I’m hoping to turn weight loss into portfolio gains with this rapidly expanding multi-level marketing company.

Author: mispriced markets

After careful consideration, I bought back into Essential Energy Services after abandoning it only a few months earlier. The valuation was simply too low to ignore.

After an extensive review of the investment landscape following the first quarter earnings season, I decide to jettison Preformed Line Products from the portfolio, take profits on PHX Energy Services and add a new name, Bird Construction to the stable.

Gerry Schwarz and I must be using the same playbook as Onex makes a second takeover offer in as many months for one of my portfolio companies.

As a whole, the ten micro cap stocks I profiled last year had a great year, rising 39% on average, driven by an impressive 397% gain in Kraken Robotics.

I recently sold my Questor Technology, locking in a satisfying 596% gain from my initial purchase price.

No longer convinced that the next recession is just around the corner, I sold off all of the put options I was using to protect the portfolio and am now operating without a safety net.

After an unusually long stay in the portfolio, Geodrill is shown the door.

This fashion retailer offers potential value as it continues to grow its online presence and expand its international footprint.

A defensive stock at a reasonable price. This new addition to the mispriced markets portfolio could benefit from the need to upgrade our aging electricity transmission infrastructure.

I have lost faith in a meaningful recovery in the western Canadian oil and gas sector. I have sold my Macro Enterprises and Essential Energy Services and with the money from these sales, have placed my bets on the current market rally losing steam by the end of the year.

In the final 2 months of the year I sold Atlas Engineered Products, pared back on my Essential Energy Services and Geodrill holdings and added Gluskin Sheff to the mix. 2018 was a year full of surprises. I take a look back at the tumultuous year just ended and look ahead at what might be in store for investors in 2019.

This wealth management company has weathered previous market storms well and seems to offer compelling value as we sail into rougher waters ahead.

5 countries go head to head in a global showdown. Amidst a flurry of p:e ratios, revenue growth rates, book values and more, the markets duke it out. When the dust settles, will one market reign supreme?

A couple of sells, some market commentary and a look at the portfolio from a defensive standpoint.

Does a recent ballot initiative to restrict drilling in Colorado mean the party is over for Questor?

The company has been growing like gangbusters while it has been out of the public eye, but are insurers willing to foot the bill?

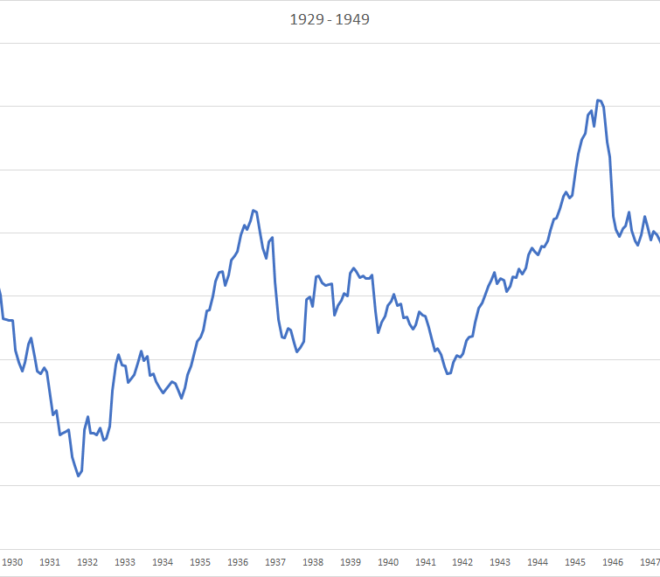

Graphing the performance of the market over the past 147 years.

Drifting through the market’s summer doldrums.

Part 6 in a series of tutorials on value investing: Knowing when to sell can be hard. It doesn’t have to be.