPS.

Melcor Development has also performed well during the covid crisis. The company has earned a profit every single year for the past 20 years and earnings in 2020 were modestly above the levels of last year. They have been expanding their operations in Colorado which offers them an interesting avenue for future growth. The stock is trading at a third of book value, low even for them. Housing is hot right now and the wave of millennials entering their prime home buying years coupled with downsizing boomers and a shift towards work from home may keep things running hot for awhile.

Teck Resources and Enerflex both offer exciting potential in the years ahead. Teck is building the massive Quebrada Blanca copper mine in Chile that could one day become one of the largest in the world. The wave of electric vehicles expected to roll off the assembly lines in the years to come are going to require massive amounts of copper to keep the current flowing and Teck will be one of the important players in this sector. The $3 trillion infrastructure bill being bandied about currently could boost demand for steel and keep their steel-making coal operations churning out the profits as well.

All those electric vehicles are going to use a lot of juice. Companies like Enerflex, a key player in the natural gas sector, are going to be needed to help supply that juice. One of the avenues of future growth that Enerflex seems most excited about is their B.O.O.M initiative. Build, operate, own, maintain. The gist of this seems to be that instead of just building gas fired power plants for their clients, they will take an ownership stake in these plants and help run them after being built. This will provide ongoing revenue and a more stable and predictable revenue stream. They’ve been building these projects around the world, in South America and Africa and I’m excited to see what they might do with this concept in the years to come. With the collapse in the American shale sector last year, business dried up and earnings took a hit, but the company has remained modestly profitable and trades at only 4 times 2019’s record earnings. Even a partial recovery in this sector should result in better days ahead for Enerflex.

Finally, I feel that Linamar has one of the most intriguing growth profiles of the group. Sales at this company tripled over the last business cycle and I think a repeat of that performance could be in the cards. This company is about more than just auto parts. Their goal is to become a leading diversified manufacturer and they are well on their way to achieving this goal. Their Skyjack division is the world’s largest manufacturer of scissor lifts and has its sights set on expansion in China where worker safety is becoming an increasing priority. Their MacDon agricultural equipment division is enjoying strong sales and earnings in North America but management sees the opportunity to quadruple the size of this division by expanding into Europe and South America. They started up a new medical/aging division to target this important and growing sector and will be shipping their first MRI equipment this year. They also see opportunities in renewable energy and water infrastructure. Meanwhile, their core transportation division is going strong after a temporary disruption during the early part of the covid crisis. 1/3 of new orders have been in the electric vehicle space and they see many future opportunities in the hybrid, fuel cell and EV space. They also see opportunities to expand beyond passenger vehicles and are currently testing out a new electric delivery vehicle for UPS.

Looking To The Future

While the short term still looks uncertain as countries continue to do battle with this wretched virus and there will no doubt be challenges to overcome in the months ahead, I am excited by the quality of the companies I own in the portfolio, by their relatively cheap prices, especially when compared to many of the more speculative names out there, and by the opportunities for growth that I see as we move forward into what may be the dawn of a new business cycle.

Full Disclosure: I own shares in Foot Locker, Genesco, Casa Systems, Omnicom Group, Teck Resources, Cervus Equipment, Enerflex, Essential Energy Services, Linamar, Melcor Developments and Hammond Power Solutions.