A couple of sells, some market commentary and a look at the portfolio from a defensive standpoint.

What’s That Growling Sound I Hear?

Last week was a wake-up call for investors. Sadly, what goes up can also come down. So far, the damage has been relatively minimal. Markets are down 6% or so from their peak of a week or two ago, but it’s hardly what you’d characterize as a bear mauling. Yet.

My belief is that we are currently in a bear market which actually started back in January. You wouldn’t know it from the energetic performance of the US market, especially the small cap Russell 2000, but other markets around the world have been signalling some distress for a while now.

The US market has been one of the strongest performers on the world stage this year. It recovered from the sharp downdraft that hit it in February and went on to post new, record highs in September. Until last week it looked like the market might remain on an uninterrupted upward path into the new year.

However, globally, stocks have not been faring quite so well. Here is a graph of Hong Kong’s Han Seng index…

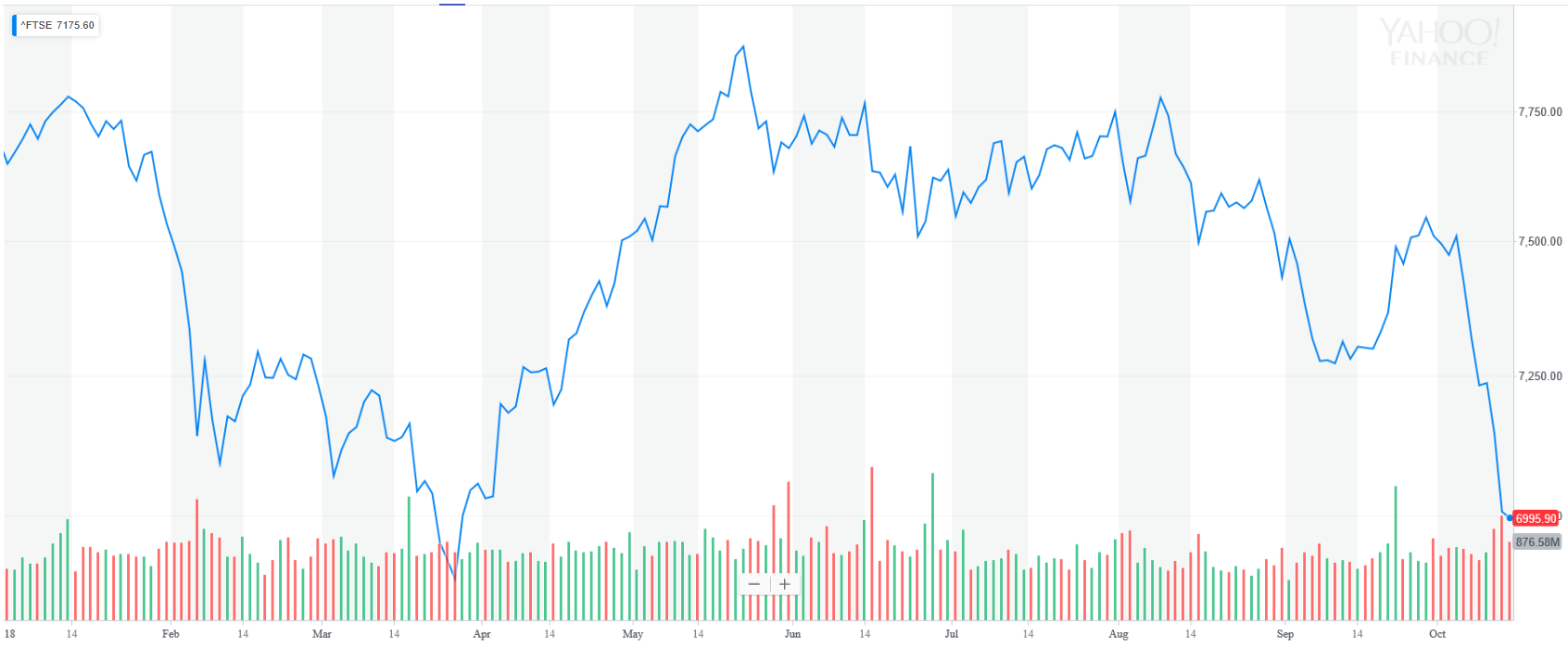

And the UK’s FTSE 100 started drifting down a few months ago…

Closer to home, Canadian small caps only partially recovered from the drubbing they took last winter and then started to lose steam again in June…

