I make a few changes to the portfolio and take this opportunity to complain about value traps some more.

Impending Doom Or Green Shoots?

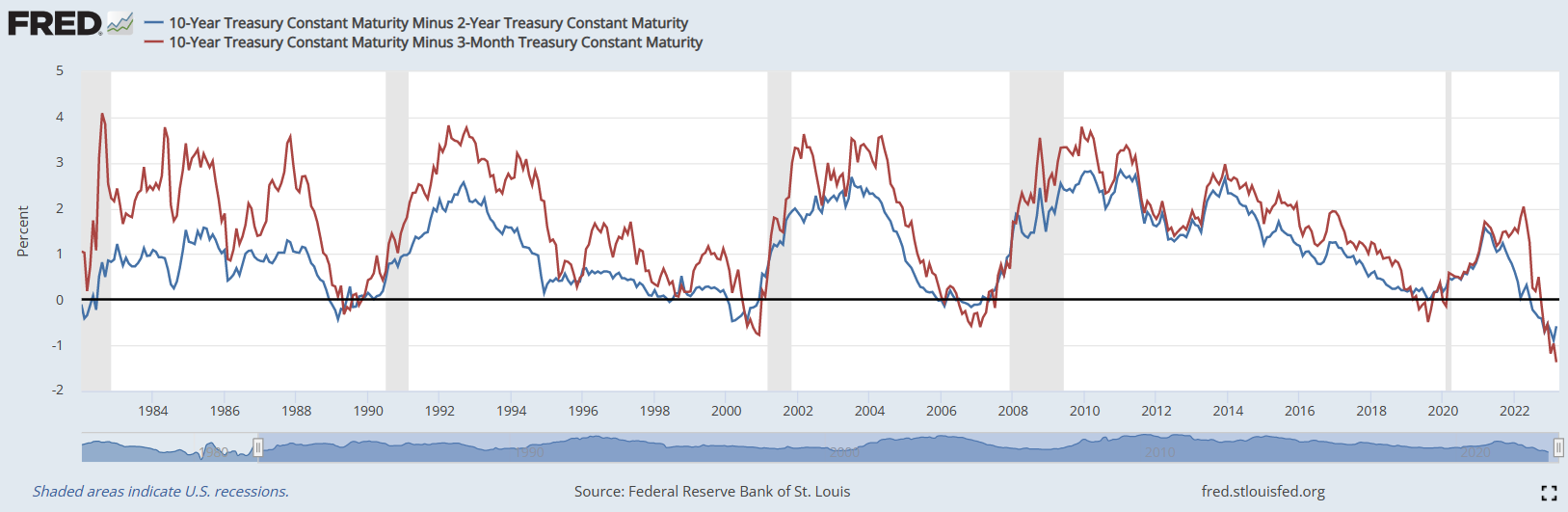

The yield curve is telling us we are going to have a recession later this year…

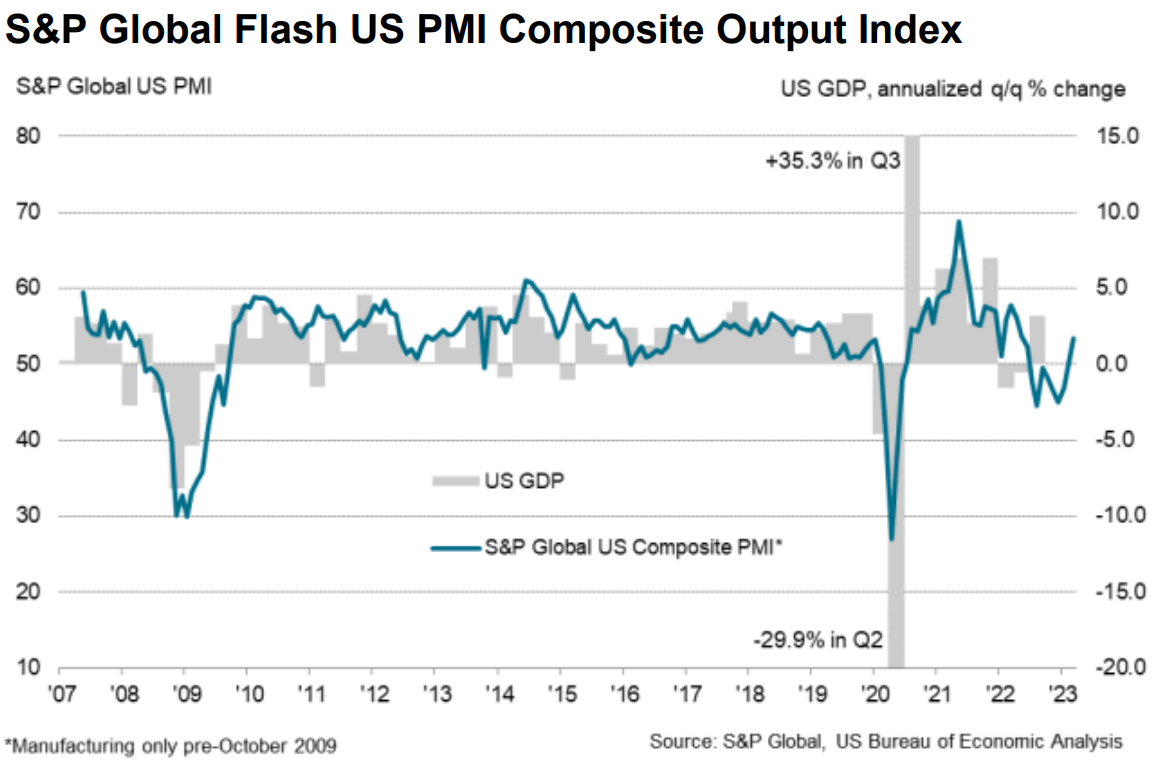

But the Purchasing Manager’s Index is telling us the worst is already behind us…

If we do end up having a recession this year it will be one of the most widely anticipated recessions of all time. And perhaps it will be a doozy. And perhaps it will crash the market. But in the meantime, the leading economic indicators have started to tick back up. They are signalling that a recovery is in the cards, not a continued downturn. And in conference call after conference call this is what corporate America is forecasting as well: a crappy Q1 followed by a not quite so crappy Q2 and then a fun and friendly return to growth in the back half of the year.

If the optimists have it right, then now is not the time to turn tail and run. Now is the time to stare danger in the face and load up our portfolios with lots of beaten down cyclical goodies. If instead, the doom and gloomers have it right, then we are careening inexorably towards a repeat of the 2008 financial crisis. The recent bank failures are a shot across the bow and the best thing to do is to not fight the fed. If the fed is intent on trying to kill inflation by seriously wounding the economy first, then best not to get in its way.

Obviously the two scenarios are incompatible. As investors we’re always trying to thread the needle between a range of possible outcomes. It’s no different this time.

High Tide

What is different this time is the degree to which company results are still being distorted by the pandemic. I just spent the last couple of weeks reviewing companies’ fourth quarter earnings. It was a challenge. To my eye, there are still value traps everywhere I look. Many companies, industries and sectors are reporting monster profits, far above what they were managing before the pandemic started.

Anytime I see a company that has been uncharacteristically successful over the past 2 years a red flag immediately gets raised. I blogged about the profusion of value traps back in my October portfolio review. Most of these value traps are still with us. Some have gotten even more extreme.

