Back the truck up.

Signed, Sealed and Delivered

C.H. Robinson (CHRW – NASDAQ) is a global logistics company, moving goods around the country and around the world by truck, ship, air and rail. If you need a pallet of rubber chickens shipped from a factory in China, Mexico or Milwaukee to your warehouse in Atlanta, these are the guys you call. They don’t own any of their own trucks or container ships but instead rely on a network of thousands of independent carriers to do the job for them. They help their customers navigate the complex global supply chain, coordinating deliveries using their advanced technology platform and their global network of brokers. Of their 15,000 plus employees, over 900 of them are devoted to developing and maintaining their software system which offers data analytics, optimized routing and AI aided ordering (converting messy faxes into automated entries).

With an $8 billion market cap, this company is a major player in what they say is a fragmented industry. With a 15% market share, there is still room to grow. Increasingly complicated supply chains and shifts in the industry and in technology offer both challenges and opportunities. Their customers are mainly in North America, but they coordinate incoming goods from around the world. A quarter of their profit comes from their ocean shipping division while most of the rest comes from their trucking operations in North America.

Their asset light model has meant that they have been able to grow at above average rates for many years while at the same time paying shareholders a generous dividend. They weathered the recessions in 2001 and 2008 very well and since going public in 1997, have never had a money-losing year.

But covid is giving them a run for their money. After enjoying a bonanza at the height of the supply chain disruptions in 2021 and 2022, the trucking industry has been caught in a historic downturn. Companies are overstocked and have been trying to sell down their bloated inventories for over a year now. Until they finally clear this excess inventory, demand for new goods to fill their shelves is going to be weak. At the same time, the initial scorchingly hot demand for trucking and shipping capacity at the height of the covid frenzy meant that both trucking and shipping companies overbuilt. The combination of weak demand and over-capacity is a very nasty combination. Trucking companies say they are in an elongated trough and as of year end 2023, C.H. Robinson did not see any immediate end to the pain. The old CEO and CFO have hit the road and a new management team has been put in place to try to right this sinking ship.

All of which could spell opportunity. It’s always darkest before the dawn and I am hoping that the prevailing gloom has offered up the chance to buy into a very good company at a reasonable price.

To get a handle on an appropriate valuation, I can start by looking at their past record. In the 6 years before covid, the company sported a trailing p:e ratio that fluctuated between 18 and 24. In the current environment, the average small cap stock in my universe is trading at a p:e of 21 and the average large cap stock is trading at a p:e of 24. Those numbers give me an idea of the kind of valuation I’m shooting for.

Currently, the stock is trading at around 24 times trailing earnings, right in line with the kind of numbers I highlighted above. But I think by any reasonable assessment, we’re dealing with heavily depressed earnings right now, so that trailing p:e is quite misleading. Instead, I think it’s reasonable to assume an eventual sales and earnings recovery at this company that would make the current share price look much more compelling.

