Kohl’s stock has performed very well in the 4 months that I’ve owned it and may have already priced in a good portion of its presumed post-covid recovery. Given the uncertainty that still surrounds this company, the economy and the fate of the department store model in general, I decided to take my profits early.

Tag: Portfolio Update

Unpleasant news from both these companies has me re-thinking my exposure to these speculative growth stories and selling out at a loss.

I get my hands dirty with a manufacturing company and use some recent share price strength to take profits on two of my existing holdings.

I move to the sidelines as the company invests more heavily in its cannabis 2.0 future.

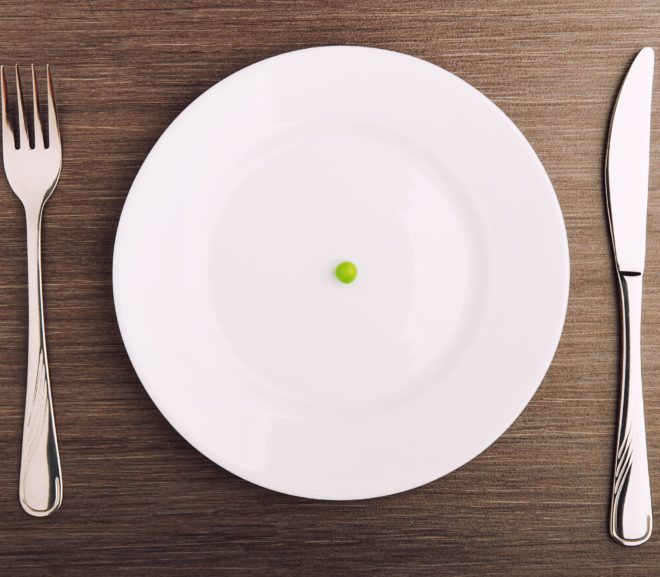

I take a comprehensive look at the retail sector in the United States. In the end, two new names enter the portfolio and four existing holdings get the boot.

A play on natural gas finds its way into the portfolio and I bid adieu to an old friend.

First quarter results that came in below my expectations have me rethinking my position in this company.

The combination of a quick return on my initial investment and a rapidly deteriorating industry outlook prompts me to beat a hasty retreat.

In for a penny, in for a pound. I go all-in on the clothing sector with the purchase of G-III Apparel.

I make the difficult decision to sell Urban Outfitters as I try to adjust the portfolio to best take advantage of this new investment environment.

Showing up fashionably late to the pot party.

People are always going to want a clean pair of underwear. With that in mind, I took advantage of the recent market sell-off to add this global manufacturing powerhouse to my portfolio.

To make room in the portfolio for Tilly’s, I decided to sell off my position in Big Lots.

A balance sheet stuffed to the brim with cash encourages me to tempt fate and add yet another retailer to the portfolio even as we head into what is looking like a possible retail Armageddon.

Harsh customer reviews prompted me to take what profits I could on this evolving online marketing company.

Looking to raise some cash, I sold off my holding in Medifast .

An interesting play on the coming 5G revolution unexpectedly shows up on my screens.

Abandoned by investors long ago, Canada’s legacy yellow pages company may be quietly transforming itself into a modern digital media, marketing and e-commerce success story.

After watching from the sidelines for the past year, early signs of a turnaround convinced me to take a chance on the recovery of this once promising apparel retailer.

I recently added this chain of sporting apparel and footwear stores to my growing collection of beleaguered US retailers.