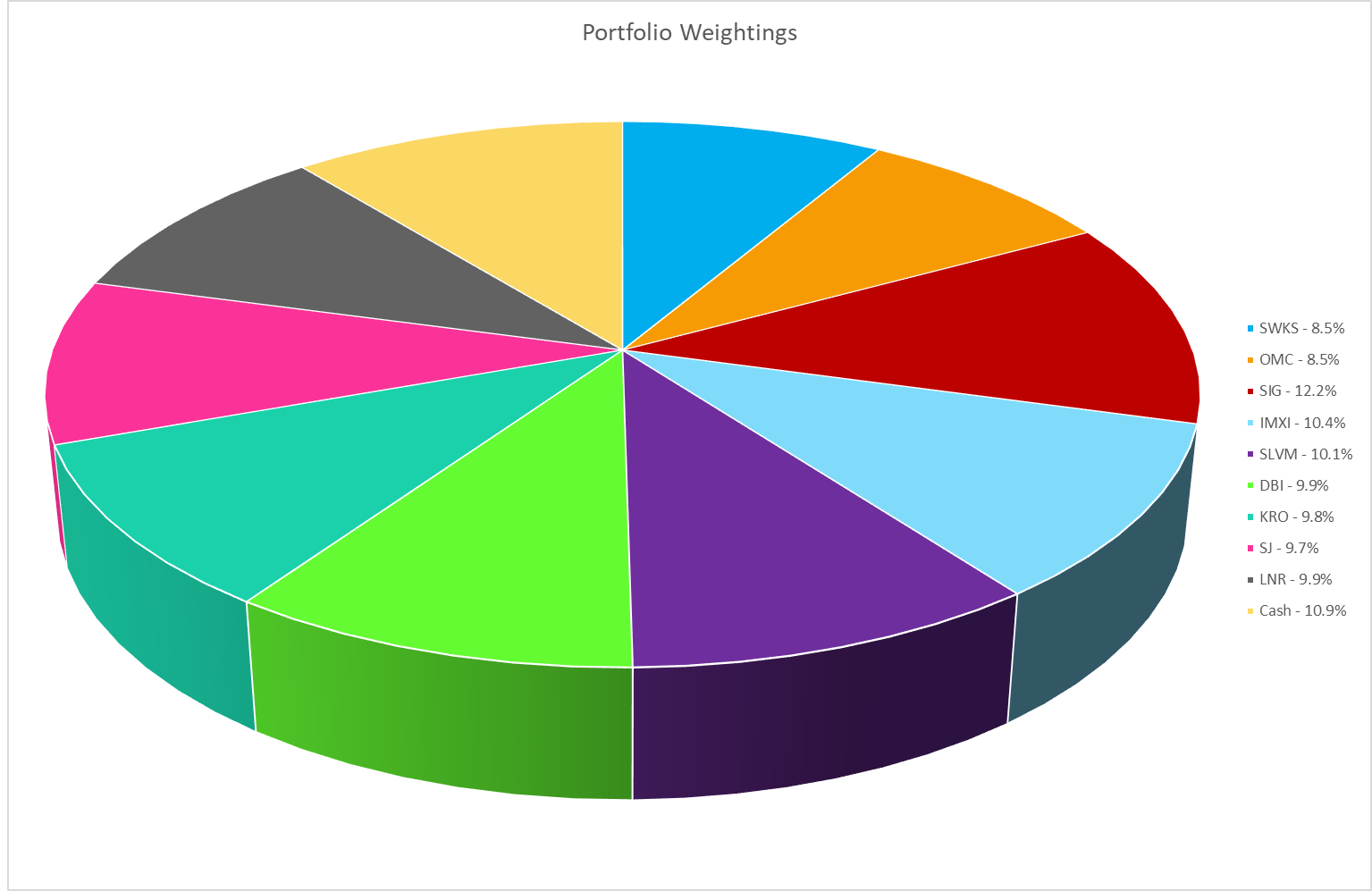

The pandemic distortions began in the retail and consumer products sectors. People rushed out to spend their stimmy cheques and supply chain disruptions meant the stuff wasn’t there to buy. Elevated demand, constrained supply. That’s economics 101. Selling prices shot through the roof and the retailers minted money hand over fist. This lasted a couple of years, but the tide is definitely ebbing in the retail sector right now and we are starting to see who was swimming naked. I’ve snapped up a couple of companies in this sector (Signet Jewelers and Designer Brands) that I think offer excellent value against lowered expectations. I’m keeping my eye out for more opportunities in this sector as babies get thrown out with the bath water.

