In an effort to clean house and focus in on my highest conviction ideas, I sell Melcor Developments and Casa Systems. I explore the state of the markets, discuss the findings from my latest quarterly review and map out my strategy going forward.

Speed Wobble

My roommate in university was coming back home one weekend from Toronto, cruising along the 401 on his motorcycle when it went into a speed wobble. Apparently, this is something motorcycles do on occasion. The wheel gets out of alignment with the steering axis, maybe because it’s gotten thrown off by a rut in the road, and the handlebars start oscillating back and forth in increasingly wider arcs. Often this ends in a crash but if you can keep your cool, keep your hands off the handlebars (apparently you grip the bike with your knees to hang on) and let the machine sort itself out, the shaking dies down and you can escape unscathed. My roommate managed to keep his cool and lived to tell the tale.

The markets and the economy are in a nasty speed wobble right now. First, we had a violent correction to the downside when the coronavirus hit, then we had an even more violent correction in the opposite direction as government stimulus money poured into the economy. I continue to be amazed at just how well many companies have done over the last few quarters during the worst of the covid crisis. Pandemics are apparently very good for the bottom line.

Wall Street seems to be operating under the assumption that these unusually strong results are here to stay, but with stories of surging energy prices, fuel shortages, blackouts, labour disruptions, chip shortages, rising raw material prices and transport bottlenecks I question that cheery narrative. If we’re lucky, maybe we’ll pull out of this speed wobble, and it will be smooth sailing ahead. But another violent correction back the other way is also a very real possibility. After all, they say speed wobbles often end in crashes.

I’ve spent the last few weeks doing an exhaustive review of second quarter results. The covid distortions are making traditional fundamental analysis particularly difficult right now. Company results have been buffeted this way and that and it is very hard to tease apart what is a temporary covid effect from the underlying strength or weakness of a company’s core operations. These covid distortions can be highly material and it often takes a bit of digging through conference call transcripts and MD&As to reveal them. The quants must be pulling their hair out at this point! As always, I try to inject a healthy dose of skepticism into my investing activities, so I have been discounting a lot of the recent fireworks and penciling in generally lower earnings as we move into the back half of the year. Using my more conservative earnings projections, I’m finding very few companies that meet my value standards.

More to the point, I found none.

Out Of Ideas

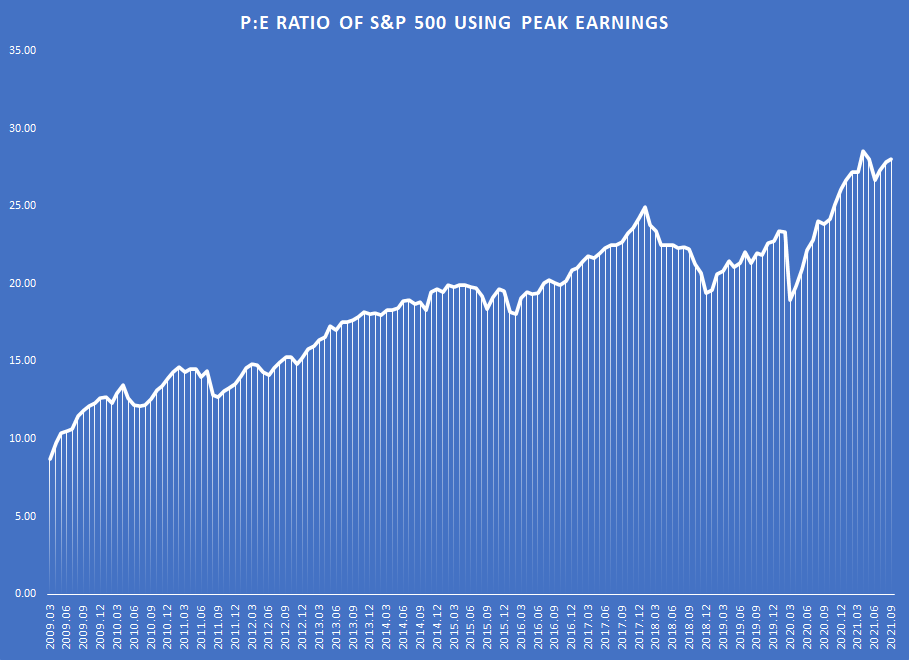

I can’t say I’m surprised. P:E ratios are at record highs and to make matters worse, those p:e ratios are based on trailing earnings that have been artificially boosted by the dramatic government response to the covid pandemic. When I bring my more sober earnings estimates to the table, I can’t find anything that is priced low enough to offer me the kind of wide margin of safety that I’ve traditionally demanded and that I credit with most of my long-term success.