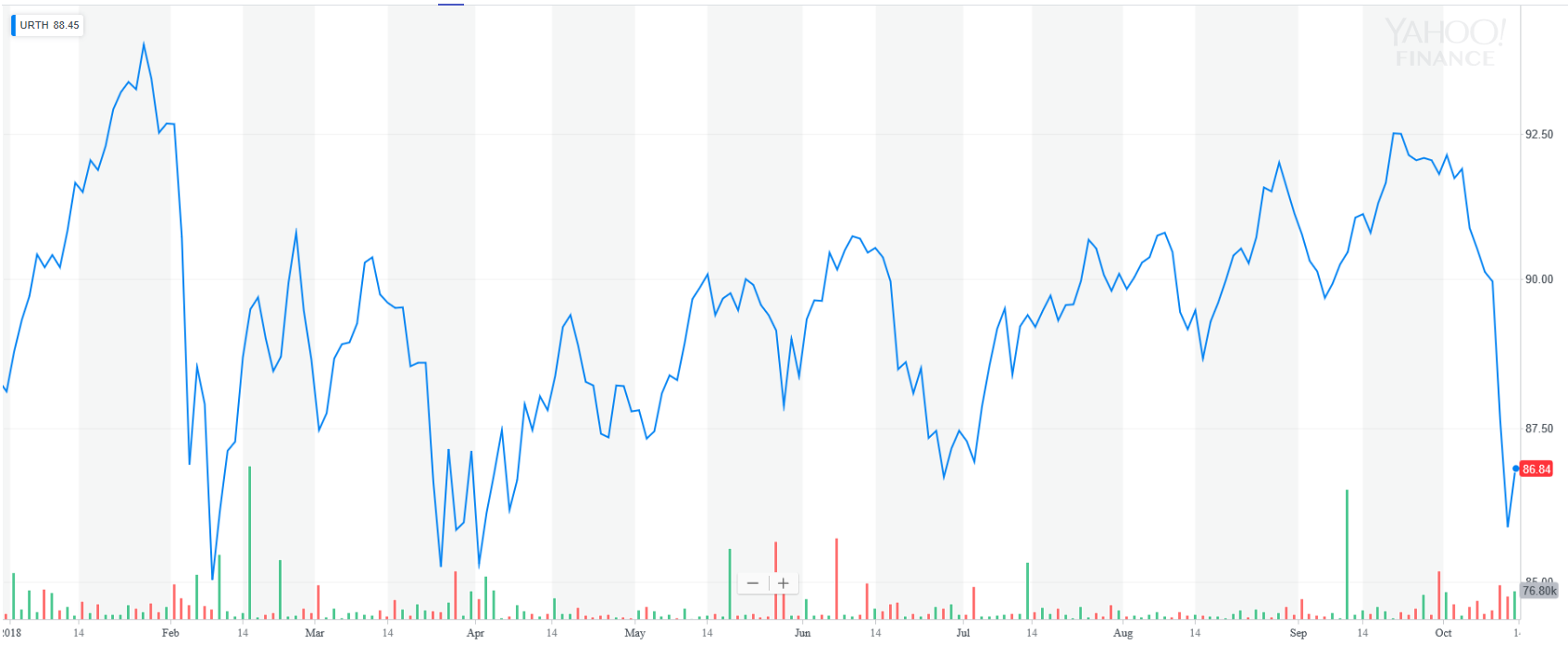

The MSCI World index never quite regained its January peak and in fact, a piece I read on Friday reported that 2/3 of all equities worldwide are now down 20% or more from their peaks.

Overall, global markets have been struggling. The massive Trump corporate tax cuts gave US stocks quite a boost this year but now, even this market is showing signs of turning over.

Timing The Market

You can’t time the market. It’s trite but, unfortunately, true. Not only is it devilishly difficult to foretell the next recession, (the track record of economists in this regard is abysmal) but to make matters even more difficult, markets tend to peak and then start to head down well before a recession even starts. The vast majority of the economic indicators (unemployment rates, GDP growth, consumer confidence, retail sales, inventory levels, etc.) that economists study are not leading indicators, they are coincident indicators. That is, they don’t deteriorate before a recession starts, they only start showing signs of weakness after the recession has already begun. The reassurance by the media that “there is currently no sign of a recession” is meaningless drivel. Once there are “signs of a recession” the recession has already begun and stock prices will have peaked many months before. In fact, “signs of a recession” means you should probably start looking for an approaching bottom in the market. Trying to react once a recession has declared itdelf is like trying to shut the barn door after the horse has left the stable.

