A stunning stock market recovery caps a surreal year in the markets and offers me a golden opportunity to take a little risk off the table.

A Tumultous Year

Rocky Mountain Dealerships exited from public view last week as management managed to convince shareholders to accept their offer of $7.41 a share. The cash that appeared in my account as a result adds to the growing pile that I’ve been accumulating in the closing weeks of what has been a wildly unpredictable year in the markets.

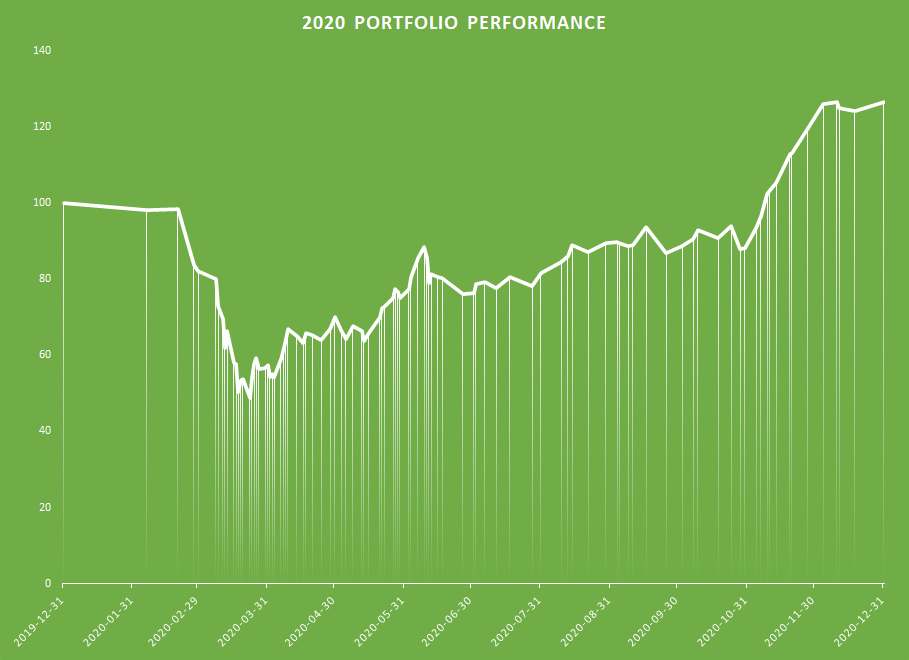

As the dust settles on the bizarre year just ended, I am left slightly dumbfounded. Will nothing ever bring an end to this energizer bunny of a market? In the final accounting, it was an astonishingly good year both for my portfolio and for the stock market in general. My stock portfolio ended the year up 26.7% from where it began vs. a gain of 20.0% for the Russell 2000. An unexpectedly strong performance given the drubbing that value stocks took earlier in the year. Only in my most wildly optimistic moments, at the depths of the market plunge in March, would I have guessed that the market would be ending the year up by double digits.

To a certain extent, I get it. Broadly speaking, the gyrations of the market have made sense. When the market plunged in March, we were facing a completely unknown threat. Economies around the world were shutting down and the stock market, coming off a period of record high valuations, was extremely vulnerable. If anything, I’m surprised that prices did not drop more than they did. But as the scope of the crisis became clear, investors started to look ahead to the other side of the valley. To a surprising extent, businesses have proven to be remarkably resilient. In fact, quite a few publicly traded companies are enjoying record profits during this downturn even as mom and pop businesses on Main Street shut their doors forever. It’s a jarring dichotomy.

In November, news of the vaccines lit a fire under the stock market, especially those more cyclical names that would benefit the most from a recovery. A dramatic surge in stock prices this fall turned what was shaping up to be a disappointing year in the markets into a surprisingly good one.

The whole experience has been quite surreal as the market hits new record highs, valuations by some measures surpass the dotcom levels of 20 years ago and a speculative frenzy grips Wall Street. An avalanche of money-losing start-ups, priced at hundreds of millions or even billions of dollars each, have flooded the market and are being snapped up by a ready hoard of eager buyers. All this as a second wave of the pandemic shuts down the economy yet again.

