An exciting play in the technology sector uses up the last of my excess cash.

Qorvo Inc. – QRVO.NASDAQ

November 30, 2021

Share Price: $146.23

Number Of Shares: 111 035 000

Market Cap: $16.2 billion

Back In The Pool

Cash always ends up burning a hole in my pocket. I have an overwhelming desire to put that cash to more productive use. Greed apparently drives me more than fear.

Nonetheless, even I have my limits and I hit those limits after an exhaustive second quarter review this fall failed to turn up anything of value. I’ve been sitting uncomfortably on a much larger weighting of cash than usual for the past couple of months, so it was with some relief that I stumbled across Stella-Jones late last week and with even more relief that I finished my analysis of Qorvo this morning and added it to the portfolio at a price of just under $147.

These two purchases bring my cash position down to a more tolerable 20%, a number which I intend to stick at. Partly out of fear (market valuations at record highs and so forth) but honestly, more out of greed, as a major meltdown from these heights could provide some pretty compelling opportunities if one had any cash left to take advantage of them.

Conceptually, though, I consider myself to be “fully invested” at this point. I’ve earmarked my remaining cash for prices much, much lower than today’s levels so if I find anything new to buy as I finish up my third quarter review (a few stragglers are still left to report), the funds will have to come from selling off bits and pieces of my existing stocks.

For better or worse, I am back in this market in force. And it is with a sexy, streamlined portfolio that I am feeling very good about. Or at least as good as I can feel with stock prices at generational highs.

A Wireless Wonderland

Qorvo has filled an obvious hole in the portfolio. You know when you’ve got a company with a stupid sounding name that means nothing that you are probably on the cutting edge of technology. And so it is with Qorvo. With the sale of Casa Systems this fall, my portfolio was looking decidedly old school. Drilling rigs, railway ties and smelly sneakers can only take you so far. It’s nice to have a little high-tech snap, crackle and pop in the portfolio too.

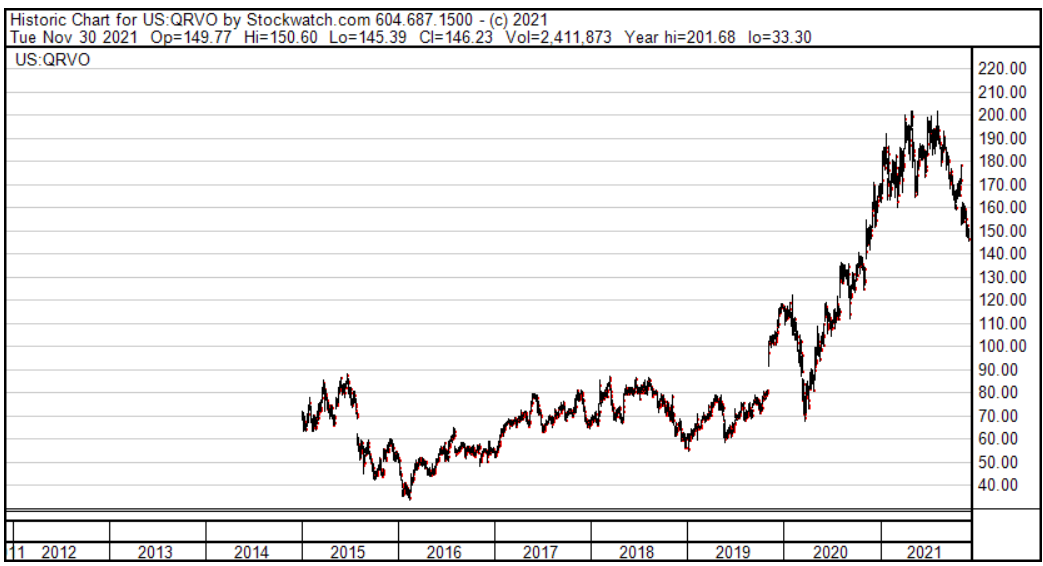

Qorvo was formed back in 2014 in a merger of two semiconductor companies. Initially, the combination didn’t look that attractive. They were doing over $2 billion in sales but didn’t seem to be making much money doing it. They had a new CEO at the helm, though, and he was looking ahead. He spent heavily on R+D, pushing the development of new 5G wireless technology to position Qorvo at the forefront of this evolution when it began. He streamlined operations, boosted productivity, trimmed wasteful capex and focused on the leading products that he felt Qorvo really differentiated themselves on. The company has its fingers in a lot of exciting pies but clearly it is their focus on cellular 5G technology that is lifting their boat right now.

Samsung recently awarded Qorvo their “best quality in mobile communications” award and with their chips on the smartphones of nearly every major smartphone manufacturer, clearly Qorvo has earned a prominent place at the table. Apple is their biggest customer at around 30% of sales, but they serve all the top names in the business.

As the 5G rollout began in earnest last year, Qorvo’s fortunes began to turn. Revenues started ramping up even as they kept a tight lid on their expenses. As a result, profits have snowballed. Profit margins have been expanding steadily and recently hit levels consistent with some of their main competitors in the field.

The skeptic in me initially discounted this strong performance as a flash in the pan, possibly covid related, probably not sustainable. But some persistent digging and a look at the long-term performance of other companies in the industry has convinced me that maybe these profit margins are in fact here to stay. At least within the context of the typical boom/bust cycle of the semiconductor sector.

Management paints a fairly convincing picture of a multi-year runway of strong 10% or greater annual growth as 5G rolls out across the ecosystem. Beyond that, they have exciting opportunities to explore in automotive connectivity, smart home applications and the still unknown host of devices and applications that a ubiquitous 5G environment might enable.

The back half of this year is likely to be somewhat restrained by the numerous supply chain issues plaguing everyone. Working backwards from management guidance, I am using EPS of $9.60 as my estimate of their current profit-making potential. At a share price of $147, that would give the stock a p:e ratio of 15. Modestly undervalued even for an average growth company. But what gets me excited about this stock is that I think Qorvo has the potential to grow at above average rates for years to come. I can’t be sure of this. With their rocky start in the years following the big merger, some skepticism is warranted. The 5G bonanza won’t last forever and when it settles down, Qorvo is going to have to prove it is more than just a one trick pony. But management is upbeat and sees a bright future in front of them and I am going along with their vision of the future at least until I see evidence to the contrary.

Looking further down the road, Qorvo sees much of the same 5G technology it is selling into phones right now start to appear in cars. As well, they recently made an acquisition in the power management space to drive their ambitions in electric vehicle charging and renewable energy. Their new high performance wi-fi equipment enables 8K streaming, low latency online video gaming and virtual reality applications.

And on a wildly tangential note, the company has developed a unique new antigen testing solution based on their acoustic wave technology. They have received emergency FDA approval for a rapid covid test based on this and have already begun shipping small, portable, stand-alone covid testing machines using this technology. The machines offer 100% specificity and 89% sensitivity (which is very good) and offer quick results in 20 minutes. It sounds like these machines offer a significant advantage over regular PCR testing. It is too soon to say whether or not this will turn into anything meaningful to their bottom line, but I like the covid angle.

So all in, a sexy, high tech company at a pretty reasonable price. I think the market is skeptical that the recent string of strong results can last but I’m willing to take a gamble that they are.

Full disclosure: I own shares in Qorvo Inc.