There are value traps everywhere you look these days. I avoid the temptation to try to grab some of the cheese and instead hunker down in the relative safety of my current holdings.

Staying The Course

When in doubt, do nothing. I’m not sure those are really words to live by, but they sum up my current feelings about the market pretty well. I looked long and hard for some new stocks to add to the portfolio this fall. After all, stock prices have dropped by 25% from their peak and while stocks aren’t exactly cheap, they’re at least cheaper than they were a year ago.

While I came across some interesting looking companies that I’ve added to my watchlist, I didn’t find anything I could fall in love with. My problem in most cases is that I don’t trust the numbers. There are plenty of low p:e stocks out there right now but only because the ‘e’ part of the equation, that is the earnings, are so bloody high. Quite counterintuitively, many companies raked in windfall profits during the covid debacle. Dramatic changes in consumer spending behaviour along with extra government support collided head-on with diminished supply. The end result was abnormally high profits in many different sectors. Retailers, homebuilders, used cars, semiconductors, technology, recreational products, lumber companies, steel manufacturing, chemicals, mining, shipping, healthcare, and trucking to name a few. To the extent that I expect many of these companies to give back most or all of these covid gains as we move beyond the pandemic, I’d label many of these low p:e stocks value traps.

Value traps are the bane of every value investor’s existence. These are companies that lure us in with their siren song of alluringly low p:e ratios only to pull the rug out from under us when the earnings supporting those ratios disappear in a puff of smoke.