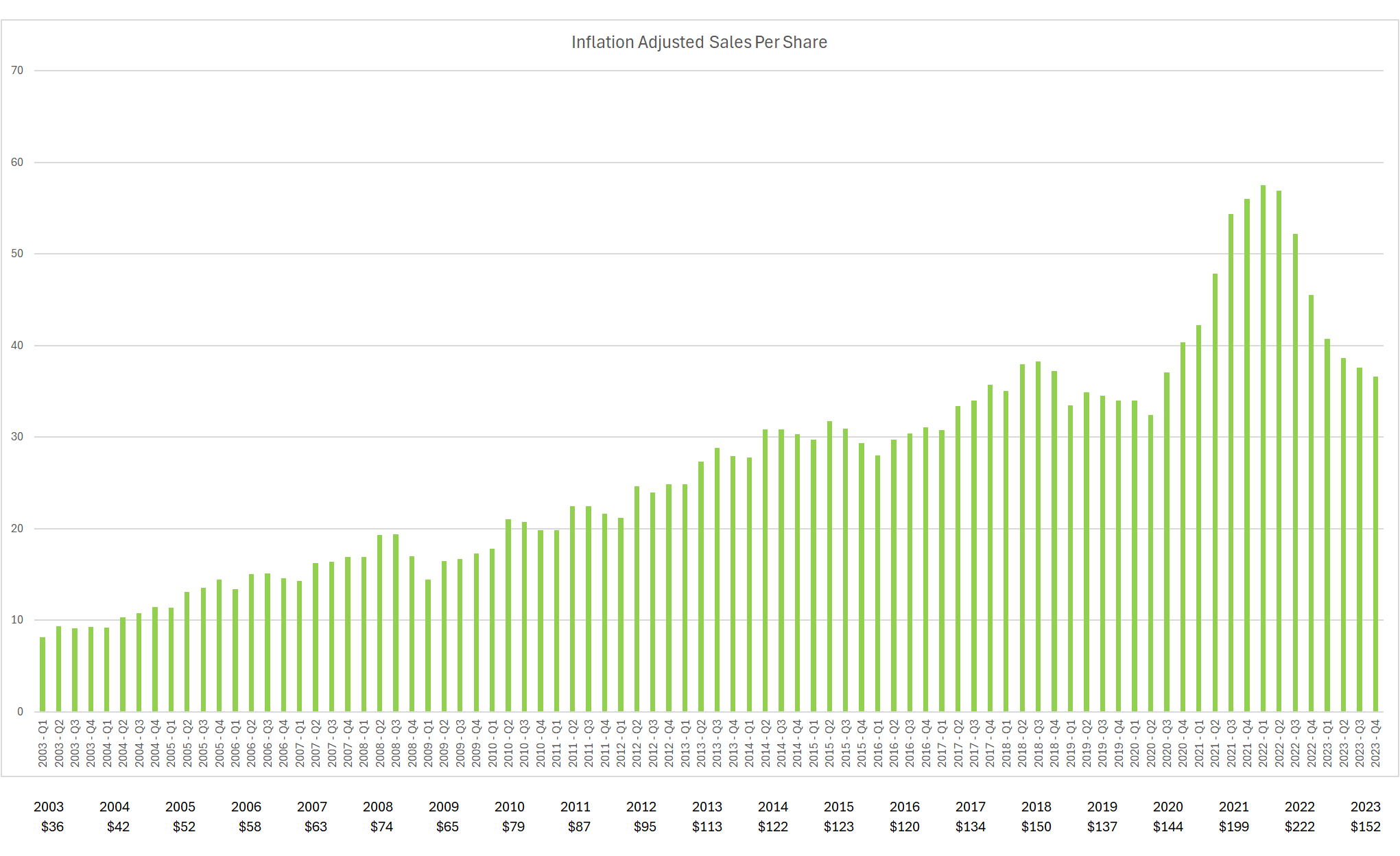

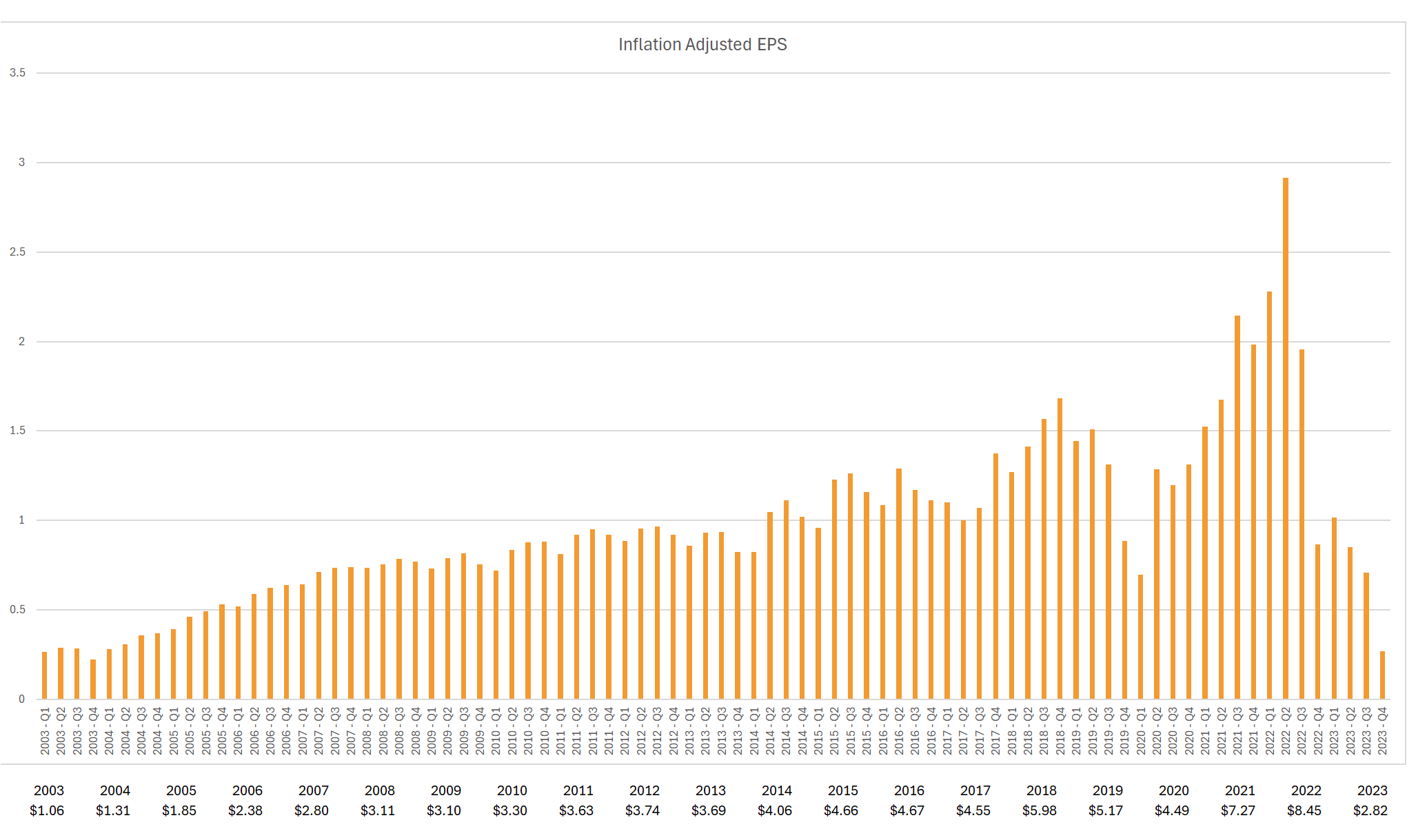

To put things into context, here are graphs of the inflation adjusted quarterly sales and earnings per share at C.H. Robinson going back 20 years…

Making History

Many actors in the trucking industry are calling the current situation a decline of historic proportions. I’ve played around with the numbers above, making various assumptions and extrapolations and every time I do, I come up with a slightly different estimate of where I think future results are headed. But they are all invariably higher than what we are currently seeing.

At the low end, we have 2019, pre covid, inflation adjusted EPS of $5.17. That would assume no progress has been made in the intervening 5 years. I think that’s being too pessimistic, but even so, at the recent share price of $68, that would give a p:e of 13.2 which still represents pretty darn good value in today’s market.

At the high end, if we take pre covid sales numbers and extrapolate them forward using historic rates of growth and then apply a pre covid average profit margin to those sales projections, we could get all the way back up to EPS of $8.00, similar to the levels the company enjoyed in 2022. Using that number gives us a p:e ratio of only 8.5. Even better.

