With a very aggressively positioned portfolio, I am charging full steam ahead into the new decade.

The End Of Stock Picking?

The rise of the ETF has led to some tough competition for aspiring stock pickers. In the days of the mutual fund, you could make a vey compelling argument for investors taking over the reins of their portfolios and choosing their own list of stocks to invest in. Why pay a stranger 2% a year or more to pick stocks for you when the vast majority of mutual funds ended up under-performing the market anyway?

But the ETF or exchange traded fund has changed the investing landscape. Now, you can buy a broadly diversified basket of stocks which are guaranteed to track the underlying market very closely for rock bottom fees of tenths of a percentage point. Buying a small handful of broadly diversified ETFs and then sitting back with a glass of wine and a good book is how most investors should probably be investing their money.

This fall, I travelled down to Washington DC for FinCon 2019, a gathering of financial bloggers and “influencers”. I came away struck by the degree to which passive investing has taken over the investing world. I managed to eventually find a few like-minded souls out there who were still buying their own stocks but for the most part, when I told people what I did with my own money I would get blank looks of incomprehension or worse, pity. Was I stupid? Or just hopelessly behind the times? Didn’t I realise that you can’t beat the market and that holding a basket of low-cost ETFs is the only sensible way to invest your money?

Admittedly, for most people, I think that is true. But I continue to hold on to the idea that with sufficient time and effort, there are still relative bargains to be found out there. The market and the “wisdom of crowds” is an incredibly efficient capital allocating machine and it is hard to find stocks that are mispriced enough to give you out-sized returns. Hard, but not impossible. There are still opportunities to be found, hidden deep in the weeds, and until my numbers show me otherwise, I will continue to hunt resolutely for those mispriced bargains.

Stuck in the Doldrums

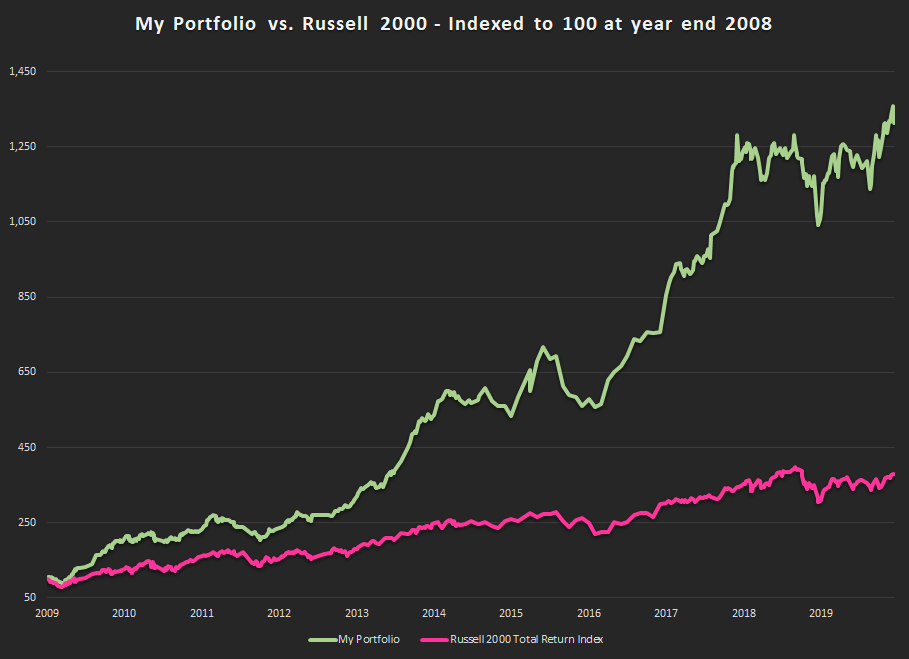

But I do watch the numbers. Specifically, I keep a keen eye on whether and to what extent I am outperforming the market. At the end of the day, it all boils down to that outperformance number. Over time, it has to be greater than zero or I am just wasting my time; I should park all my money in a broad-based ETF and call it a day.

Tracking your performance is sometimes easier said than done. The market is a chaotic place. Beating the market often means owning a portfolio that looks very different from the market. There are stocks I own that will soar to unexpected heights. There are others that will crash and burn. Month to month and even year to year, the trajectory of my ragtag group of undervalued stocks will meander above and below the market’s trajectory with occasional periods of brilliance interspersed with sometimes long periods of fairly uninspiring performance.

The portfolio is in one of those doldrum periods right now. Over the past two years, my portfolio has struggled to make much headway against the market. I’ve had some successes: Viemed Healthcare, Gluskin Sheff and Questor Technology were all bright spots. But I’ve also had quite a few setbacks: the punishing blows that my two agricultural dealership stocks took as weather and geopolitical events conspired against them, were a painful thing to watch.

Year to date, the Russell 2000 Total Return index of small cap stocks is up 24.1%. As chance would have it, my own stock portfolio, as of the close of the business day on Friday, Dec 13, is also up exactly 24.1%. While it’s hard to complain too much about a portfolio that is up 24% in 12 months, these numbers are somewhat misleading as they are being measured off a low point. The market took a big tumble towards the end of the year last year which offered up an easy comparison this year. More instructive is to look back over the past two years. From Dec 31, 2017 to the present, the market hasn’t made nearly as much headway. The Russell 2000 (dividends included) is up 8% over this time period while my portfolio has been bringing up the rear with a gain of only 6%.