Pandemic Profiteering

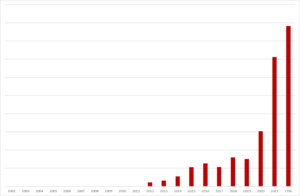

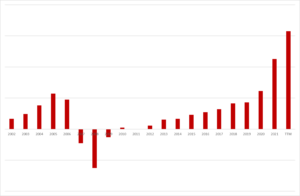

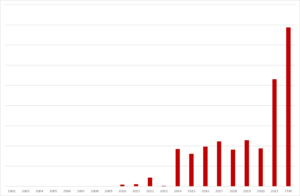

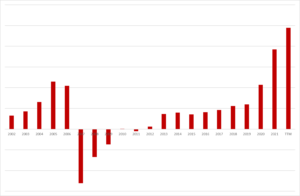

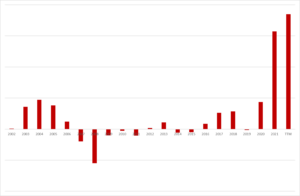

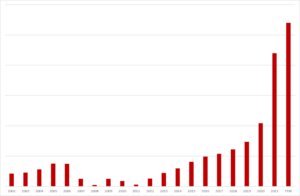

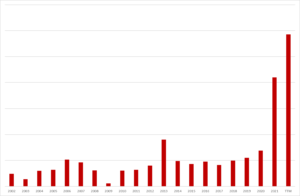

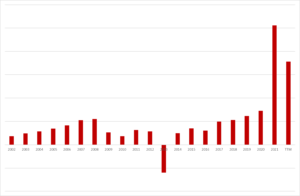

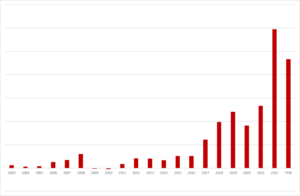

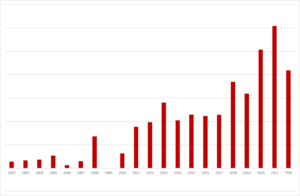

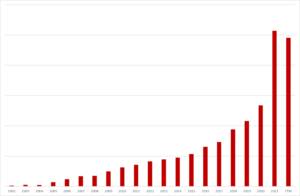

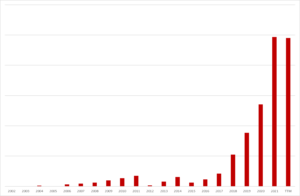

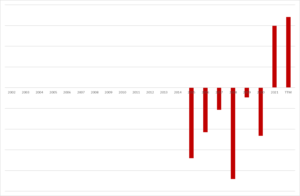

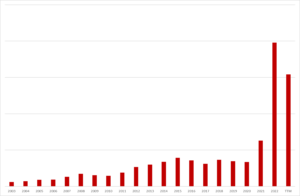

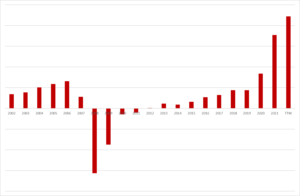

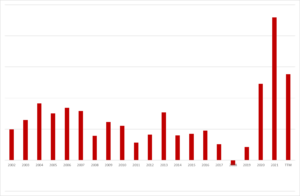

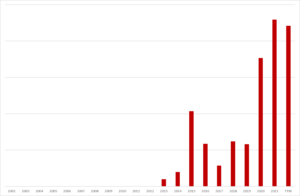

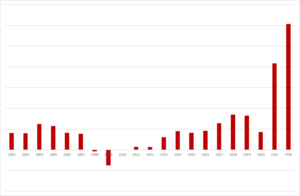

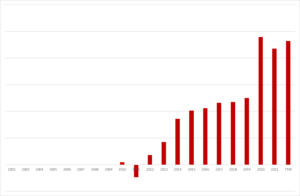

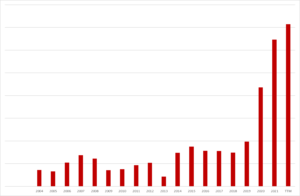

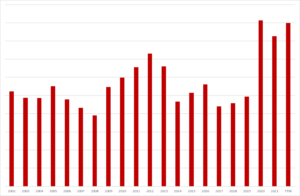

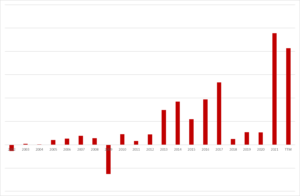

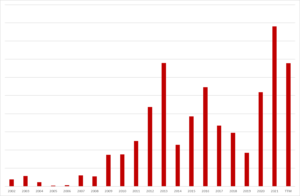

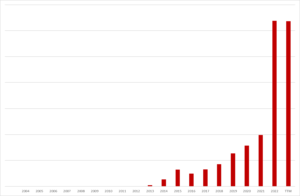

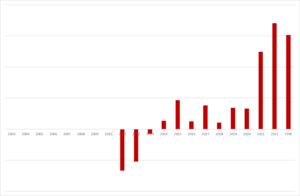

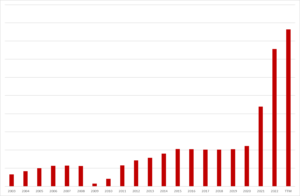

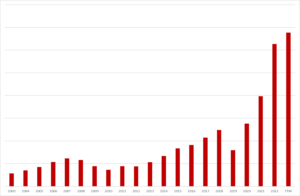

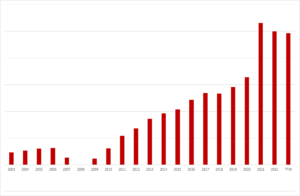

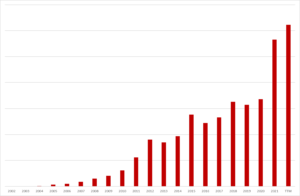

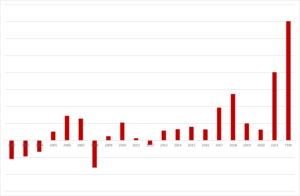

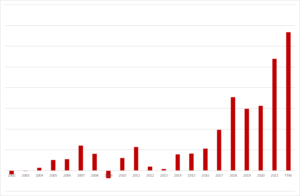

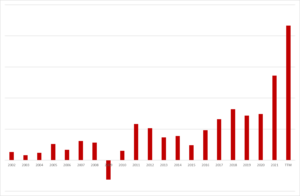

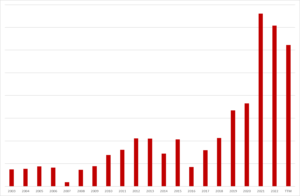

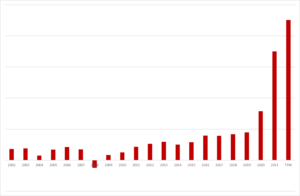

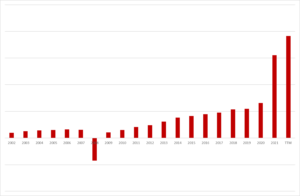

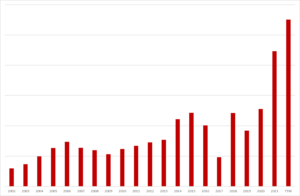

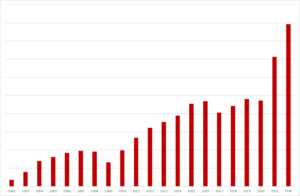

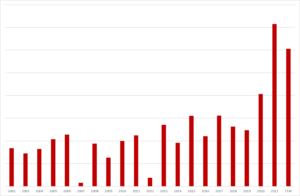

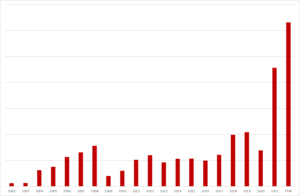

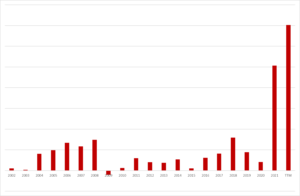

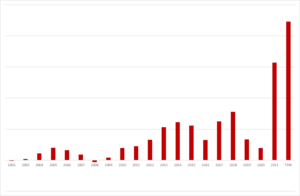

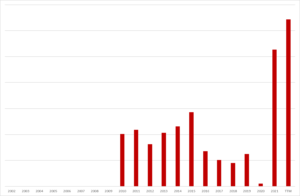

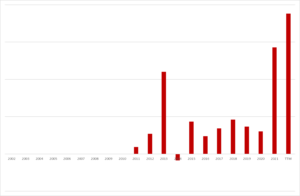

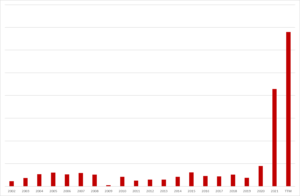

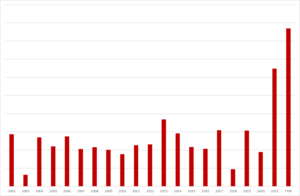

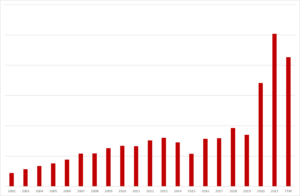

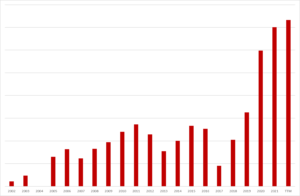

Here are a few earnings charts that I hope illustrate what I am talking about. (Annual earnings per share from 2002 to the present with the trailing 12 month figure on the far right.)