But the pandemic gravy train didn’t stop with the retail sector. With a lag, it moved on to the companies that provide the under-pinnings of the economy. The trucking and logistics companies, the domestic manufacturers, the distributors, the semiconductor and technology companies, the home builders. The same elevated demand/reduced supply dynamic has hit all these sectors as well. The ball really got rolling in the second half of 2021 and has picked up steam throughout 2022. Sales have jumped as companies found they were able to dramatically jack up their selling prices, often much more than the rise in their underlying costs would have warranted. As a result, profit margins (earnings as a percent of sales) soared. Higher sales and higher margins on those sales combined to produce record earnings at company after company.

As I worked my way through fourth quarter results over the last couple of weeks, I kept seeing this pattern repeat over and over again. A company with a long history of mediocre performance suddenly experiences a turn of fortune starting in Q3 or Q4 of 2021 and goes on to deliver uncharacteristically strong growth in 2022. Reading through the earnings releases and conference call transcripts, whenever I saw the phrase “selling price increases” alarm bells would start to go off. Occasionally companies would break down their revenue gains between the amount of the increase that came from raising their selling prices and the amount that came from actually selling more stuff. Typically, increasing the price of their widgets had accounted for the vast majority of their revenue gains. The actual number of widgets they had sold often hadn’t increased that much. Which meant that their overhead and selling costs stayed relatively fixed while their revenue shot up. That’s a recipe for unusually fat profit margins and a big boost to the bottom line. Of course, management typically took full credit for this profit-friendly state of affairs. They would say their strong results were due to the “hard work of their employees” and the strategic choices management had made. Yeah, right. It was the rare company that hinted that these selling price increases were shamelessly opportunistic, had everything to do with the unusual business environment we are in right now and are likely to be temporary.

We’ve just seen how this story ends in the retail sector as well as in other isolated pockets of the economy like the lumber and forestry sector. I heard a good comment by a guest on one of the many financial podcasts that I’ve become addicted to. He said that he’s never seen a shortage that didn’t eventually end in a glut. I think that same dynamic is going to play out over the coming year or two in many of these companies that are flying high right now.

And so I’ve been striking these high flyers off my list. I’ve been ruthless in my skepticism. Any company that has enjoyed a sales boost and record profit margin gains over the past 2 years gets absolutely no credit from me for a continuation of those results. I’ve been assuming we eventually do a complete round trip with sales falling back to pre pandemic levels (once adjusted for inflation and previous growth trends) and that profit margins likewise retreat to pre pandemic levels. This eliminated many companies from consideration that on the surface looked quite attractive because of their low p:e ratios relative to bloated 12 month trailing earnings and high recent growth rates.

In tarring all these companies with the same brush, I am probably throwing my own fair share of babies out with the bath water. Some of these companies may have other, very legitimate and more sustainable reasons for their recent success. But until the tide turns, I won’t know which ones those are. As always, I’m erring on the side of caution.

Harvest Time

This skeptical outlook led me to sell two of my existing holdings: Preformed Line Products and Hammond Power Solutions. Both of these companies were lucky enough to get on board the pandemic gravy train and both have ridden it over the past year to record high earnings. Their share prices have followed the elevated profits higher. Preformed has doubled from where I bought it last spring and Hammond is up by a whopping 6 times what I bought it for earlier in the pandemic!

The same dynamic of robust demand and constrained supply in the electrical power paraphernalia sector let these two companies jack up their selling prices more than the increase in their underlying costs really justified. The result has been high profit margins and record high profits. I’m applying the same conservative treatment to these two as I am to the myriad other companies that are showing the same pattern. I’m taking sales and earnings back down to pre-covid trend lines and deciding that the current share price represents a fair value to those more conservative future earnings expectations. Never one to overstay my welcome, I decided to take my profits off the table before I am left holding the bag.