But with cash piling up in the portfolio from a spate of recent sales, I am left with the question of what to do about this. As I see it, I have several options open to me. I can keep turning over more and more rocks, hoping to eventually turn up a bargain. I can throw my hands up in despair and hide out in the relative safety of cash or I can double down on my existing holdings. I ended up doing all three.

London Calling

My first trick was to go searching further afield. I’ve had some experience investing in the UK market and have been keen to go back and have another look. So I brushed off my old spreadsheets and did a top to bottom review of stocks on the London stock exchange.

It was an interesting exercise. There are a couple of hundred stocks of potential interest over there. (Companies listed on the main board, in sectors that I favour, with relatively low debt levels and a history of profitability.) There has been a lot of talk lately amongst the value investing crowd that the UK and Europe offer a compelling safe haven of value in a world gone mad. Sadly, I can now report from a thorough bottom-up review that in the case of the UK market, that is demonstrably untrue. The UK is a different market with different sector weightings. Less technology, more resources and services companies. But if you’re looking at similar companies of similar sizes in similar industries with similar growth rates, I found valuations in the UK were nearly identical to those here in North America. Which is to say, too high for my liking.

My Line In The Sand

To my consternation, my review of the UK market turned out to be fruitless. So back to the drawing board. The obvious answer, it would seem, if I am having trouble finding stocks that are cheap enough to buy, is to relax the criteria I am using. This is exactly what I’ve done over the years as the market marched ever higher. But I think I have hit my limits. There is a price level at which I simply refuse to invest.

We’ve seen valuations rising steadily over the past decade. The P:E ratio of the S&P 500 has climbed from the low of 8.7 it hit at the bottom of the market in 2009 to its current value of 28.1. Most of the impressive price gains we’ve seen over this time period have come not from rising corporate profits (although those have been rising as well, consistent with their long-term trends) but from a steady expansion in the price that investors are willing to put on those profits.

Year after year, over the last decade, valuations have moved inexorably higher. As valuations move higher, you adjust your thinking. You adjust your fair value parameters. You try different things. Maybe you stretch on some more speculative ideas. You lean more heavily on turnarounds and distressed companies. Maybe you try dipping your toe into sectors where you don’t normally tread. You widen your universe of possibilities by moving into new countries or new market cap segments. All in the quest for overlooked value.

But I think I’ve finally run out of ideas. I’ve looked in the places where people are saying they still see some vestiges of value. I’ve looked at Japanese stocks. I’ve done a thorough review of the UK now, post-Brexit. I’ve made a couple of runs through the resource sector, looking at energy, gold, forestry and base metals, thinking that maybe if I looked at things from more of an inflation hedge standpoint, I could make the numbers work for me.

At some point, I need to face facts. I’ve left very few stones unturned. Prices have simply gotten too expensive for me. At these levels, I’m reluctant to keep playing the game.