Portfolio Roll Call

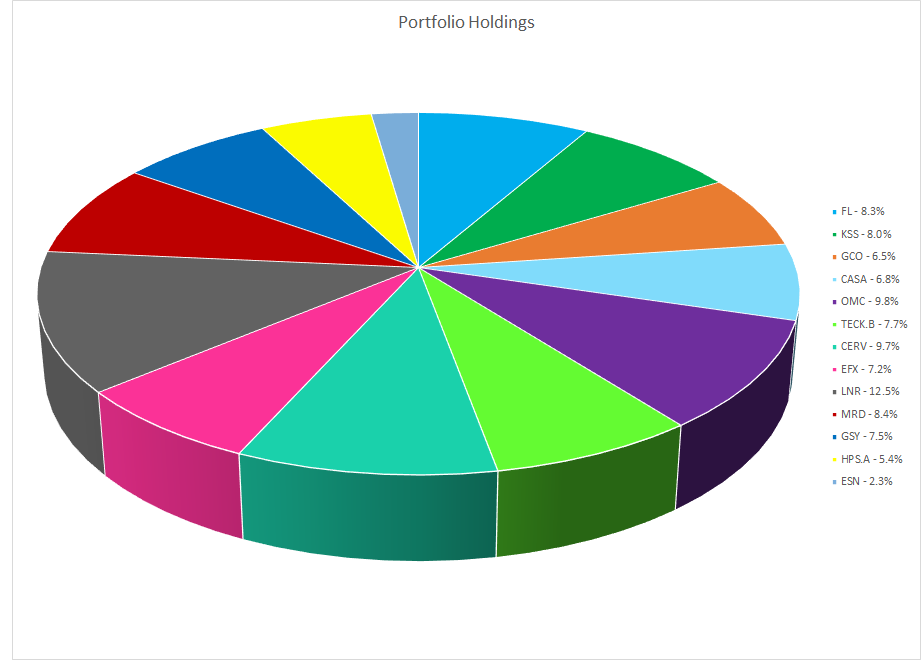

In my own corner of the investing universe, things seem a little more sane. The average p:e ratio of my collected portfolio of 13 companies is sitting at around 8 right now, using my projected earnings estimates. Compared to a market that is trading at 20+ times earnings, that appears to leave lots of room for further gains as we head into the new year. However, I’m saying “projected” earnings. Reality may not quite live up to my expectations.

Take a company like Kohl’s. Kohl’s has a long history of steady and consistent earnings behind it. They sailed through the last recession without breaking a sweat. Several of their competitors have gone bankrupt in this downturn and that should help clear the playing field. Their inventory levels are in good shape and like most retailers they have been making great strides in the online e-commerce space. And yet they have lost money for the last 3 quarters. Management believes it can get back to previous levels of profitability but is this just false bravado? The retail landscape is changing rapidly and a full or even partial recovery is not guaranteed. Perhaps 8 times earnings is going to be as good as it gets for this aging department store chain. I’ll probably stick around for at least one more quarter to see if I can get an answer to that question.

Or Enerflex, currently trading at only 6 times its average earnings of the last few years. This company has put together a solid track record servicing the natural gas industry with what until 12 months ago was a very successful design and engineering division working on projects around the world. But the company has seen profits fall precipitously and its backlog is drying up. Going forward, what exactly is the future of natural gas in the new economy? Will there be enough business left as the industry recovers to make Enerflex’s current share price look like the bargain it appears to be?

Or Linamar, currently my largest holding? Trading at only 7.5 times its peak earnings, with a healthy order book and an excellent history of growth through the last up-cycle, this company could be set to shine in the years ahead. But what effect will the shift to work-from-home have on car demand? How will Linamar navigate the switch to electric vehicles? Until we see what the world looks like on the other side of this pandemic, the true value of these companies will remain a question mark.

Other companies in the portfolio appear to be on more solid footing. Omnicom had a strong third quarter as did Foot Locker. Cervus Equipment also had a great quarter with profits right back up to near their peak levels. With inventory levels well in hand, I am hopeful that the tide has turned for this chain of agricultural equipment and transport truck dealerships. I’ve lost Rocky Mountain but I still have this company, trading at only 7 times peak earnings, to give me some exposure to the farming sector.

GoEasy is piling on the profits as well, as customers are unexpectedly flush with mortgage deferrals and government stimulus cheques. I’m a little nervous about what an end to all this largesse might mean to profits so I’ve sold down my position a bit to bring it more in line with my other holdings.

Genesco had a fairly decent quarter, although the positive news was obscured by substantial losses at its men’s dress shoe banner. While its customers work from home, covid related losses at this relatively small division are hiding strong performance in its core Journeys banner which helps to explain the stock’s low p:e of 6.5 to last year’s earnings.

Casa Systems reported a profit in their latest quarter which will hopefully be the first of more to come. This is my one toehold in the sexy technology sector, so I’m giving it more latitude than I would most of my other companies.

Hammond Power Solutions is a recent addition to the portfolio and the stock has done well right out of the gate. Profits are down now but their exposure to the mining industry and electrical infrastructure could stand them in good stead moving forward.