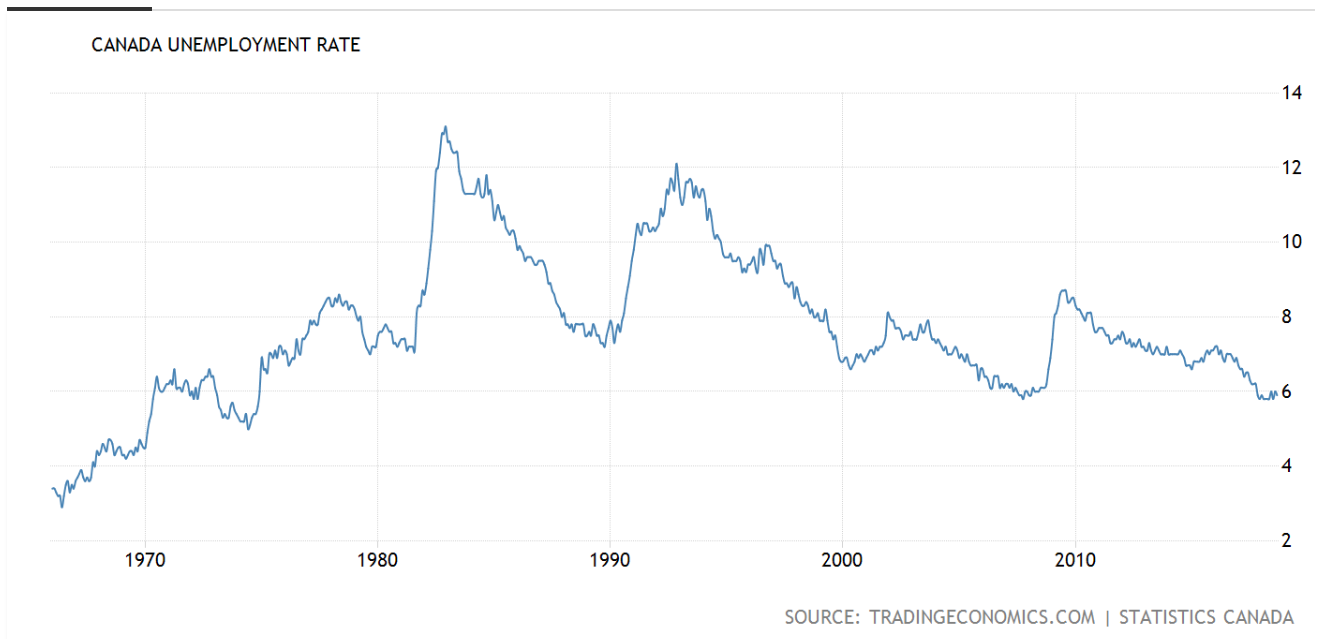

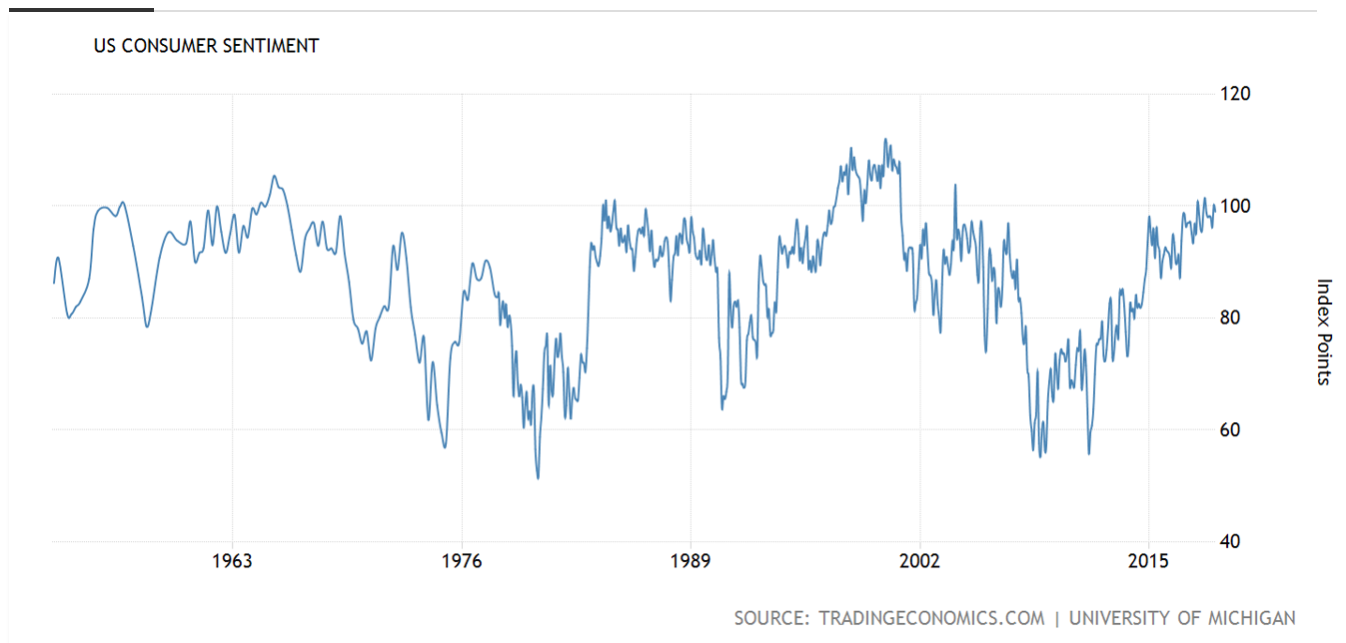

If you truly want to predict a coming recession, the signs to look out for are the exact opposite of what you’d intuitively expect. You are looking for signs that everything is great. Unemployment rates should be at record lows, consumer and business confidence should be at record highs. Corporate profits should be strong, sales should be strong, businesses should be bumping up against capacity restraints. The true sign that a bear market and recession are on their way is that everything looks wonderful.

This pretty much describes the scenario today.

