Oil stocks, auto parts, overheated markets and opportunity. A look back at 2017 and a look forward into 2018.

2017 was a good year for the markets. The Russell 2000 small cap index was up 16% on the year while the large cap S&P 500 rose an even more impressive 21%, powered in large part by the 5 tech titans, commonly known as the FAANG stocks. (Facebook, Apple, Amazon, Netflix and Google). The Canadian market, perhaps because of a dearth of big, gaudy tech champions to call its own (sorry, Blackberry, you ain’t cuttin’ it these days) lagged its US counterpart somewhat in 2017 with a more modest gain of 9%. I’m happy to report that my stocks managed to outperform all of these indexes by a healthy margin, posting a return of 41% on the year.

After playing around with some hedging strategies in 2015 and early 2016, by the fall of 2016 I had (almost) all my chips back on the table. The economy had slowed down in 2015 and 2016 and the market had come off its peak. There were once again some bargains to be found. The oil and gas industry had been hit especially hard as oil prices had fallen in half. I love a good turnaround story and was finding plenty of opportunities in this beaten down sector. Because Canada is a relatively small place, the collapse of the oil industry affected a wide variety of stocks. Companies like Westjet that have planes flying out of Alberta or Melcor Developments, a property developer from Calgary, were caught up in the downdraft and I was able to snap them up at what looked like compelling prices. Going into the start of 2017 I had a record 23 stocks in the portfolio, most of which sported single digit p/e ratios. The conditions seemed ripe for a good year and the portfolio did not disappoint.

Some of my bigger successes in 2017 included Cathedral Energy Services, an oil and gas drilling company that I bought in the 35 c range at the height of the oil price collapse and sold late in 2017 at $1.70 for a nice 450% gain. I also made good money with Questor Technologies, a company that has a system for cleaning up the methane emissions that are a by-product of oil and gas drilling. After Trump’s election in the fall of 2016, this stock took a severe nosedive, falling from the 65 c range down to the 45 c range. Investors were worried that Trump’s lax position on environmental standards would put a kaibosh on Questor’s plans for expansion in the US. But with over 20 c per share of cash on their balance sheet, their operations in Canada where Trudeau was taking a much harder line on the environment and their initial focus on Colorado where state environmental laws were promoting the use of Questor’s technologies, this looked like a wonderful buying opportunity to me. I was in there buying with both hands and within a few days the price had recovered. It went on to rise a further 300% or so to close out the year at $2.70.

Outside of the oil and gas sphere, I made some decent money with my plays on the auto sector. I owned three auto parts companies going into 2017. Wall Street was remembering the carnage in the auto sector that had occurred during the Great Financial Crisis in 2008 that saw Chrysler go bankrupt and GM get a big government bailout. As a result, the entire sector was being valued at very low levels compared to everything else. I was able to pick up two of Canada’s largest auto parts makers, with global operations and a long track record of outperformance for p:e’s in the 7 range. I also grabbed a smaller auto parts company that was doing very well with a line of interior LED lighting systems at an attractive price. This company was taken over during the year at a nice premium, giving me a 4 bagger from my purchase price.

Another company I owned, which operates a global fleet of helicopters for hire and which I purchased for less than the book value of said helicopters was also taken over at a nice premium. I doubled my money on the shipping company, Scorpio Bulkers, as this sector started to recover from the severe downturn that hit it in 2015 and 2016 and my investment in the Easy Financial franchise saw a gain of over 50% in 2017. Finally, while it took several years to play out, my investment in the machine vision company, Photon Control, paid off with a gain of several hundred percent as I took my profits and exited this position.

After the downturn in 2015 and 2016 (not a full blown recession, but a definite pause in the festivities), the economy kicked into higher gear in 2017. By the end of the year, corporate earnings had recovered to the levels they were at prior to the slowdown. After years of grim news out of Europe, the economies there were starting to show signs of strength as well. China benefitted from a manic burst of state sponsored lending leading up to their national congress in November. And the big central banks around the world continued to pour money into the global liquidity pool through that bizarre process known as quantitative easing. The end result was the best run of coordinated, worldwide expansion the global economy had seen in quite a while. And stock prices reacted by moving steadily higher.

