Portfolio alumnus Medifast returns to the fold, replacing takeover target Hibbett.

If At First You Don’t Succeed…

I first bought Medifast stock (MED.NYSE) for my portfolio back in the fall of 2019. My initial write-up on the stock can be found here and offers a good overview of the company. The gist of it is that this is a direct selling company that offers weight loss management plans through its army of independent, home-based coaches.

When I first bought in to this story, the company had been doing very well with a new program they called OPTAVIA. Profits were up and the company was growing quickly.

Then the covid virus appeared, the stock market tanked and I ended up selling this stock for ammunition. Overall, I’m very happy with the way I stick-handled the portfolio through the whole covid debacle, but with 20/20 hindsight, there were a few things I might have changed.

One would have been to hang on to my Medifast stock a while longer! I sold this holding early on in the pandemic, looking to raise cash for other bargains I saw appearing. As it turns out, I missed out on a fairly spectacular run.

I sold the stock at around $75 a share in March of 2020. From there, the stock went on to hit a high just north of $300 as they doubled the number of home coaches in their network and as people, stuck at home and anxious about their health, signed up in droves for Medifast’s weight loss programs.

But as with so many companies and so many industries, this initial covid driven boom led to an eventual post covid bust as coaches exhausted their network of family and friends and life gradually returned to normal. Revenues started to fall and profits followed suit. The stock price gave back all of its gains and then some.

Against this already challenging backdrop a new threat to the company emerged. A class of weight loss drugs called GLP-1 agonists (Ozempic, Wegovy, etc.) stormed onto the scene. These offered the promise of significant weight loss without all that unpleasant hunger pain. More coaches signed off. From a network of 30 000 coaches pre covid, to a count of more than 60 000 at the peak, the company is now back to around 38 000 coaches in its network.