Here is a graph of Canadian unemployment rates…

And here is consumer confidence…

Things are so good that the Fed has finally started hiking rates again…

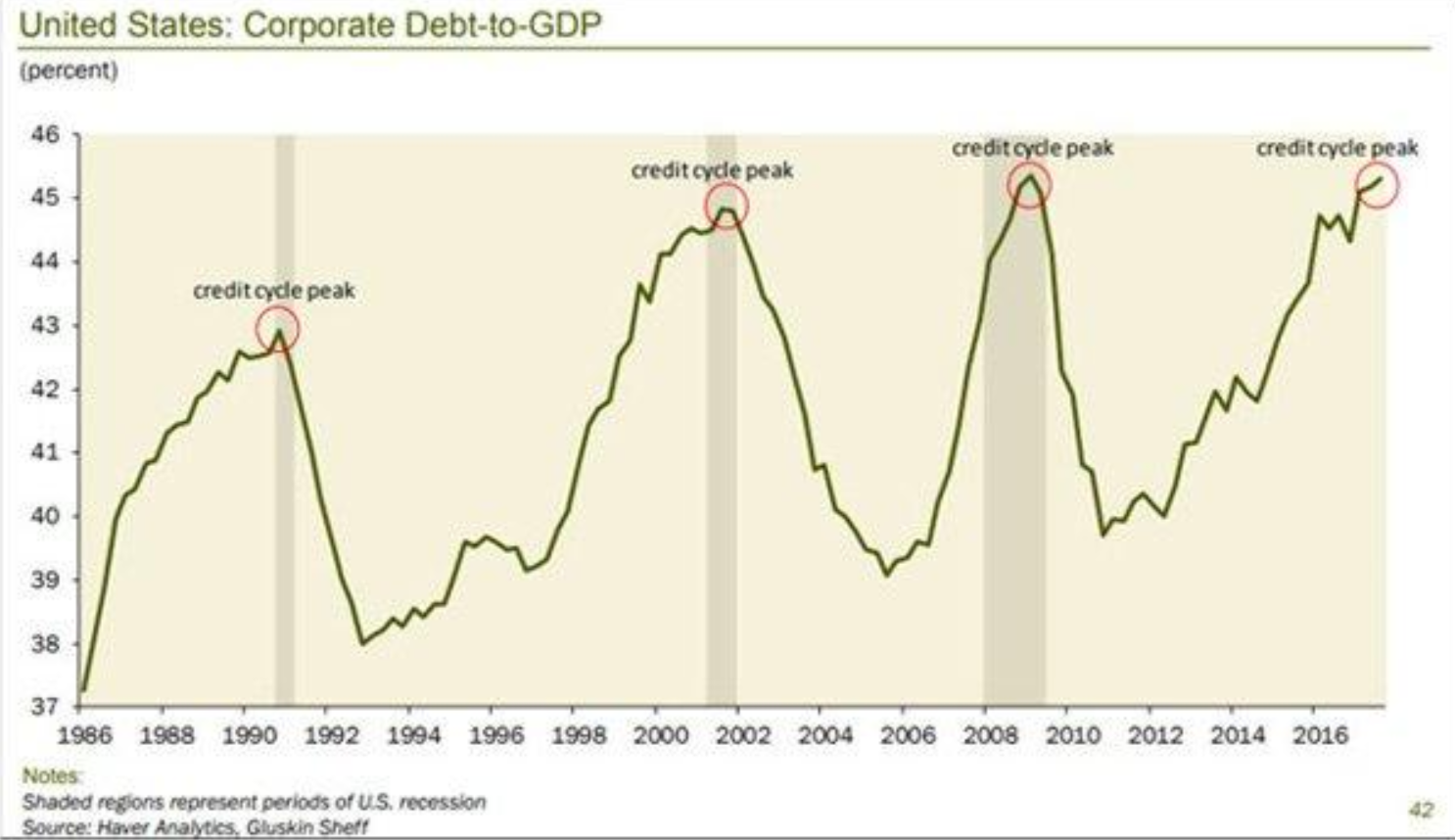

When things are this good, why not borrow a little more…

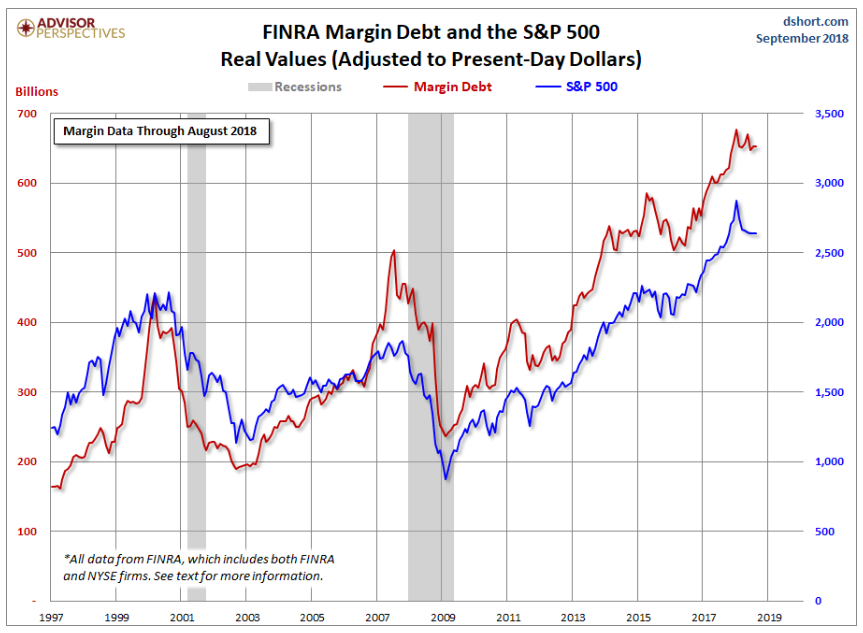

Investors have joined in the party, pushing margin debt to record levels…

Does all this mean a recession is right around the corner? Not necessarily. It could still be a few years away. Or it could be right around the corner. Unfortunately, by the time we know it’s arrived, it will be too late to do anything constructive about it.

Recession + Overvalued Stocks = Bear Market

Assuming a recession is going to grace our doorsteps at some point in the not-too-distant future, does it necessarily follow that we are also going to have a severe bear market? No. Recessions don’t have to be accompanied by bear markets although they often are. And if there is a bear market, it doesn’t have to be a severe one. Apologies to anyone who lived through the Black Monday crash of 1987, but the 32% drop that year was quickly erased and the subsequent recession that hit in 1990 was accompanied by a fairly mild bear market that just saw prices drift sideways for a few years.