By the end of the year, investors had gotten quite giddy. It was “risk on” time in the markets. In Canada, marijuana stocks were the stars of the show as investors looked forward to the impending legalization of this miracle substance. In fact, as the buying frenzy reached a fever pitch towards the end of the year, the major brokerages were reporting periodic crashes as their systems could not keep up with the volume of investors logging in to trade, or just check the prices of, their sky rocketing pot stocks. The fact that a company with $50 million worth of greenhouses was being valued at over 10 times that amount didn’t seem to phase anyone.

But even this mania paled in comparison to the cryptocurrency craziness. Bitcoin and the hundreds of proliferating alt coins that were being minted from thin air made the perfect speculative vehicles. With no earnings or hard, tangible value to worry about, their value was limited only by the size of your imagination. And evidently, people could imagine quite a lot. The price of a bitcoin rose by over 1300% in 2017. At one point, a few days after the end of the year, the inventor of a competing coin called Ripple briefly became the richest man in the world.

As we enter 2018, animal spirits are in full force. Surveys of retail investors by the major brokerages show that their clients are more heavily invested in the stock market than at almost any other time in history. Cash holdings in brokerage accounts are at record lows. Margin debt is at a record high. Surveys of investor sentiment are breaking records as well. Most Wall Street strategists are forecasting continued global expansion and stock market gains for 2018. Already, only 3 weeks into the new year, the S&P 500 has smashed through half of the major analyst’s year end price targets. Analysts are falling over themselves to ratchet up their earnings estimates as Trump’s recently passed corporate tax bonanza is expected to rain down profits on Wall Street.