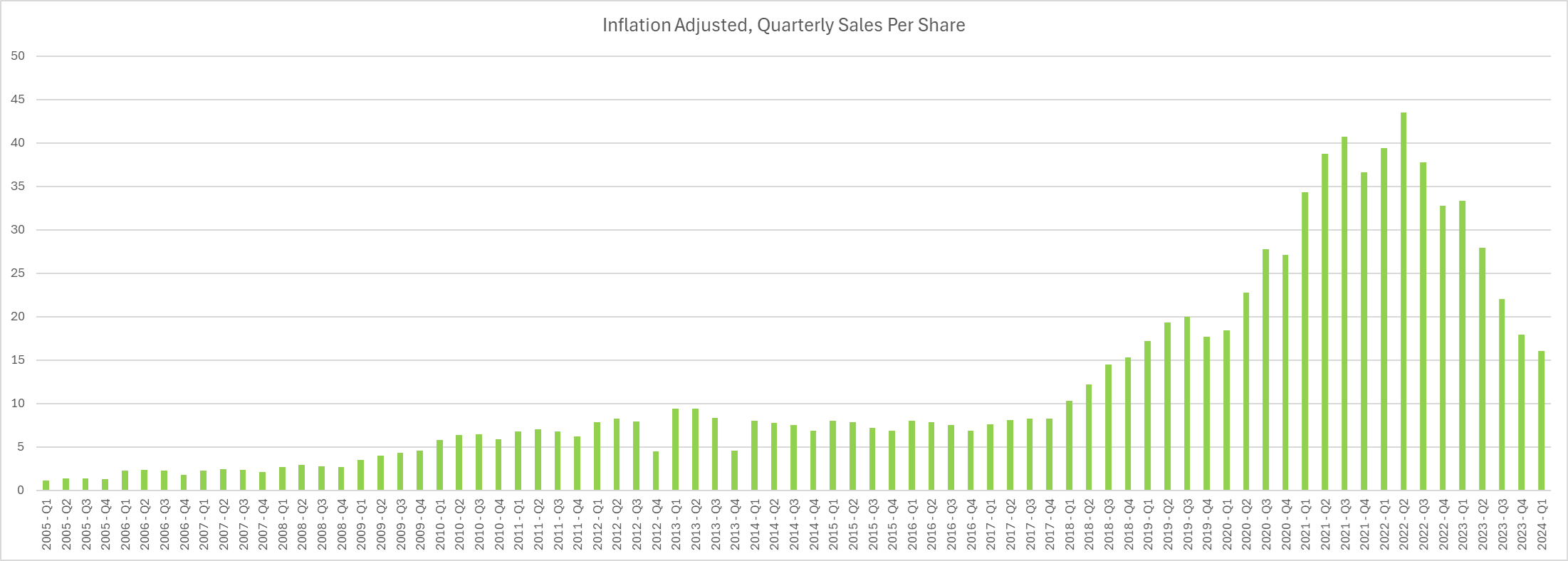

This graph of inflation adjusted, quarterly revenue per share tells the story…

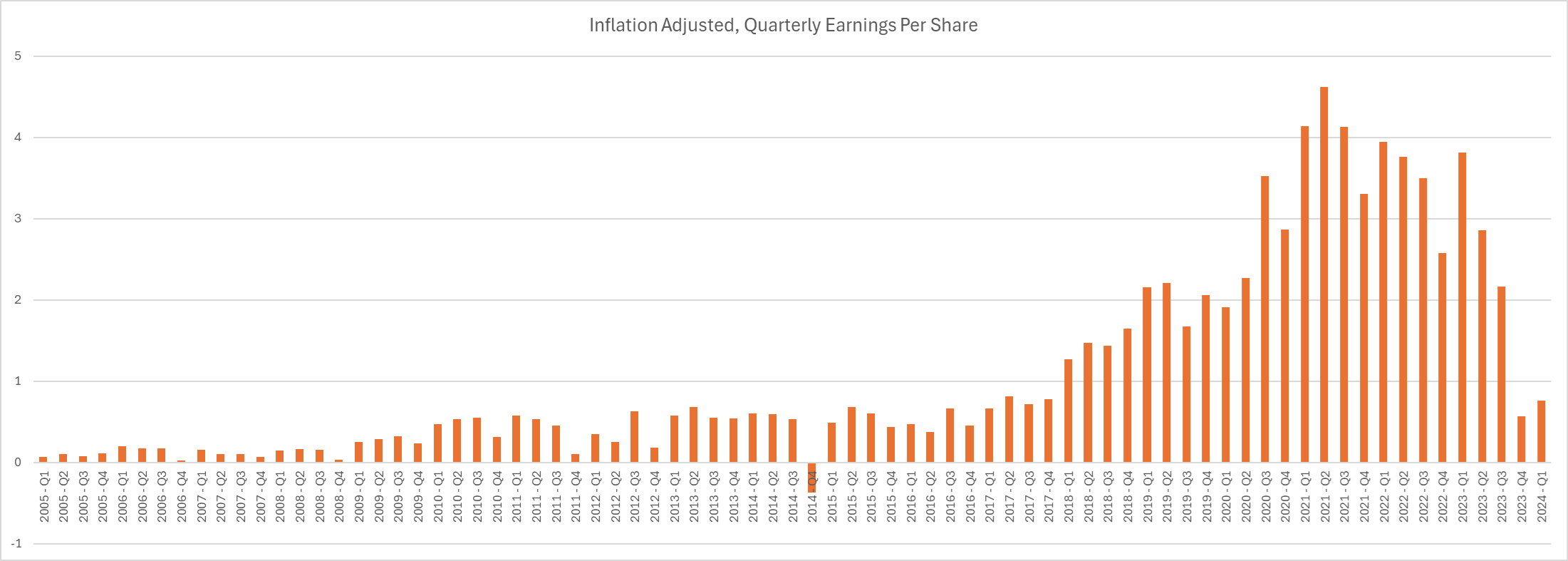

Profits followed revenues first higher then lower…

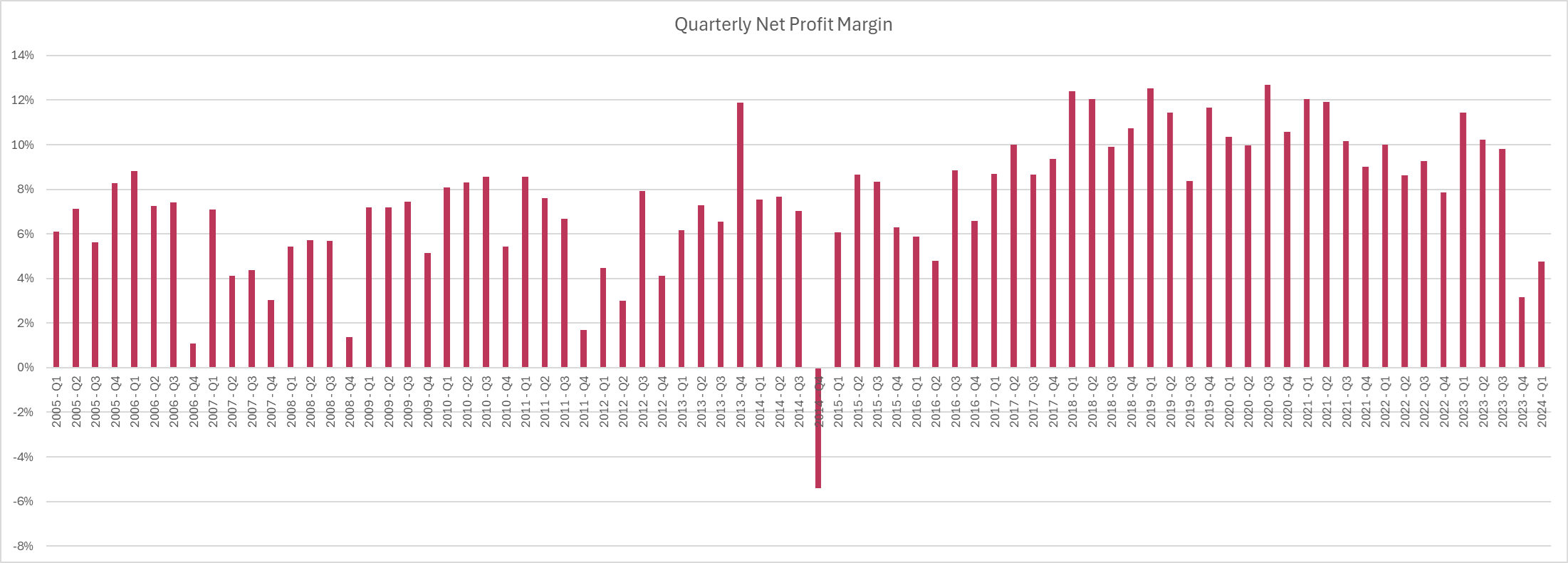

And the stock price did the same…

Second Chances

This is where I re-enter the picture. Looking at the graphs above you can see where we stand now. Revenues have come way down from their covid era highs and are back to roughly where they were before the whole covid fiasco began. The way I read the tea leaves, it looks to me like the plunge in sales is levelling off and I am hoping the company can maintain sales at about the current level going forward.

Profits have really taken it on the chin in the past two quarters and company guidance is for them to deteriorate even further in the coming quarters. I suspect what is happening is that the company expanded operations during the covid boom and is now having to cut back as coaches exit the system. I suspect there is a disconnect there and that it will take a number of quarters before the company can trim the fat enough to re-adjust to their diminished revenue stream and recover some of those lost profit margins. The advent of the GLP-1 weight loss drugs may be playing a large role as well in the declining margins and this may be more of an existential threat.

Prior to the revamp of its operations and the launch of the new OPTAVIA program, the company was earning a profit margin of around 5-6%. The introduction of OPTAVIA in 2016 revitalized the company and sent profit margins up to the 10% range. They continued to enjoy these high margins through the covid boom years but in the past two quarters, the heavy decline in revenue and the competition from the GLP-1 drugs has caused profits to crumble.

