The way most investors approach the market is all wrong. They are stumbling around in the dark, trying to make sense of the markets without having the information they need to make good decisions. Value investing can help light the way.

Category: Value Investing 101

What you don’t buy is just as important as what you do.

By focusing more on the profits that I expect my portfolio companies to generate and less on their stock prices, big stock market drops become much less intimidating.

A comprehensive look at the inner workings of the mispriced markets portfolio. What is it? Why am I publishing it? How often is it updated? How do I choose which stocks make it onto the list and how might you use it in your own investing?

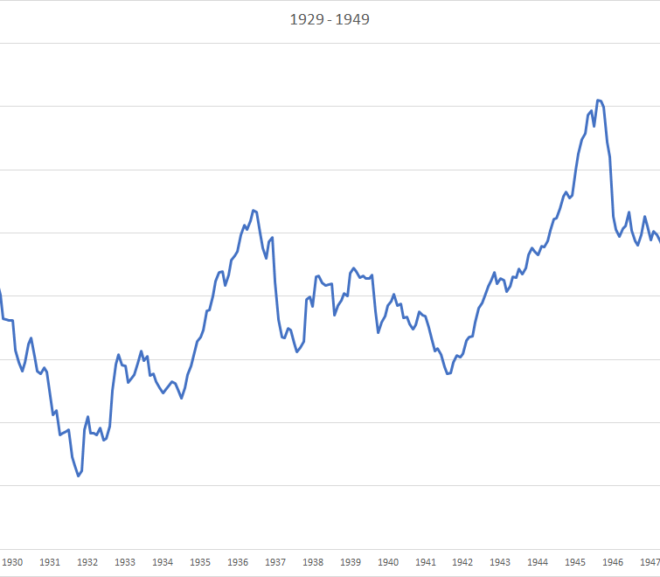

Graphing the performance of the market over the past 147 years.

Part 6 in a series of tutorials on value investing: knowing when to sell can be hard. It doesn’t have to be.

You have to turn over a lot of rocks to find those rare hidden gems. Sometimes the best approach is to simply start with the ‘A’s.

Whether it be marijuana or bitcoin, you don’t need to be invested in the most talked-about sectors to still make very good long-term returns.

How much money do I need to start? How much can I lose? How do I make my first stock purchase? Which brokerage is best? Some basic advice for first time stock buyers.

How picking stocks at random can be a surprisingly effective strategy.

Part 5 in a series of tutorials on value investing: A step by step guide to the process I use to evaluate a new stock.

Part 4 in a series of tutorials on value investing: The ratios and formulas I use to find undervalued opportunities.

Part 3 in a series of tutorials on value investing: Earnings, book value, debt, growth rates and market capitalization.

Part 2 in a series of tutorials on value investing: Putting theory into practice. How we might begin to value an old time general store.

Part 1 in a series of tutorials on value investing, the mispriced markets way.