Turtles All The Way Down

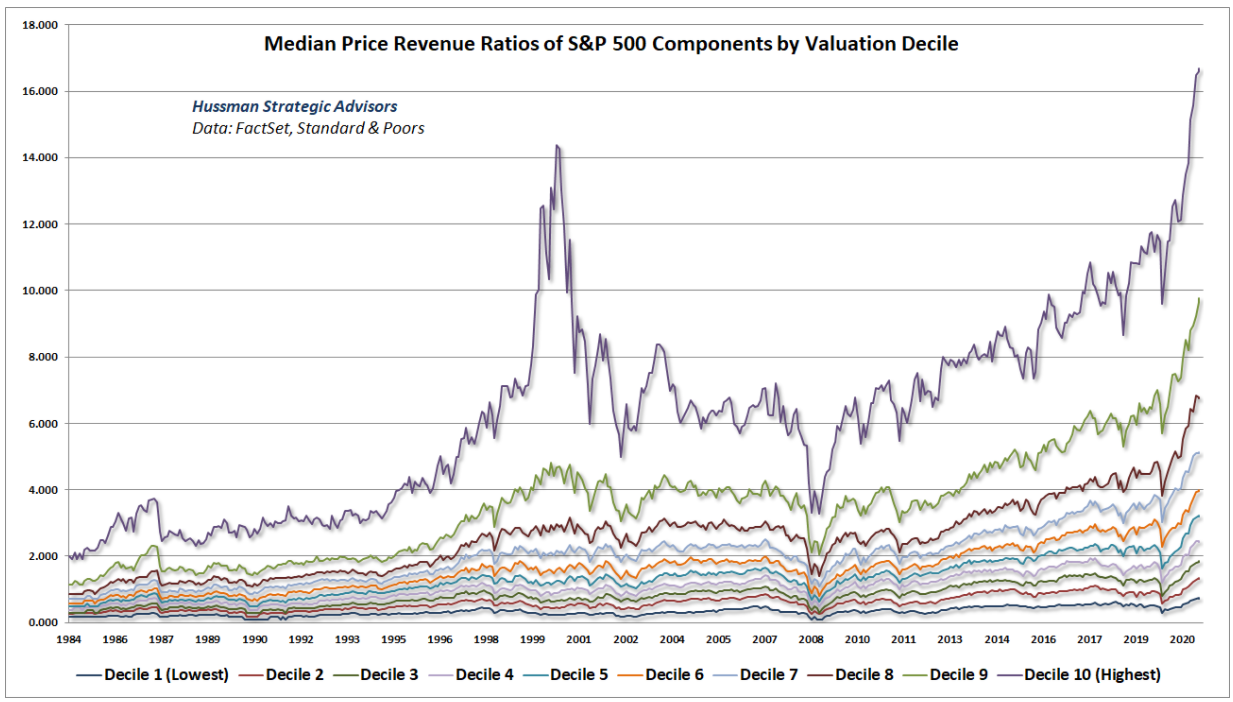

Here is a graph from John Hussman’s website showing the median price to sales ratio of different segments of the market and how they have evolved over time, from the bear market lows of the 1970’s to the current bull market highs. Instead of a price to earnings ratio, which can be distorted by recessionary slumps, he focuses on the price to sales ratio which is a more stable and comparable measure and divided the market up into deciles based on this price to sales metric, from most expensive (top line) to least expensive (bottom line).

Source: Alice’s Adventures in Equilibrium – Hussman Funds

A couple of things pop out at me from this chart. The first is that the market extremes hit during the 2000 internet bubble were really confined to just one dramatically overvalued sector (Technology). The vast majority of the market did not participate to nearly the same extent in this outburst, which is why the majority of stocks, and my portfolio, sailed through the bursting of the internet bubble relatively unscathed.

By comparison, this latest episode of manic buying is widespread and universal. It plays out across all segments of the market. The cheapest stocks in the market are almost as overvalued relative to what they were trading at in 1984 as the most expensive stocks are. My own investigations confirm this fact; there is truly nowhere left to hide.

The second thing that is fairly apparent, is the sheer magnitude of the current valuation bubble. The average price to sales ratio of the S&P 500 is 6 times what it was back in the early 80’s. This is confirmed by other measures of market value like price to earnings, price to book or market cap to GDP (which is essentially an economy wide version of the price to sales ratio). Over the past 40 years, these ratios have all risen by a factor of 5 or 6. Fully reversing those gains would require a drop of 80% or more.

The thing about market valuations is, they only tell you how much trouble you’re in, they don’t tell you what your punishment is going to be. Will it be 30 years of churning up and down market action that ultimately gets us nowhere? Will it be an epic 1929 style crash? Or will it be a scorching burst of hyper inflation that boosts the price of everything except our stocks? As investors, we’re clearly in for something unpleasant at some point, but we don’t know what and we don’t know when, which makes it awfully hard to plan for.

Nonetheless, these valuation charts are sending a message. My recent market review is also telling me something. When I spend several weeks poring over the results of over 1500 companies from 3 different countries and find nothing that I feel is worth investing in, that is sending me another powerful message. And when I see some of the truly bizarre investor behaviour in the meme stock, cryptocurrency and NFT world, that sets off alarm bells as well.

So I am taking a defensive stance. I am battening down the hatches. I am getting rid of excess inventory. I am raising cash and I am marshalling my resources behind my best and my brightest.

Harvest Season

With valuations at record levels and after the epic stock market run of the last 12 months, now seems like an excellent time to harvest some gains in the portfolio. Given my apprehensive outlook for the market, I’ve been selling everything that I thought was getting close to its fair value. If we’re headed for stormy weather ahead, I want to do it with my highest conviction stocks.