Why do some recessions trigger off stock market crashes while others have a much more modest effect on stock prices? In a word, valuations. When stocks are very overpriced relative to the underlying fundamental value of the companies they represent, this makes those stocks more vulnerable to a violent pricing reset. When they are more sensibly valued, they can deal with a recessionary setback with much greater aplomb.

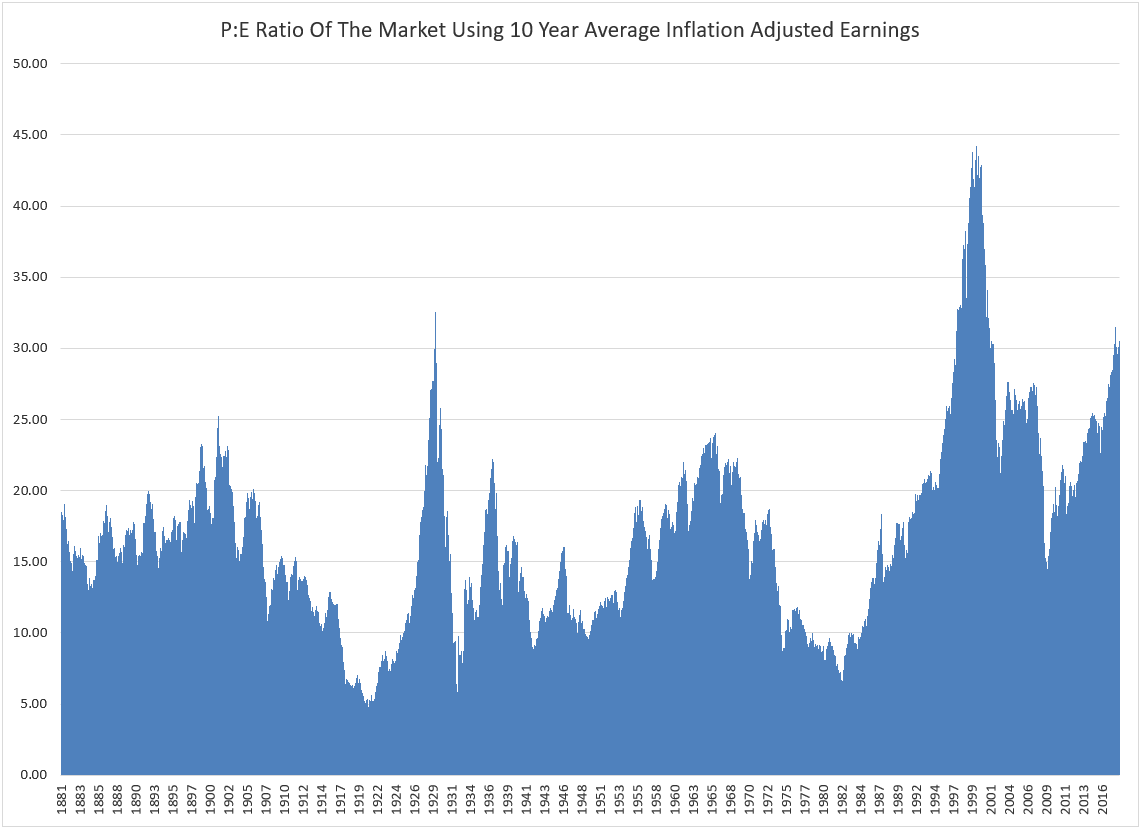

Unfortunately, here at the tail end of 2018, valuations are high. Very high. By a number of measures, the stock market is at or close to the extreme levels of valuation it hit in 1929 and 2000. That does not bode well for the stock market’s performance when the next recession hits. John Hussman explains this much better than I ever could. You can find his doom and gloom prognostications here. I’ve been avidly reading his play by play of the growing Wall Street folly for years now and will continue to hang on to his every word through the eventual bear market that is to come.

In short, regardless of the yardstick you use, stock prices look uncomfortably high at the present. Whether you use price to earnings, price to book, price to sales, market cap to GDP, Shiller’s CAPE ratio or various other more esoteric ways of measuring stock market value, the answer comes out the same in all cases. Stocks are near extreme levels of overvaluation and this does not bode well for how they will react to the next recession.

GuruFocus

I recently bit the bullet and passed over $289 of my hard-earned cash to sign up with the website GuruFocus.com and the wealth of fundamental data that they have put together on the Canadian stock market. A one year subscription comes with access to up to 30 years of fundamental data (earnings, sales, book value, etc.) on virtually every listed Canadian stock. I am still in the process of downloading and collating all of this data, but I’ve started to put together some initial inferences.