That’s really the beginning and end of my investment thesis. This is a good company, with a very solid long-term track record. Debt levels are modest. They have continued room to expand and grow their market. They’ve fallen on hard times lately but so has the entire industry. I don’t know how long it will take the industry to work though the dislocations caused by covid. I don’t know to what extent sales and earnings will recover on the other side of this downturn. The market seems to be saying there will be no recovery, that this is as good as it gets. I think that’s overly pessimistic. My outlook is a good deal more cheerful than that and so I see value here where others might not.

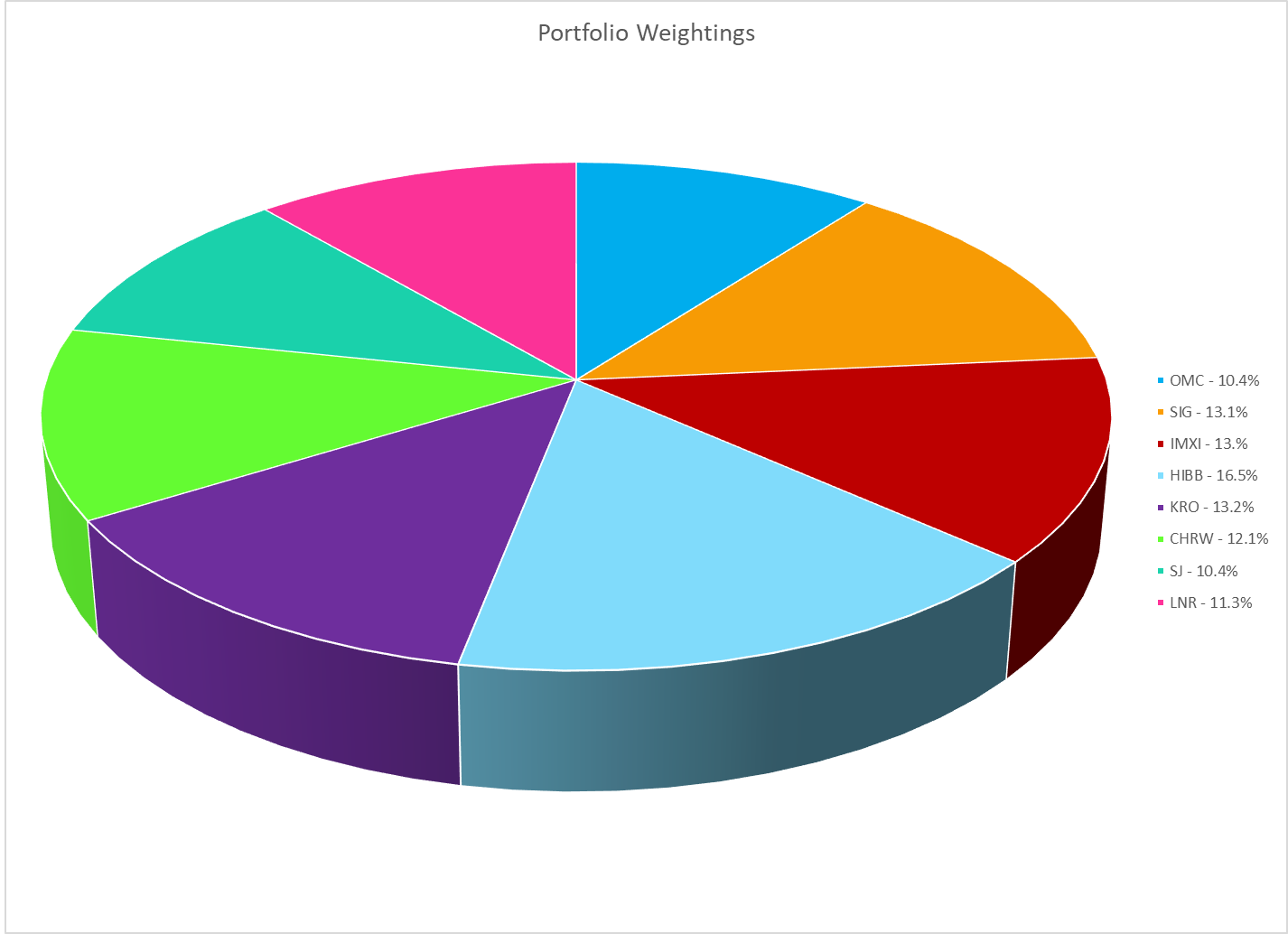

I used the cash I raised from selling Sylvamo late last year to fund this new purchase. It’s a full position in my portfolio and means I am now fully invested again.