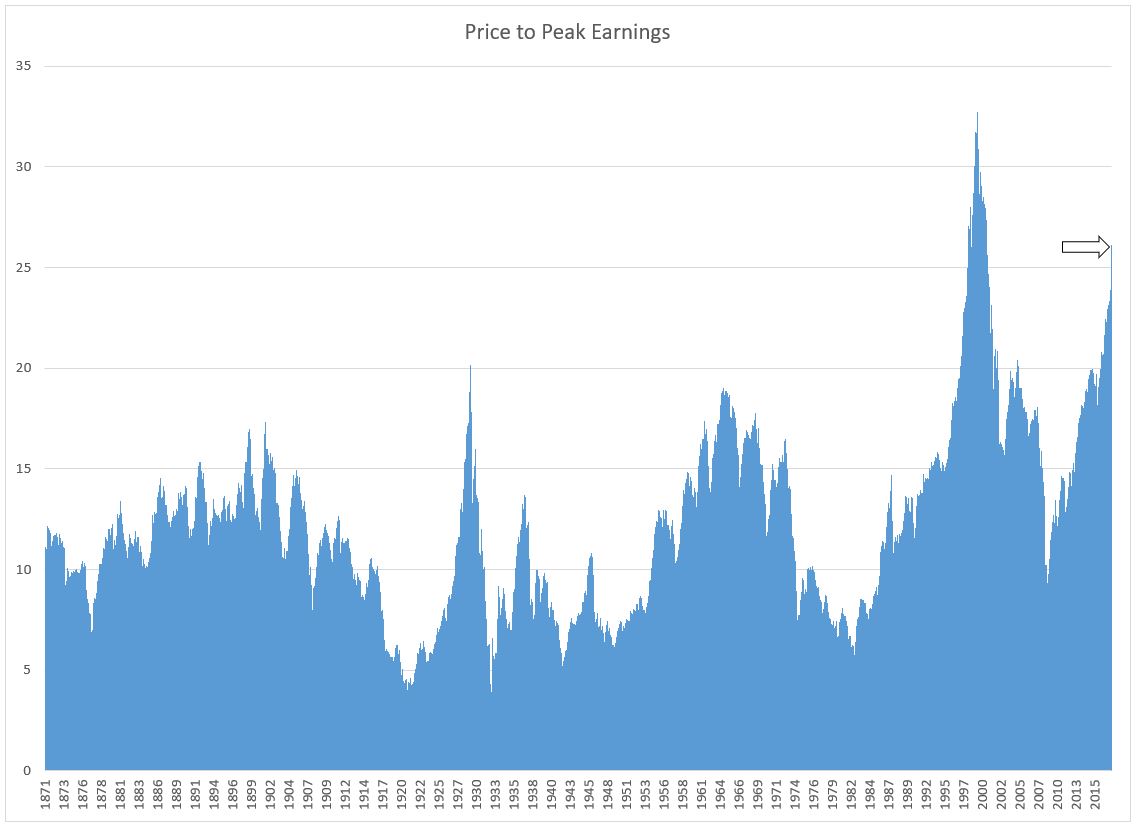

It is never a good idea to simply ignore what the market is saying. With its remarkably strong finish to 2017 and beginning of 2018, the market is saying that analysts are right. If earnings do indeed march higher in 2018 then this bull market could still have room to run. But there are a lot of reasons to be apprehensive, the chief one being valuations. However you choose to look at it, stocks are as or even more expensive than they have ever been. The following graph is a sobering one. It shows the price of the S&P 500 (or its precursor indexes) compared to the most recent peak in earnings. ie the p/e ratio of the S&P 500. As you can see, we are past the peak of 1929 and well on our way to the all time high hit at the end of the internet bubble in 2000.

In contrast to the environment in 2000, though, when investors drove internet stocks through the roof while the old economy, brick and mortar style companies stood alone and forgotten, in this bubble there is nowhere to hide. Everything is expensive. Pundits are calling it the “everything bubble”. And it is not just stocks either. Governments around the world are issuing bonds with interest rates below the level of inflation. Investors are lining up to pay these governments to take their money. House prices are high as well and in some areas, like Vancouver, Toronto and Sydney, they have become completely untethered from reality.