Melcor Developments has been reaping the benefits of a strong covid-fueled housing market. This has lifted the share price and is giving me a reasonable opportunity to take some money off the table. Melcor is a somewhat confusing combination of a REIT, an operating company and a book value play. Trying to come up with a fair value estimate is a bit of a Frankenstein exercise in piecing together the different moving parts. I always thought it offered good value, even if solely based on the value of its raw land holdings, but the market never really seemed to see things my way. With the share price up near its highs of the last 5 years, I decided to stop fighting this particular battle and I have sold off the majority of my holding. I still do have a small number of shares remaining in my portfolio but I’m not free to monitor my trades for the next little while so I decided to issue this blog update now and come back in a week or two to liquidate the rest of my position.

I also sold Casa Systems. I bought this telecom equipment maker as a turnaround play after a collapse in cable industry spending put the stock on sale. I’ve been pinning my hopes for this stock on success in their new 5G division and until recently, things were looking good. They were introducing a spate of new products, sales were climbing and new customers were signing on. But second quarter results were a disappointment and their outlook for the second half is not much better. Given the way the story is developing, I’m not sure the company is demonstrating the kind of profitability and growth that justify a significantly higher share price.

In the end, this stock ended up being close to a 2 bagger for me. Not bad, but honestly, I was hoping for better. Still, given the market environment, better to clear the decks now, I reasoned, than to hold out for uncertain future gains.

Quality Over Quantity

All of my stock sales this fall have left my portfolio bulging at the seams with unused cash. I’m happy holding a hefty sized chunk of cash in the portfolio right now, but I’m not ready to completely give up on the market just yet. After all, this game may well go into overtime. And when the jig is finally up, a market crash is only one possible scenario. A long sideways grind is another one. A punishing burst of inflation that would quickly eat away at that cash pile is yet another.

An email exchange with a reader from Belgium this summer opened up my mind to a possible solution to this problem that I hadn’t seriously considered before. He wrote me to ask why I invested in as many stocks as I did. Why not simply own a few of my best ideas?

I brushed him off initially, by saying I never knew which ideas were my best ones until after the fact. Also, the more horses I have in the race, the greater the likelihood that one of them will cross the finish line first.

While this is very true, he kept pressing me on the issue. He pointed me to the example of value investor Mohnish Pabrai, a fund manager who famously paid $650,000 for lunch with Warren Buffett. Mohnish has always tended to run a concentrated portfolio, but he has taken this to extremes lately by holding only 3 stocks in his flagship fund.

This got me to thinking. In the past, I’ve shied away from running a very concentrated portfolio, partly for the reasons above and partly because I just couldn’t stomach the risk and volatility inherent in owning a very small number of highly volatile micro-cap stocks. But my portfolio has evolved over the years. Many of the companies I own now are larger, more stable enterprises. Maybe I could justify narrowing my focus more than I have in the past. And perhaps this might help to ease the strain of being unable to find enough value in today’s overheated markets.

So after careful consideration and a rainy weekend pondering the ramifications of this move, I decided to double down on my existing stocks. Because of their size, I’m limited by how much I can put into Hammond Power and Essential Energy, but the other five are fair game and I added to my holdings in each of them.

Portfolio Roundup

Taken as a group, I think these 7 stocks form a pretty good lineup.

Foot Locker

Wow. From the near death experience of the retail apocalypse to outright Armageddon in the first few months of covid to the sudden stimulus fueled ascent into the stratosphere, the retail sector has taken investors on a crazy ride over the last few years. I’ve enjoyed a front row seat to all of this and have had my share of both successes and failures. As the dust begins to settle, I have surveyed the landscape and consolidated my retail strategy into this one remaining holding.

And I think it’s a good one. I’ve taken a look at the rest of the sector. There are somewhat over a hundred publicly traded retailers of note in the US and I think Foot Locker currently offers the best value out of that list, especially with the recent pullback in the share price which, to my mind, is unwarranted. Yes, earnings will dip in the coming quarters as supply chain issues take a toll on everyone. But Foot Locker has been a robust and stable performer over the last 5 years and stood up much better than most to the carnage that was shaking up the sector pre-covid. After the covid spending mania dies down, I have to wonder if the weaker players will again start to hemorrhage. It is hard not to get caught up in the excitement of the blow-out profits that all these retailers have put up over the last few quarters but in most cases I think these windfall profits are temporary. They have been fueled by government stimulus payments, reduced operating costs during the pandemic, a lack of the usual promotional activity and consumers with nothing better to do with their money than buy stuff.

So I’m mostly ignoring the recent covid numbers. Instead, I’m looking back at results pre-covid and based on those, I think Foot Locker offers excellent value.

