Viemed, Questor and Magna were the bright spots in what was a fairly uneventful start to the year. With the market undecided as to which direction it wants to go, I maintain my hedge but use up most of my remaining cash to add 4 new holdings to the portfolio.

Author: mispriced markets

After working my way through a list of promising-looking US stocks, these 10 made it onto my watchlist.

Why I think this company might have what it takes to survive the retail apocalypse.

The mystery is revealed: A roll-up play in the construction industry catches my eye.

Introducing the “Tiny Ten”. Also, a new addition to the portfolio, opportunities in portable toilets, data analytics, solar power and cartoons, and I cross paths with some crafty elks.

I recently initiated a small position in this provider of in-home ventilation assistance for patients with end stage respiratory disease.

Underwater robotics, surveillance cameras, cryptocurrencies, military protective wear and addiction counselling. Five interesting looking companies that I have added to my watchlist.

I recently added this chain of farm equipment dealerships to my portfolio. I feel it offers good value as the sector continues to recover from the downturn of the last few years.

How to protect your portfolio from the coming bear market.

You have to turn over a lot of rocks to find those rare hidden gems. Sometimes the best approach is to simply start with the ‘A’s.

Whether it be marijuana or bitcoin, you don’t need to be invested in the most talked-about sectors to still make very good long-term returns.

With a global footprint, record sales and earnings and a shiny, new acquisition in the works, this automotive and industrial manufacturing company is firing on all cylinders.

How much money do I need to start? How much can I lose? How do I make my first stock purchase? Which brokerage is best? Some basic advice for first time stock buyers.

How picking stocks at random can be a surprisingly effective strategy.

An in-depth look at why this rapidly expanding alternative lender is a bargain at the current price.

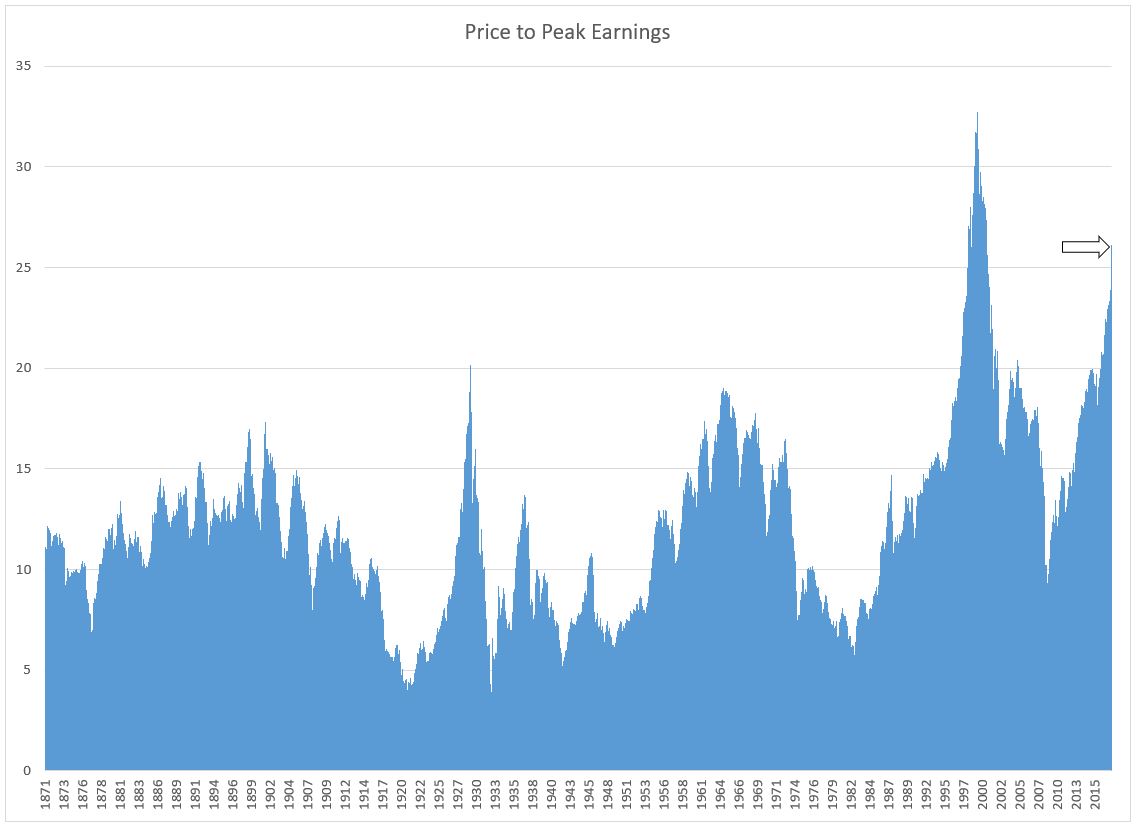

Oil stocks, auto parts, overheated markets and opportunity. A look back at 2017 and a look forward into 2018.

Part 4 in a series of tutorials on value investing: A step by step guide to the process I use to evaluate a new stock.

Part 3 in a series of tutorials on value investing: Using the 5 Year P:E ratio to level the playing field and identify undervalued opportunities.

Part 2 in a series of tutorials on value investing: Putting theory into practice. How we might begin to value an old time general store.

Part 1 in a series of tutorials on value investing, the mispriced markets way.