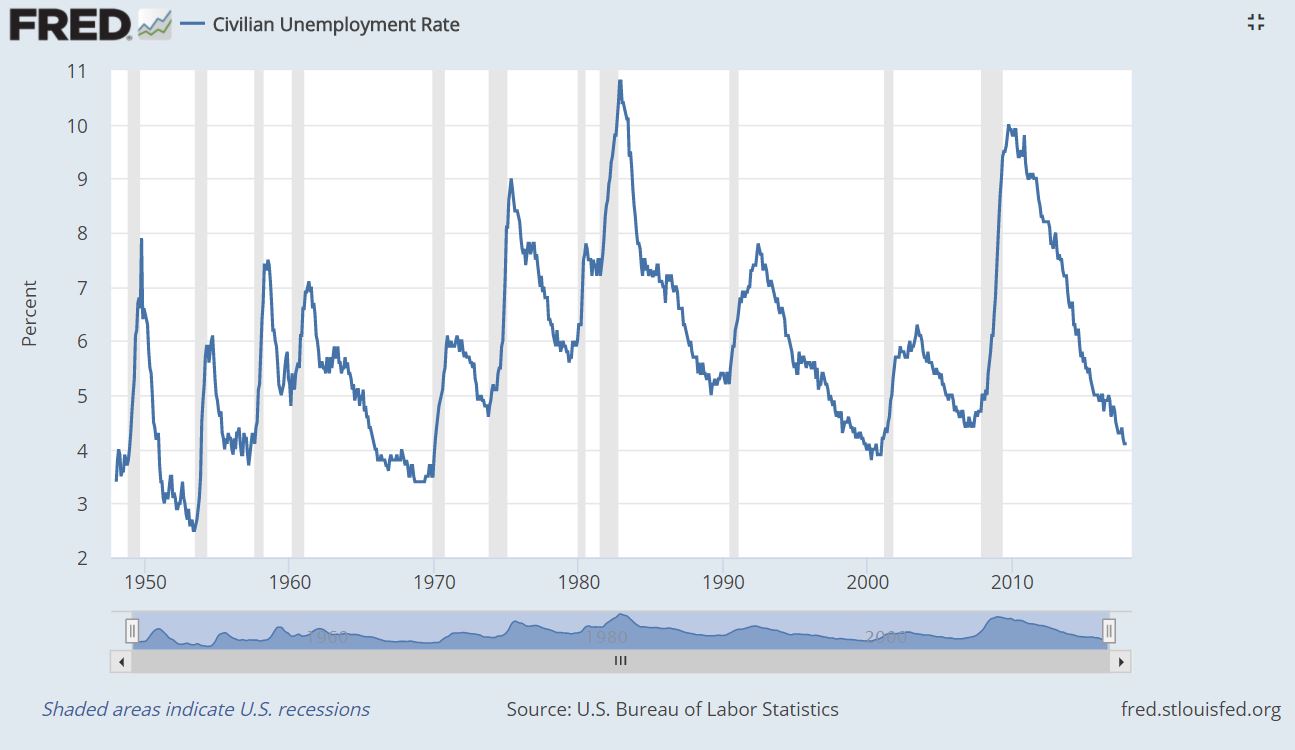

Here is another graph to give you pause as your finger hovers over the buy button on your online brokerage account…

This is a graph of the unemployment rate with recessions shaded in grey. Perhaps the unemployment rate will stay down for a few more years as it did in the late 80s. Perhaps it will even go lower. But surely a rational person looking at a graph like this would at least entertain the possibility that the next recession could be just around the corner.

These two graphs sum up my concerns. On the one hand, valuations are off the charts. Stock prices are in nosebleed territory here and I am having to stretch my usual valuation parameters to justify holding onto the stocks I own, let alone finding any new ones to buy. The typical small cap, Canadian stock is trading at around 16 times earnings compared to the 12 times earnings that is more the historical norm. At the same time, we are now 9 years into this economic cycle and a number of economic indicators, like the unemployment rate above, are looking pretty long in the tooth.

I have been actively investing for a little over 20 years now and have seen a number of major market meltdowns come and go. The first one, the internet bubble, was largely confined to the technology sector. Where I was hiding, in old economy, small cap stocks, the bursting of the bubble barely had any effect on stock prices. The Great Financial Crisis was another story all together. Within the span of months, the entire market dropped in half. Very few stocks were spared this time around but the pain was short lived. If you had gone to sleep in the summer of 2008 and awoke a year later it would appear as if nothing had happened. So in these 20+ years that I have been an active participant in the Wall Street casino I have never experienced a long, grinding bear market; one that goes on for day after day, month after month and year after year. I fear that such a beast may be headed our way.

How I will perform in such a years-long bear market remains to be seen. I would hope that my deep value approach will help to mitigate some of the losses but there is reason to question this. Simple quantitative value strategies (buying all the stocks with the lowest p/e ratios or the lowest price to book ratios, etc.) tend not to outperform on the way down. It is when the market bottoms and stocks start heading back up that they really shine. I’ve noticed a similar tendency in my own portfolio over time. (I have, typically, outperformed during market declines but not by nearly the same degree that I outperform on the way back up.) So I don’t think I can afford to be complacent. As they say in the business, “Past performance is no guarantee of future results.” I don’t want to rely on my prowess at stock picking to save me from a bear mauling. Hence the hedges.

Everyone says you can’t time the market. Everyone also says you can’t reliably beat the market over the long term. Over the past 20+ years, my portfolio has risen by 38% per year. The market hasn’t. So if everyone is wrong about the second statement, maybe they are wrong about the first one too. It sure looks to me like the stars are aligned here for a major market rout. However, the devil is in the details. I’m mostly in agreement with conventional wisdom. Timing the market is incredibly difficult. It’s one thing to be able to say with confidence that the market is more overvalued than at almost any other time in history. It is another to know when prices are going to move lower. And if they do, how low they will go, how long they will head down and when they might start to turn back up.

There are a variety of ways to bet on a drop in stock prices and none of them are cheap. The longer you keep a hedge in place, the more expensive it becomes. So as some say, being right too early is the same thing as being wrong. Nonetheless there are so many red flags flapping in the breeze right now, that I cannot sit by and ignore them. As we enter 2018, I am fully hedged for the coming year with put options on the S&P 500 that let me profit from a drop in the price of this index. No hedge is perfect but this one looks pretty good in the spreadsheet models I’ve drawn up. Right now, downside insurance (in the form of these put options) is cheaper than it usually is because investors are so bullishly inclined that they see little need for downside protection. You could say that downside protection is one of the few undervalued assets left to buy. And it is in that spirit that I have snapped up these bargain priced options. I believe that the way I have bought them will mostly protect me in the event that the market turns south, at least for this year. The options expire at the end of the year and at that point I will have to reassess and decide what strategy I will use going forward. If we are in for a prolonged bear market, it could well take years to play out so this could merely be the opening salvo of what is sure to be a difficult game to get right.