We were all trapped in our homes during covid. Those that didn’t have one, wanted one, and those that had one, got tired of staring at the same yellow stain on the carpeting…

All that eager beavering needed wood and other building supplies to keep it going…

While sitting at home there wasn’t a whole lot to do so we played video games…

Or surfed the internet, watched a movie or maybe even got a bit of work done…

And when we got tired of doing that, we ventured out into the great outdoors…

All that activity gave us a powerful appetite…

Of course, we needed to protect ourselves from all the other stressed-out humans running amuck so we bought some guns (or at least the Americans did)…

The money we saved by not doing anything and not going anywhere got spent on stuff…

Including lots of electronic gadgets…

All those electronics need semiconductors to make them tick…

Which meant there weren’t enough chips left to build any cars, which sent used car prices through the roof…

It took a lot of trucks to ship all this stuff to our front door…

Amidst all the mayhem, steel and chemicals were apparently in short supply…

Meanwhile, the companies shipping all this stuff back and forth across the oceans were raking it in…

And lest we forget the original culprit behind this bizarre profit-palooza, there was this nasty virus called covid that needed to be dealt with and plenty of players in the healthcare sector eager to help us do just that…

A New Normal

In each of these cases, you can see visually how exaggerated profits have been over the past couple of years. Any sort of valuation model built on these earnings is going to be deeply misleading. I’ve highlighted some of the more glaring examples but there are many companies where the distortions are not quite as apparent, perhaps because there is not enough past history to see a clear pattern or because there were other offsetting factors that kept a lid on the gains. In these cases, you’re left scratching your head. “How much of what I’m seeing is real and how much is a temporary covid induced fever dream?”

