I get my hands dirty with a manufacturing company and use some recent share price strength to take profits on two of my existing holdings.

Hammond Power Solutions – HPS.A.TSX

November 21, 2020

Share Price: $6.18

Number Of Shares: 11 740 000

Market Cap: $73 million

Bought Hammond Power Solutions

Hammond Power makes electrical transformers. These transformers aren’t much to look at: non-descript, grey, metal boxes for the most part. But inside lurks a carefully engineered set of components that help connect a building’s electrical supply to the power grid. Hammond’s transformers can be found everywhere. From a Boeing manufacturing plant to a cannabis growing operation. From a giant server farm to a warehouse, office park or condo building. The mining and oil and gas industries are big customers but Hammond is also doing a brisk business selling to the new wave of renewable power projects and electrical charging stations that are being built.

They are one of the largest manufacturers of dry-type transformers in the world, with manufacturing facilities in Canada, the US, Mexico and India. The US is their primary market although they have their sights set on possible future expansion into Asia and Africa and have been trying to build their manufacturing presence in India.

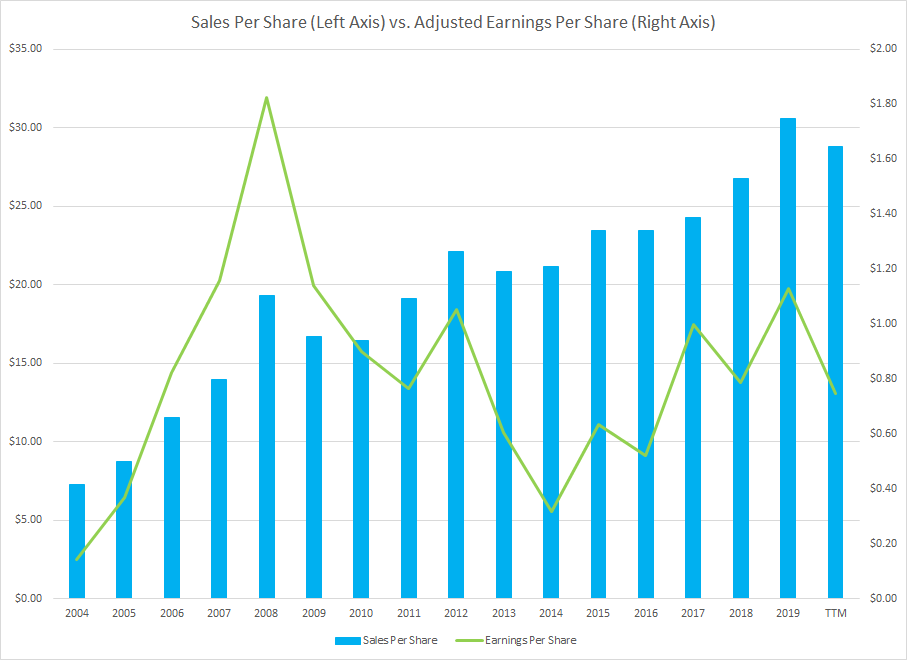

The company has been profitable for every one of the last 16 years with this year, despite the extreme challenges caused by covid, being no exception. Back in the late 00’s and early 10’s the company was posting record results as they sold transformers to a booming mining and energy sector hungry for power. They enjoyed high profit margins at the time and strong sales growth. But these good times didn’t last. The resource sector went bust and company profits collapsed. Undeterred, the company has adapted and moved on. They’ve been steadily growing their sales, albeit at a slower rate, as they add new products and capabilities, sign on new customers and push into new geographic areas.

An acquisition they made in 2011 of an Italian transformer manufacturer did not seem to work out that well for them and further depressed profits for a number of years. They did manage to acquire some valuable technology and know-how in the transaction, so it wasn’t a complete loss. But after years of struggling to try to make this division earn its keep, they finally threw in the towel in 2018 and shut it down for good. (My EPS numbers above exclude the losses from these discontinued operations in 2017 and 2018.)

With this difficult decision behind them, they enjoyed a very good year in 2019 with adjusted earnings per share of $1.13. At the recent share price of $6.18, that gives the stock a p:e of 5.5 to last year’s earnings. Throw in a strong balance sheet with minimal debt, a long track record of profitability and several avenues for future expansion and you have the makings of a very interesting potential investment.

This stock has always been on the cheap side and it has popped up on my screens repeatedly over the years. I believe its true value has been obscured to a certain extent by the large decline in the fortunes of the resource sector, a major target market for these guys. I am hopeful that as they continue to grow and expand their customer base across a wide variety of industries and sectors that the underlying value of the company will shine through. I like the exposure to the renewable energy market, electric charging stations and a possible upgrading and transformation of our electrical grid.