That’s two years now of uninspiring relative performance. Is it time to pack up the bags and go home? Should I be searching google for “10 best ETFs to own in 2020”? I don’t think so. I’m not ready to throw in the towel just yet.

The PMI and I

Over the past 11 years, starting from the approximate bottom of the market on Jan 1, 2008, the performance of my portfolio has been very good. While the Russell 2000 has put in an impressive showing, gaining 12.9% per year (including dividends), my portfolio has done significantly better, gaining 26.4% per year and beating the market by 13.5% per year.

Despite this good showing overall, on three separate occasions over the past 11 years, my portfolio has gotten stuck, spinning its wheels in the mud. On each of those occasions I began to question myself. Even after playing this game for more than 20 years, I sometimes start to have doubts after a couple of years of zero outperformance. Is that it? Is the party over? Am I going to have to get a real job? Fortunately, my aversion to real work keeps me soldiering on and each of these periodic periods of zero outperformance have been followed by a burst of exuberance in my portfolio.

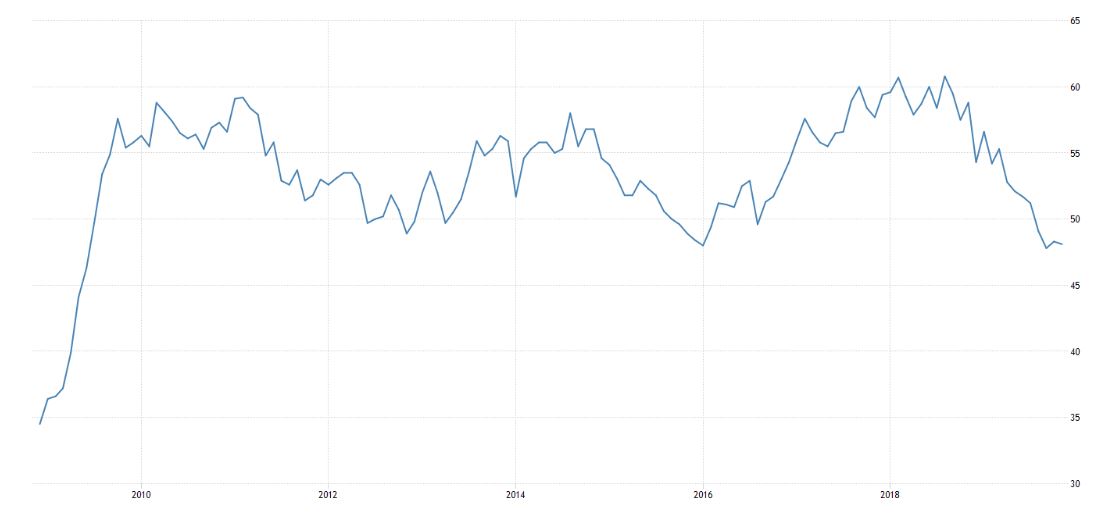

If I compare my portfolio performance graph to a graph of the ISM purchasing managers index (which roughly correlates with the level of economic exuberance out there), an interesting pattern begins to emerge…

The three recent instances of zero outperformance (and looking back further, similar periods in the early 2000’s and in 2007-2008) have occurred during slowing periods in the economy.

During the halting recovery from the financial crisis in 2008, there have been three periods in which the economy has slowed down and the possibility of another recession has been on the table. In each of these three periods, my portfolio struggled to make much headway against the market. I tend to take a fairly aggressive stance with my portfolio. I generally assume that things will get better and that beaten down stocks, companies and industries will at least partially recover. That out of favour stocks will once again find favour and that even boring companies can sometimes do very exciting things. This strategy pays off well when times are good, but doesn’t work as well when economic conditions are deteriorating and investors are fearful.

Which pretty accurately describes the current situation. Once again, the possibility of a recession is on the table and once again, my stocks have had trouble pulling away from the pack. I take solace from the fact that at least up until now, I don’t seem to underperform the market in these slow periods. Even during the meltdown of 2008, while I didn’t manage to avoid any of the carnage, I also didn’t fare any worse.

Don’t Try To Tell The Market What You Should Buy

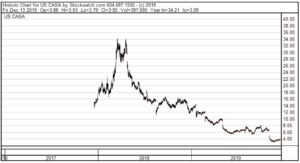

I spend my time as an investor waiting for the recoveries and for the good years in between the doldrums. A famous investor once remarked, “I made all my money during bear markets, I just didn’t know it at the time.” I often feel that way. While there has not been much to show for it the past two years, I have nonetheless been busy, tweaking and fine tuning the portfolio. Harvesting what gains I have been offered and moving money into even better, more undervalued opportunities. This past fall was especially busy as I moved the last of my remaining cash into a series of deeply unloved stocks. Companies like Francescas, Yellow Pages and Casa Systems which have seen their stock prices fall by 90% or more from their peaks.