Portfolio Review

I recently finished up a top to bottom review of year end results. At times I thought I might have a line on a few interesting new opportunities, but none of them stood up to close scrutiny. The market is a real mixed bag right now. Some companies, like C.H. Robinson have already succumbed to gravity and are paying a price for their covid era excesses. Many others though, are still riding high, enjoying record high profit margins. I continue to pass these by, assuming that reality will at some point intervene and profits will settle back down to earth. It means my universe of options is constrained, but so far at least, that doesn’t seem to have hurt my performance.

There are a number of stocks in the portfolio that are partway through their journey from deeply undervalued to what I would consider to be fairly valued. To be specific, Omnicom, Kronos and Stella-Jones. None of these three would be cheap enough to buy anymore if I were to come across them during a fresh review, but at the same time, none of them are dear enough to warrant selling just yet. Particularly since I did not come up with anything, apart from C.H. Robinson, that I felt was compelling enough to replace them.

And each of these three still holds promise. Omnicom Group has both the Olympics and an election year to look forward to. Both of these events have historically driven strong demand for advertising and marketing services. As well, Omnicom continues to work on its industry leading technology platform, exploring areas where it can add AI functionality.

Kronos had to refinance its debt recently at significantly higher interest rates. Admittedly this has lowered my long-range expectations for average EPS and lowered my target price to match. But the most recent quarter showed an encouraging improvement in their profit and loss. (No profit but less loss.) Like C.H. Robinson, I think Kronos is a play on the post covid inventory destocking and as this force winds down, I expect quarterly results to continue to improve. This is the part of the cycle when I want to be riding the momentum back upwards and I am trying not to bail out too soon.

Finally, Stella-Jones seems well positioned for a multi-year run as the electrical grid gets built out. They are making noises which suggest there may be some softness coming up in the next few quarters and the stock is not as cheap as it was, but I like the exposure to the grid strengthening macro trend so am content to hold the course until something better comes along.

I still quite like my two retailers, Hibbett and Signet. Signet keeps promising that those covid era couples will shake off their PTSD and start getting engaged. And Hibbett still looks really cheap. I went down to Tennessee for a hiking holiday with my family recently and we stopped by a Hibbett Sports store just outside of Knoxville. I was impressed by the offerings. This was definitely an upgrade over the somewhat sad and sorry store I visited at a decrepit strip mall in Pennsylvania a few years back. The word on the street is that their acquisition of City Gear has revitalized and breathed new life into this company and I see how you could make that case from the fresh looking inventory I saw on their shelves. This holding is my biggest position right now and I am happy to keep it that way.

International Money Express is another one of my favourites. The stock is deeply undervalued by my calculations. The only thing that might derail this thesis is if the company starts falling prey to the army of online money transfer companies that threaten its existence. They’ve successfully held their own against this onslaught up until now, but it’s something I have to keep an eye out for.

And finally, Linamar. What’s not to love? I took a look at a couple of other auto parts companies in this latest review but at the end of the day, they just weren’t as good as Linamar.

I’ll be looking at first quarter results sometime this May, June or July but I’m not quite sure when. My children have become annoyingly independent and it is awfully hard to plan my schedule around them. If I find something of note I will, of course, blog about it. Otherwise this may be the last you hear from me until the fall. If so, enjoy your summer.

Full disclosure: I own shares in Omnicom Group, International Money Express, Hibbett Sports, Signet Jewelers, Kronos Worldwide, C.H. Robinson, Stella-Jones and Linamar. I do not own shares in Sylvamo.