What’s more, I am excited by the two acquisitions they did this summer. They had a sizable cash hoard which they used some of to make these acquisitions. They think these will add almost 10% to their earnings next year. More importantly, they give them some exciting avenues for future growth in the hispanic community and in high end sneaker design and fashion. They also have an interesting equity stake in an up and coming online reseller of athletic shoes and are growing their presence in Asia with some fun and interesting looking new store concepts.

Trading at less than 10 times pre covid earnings, I don’t see a lot not to like.

Omnicom

Like Foot Locker, this is another robust, large cap company. One of the world’s premiere advertising agencies, they have been growing slowly and steadily over the years. The advertising and marketing world is changing dramatically and this creates both challenges and opportunities which is perhaps what is keeping the share price down. I’m not expecting fireworks here, but I am expecting continued slow, steady growth as they help companies navigate the wild new frontier of online and social media advertising. A p:e of 12 gives significant room for price appreciation if they can demonstrate continued growth on the other side of the pandemic.

BGSF Inc.

This one takes me back to my roots. A micro-cap company in the staffing sector, this is a small, niche player in a large industry. As a small fish in a big pond they have their fair share of risks but they also have a lot of room to grow. They focus on a few key sectors, two of which have been doing reasonably well during covid but one of which has been side-swiped. As a result, their earnings have dipped, although haven’t completely collapsed and I think the weakness is giving me a wonderful opportunity to buy into this company at a great price.

Their biggest money maker is their real estate services division which offers temporary staffing to landlords looking for help in maintaining, managing, cleaning and showing apartments to new renters. With the rent and eviction moratoriums, landlords were left with empty pockets to pay for temporary help and a lack of renter turnover for which they would require the extra help for in the first place. As covid settles down, moratoriums end and the sector returns to business as usual, I would expect activity to pick back up again.

Meanwhile, the company made a sizable acquisition in its IT services division just as covid began but the full benefits of this acquisition have been hidden by the weaker real estate results during covid. IT services seems like it will be a solid and profitable sector for the foreseeable future with plenty of room for future growth.

Finally, the company helps to staff the warehouse and logistics sector and this division has been doing well during covid as retail moves online in a big way. There may be some give back here as the economy reopens and shoppers move back into the stores, but I think longer term trends still favour this sector.

The company is trading at only 10 times pre-covid earnings. Despite the acknowledged difficulties in the labour markets right now, I don’t see why the company wouldn’t be able to regain that level of profitability and go on to reach new heights beyond that.

Linamar

I’ve owned Linamar for a long time now. I bought it 5 years ago at $46 a share. It was cheap then and it is cheap now. Like most of the auto sector (excluding EV’s of course!), Linamar has rarely gotten much love from investors even during the early 2010’s when earnings tripled over the span of a few years.

So I have to be realistic. The stock is trading at 10 times trailing earnings and that is about as good as it seems to get for this company. Considering everything it has going for it though, I can’t really make sense of that. The company has a rock solid balance sheet, it has diversified into construction, agricultural and medical equipment to reduce its reliance on the auto sector, it has made important inroads into the explosive electric vehicle sector and has formed alliances with important players in the fuel cell and power storage industry.

Yes, there are challenges ahead as the industry shifts from the internal combustion engine to alternate forms of motive power and as global chip shortages shut down large swathes of the industry. Near term results are likely to be disappointing, but I think the longer term outlook for Linamar is excellent. Given it’s past history, I may never see the 20+ p:e ratio I think this stock deserves but in the meantime, I feel good about owning a world class manufacturer from my own backyard at a very reasonable price.

Enerflex

Spun out from Toromont a decade ago, this natural gas compression and processing equipment company has been a strong, steady performer even as the price of natural gas has dwindled. The covid crisis and the freefall in the energy sector put this company on sale and I managed to pick it up for a song late in 2020. The sector is slowly coming back to life as energy prices recover and I see continued upside from here.

Natural gas prices are through the roof in Asia and Europe and are moving significantly higher here in NA as well. This bodes well for future activity in the sector. With their global reach I am hopeful that Enerflex will benefit from all of this.

Longer term, the fate of the fossil fuel industry is in doubt. Clearly, the goal is to move away from fossil fuels, but the switch to an alternative energy future will take time. I am holding Enerflex in the belief that there will still be a vital role to be played by natural gas in the decade to come.