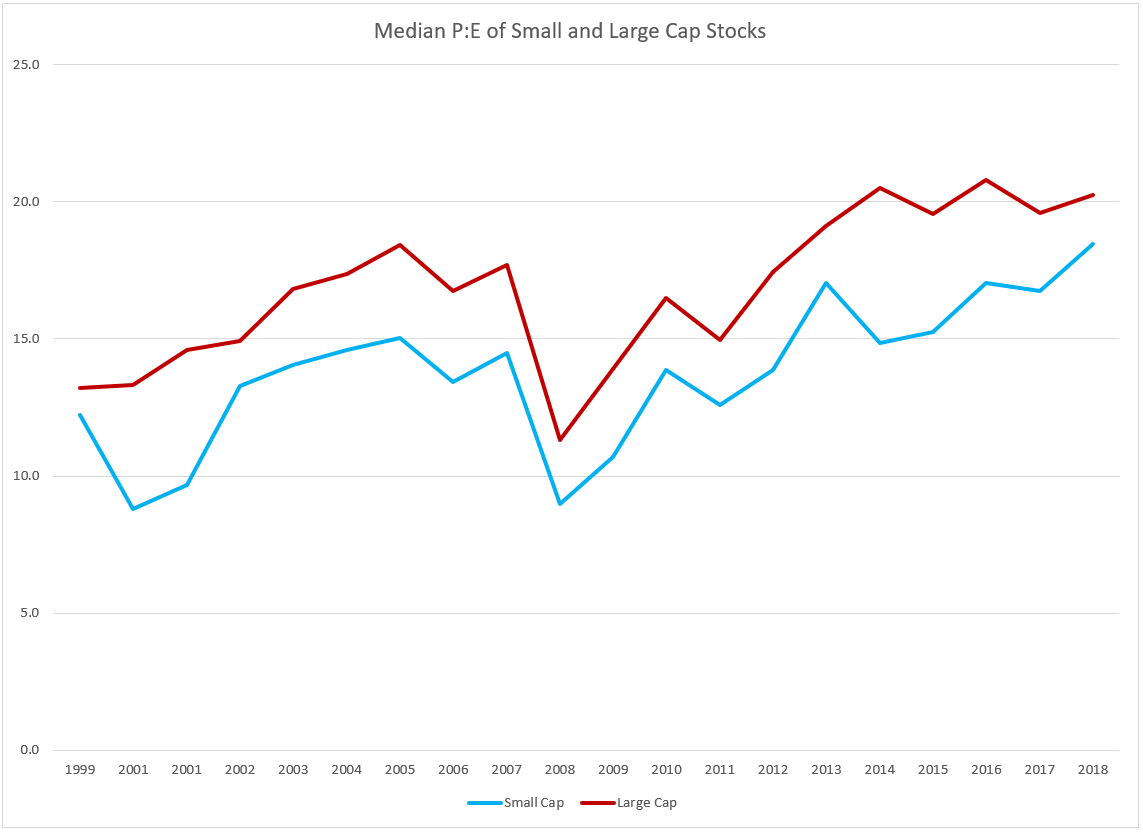

Below is a graph of the median p:e ratio of the small cap (<$1B market cap) and large cap (>$1 B market cap) stocks in my personal investing universe, (which excludes most resource producing companies, REITs and stocks with insufficient trading volume) as calculated using the GuruFocus data going back to 1999.

It is easy to see how the p:e of the typical stock has ebbed and flowed over the past 18 years in concert with the timing of the two major recessions (in 2001 and 2008). It’s also easy to see how we could be nearing the end of the current market cycle. What isn’t apparent from this graph is that p:e ratios have been consistently high for this full 18 year stretch. While p:e ratios don’t look egregiously high when compared to their level at the end of the last cycle, it’s important to note that ratios were quite high during the last cycle as well. A graph of p:e ratios over the past 137 years gives us a better sense of where we stand today…

Nowhere To Hide

So we know that a recession is coming our way because well, they always do. And because everything looks so good right now, we know we probably won’t have to wait long. As well, because valuations are very high relative to their historic norms, we know that the stock market’s reaction to the next recession is not likely to be pretty. Where does this leave us as investors?

Unfortunately, it is not just stock prices that are stretched. A combination of massive coordinated savings by aging baby boomers around the world, an unusually accommodative stance from the world’s central banks and the globalization of the world economy has led to a giant wave of money that has swept the planet, looking for a productive home. Any financial asset that could be bought, has been. Stocks, bonds, houses, commercial real estate, private equity, farmland in Kentucky, timber in Maine, even nebulous digital cryptocurrencies; everything is expensive. We are living at the tail end of the “everything bubble”.

How on earth do we deal with this as investors? What can we sensibly do with our money in the face of such widespread overpricing? One very good alternative is to hold plenty of cash. Interest rates are starting to creep back up and GICs and high interest saving accounts are actually yielding something more than zero again. You might even manage to keep pace with inflation if you’re lucky. While making a real, inflation adjusted return of 0% may not seem overly attractive, when the sh*! hits the fan, that 0% could end up looking pretty good.