As of the end of the second quarter, in June of this year, the party was still going strong. Trailing 12 month earnings still looked glowingly positive, but cracks were starting to appear. We’re beginning to see a steady stream now of companies missing earnings expectations or revising their guidance lower, and each time that happens, the stock price usually takes a nosedive. This is not a heathy environment for investors.

At this point, it is very hard to tell where the bottom is. As the world returns to some semblance of normality, I would expect these covid dislocations to gradually correct themselves. In both directions. The companies that benefitted from covid will see their sales and earnings return to earth and the relatively fewer companies that were sidelined by covid should recover, albeit somewhat battered and bruised by the experience. Sooner or later though, things should return to some sort of equilibrium. The number I want to use in my p:e calculation is not the trailing 12 month earnings number which, in many cases, is still elevated. Instead, I want to use earnings a year or two down the road, once the dust has all settled. At this point in the game, though, it is very difficult to know exactly what that equilibrium level will be. I can’t necessarily go back and use pre-pandemic earnings from 2019 as my baseline because 2019 was a slow year for the economy. We weren’t in a full-blown recession, but we certainly weren’t firing on all cylinders either. So do I go back even further and use 2018 or even 2017 earnings as my baseline? Perhaps. But that’s almost 5 years ago now. A lot can change and a lot has changed in the past 5 years for better and for worse.

For one thing, the money supply has exploded higher, and inflation has re-appeared. All other things being equal, if prices are up by 10-15% from their pre pandemic levels, you’d expect corporate sales and earnings to be up by 10-15% as well. Also, those record windfall profits that companies were earning over the last 2 years didn’t just vanish into thin air. They’re going to be making a new home on the companies’ balance sheets and at some point, those excess earnings will likely get re-invested, which should support higher profitability down the line. Transport costs will come down as supply chains unkink. So not all of these covid gains are necessarily going away. Some companies really will have gotten bigger and stronger and more profitable during covid. But to what extent and which ones? I’m hopeful that Skyworks and Signet Jewelers, for example are two companies that will manage to hang on to some of their covid gains and emerge stronger out the other side of this turmoil. But I can’t be sure of that.

On the other side of the coin, interest expenses are rising along with interest rates and input costs may continue to rise as well, as labour shortages and spiking energy prices bite into profits. The war in Ukraine has created its own set of dramatic dislocations. A recession this winter could obscure the true earnings picture even more. It all adds up to one giant mess.

Value investors rely on fundamental analysis, but this requires you to know what the fundamentals of a business are. It’s not complete anarchy out there, but the picture is definitely a lot blurrier than it usually is. To assign a fair value to a stock, I need to have a reasonably considered opinion as to what future earnings are going to look like. In this environment, I often feel like I’m shooting in the dark.

Watchful Waiting

So I watch and I wait. At some point, things will settle down and the picture will come into sharper focus or else values will just get so cheap that the worst-case scenario is already fully priced in. In the meantime, I’ve divided my money roughly equally between my remaining 8 core positions plus as much as I feel comfortable shoving into the more thinly traded Hammond Power. I reviewed the most recent set of quarterly results and I saw nothing there to change my investment thesis for any of them.

So far, these stocks have held up fairly well during this bear market. In the past, I’ve made most of my money coming up the other side of a downturn in the economy, so to be outperforming on the way down as well is an unexpected bonus. Year to date, my portfolio has dropped by 12.5% vs. the 23% drop in the Russell 2000. Of course, I’d rather be making money, but losing less is good too.