Teck Resources gives me more direct exposure to the mining industry, specifically copper, zinc and metallurgical coal. As the global economy heats up again, commodity prices are rising. Given that I don’t really have a clue where commodity prices might be headed, I’m not sure where exactly I’m going to cash out; one of the reasons I generally avoid the resource sector. But the company is trading at only 8 times average earnings and 60% of book value. I’ll be hanging around for a little while longer.

Melcor Development is still trading at only a third of book value with a big part of that book value being its inventory of raw development land. I know the price for a vacant building lot is shooting through the roof in my neck of the woods, so I don’t mind owning a chunk of this real estate developer in my portfolio.

And finally, I seem to still own Essential Energy Services. I must see some value in this stock, or I would have sold it by now, although a casual observer would struggle to see the attraction.

All told, a decently well-rounded portfolio I think. There are some pitfalls to be wary of in there, some bright lights and a reasonable amount of potential. But while I’m fairly happy with my own collection of companies, the market at large seems disturbingly frothy. It’s always hard to spot a bubble when you’re in the middle of one but there are signs of over exuberance, risk taking and complacency everywhere I look. Stock prices and valuations are not only back to what they were before the pandemic, they’ve blown through that high-water mark and are setting new records daily.

In Search Of Greener Pastures

During my third quarter review, I struggled to find anything that offered better value than what I already owned. In December, I went looking further afield, downloading market data for the Japanese and UK markets, hoping perhaps that these foreign markets might offer a better set of opportunities. Particularly, I thought that perhaps fears of Brexit had been overblown and might be creating some bargain opportunities there. Sadly, I found the same pervasive over-pricing in these markets that I’m finding in my own backyard. In fact, in my target universe of small cap stocks, in the industries and sectors that I favour, p:e ratios were higher overall in the UK than they are here. Japan did offer slightly lower p:e ratios but prices there are still hardly what one would call cheap and the lack of a comprehensive and reliable source of English language financial reports would deter me from pursuing this avenue of investigation until the valuation discount got a good deal wider.

Cashing In My Chips

It’s an uncomfortable tug-of-war. I like the stocks I still own but I’m increasingly skeptical about the rest of the market. After a long, difficult conversation with myself, I’ve decided to move a significant chunk of money to the sidelines and keep it there. At least until greed and fear-of-missing-out weaken my resolve. After the shock of this past year, I’ve realized that my risk tolerance may not be quite as great as I liked to think it was. I’ve been accumulating cash, not just because I am seeing a dearth of good value opportunities out there, but also simply because I want some do-over money in case the market goes completely to the dogs. With the fever that’s gripped Wall Street and the financial excesses building up in the system, I think that’s a definite possibility.

The proportion of anyone’s portfolio that they feel comfortable risking in the markets is intensely personal. It will depend on their own risk tolerance, on their work situation, on their other investments and on what stage of life they find themselves in. So from now on, I’m going to be reporting the returns of the stock portion of my portfolio only, and I’ll try to refrain from spending too much time dwelling on the specifics of how much money I might or might not have parked off to the side. I think the dramatic stock market recovery this year is giving investors a rare gift. A chance to seriously evaluate their risk tolerance thresholds and adjust their portfolios accordingly without the sting of recent market losses limiting their options or clouding their judgement. But that’s a determination that every investor has to wrestle with on their own.

While it would be easy to get scared out of this market by the obvious speculative excesses we’re seeing in the face of a still deeply uncertain future, it is not all doom and gloom out there. A persuasive case could also be made for a more hopeful outlook.

Anything Is Possible

After all, it’s possible that central banks around the world will keep their feet planted firmly on the gas pedal. It’s possible that a tsunami of retiring baby boomers with a voracious appetite for retirement assets will keep prices unexpectedly high for an unexpectedly long period of time. It’s possible that an explosion of pent-up demand from a population that’s been cooped up inside for far too long will drive a wave of spending and capital investment. And it’s possible that a disciplined strategy of seeking out a handful of the most undervalued stocks from a universe of thousands of possibilities will continue to pay handsome dividends.

All of this is possible, so while I fret and worry and second guess myself, and make sure that I’ve given at least a token nod to some level of prudence, I am staying committed to value investing with the majority of my portfolio. Despite my many reservations, I think it’s still the best game in town.

Full Disclosure: I own shares in Foot Locker, Kohl’s, Genesco, Casa Systems, Teck Resources, Cervus Equipment, Essential Energy Services, Enerflex, Linamar, GoEasy, Hammond Power Solutions, Melcor Development and Omnicom.