Put Up Or Shut Up

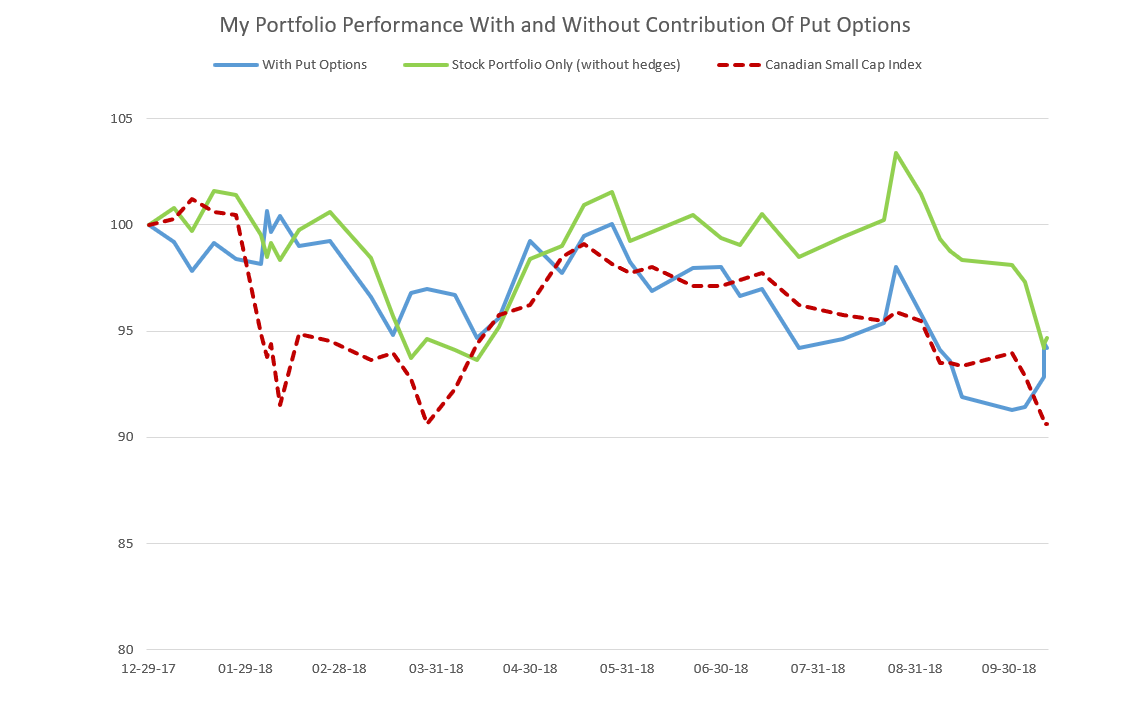

As I’ve mentioned, my personal strategy is to buy put options on the S&P 500. I can buy these things within my RRSP where the bulk of my personal savings reside. They hold the promise of going up in price as the stock market drops and if I’ve done my calculations right, they should gain in value by almost the same amount as the market drops. Assuming that my stocks drop roughly in line with the market, this should provide a good hedge and insulate the portfolio from the worst of the bear mauling.

The problem, of course, is that my stocks may not move in exact tandem with the S&P 500. Looking at my portfolio, with its weighting towards small, mostly Canadian companies, it is easy to see how the path of my portfolio and the S&P 500 might diverge at times. This has been one of those periods. While the S&P 500 has powered higher after the market stumble in January and February, the Canadian small cap market, like many markets around the world, has not fared quite as well.

Here is a graph of my portfolio performance so far this year both with and without the put option hedge. Until last week, the put options were dragging down my portfolio performance as they steadily lost value in the face of a relentlessly rising S&P 500. However, last week’s abrupt sell-off went a long way to narrowing the performance gap between my portfolio and the big name US behemoths. My hope is that over the next few years, if we are indeed due for a big, bad bear market, the S&P will provide a reasonable enough proxy for my own portfolio’s performance that my hedging activity will not be in vain.

Portfolio Update

This fall I took profits in Viemed healthcare. This was a nice, quick payoff. I bought the stock back in March at around $3.20 and sold it at the end of the summer for a little under $6, for a quick 56% gain over 5 months. It was with some reluctance that I bid it farewell as this would have been a great, non-cyclical stock to own in the portfolio during a recession. However, after its run-up, the stock appeared to be fairly valued to me, especially considering my lingering concerns about its reliance on a single medicare billing code, and my goal is to always own the cheapest, most undervalued stocks I can find.

I also sold off my small holding in Difference Capital. I have to sheepishly admit that I do not have a particularly good reason for selling this stock. Honestly, after holding it for several years, I think I just got tired of waiting for something to happen. The stock is still trading at a big discount to its supposed net asset value. But I have no way of independently assessing that net asset value. It is based on the value of the various holdings of this company; investments they have made in a variety of small early stage companies, most of which are not publicly traded. It’s the kind of more speculative investment that I am trying to move away from as we get nearer to the next recession.

Playing Defense

My bias is definitely towards the defensive end of the spectrum as I look at the field of potential investment candidates. Right now, I am making my way through the companies that make up the Canadian large cap universe. There are a few ideas here that look promising and I am particularly looking for companies that demonstrated some resiliency in their earnings through the last recessionary downturn.

Of the companies that are currently in my portfolio, my hope is that Big Lots, Rocky Mountain Dealerships and Cervus Equipment all fit this relatively stable, long-term earnings profile and as a result may hold up better than most during a coming bear market.

To my mind, though, being defensive doesn’t just mean looking for high quality companies with stable long term earnings.

Another way to get defensive is to buy in to stocks that have already been pummeled, with the idea that the worst has already been priced in to the stock, so that it doesn’t have much further to fall. My oil and gas turnaround plays (Macro Enterprises, PHX Energy, Essential Energy Services) would all fall into this category. They are already trading near or below book value and are losing money. How much worse can things get? (okay, don’t answer that.) And while oil prices may take a dive if we head into a major recession, at a company-specific level, things have been looking up for at least one of these holdings. After getting sideswiped by the announcement that their big contract to help build the Trans Mountain pipeline was being delayed yet again, this time by killer whales, Macro Enterprises got a piece of very good news as it was announced that LNG Canada was actually going to go ahead with the massive construction of a new LNG terminal on Canada’s west coast. This will be the largest infrastructure investment in Canada’s history and could mean massive opportunities not just for pipeline builders like Macro but also for other players across Canada’s oil and gas spectrum.