There is another adage that I live by as an investor, and this one I made up myself: “Don’t try to tell the market what you should buy, let it tell you.” I’m very much a bottom-up investor. I don’t invest with some grand over-arching strategy in place or some vision about where we’re headed as a society. I like to get down in the weeds and search out individual companies that are selling cheap. I never know what I’m going to find and I try to keep an open mind. If oil and gas stocks are cheap, I’ll buy them. If technology stocks are on sale, I’ll buy those. I try to go where the market is leading me and buy whatever seems to be offering me the most value.

Risk On Sale

As I stand back and survey my portfolio at the dawning of a new decade, I am surprised and, to be honest, a little frightened, by just how aggressive it has become. This is not a portfolio for widows and orphans. One could argue it is also not a portfolio for a 51 year old man with a family to support either. But it is where the market has led me. Right now, the market is telling me that danger and risk are on sale. It is no secret that the economy has been faltering. We are 11 years into the longest business expansion in US history. Stock prices are at record highs. CEOs are sweating bullets and insiders are selling off stock in droves. Wall Street consensus is that we are very likely headed for a recession in 2020. In this environment, defensive stocks and growth are in favour. Investors haven’t completely abandoned the market. After all, where else are they going to put their money? But they have gravitated towards the companies that can best weather the storms they see coming.

Which means they have turned their backs on the riskier corners of the market. That is why these sorts of companies keep showing up on my screens and why my portfolio has become increasingly speculative. Perhaps I am jumping the gun; buying into a bunch of value traps that are going to blow up in my face. Perhaps. But I’ve been down this road before. And despite the scary signs on the road ahead, I am feeling strangely optimistic.

Falling Knives Everywhere You Look

At first glance, my portfolio looks like it was put together by an investing simpleton with only one basic criterion: buy whatever has fallen the most. Looking at a collection of price charts for the stocks in the portfolio definitely gives one pause…

First the good news…

And then everything else…

Ghost Stories

There are some pretty scary stories to go along with all those scary charts. Farmers out west are facing a perfect storm: China has stopped buying our canola, wet weather has reduced harvests and a new carbon tax means farmers are paying through the nose to dry out their waterlogged wheat. My two agricultural equipment dealers have seen orders dry up and costly inventory has built up on their lots. They are both losing money now and there is no obvious respite for them on the horizon. The same woes have hit Linamar which took on a big slug of debt in 2018 to buy an agricultural equipment manufacturer in what looks to have been almost comically bad timing. This move was made in an attempt to protect itself as technology shifts and the market moves away from the internal combustion engine and towards electric cars. A move which would make a big part of Linamar’s business obsolete. Magna is also vulnerable to the changes taking place in the auto industry. Millenials aren’t buying as many cars as their boomer parents. And autonomous driving could make “2 cars in every garage” a thing of the past.

Technology shifts are also sweeping across a number of other industries these days including retail where Amazon is eating everyone’s breakfast. Investors are seriously questioning the long-term viability of the whole retail industry. Portfolio holdings Francescas, Big Lots, Urban Outfitters and Hibbett Sports look highly questionable in this light. Shifts in technology have also affected Casa Systems where the industry may be moving from cable delivery to fiber optic and wireless. This has led to losses and growing debt at this once highly profitable cable systems provider.

And let’s not forget Yellow Pages which has been trying to salvage what it can from its legacy telephone directory business but is facing a frightening exodus of customers. Or Essential Energy Services whose oil and gas drilling services appear to be anything but essential as the oil and gas sector in western Canada dies a slow and painful death. Even an apparent good news story like GoEasy, which has seen sales and profits double over the last few years seems to be asking for trouble with its growing portfolio of high credit risk loans to sub-prime customers.

No one is sure if they can really trust the numbers being put up by Assure Holdings which frankly look almost too good to be true. And Bird construction has spilled a fair amount of red ink over the last couple of years. Who’s to say it won’t spill any more? With Canadian household and mortgage debt at record levels, a holding in Melcor Developments doesn’t exactly fill one with confidence either. Finally, Medifast was hit recently by a large scale coordinated cyber attack which threw its network into disarray and caused some of its home-based coaches to pack up and move on in frustration. It’s uncertain to what extent it can recover that lost ground.

Ready For The Turn

So why do I own all of these stocks? And why did I recently use up the last of my spare cash to top up my holdings in many of these scary looking stories? Why am I going out of my way to buy stock in companies that are losing money and have very uncertain prospects? Because the market is telling me to. The market is telling me that these stocks are cheap. Some of them are very, very cheap. My bet is that most of the bad news has been priced into these stocks already. That the day is always darkest before the dawn. There may be more pain to be endured first. Some of these investments may end up going to zero. An ultimate recovery may be a ways off. It could even be years away. Or it could be around the corner.

When it comes, I’m ready for it.

Full Disclosure: I own shares in Assure Holdings, Big Lots, Bird Construction, Casa Systems, Cervus Equipment, Essential Energy Services, Francescas, GoEasy, Hibbett Sports, Linamar, Magna International, Medifast, Melcor Developments, Rocky Mountain Dealerships, Urban Outfitters and Yellow Pages.