Which left me searching for some replacements. Unsurprisingly, given my level of skepticism right now, I didn’t come up with much. Because I’m excluding any company that has been uncharacteristically successful over the past year or two, by process of elimination I’m therefore concentrating my attention on the companies that have been the least successful. Which seems deliciously contrarian.

A World In White

This review of the least successful companies led me to my new pick, Kronos Worldwide (KRO.NYSE – $9.21). On the face of it, things don’t look great for Kronos. This company makes titanium dioxide, a white pigment found in pretty much everything from washing machines to sunscreen to laminate flooring to (unsettlingly, since it’s a known carcinogen) food and pharmaceuticals. (On a sidenote, by complete coincidence, no sooner had I finished buying this stock last week than a news item popped up on my news feed saying that California was considering passing a law banning the sale of Skittles and other offending candies in the state because they contained TiO2. What with it being a carciniogen and all. Apparently Europe passed the same ban years ago. I decided this new piece of information did not derail my investing thesis.)

Because it’s so ubiquitous, this magical pigment is often used as a bellwether for the global economy. Looking back over the last 20 years, Kronos’ earnings performance has closely followed the ups and downs of the economy. It may be telling then that they swung to a loss in their most recently completed fourth quarter. This was their first quarterly loss since the beginning of 2016 and has helped drive the company’s stock price down as investors anticipate more of the same.

The company owns and operates plants in Europe, Canada and the US. The economic weakness in Europe this fall was what dragged down their results. Weak demand coupled with sky high prices for the natural gas used to power their factories led them to shut in production. As we move into 2023, it would be quite reasonable to expect that things may get worse before they get better, although the company says it is seeing some green shoots appearing in the European market.

Long term, this company has been stagnant. Once you adjust for inflation, this company has not grown its book value at all over the past 20 years. The majority of shares are owned indirectly by the heirs of a deceased patriarch. As minority shareholders, we are definitely not in the driver’s seat on this one. We are simply along for the ride. TiO2 is a commodity product. There is nothing proprietary in what Kronos does and they are the world’s fifth largest producer of this stuff. Meaning there are four other producers who are bigger and meaner than they are. Finally, the company’s plant in Canada has been hit by labour problems in the past. A number of years back, those pesky socialist Canadians went on strike and were partly responsible for producing one of only three years in the last 20 that this company lost money.

That’s the bad news out of the way. As I said, I’ve been focusing on the unsuccessful companies. So far, this company seems to fit the bill. But there are some redeeming features here as well. As I mentioned, the company has actually turned a profit in 17 out of the last 20 years. For the producer of a commodity good, that’s a pretty respectable performance. There are a handful of other TiO2 producers out there that are also publicly traded. They all lost money as well in the most recent quarter, so Kronos’ recent troubles are an industry wide thing, not a company specific issue. The stock is, of course, cheap. I wouldn’t be looking at it if it wasn’t. But what really pulled me in was the dividend.

I am typically not a dividend investor. I prefer to focus on earnings. I don’t care how a company apportions those earnings. A dividend is fine. So are share buybacks. So is making a well considered acquisition or using the money to build a new factory or open new stores. All worthwhile uses for those profits.

But here, we have a company that is very much focused on dividends to the exclusion of pretty much everything else. Which makes sense if the company is being run for the benefit of a family trust. All those heirs apparent need a steady dividend to finance their lifestyle of caviar and champagne. As I pointed out, book value has not grown in 20 years. But nor has it shrunk. The company seems to be retaining just the right amount of earnings to keep its factories up to date and running at a consistent level. Everything else has been paid out as a dividend.

Valuing this then becomes reasonably straight forward. If you give the company the benefit of the doubt and assume that they will be able to pull off the same performance over the next 20 years as they have over the last 20, then you just need to look at the dividend and decide what yield you’d be happy accepting.