Meanwhile in another part of the energy sector, I continue to nervously await the outcome of the Nov. 6th elections and Colorado’s ballot initiative to essentially ban new oil and gas drilling in the state. I have been talking to a reader of this blog (a lawyer), who in turn has been talking to his lawyer friends south of the border and he feels that even if the initiative were to pass, the big oil and gas companies could keep the new law tied up in the courts for years. So all may not be lost for Questor and it continues to hold down a spot in my portfolio.

In the same “how much worse can things get?” vein, I still feel reasonably good about my holding in WestJet. Their last quarter was an absolute disaster. They lost money for the first time in many years as high fuel prices and an aggressive expansion plan bit in to their bottom line. The stock is now trading for an incredible 5 times their peak earnings of a few years ago. There is a growing wave of competition coming at them from all sides as new, discount carriers like Norwegian air and Wow Airlines try to muscle in on their turf. Perhaps a recession might not be the worst thing in the world to shake off this competition and drive these upstarts back out of the market. In any event, I can’t pass up that mouth-watering p:pe and I continue to hold on to see how this story develops. Hopefully, I won’t be sheepishly selling out of it at half the current price a year down the road.

Magna and Linamar are also taking it on the chin. The boost in the share prices we saw after the announcement of the new free trade agreement was certainly short lived as signs mount that the next major car market downturn is finally upon us. The major car makers have been reporting alarming drops in auto sales over the past few weeks. A recent news item reported that sales in China are also tanking. Obviously, this does not bode well in the short term for either Magna or Linamar. But the valuations on these two stocks are very low. Granted we are probably looking at the peak of the cycle right now and it may take another 5 years before earnings make it back up to this level but one advantage of being a private investor is that we can afford to take the very long view. If earnings recover to their recent peak levels 5 years down the road, the current share price gives a p:e of only 6 or 7 on those earnings and that will look like a very attractive price coming out of the recession (as opposed to going in). I am especially excited about Magna and the string of announcements it has been making about its initiatives in the electric and driverless car spaces. In fact, both companies sound quite excited by the possibilities they see before them. There may be some pain to endure first, though.

Another way I like to convince myself that I am being defensive, is by looking for companies selling at a big discount to their tangible net worth. Essential and PHX fit this mold, selling at a discount to the value of their fleets of drilling rigs. Melcor Developments also qualifies, trading at half of book value, that book value being made up of land and real estate in the Calgary area. Granted we may be in for a nasty housing downturn, but Melcor has been around for decades and the housing market in Calgary is surely less frothy than the insanely overpriced markets in Vancouver and Toronto so any downturn may be less severe there.

Assure Holdings fits the defensive bill on two counts. On the one hand it operates in an industry (healthcare) that is reasonably buffered from the ups and downs of the business cycle. As well, it offers the allure of potentially high growth that could mitigate any recessionary drag.

GoEasy is another exciting holding that offers the promise of strong growth to offset the negative effects of a recession. To be sure, I am concerned about the credit worthiness of its customers and how well they will be able to keep up payments as a recession takes hold and layoff notices are issued. But perhaps for every client that they lose to the ravages of a recession they will gain a new one whose credit profile drops them into GoEasy’s target market. Because of its strong showing this year, this had become (and still remains) my largest holding but I did trim my stake a little this fall to raise some cash and put food on the table.

Which leaves us with Geodrill and Atlas Engineering as my two final holdings. Gold is the ultimate defensive holding in times of crisis and having a gold drilling company that is solidly profitable and growing while selling at a modest p:e ratio of around 10 seems like a nice way to round out the portfolio. I was a little caught off guard by the sudden rise in the withholding tax that the Burkina Faso government imposed on Geodrill starting this year. This has had the effect of jacking up their effective corporate tax rate to a whopping 60%. One of the risks of operating in the emerging markets. Nonetheless, even after paying this usurious tax rate, the company remains profitable and the stock remains reasonably priced even when compared to after tax profits.

Atlas Engineering is a wild horse here. I can’t really claim that this is a defensive holding by any stretch of the imagination. If a housing downturn is upon us then surely this company is going to struggle to make ends meet. And they are still losing money. However, they did a big acquisition after the end of last quarter and this could change the picture significantly. I am holding on to this as a small, speculative holding. There has to be room for a little adventure in any portfolio even when the bear snuffling around outside the tent has us shaking in our boots.

Hunting For New Opportunities

Fall is always a busy time for me. As third quarter results come out, I am going to be doing a full review of the Canadian markets and time permitting, would also like to take a look at some of the more appealing situations south of the border. I feel good about the stocks I currently own in the portfolio but am always on the look out for even better opportunities. As we move closer and closer to the next recession, I am keeping an eye out for companies with defensive characteristics. Companies that have demonstrated resilient earnings through the last recession, companies that offer the hope for high growth to outweigh the dampening effects of a recession, companies that have already had the stuffing knocked out of them and hopefully don’t have much further to fall or stocks that are simply too cheap to ignore.

Full disclosure: I own shares in Big Lots, Rocky Mountain Dealerships, Cervus Equipment, WestJet, Macro Enterprises, PHX Energy Services, Essential Energy Services, Questor Technology, Linamar, Magna International, Geodrill, Melcor Developments, GoEasy Financial, Atlas Engineered Products and Assure Holdings.