What level will sales and profitability finally settle out at after this period of massive disruption? Will the company even be able to stay profitable at all? Unfortunately, I don’t have those answers. So I am left to speculate.

Pick A Door

I have three broad scenarios in mind for how the future might play out. Scenario #1 is that sales level off around the current level of $15 per share per quarter = $60 per year. That would put sales back where they were before the whole covid mess began. A profit margin of 4% on that, which is what the company earned in the most recent quarter, would give EPS of $2.40 and a p:e of 10 at the recent $24 share price. If this was as bad as things got, that kind of valuation would offer good value and would certainly justify the purchase of the stock at this price.

Scenario #2 is more dire. In this scenario, coaches continue to abandon ship and revenues continue to fall. Profits vanish. The company struggles to find its meaning in life. Fortunately, in this not inconceivable scenario, all is not lost because the company has an ace up its sleeve. It is blessed with a large cash hoard and zero debt. They are planning a large advertising and marketing campaign this fall, but even after taking into account the $30 million they plan to spend on that, they should still have about $12 per share left in cash and investments. That provides a nice floor under the stock price and gives the company quite a bit of breathing room to play around with alternative strategies and see if they can salvage their business. At the very least, they could use this money to acquire another, more viable business, and run with that instead.

Scenario #3 is the one I like best. In this Wayne’s World style, mega happy ending, the company gets back on its feet. It adjusts its overhead expenses to the smaller headcount and gets its profit margins back up to the 10% level it was enjoying immediately pre covid. Sales plateau at the current level and then start to grow again. A 10% profit margin on sales of $60 per share would give EPS of $6.00 which is about what the company made, on an inflation adjusted basis, back in 2018 and 2019, before all hell broke loose, so this doesn’t seem like that much of a stretch. An average growth p:e of 20 on EPS of $6.00 would give you a share price of $120, a 5 bagger from current levels.

So… substantial upside and a downside protected at least partially by a large cash cushion (as well as a long and successful operating history). That’s the kind of asymmetric risk/reward relationship I love.

If You Can’t Beat ‘Em, Join ‘Em

This company has re-invented itself in the past and it is in the process of doing so again. They have partnered with LifeMD (also publicly traded), a company that offers telemedicine services nationwide, to offer their clients a combined package that includes a GLP-1 prescription along with Medifast’s coaching and support and supplemented by some protein booster products.

With any rapid weight loss regimen, significant muscle loss can be a big issue and the same has been seen with the GLP-1 drugs. So combining a GLP-1 drug with some protein supplements makes some sense. But more than this, surveys show that patients want more than just a prescription; they want coaching, advice and support. Medifast coaches have been giving this kind of support for years, so it is a natural fit. They are training their coaches now and will be launching the new LifeMD collaboration in the coming quarters.

Coinciding with this, they plan to spend $30 million of their $150 million cash hoard this fall on a big marketing push. This will likely result in an outright loss in the upcoming third quarter as they expense those marketing costs, but the hope is that these two initiatives will set the stage for a return to profitable growth in 2025.

It is in anticipation of this turnaround that I recently bought a full position in Medifast stock, selling my holding in Hibbett to fund the purchase. The recent takeover offer for Hibbett by JD Sports made it the obvious choice for source of funds and gave me an easy exit.

There is a great deal of uncertainty around Medifast stock right now. Its business is in flux and it remains to be seen if they can find their footing in this new drug enhanced weight loss environment. Conditions are likely to get worse before they get better and timing the bottom of a potential turnaround is always difficult. But if they can adapt to the new reality, they could not only stabilize their operations, I think they might even be able to prosper and thrive in the new environment. If they can pull that off, the upside is considerable and in my opinion makes this a risk worth taking.

Full Disclosure: I own shares in Medifast. I do not own shares in Hibbett Inc.