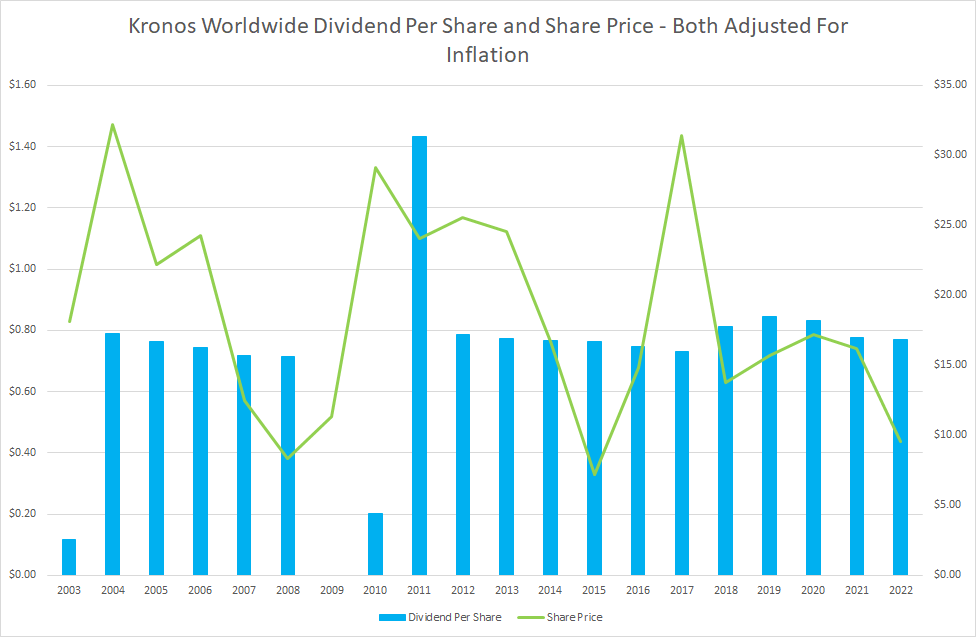

Here is a graph of the dividend per share and the stock price both expressed in 2023 dollars.

As you can see, the dividend has been remarkably consistent, while the stock price has moved schizophrenically up and down as the market blows hot and cold. There was one year, 2009, that they halted their dividend because of losses that year but then in 2011 they paid an extra large dividend to compensate. In current dollars, the dividend has held very steady at 76 cents per share. At Friday’s closing price of $9.21, this gives the stock a dividend yield of 8.2%. If the next 20 years plays out like the last 20 did, that means you’re getting an inflation protected return of 8.2% on your money.

That seems like a good deal. All you have to do is potentially put up with some discomfort for the next year or so if the global economy really heads into the toilet. You also have to accept that the next 20 years may not be a repeat of the last 20 and changing circumstances could mean you don’t get the returns you were hoping for. Maybe you can commiserate with the heirs over a glass of Chardonnay on the deck of their repossessed yacht. On the other hand, you might not have to wait 20 years for the market to take a renewed interest in this company. You can’t get an 8% inflation protected yield many places these days. If investors pile back into the stock, you could exit much earlier for a quick double and put your money to work elsewhere.

Staying Hungry

So one chunk of cash successfully redeployed. That still leaves me with another chunk that’s looking for a home. After looking carefully at the menu, I decided to go home hungry. Hara Hachi Bu as the Okinawans would say (“eat until you are 80% full”). In conference call after conference call, company executives have been forecasting a challenging Q1 coming up. It sounds to me like we will finally be getting some insight into which companies will be seeing their covid era profits disintegrate and which won’t. The fallout from that may provide some opportunities and I don’t mind having some extra cash on the sidelines to take advantage of that.

My plan is to put the portfolio to bed and revisit it in June after Q1 results have been released. Until then, tell your friends to load up on Skittles while they still can.

Full disclosure: I own shares in Kronos Worldwide. I do not own shares in Preformed Line Products or Hammond Power Solutions.