I’m hoping to turn weight loss into portfolio gains with this rapidly expanding multi-level marketing company.

Tag: Portfolio Update

After careful consideration, I bought back into Essential Energy Services after abandoning it only a few months earlier. The valuation was simply too low to ignore.

This fashion retailer offers potential value as it continues to grow its online presence and expand its international footprint.

A defensive stock at a reasonable price. This new addition to the mispriced markets portfolio could benefit from the need to upgrade our aging electricity transmission infrastructure.

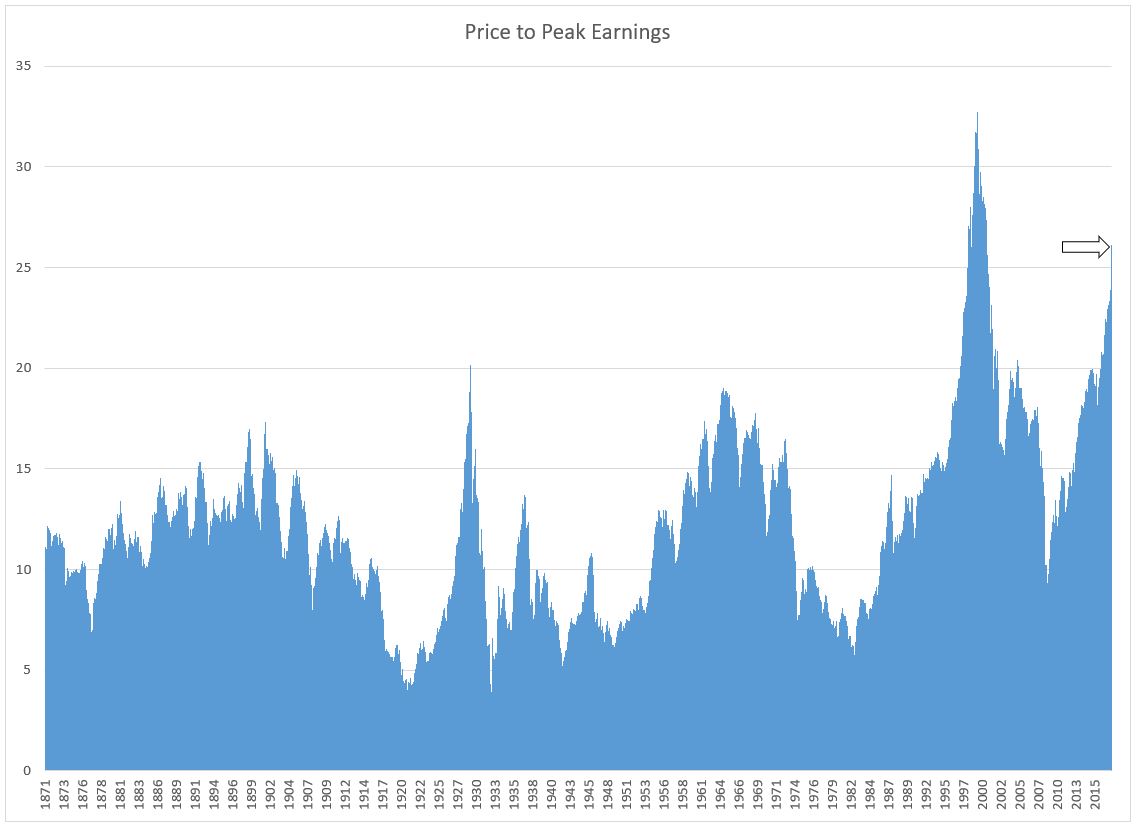

I have lost faith in a meaningful recovery in the western Canadian oil and gas sector. I have sold my Macro Enterprises and Essential Energy Services and with the money from these sales, have placed my bets on the current market rally losing steam by the end of the year.

Does a recent ballot initiative to restrict drilling in Colorado mean the party is over for Questor?

The company has been growing like gangbusters while it has been out of the public eye, but are insurers willing to foot the bill?

Why I think this company might have what it takes to survive the retail apocalypse.

Oil stocks, auto parts, overheated markets and opportunity. A look back at 2017 and a look forward into 2018.