The near term is likely going to be difficult. They still enjoyed solid profits in their latest third quarter despite the many challenges posed by the covid pandemic, but they are upfront about the continued headwinds they are facing in this environment and they expect sales to drop going forward. It is possible that profits might even dip into the red for a time, breaking their very impressive 16 year streak. But as we emerge from this downturn, I am assuming that they can regain their previous level of profitability and then continue to grow beyond that. Even if I were to bail out of this stock at a still very low p:e of 10 or 12, consistent with the low p:e ratios the company has been awarded in the past, I’d still have a nice 2 bagger on my hands. With the p:e ratio of the average stock now pushing up over the 20 mark, these much lower numbers seem to offer one of the few bargains left in an overheated market.

Unfortunately, Hammond Power is a more thinly traded stock. Some days only a few thousand shares trade hands. For that reason, I’ve had to buy less of it than I would have otherwise wanted to. Like the hotel California, you can check in any time you want but if you’re not careful, it can be hard to leave.

Sold Magellan

Magellan makes airplane parts. It does some work for the military as well as some repair and maintenance work but the majority of its profits are earned from the commercial aviation sector. I bought this stock cheap, hoping that as the pandemic died down and business returned to normal, the company would once again start producing healthy profits.

But as the pandemic has progressed, I’ve been starting to re-think this optimistic outlook. The aviation industry is struggling mightily and balance sheets are deteriorating. Even once the pandemic passes, the scars on this sector may last for years. Consumers are going to be shy about returning to the skies and more importantly, businesses may have realized that they can save a lot of money on travel expenses by conducting their business online instead of face to face. It may take quite awhile for this industry to fully recover and I’m not sure I want to stick it out for the long haul.

I actually finished selling this stock earlier in the week, just before the news landed that the FAA had finally cleared Boeing’s troubled 737 MAX plane for take-off. This news sent the stock price soaring and I think offers an excellent opportunity to take profits and move on to companies with a somewhat less uncertain future.

Sold PHX Energy Services

In a similar vein, I also sold off my holding in PHX Energy Services. Again, the stock price has moved up smartly from where I bought into it in the teeth of the covid scare. As is typically the case, the market is pricing in a recovery long before it actually happens. The future of the oil and gas industry in the US, where PHX does most of its drilling, is still very much up in the air. If OPEC opens up the taps again or if the electrification of our light vehicle transport system saps future demand for oil or if the new Biden administration follows through on its environmental agenda, oil drilling in the US could face a tough road ahead. I decided to take my profits in PHX and rely on Essential Energy Services, which operates in Canada and Enerflex, whose fortunes are tied more to the natural gas industry, to do the heavy lifting for me for my exposure to the beaten down energy sector.

The Recovery Portfolio Starts To Recover

It’s been a tough slog this year. I’ve felt even more out of step with the prevailing consensus than usual. Value investors are always on the wrong side of conventional wisdom but this year has been unusually harsh on us contrarians. Recent market action, though, seems to be rewarding the value narrative for a change. The portfolio has made good strides as a rotation away from the sexy high growth names and back into stodgy old cyclicals seems like it might be underway. The mispriced markets portfolio is finally outperforming the Russell 2000 on the year; a benchmark that has proven a formidable point of comparison throughout the covid crisis.

Of course, it is far too soon to count my chickens. As it stands now, the portfolio is still very much a “recovery portfolio”. If 2021 does indeed prove to be a year of recovery for the economy then I am optimistic for my prospects, but an awful lot could still derail this rosy scenario.

I just finished my third quarter review and apart from Omnicom and Hammond did not come up with any other ideas that I thought were better than the ones I already owned. The US retailers will straggle in with their results over the next couple of weeks and perhaps there will be an opportunity for some changes there, but if not, I am happy to sit with the portfolio as it stands now and see how this recovery plays out.

Looking ahead, if or when stocks in the portfolio hit my fair value targets it is going to become challenging deciding what to do as there is a real lack of any compelling alternatives in a very frothy market. Do I go to cash? Do I double down on a shrinking roster of existing holdings? Or do I lower my standards and start buying companies I wouldn’t normally consider cheap enough to buy? I guess I’ll cross that bridge when (or if) I come to it. The possibility of a big market crash is still on the table and may solve this problem for me.

Also, one final note on Rocky Mountain Dealerships. They have received a going private offer from senior management at $7 a share which should close sometime in late December. I am not happy with the price; it seems opportunistic to me. I believe the company is worth double that. And so I continue to hold it. There is an outside chance that management may be shamed into raising its offer or a higher bidder may come along. If not, I’ll take the $7 payout and will probably just park this money in cash for the time being.

Full Disclosure: I own shares in Hammond Power Solutions Essential Energy Services, Enerflex and Rocky Mountain Dealerships. I do not own shares in Magellan Aerospace or PHX Energy Services.