Hammond Power Solutions

This is another company with ties to the energy sector. They play both sides of the street with customers in the traditional oil and gas sector as well as the renewable energy sector. Their transformers are used in a wide range of industries and applications although the resource industry, mining in particular, has always been one of their biggest clients. This skew towards the resource sector I believe has kept a lid on the results of what is a solid, well run company as the last decade has seen the twin collapses of both the mining and the oil and gas industry.

But the mining sector, at least, is making a resurgence and the company has broadened its focus in the meantime. Pre-covid, earnings were on a roll and as the world recovers, I am looking for this trend to persist. The stock is currently trading at around 10 times pre-covid earnings and in the latest quarter, earnings had managed to claw their way back to that high water mark. I am expecting better things for Hammond in the decade ahead than the one just passed and am hoping that if my optimism proves out, the p:e ratio will rise to reflect that.

Essential Energy Services

This stock has enjoyed the longest sojourn in my portfolio. I first bought it way back in 2015 at what looked like the bargain price of 75 ¢ a share in the aftermath of the first big oil price collapse. It failed to make much of a comeback even as the price of oil staged a partial recovery in 2018. I suppose I should have taken the hint at that point and bailed on this turnaround turned bust, but I remained optimistic and rode the stock all the way down as the sector got hammered once again by takeaway constraints, competition from US shale and then, to put the nail in the coffin, covid.

I’m not one to dwell on past losses. In fact, I had to look up my purchase price on this stock because I had only a vague recollection of what it might have been. If I see value in a stock, I hold it and if I don’t, I don’t. I haven’t held on doggedly to this stock for this long because of a bruised ego or some misguided desire to make myself whole on my investment. I’ve held on because I’ve continued to see the potential for value all along the way. And I continue to see that potential.

I’ve looked carefully at the oil and gas service sector. Clearly the writing is on the wall for the fossil fuel industry but within that assumption seems to lie the possibility for overlooked value. The transition to renewable energy is not going to be smooth or painless and as the prices of oil and gas are showing us right now, we are not done with fossil fuels just yet. I’d like a way to play this contrarian idea, but I’ve struggled to find something that offers me enough of a margin of safety. Enerflex is one idea. Essential is the other. The company is one of the significant players in the western Canadian oil and gas sector. It is also one of the best capitalised with no net debt on its balance sheet, in sharp contrast to virtually every other company I’ve looked at in the sector. While they have been fluctuating around break even for the last few years, their cash flow has looked a lot better than that because of the accounting expenses they have to book to depreciate their sizable fleet of drilling rigs. My hope, and admittedly, it is a bit of a long shot, is that Essential will end up being one of the last men standing in this industry as the lights slowly go out. I could maybe foresee a future where they can call the shots and set their pricing at much more favourable levels. As well, the giant new LNG export facility being built in Kitimat is getting virtually no press. When it comes on stream, especially considering the rocketing price of natural gas worldwide, might this drive a resurgence of drilling activity in the western Canadian basin?

Admittedly this all seems quite speculative at this point and also admittedly, I don’t have much riding on the idea. The thin trading volume means I have to keep this position as a small part of the overall portfolio or run the risk of getting trapped in something I can’t get out of.

I debated selling off Essential as part of my recent portfolio purge, but I chose to continue hanging on. For one more quarter at least. Always for one more quarter.

Cash Rich

I’m pleased with the stocks that remain in the portfolio. But I’m also keeping a healthy chunk of funds out of the market. I’m currently sitting at a 60/40 stock/cash split which for me is unusually defensive. But everyone has their own risk tolerances. Take a good long look at Hussman’s price to sales chart above and decide what yours are!

The way to make it through a speed wobble is to let up on the throttle and keep a very loose grip on the handlebars. Wait until the turbulence is over before you re-engage. That analogy seems apt to these market conditions. With corporate results in such a state of flux, it is difficult to get a firm read on where companies are headed. Until we get more clarity, I’m happy to sit with a larger than usual helping of cash on the sidelines.

I remain hopeful that at some point value will start to appear again. Every quarterly review is a fresh opportunity to uncover new and exciting ideas. The broader market, as reflected in the Russell 2000, has been moving sideways for most of the year. As prices drift sideways, or in quite a few cases, down, it gives time for earnings to play catch up. If I am patient, new opportunities will appear again at some point. I’ll be ready for them when they do.

Full disclosure: I own shares in Foot Locker, Omnicom Group, BGSF Inc., Linamar, Enerflex, Hammond Power Solutions and Essential Energy Services (and a small number of shares in Melcor Developments which I intend to dispose of soon). I do not own shares in Cervus Equipment, Teck Resources, Genesco or Casa Systems.