Out of my current portfolio holdings, I’d nominate Skyworks as the stock “most likely to be a value trap”. Most of its smartphone sales are to Apple and if you look at the Apple earnings chart in the section above, this company looks like a strong candidate for value trap status. Apple has been disappointing investors recently with reports of weakening demand for its new iphone 14 model. It wouldn’t be surprising to see Apple sales take a breather after the orgy of buying they’ve experienced over the last two years. I admit the recent downbeat news has me a little nervous, but I’ve decided to hold fast for the time being. One potential saving grace for Skyworks is the rapidly growing non-smartphone side of its business (connected autos and other devices) that now make up 38% of overall sales. I’m hoping this may help to offset declining Apple sales and could provide a strong growth driver in the years ahead, but in the meantime, if Apple sales do fall back down to earth, I may have to lower my baseline earnings expectations for Skyworks as well.

Signet Jewelers is another obvious candidate for value trap contender. Looking at the charts of the retailers above, there are plenty out there that benefitted massively from hoards of undiscriminating buyers ready to pay full price for their merchandise. Signet enjoyed some of the same high margin selling. But unlike many other retailers, their inventory levels are well in hand. They’ve been actively re-structuring their operations, embracing new cutting-edge digital technologies and making acquisitions. I believe they can hang on to some of the gains they made during covid, and the valuation is low enough that it already prices in a significant retrenchment.

Stella-Jones enjoyed a boost from the home reno, deck building boom with its pressure treated lumber division but as lumber prices have come down, its other two divisions: utility poles and railway ties seem to be taking up the slack. The company’s guidance doesn’t suggest that they see a big fall-off in results going forward and they sailed through the 2008 recession and home building bust without breaking a sweat, so I remain cautiously optimistic on this one.

Linamar could face more pain ahead if the economy sinks into recession. But I’m certainly not going to bail on this idea at this stage. My faith in their ultimate resurgence during the next up-cycle remains intact although if I am eventually proven right, it looks like I may have been 5 or 6 years too early on this call!

Sylvamo has been swinging wildly up and down over the summer, but nothing fundamental has really changed at the company as far as I can see. They use their own biomass to provide the majority of their energy needs so will hopefully be somewhat protected from the soaring natural gas prices in Europe. I’ve added to my position twice now on each of the big swoons in the stock price. I’m hoping that the low stock price fully factors in any bad news that may be coming, but I don’t have a lot of insight into the global paper industry, so this is a learning experience for me and I’ll simply be reacting to results as they come in.

International Money Express had another good quarter in Q2 and management remains solidly upbeat. They’ve been growing quickly as they add new locations to their selling network. As these new locations mature, they tend to become more profitable which should help them keep up their growth momentum. A large proportion of their customers work in the agricultural industry which may be relatively protected from an economic downturn. The company grew strongly through the 2008 recession and they see the opportunity to continue to grow over the next few years despite the worsening economic outlook.

Preformed Line Products also had a very good quarter and along with Hammond Power looks to be well positioned going forward. Hammond is enjoying a strong order backlog and both companies stand to benefit from future investments in the electrical grid.

Finally, Omnicom Group looks like a good company to hold through a downturn. They are a large, stable company and posted reasonably robust results throughout the 2008 recession. They have been drifting a bit over the past 6 years as the advertising industry goes through a major transition period, but they are putting a lot of effort into developing the digital side of their business and they have been streamlining operations and selling off legacy divisions. I think they could be well positioned to participate more strongly as the next business expansion gets underway.

I’m not going to bang the table on any of these companies right now. It doesn’t seem like the time or place to be pumping up the excitement factor. It feels more like an environment to take measured risks and be cautious and careful. There will come a point when it is time to get aggressive and swing for the fences, but I don’t think we’re there yet. There isn’t blood in the streets yet, just the nagging concern that were headed in that direction. I’m happy with what I already own and I’m sticking with it. I think these core companies offer a good blend of low valuations and reasonable stability but also strong future growth potential as we come out the other side of this slowdown and move into the next major business expansion phase.

Just remember, as you survey the landscape looking for beaten down opportunities in this bear market, beware the value traps out there. They are legion.

Full disclosure: I own shares in Skyworks, Omnicom Group, Signet Jewelers, International Money Express, Sylvamo, Preformed Line Products, Stella-Jones, Linamar and Hammond Power Solutions. I do not own shares in any of the other companies mentioned in this post.