One of the major drawbacks of buying these hedges is that it limits your potential upside. I believe I have limited my potential loss but I have also handicapped my potential upside performance. If my skepticism proves to be unfounded and the market turns in another stellar showing in 2018 my gains will be more limited than they would have been otherwise. More limited, but hopefully not cancelled out entirely. I still have a strong portfolio of 14 undervalued companies across a variety of sectors that could surprise to the upside if the economy keeps barreling ahead.

As the head of banking behemoth Citigroup said in the summer of 2007 just as the market was peaking, “When the music stops, in terms of liquidity, things will get complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.” And with the protection offered by my put options and the growing pile of cash that I am accumulating, I feel a little more comfortable staying out on the dance floor.

I still have my collection of oil and gas service companies. Questor technologies has made remarkable progress in commercializing its emission control technology and even though the stock is up several fold from where I first bought in, there could still be more room for this story to develop. I also own shares in Phoenix Energy Services which has developed a system that helps automate the drilling process, meaning fewer hands required to operate the drilling rigs. Safer and less expensive; drill rig automation is a new trend in the oil patch. Canadian oil and gas has been selling at a steep discount to US supplies because of a lack of pipelines able to bring this oil and gas to market. I own shares in a pipeline construction company which could benefit if any of the big pipeline projects currently on the drawing boards ever get underway. The oil industry is in flux right now. Demand is still growing, fueled by the modernization of developing economies and the industry is slowly adjusting to the supply shock caused by the invention of fracking technology. On the other hand, the possibility of a wide scale electrification of the world’s transportation network (electric cars, trucks, ships, etc.) poses a serious longer term risk to the oil industry. While a potential boon for mankind, it is something to keep an eye on as it relates to my oil and gas investments and the Canadian economy in general.

This electrification could also impact my remaining two auto parts stocks. Although which way it will impact them is up for debate. Both Linamar and Magna have both said they see lots of opportunities to win new business with the spate of new electric models due to come on stream over the next few years. As well, Linamar recently made a major acquisition in the farming equipment space which could help diversify their operations going forward and Magna has been making serious headway in developing autonomous driving systems. So I remain cautiously optimistic on these two powerhouses of Canadian industry, especially since they sport some of the lowest valuations in the marketplace today.

I own stakes in Canada’s largest envelope maker and a large chain of farm equipment dealerships. Both of these stocks look fully priced at the moment but I am keeping them in the portfolio until I see better opportunities because they are both defensive plays whose earnings should hold up better than most in the event of a coming recession.

I own shares of GoEasy which has a growing chain of retail branches across Ontario, offering lending services to individuals and small businesses that are too small for the big banks to bother with. The company says this is an underserved market that they see plenty of opportunity to grow in and while the stock has been a strong performer in 2017, the valuation still looks reasonable and if the economy continues to grow in 2018 could continue to perform well.

I own a stake in a gold drilling contractor in western Africa (Geodrill) that has been doing very well again after the long contraction in the gold mining industry of the last few years. I also have a finger in the property development game in southern Alberta through my stake in Melcor Developments. I was able to buy into this developer after the oil bust at half the value of its land holdings. This company has been around for decades through multiple oil booms and busts. Calgary is a dynamic, multi-cultural city and my hope is that longer term the company will be able to realize the full value of its property holdings.

And finally, I recently bought into a very small, speculative play on the healthcare sector in the US. Assure Holdings until recently was little more than a one man show offering surgical neuromonitoring services in the state of Colorado. I’ve bought in during the very early stages for what looks like a potentially attractive price. The company is in the process of broadening its management team and expanding into other states such as Texas and California. The opportunity is very large but there are many opportunities to stumble along the way so I will be watching this one closely. If they can execute on their growth plans then their future could be bright.

Another exciting year in the markets come and gone. No doubt 2018 will continue to offer up its fair share of twists and surprises. I feel good about how I am positioned and look forward to an exciting year.